sfe-co2/iStock via Getty Images

Today, International Paper (NYSE:IP) reported its quarterly results, and it is interesting to note how the packaging corporation is adjusting its presentation moving to the very bottom Ilim JV disclosure. Our most devoted readers know that Ilim is the largest integrated manufacturer of pulp and paper in Russia, and International Paper has a 50% equity stake. For the new readers, we suggest having a look at our previous publications, in which we analyzed how Ilim Group had positively impacted the company’s earnings over the last years. After the Q1 results and the Q&A call, once again, we decide to initiate a long position in IP. So far, the stock price output was not in line with our expectations, but having checked the Q2 performance, we believe this is going to be a turning point.

Why are we still positive?

- In our model, we are forecasting higher selling prices. In addition to the raw material cost increase, we are estimating higher basic chemical costs, having analyzed both BASF and DOW Q2 results and their future estimates on chemical credit spreads;

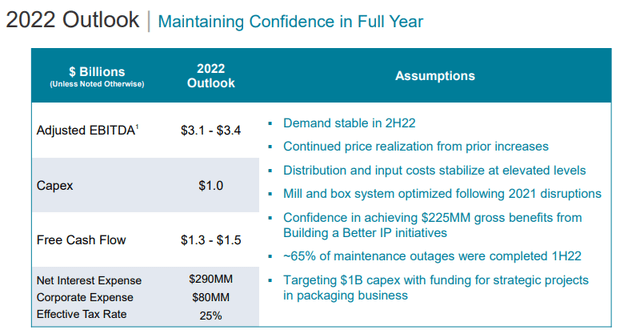

- In Q1, IP was impacted by higher maintenance costs. Again, we are assuming a lower cost in the second half of the year; adjusting our model, we estimate $85 million in Q3. This is supported by the Q2 IP disclosure and also by the lower CAPEX requirement for the full year;

- Aside from the financial considerations, we are confident in the following:

- Global e-commerce trend and solid demand for IP products;

- Plastic bans in developed countries will support higher topline sales;

- We recognized IP as a leading ESG player.

Q2 Results

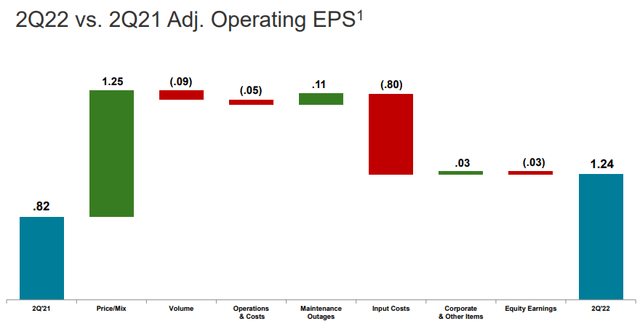

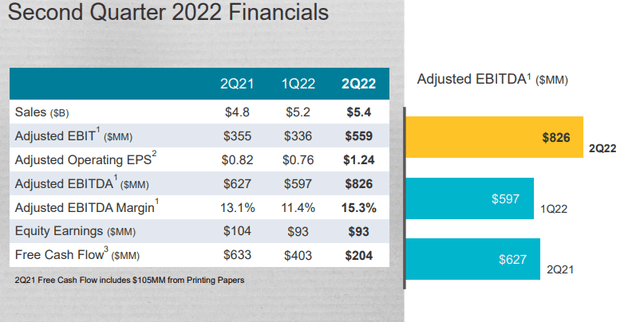

Looking at the quarterly report versus the Street analysts’ expectations, Q2 results of adjusted earnings per share were 16% above IBES numbers. In detail, the operating profit reached $559 million versus a consensus forecast of $480 million. Before analyzing the company-specific segment, we can clearly state that International Paper was able to mitigate raw material inflationary pressure with higher selling prices.

IP EPS Evolution (IP Q2 Results)

Regarding the divisional basis, here below our key takeaways:

- Industrial Packaging’s operating profit was up compared to the Q1 and also to the previous year’s quarter. This positive performance was due to multiple factors: lower operating costs, lower maintenance costs and higher selling prices.

-

Global Cellulose Fibers’ operating profit stood at $25 million compared to a million achieved in the same quarter one year ago. We should also state that a good performance was achieved quarter on quarter. Aside from the positive contribution as already pointed out in the Industrial Packaging division, we add that volume was impacted by supply chain constraints.

-

Ilim Group reached an equity contribution of $95 million, a lower result compared to the 2021 Q2. This was driven by higher operating costs that were not offset by higher selling prices. International Paper is continuously focusing to find a strategic option for its JV. In the Q&A call, the CEO confirms that IP “has engaged advisors and are actively working with interested parties. We’ve made good progress during the second quarter and have identified serious options that we believe could be attractive”.

IP Financial Snap (IP Q2 Results)

Conclusion and Valuation

We knew that Q1 results were impacted by labour & supply chain constraints and higher maintenance costs. These impacts were reverted in Q2. This is why our target price is left unchanged. Our internal team was already ahead of consensus expectation, and reinforced by these good results, we continue to value the company with a target price of $55 per share based on the average between:

- An 8.0x EV/EBITDA on our 12-month forward estimates,

- A DCF analysis in which we assume a 10% cost of equity and a terminal growth rate of 2%.

Risks to our target price are the following:

- additional capacity that imbalance supply/demand;

- macroeconomics risk and consumer sentiment;

- box demand in North America;

- higher raw material costs.

Be the first to comment