Choreograph/iStock via Getty Images

This article appeared in the Daily Drilling Report on Nov. 25.

Introduction

Tourmaline Oil Corp. (OTCPK:TRMLF) has rallied strongly over the past couple of months. A time when many E&P companies have been knocked down a peg or two. Or three. We are attracted to success around the Daily Drilling Report, and decided it was time to see how the company was turning in such positive results.

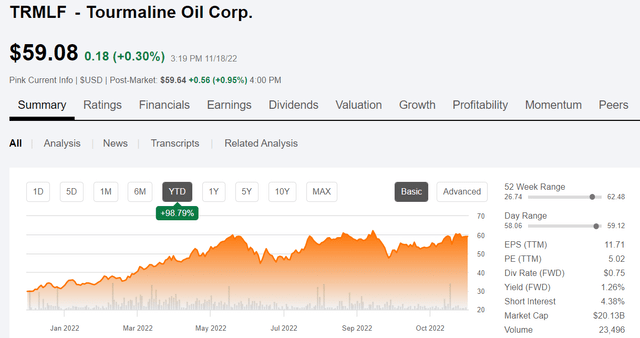

Price chart for TRMLF (Seeking Alpha)

As you can see by the price chart above, the company has made steady progress through the year, bagging a double since our last article. Something that strikes me about the chart is the deflection between peaks and valleys in the price, as oil and gas have pinballed around-price wise this year, isn’t quite as severe as for many of the U.S shale players. Deflections of 30-40% have been common in mass selloffs in some of our favorites. Devon Energy (DVN) and Marathon Oil (MRO) come to mind in the wide-swing category. Tourmaline, by comparison has seen deflections of as much as 25%, but generally less-15-20% on the rough patches. That is statistically interesting to me.

The stock is trading now at $60ish, near its one year high. Is it setting up to go higher? It could be. Let’s review our thesis for the company before we get into valuations.

The thesis for natural gas and LNG

In an article last month I laid out a solid thesis for gas. North America is blessed with the stuff and has, or is developing, the infrastructure needed to exploit it efficiently. Here is a quote from that article that summarizes the opportunity.

Gas exports from the U.S. are going great guns. The liquefaction trains on this side of the Atlantic are chilling the stuff down to -260F for transshipment to the EU or Asia. Where the process is reversed and good, clean American gas heats the homes or powers the factories of these good folks… and U.S. producers exposed to TTF or JKM pricing are making an absolute killing. There’s a bottleneck or two along the way, but these will be worked out in time as these contracts are decades long typically.

I might add that gas exports as LNG are one of the few areas where the current U.S. political regime doesn’t fight the industry tooth and claw. You take your wins where you find them.

The thesis for Tourmaline

‘All Singing, All Dancing’ is an expression I picked up in my time in the UK. It’s reflective of a moment near the end of a musical when all the villains have been defeated and the cast comes together for a final song and dance. I am reaching a bit adapting this expression to TRMLF, but not a lot. Things are going well for this Canadian large cap producer, and if you elect to enter the company at current levels, you may break into song yourself when the divvy checks come in the mail.

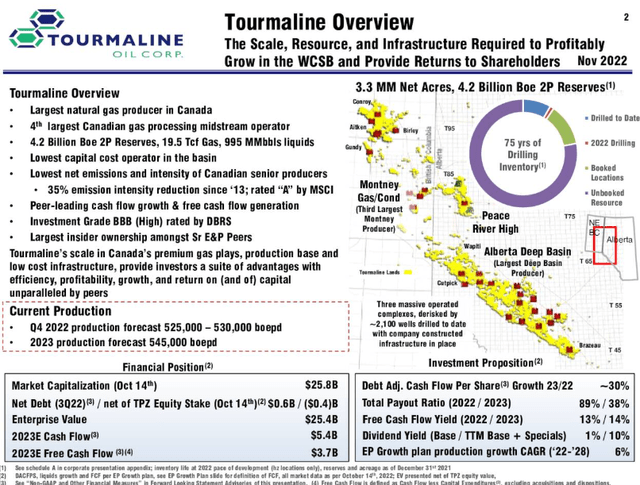

TRMLF overview slide (OTCPK:TRMLF)

As I noted above, there is a fairly complete thesis for natural gas globally. North America has it along with the technology to condense it for shipping around the world. Technology that is highly evolved and entering a growth spurt to satisfy world demand. Demand for our gas. Supply and demand! The story for gas appears to have a fairly long arc independent of oil.

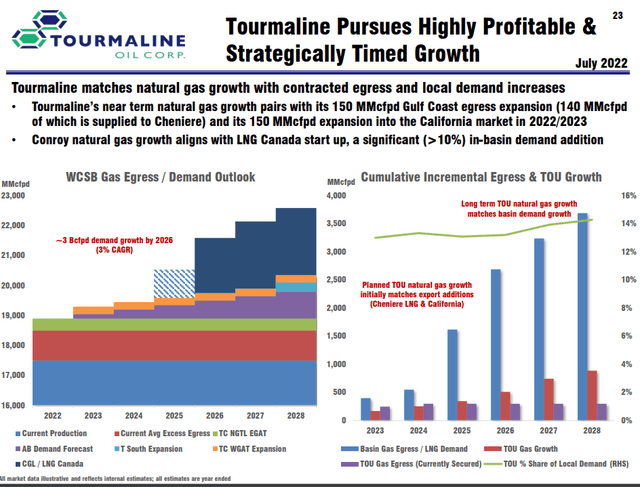

TRMLF growth profile (OTCPK:TRMLF)

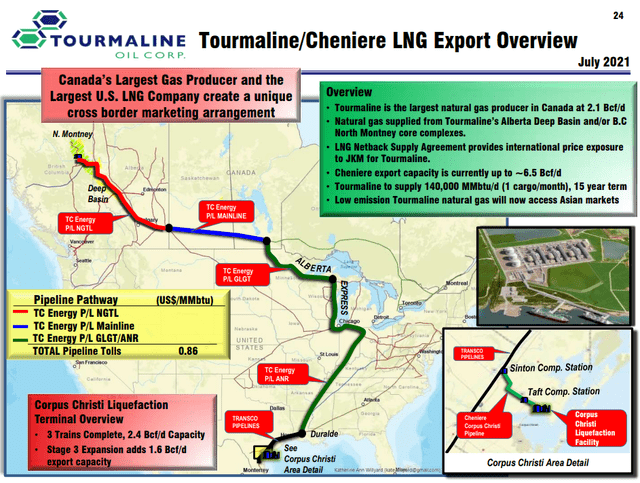

In the case of TRMLF the future story of supplying Montney gas to LNG Canada is on track, but they have also taken steps for exposure to Gulf Coast export-JKM, pricing with its sales to Cheniere.

TRMLF and Cheniere (OTCPK:TRMLF)

Tourmaline is the largest producer of gas in Canada. That is important because in a commodity business size is everything. Along with size comes scale, and that is the secret to not only being the biggest producer, but grinding cost out of the operation.

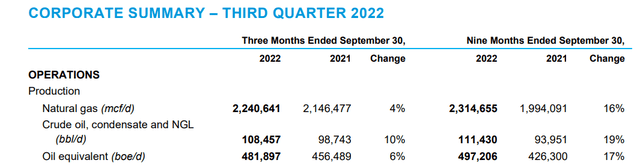

Another contrast between Tourmaline and their American counterparts is growth of the revenue basis QoQ and YoY. TRMLF’s exposure to the premium plays in the WCSB makes this possible.

TRMLF production summary (OTCPK:TRMLF)

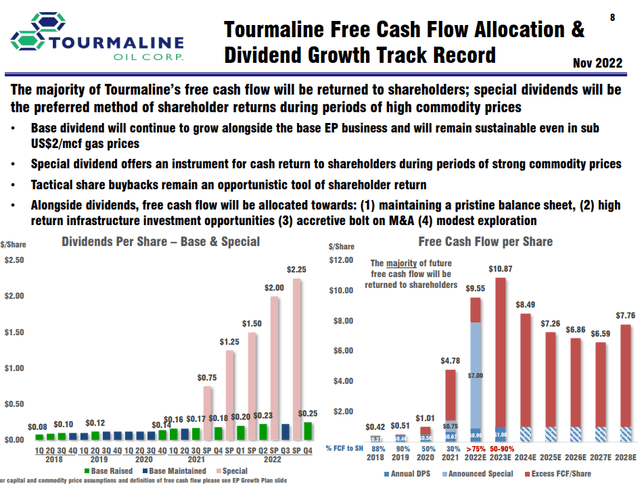

Investors are often asked for patience in return of capital. TRMLF has adopted the fixed plus variable dividend policy that sends a big chunk of free cash back to shareholders. Growth to $1.00 per share on an annual basis is programmed to for 2023 for the fixed dividend. As you can see, the variable dividend forecast for next year is simply prodigious.

TRMLF Free Cash Allocation (OTCPK:TRMLF)

Finally, capital costs and particularly land acquisition costs, are set to decline. With 1.2 mm acres under lease and participation in all key areas of the WCSB, the organic growth of TRMLF is complete.

Q-3 and Guidance

Third quarter 2022 before tax cash flow was $1.056 billion and $1.051 billion after tax , a 38% increase over third quarter 2021 CF. Third quarter 2022 free cash flow was $568.3 million. The company paid a special dividend of $2.25/share on November 18 to shareholders of record on November 9 and beginning in Q4, will increase the quarterly base dividend by 11% to $0.25/share providing for an annualized dividend of $1.00/share. Including the payments of both the Q4 special dividend and base dividend, the company will pay a total of $7.90/share in dividends in 2022, resulting in approximately a 10% yield based on an October 14, 2022 closing share price of $76.51. Third quarter 2022 EP capital spending was $468.8 million, within previous guidance. Net debt at September 30, 2022, was $564.6 million, well below the long-term net debt target of $1.0- $1.2 billion.

Tourmaline has an average of 711 mmcfpd hedged for 2023 at a weighted average fixed price of CAD $5.77/mcf, an average of 110 mmcfpd hedged at a basis to NYMEX of USD $0.12/mcf, and an average of 754 mmcfpd of unhedged volumes exposed to export markets in 2023, including Dawn, Iroquois, Empress, Chicago, Ventura, Sumas, US Gulf Coast, JKM, Malin, and PG&E.

Forward guidance. At current strip pricing, full-year 2022 CF of $4.76 billion is now anticipated. Tourmaline’s 2023 EP capital program is estimated at $1.6 billion. The 2023 EP program is expected to deliver an annual average production of 545,000 boepd, and CF at strip pricing of $5.4 billion, yielding FCF of $3.7 billion in 2023. (Source)

Risks

I think the key risk facing TRMLF is political. Like the U.S., the Canadian government has planted an oppressive foot on the industry, in my opinion. Like the U.S., Canada is a huge country with a government determined to comply with the 2030 climate edicts of the Paris Convention. It is hard to see this changing as the population distribution in Canada ensures this faction will maintain control of the country. The risk is asymmetric and difficult to assess. Investors should just be aware that natural resource companies, like TRMLF, are under attack. This is a risk we all assume investing in these companies, above and below the 49th parallel.

Your Takeaway

I have been a fan of this company since first covering it. I like companies that are reaching for a leadership position in their industry. TRMLF has certainly done that with its acreage base, proven drilling inventory and recognition that further growth might be counterproductive.

Their balance sheet is pristine with just a few hundred million in long term debt against a capitalization of over $20 bn. That is a dream ratio that permits the ambitious return of the capital program the company has outlined.

Right now the company is trading at 3.5X projected OCF, definitely on the low side in this metric. Nor are they expensive on a flowing barrel basis at $36K per barrel. With 4.2 bn BOE of 2P reserves booked, the company has 21 years of production without discovering another barrel. That said, they are not sitting on their laurels. The company plans an aggressive growth campaign resulting in BOE of 700K per day by 2028.

With its tilt toward gas, it wouldn’t surprise me to see the TRMLF multiple creep higher when the market sentiment shifts back toward energy. For reference, top American gas producer, EQT (EQT) is trading at 4.5X OCF. If you gave TRMLF EQT’s multiple, the share price would adjust to $80 per share in USD, implying a potential 30% upside on present metrics. Longer term, as the production nears 700K per day in 2028, cash flow should drive the share price above $100 in USD.

Investors looking for income would be hard pressed to do better than TRMLF in 2023. With a free cash flow yield of 14%, the stock is materially undervalued in the market, which should give a further boost to shares in a more supportive market.

Sagacious investors might monitor the company before plunging into TRMLF. The current turbulence in the market is chipping away at gains made earlier in the quarter. That said, you of course run the risk of missing what is an attractive entry point at current levels.

I rate the company as a top pick for growth and income.

Be the first to comment