Ceri Breeze/iStock Editorial via Getty Images

Investment Thesis

- Investing in the airline industry in general and particularly in Delta Air Lines (NYSE:DAL), comes with a lot of risk factors.

- In my opinion, the reward of investing in Delta Air Lines is not worth the risk. Therefore, I rate the company as a sell.

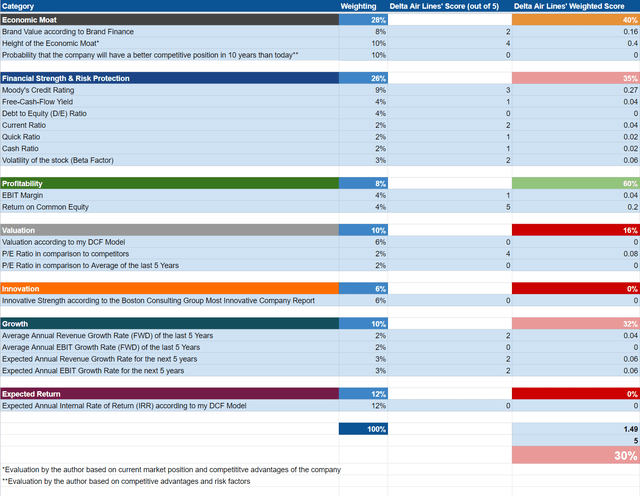

- The HQC Scorecard confirms that Delta Air Lines is unattractive in terms of risk and reward. The company doesn’t achieve a very attractive rating in any category. Only for Profitability (60/100) is it rated as attractive. In the categories of Financial Strength (35/100) and Growth (32/100), Delta Air Lines is rated as unattractive. For Valuation (16/100) and Expected Return (0/100), it receives a very unattractive rating.

Delta Air Lines’ Competitive Advantages

The company’s global network contributes to a strong competitive advantage. Delta Air Lines serves over 130 countries and territories as well as over 800 destinations around the world. At the end of 2021, Delta Air Lines offered more than 4,000 daily departures to its customers. Furthermore, the company’s global network is supported by a fleet of about 1,200 aircrafts that vary in size and capabilities. This gives the company flexibility to adjust aircraft to its existing network.

The global network of Delta Air Lines and other existing airline companies in combination with high necessary capital expenditures (such as for aircraft leases and leases of airport property and other facilities) contribute to the fact that it’s extremely difficult for new competitors to enter the industry.

Delta Air Lines shows the highest Return on Equity Ratio (23.57%) as compared to its competitors American Airlines (NASDAQ:AAL), United Airlines (NASDAQ:UAL) and Southwest Airlines (NYSE:LUV). This demonstrates that the company efficiently uses shareholders’ equity in order to generate income. Its higher EBIT-margin (4.11%) as compared to competitors American Airlines (-3.54%) and United Airlines (-2.05%) is another indicator of the company’s relatively strong competitive position.

With an EBIT-margin of only 4.11%, Delta Air Lines has one of the highest margins compared to its competitors, which shows us that the margins in the airline industry are very low compared to other industries. It’s an indicator that means we should be very cautious about investing in the airline industry and aware of the enormous associated risks. Declining revenues can cause airline companies to generate significant losses, which in turn increases the risk of bankruptcy.

Delta Air Lines’ Valuation

Consensus EPS Estimates for Delta Air Lines are $5.33 for 2023. Using a 10x P/E Multiple (which is based on its Average P/E Non-GAAP [FWD] of 10.15 over the last 5 years) would result in a share price for Delta Air Lines of $53.30. At the company’s current share price of $33.31, this would result in an upside of 60%.

Delta Air Lines’ P/E Ratio is 14.86, which is 15.65% below the sector median (which is 17.62). This provides us with an additional indicator that the company is currently undervalued.

Delta Air Lines In Comparison To Some Of Its Competitors

|

Delta Air Lines, Inc. |

American Airlines Group Inc. |

United Airlines Holdings, Inc. |

Southwest Airlines Co. |

|

|

Sector |

Industrials |

Industrials |

Industrials |

Industrials |

|

Industry |

Airlines |

Airlines |

Airlines |

Airlines |

|

Market Cap |

20.98B |

8.98B |

12.06B |

22.23B |

|

Employees |

83,000 |

129,200 |

91,200 |

62,333 |

|

Revenue [TTM] |

41.80B |

40.72B |

35.62B |

21.15B |

|

Operating Income [TTM] |

1.72B |

-1.44B |

-729.00M |

1.27B |

|

Revenue Growth Rate 3 Years [CAGR] |

-2.93% |

-3.31% |

-5.71% |

-1.80% |

|

Revenue Growth Rate 5 Years [CAGR] |

0.99% |

-0.35% |

-0.97% |

0.34% |

|

Gross Profit Margin |

16.33% |

17.47% |

23.87% |

24.15% |

|

EBIT Margin |

4.11% |

-3.54% |

-2.05% |

5.98% |

|

Return on Equity |

23.57% |

NM |

-27.54% |

9.57% |

|

P/E GAAP [FWD] |

14.86 |

NM |

NM |

18.72 |

|

Dividend Yield [FWD] |

– |

– |

– |

– |

|

Payout Ratio |

– |

– |

– |

– |

|

Dividend Growth Rate 5 Years [CAGR] |

– |

– |

– |

– |

|

Consecutive Years of Dividend Growth |

0 Years |

0 Years |

– |

0 Years |

|

Dividend Frequency |

– |

– |

– |

– |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

“The HQC Scorecard aims to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here, you can find a detailed description of how the Scorecard works.

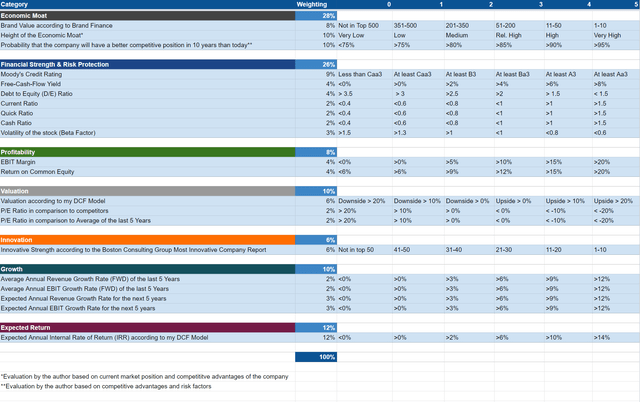

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Delta Air Lines According to the HQC Scorecard

According to the HQC Scorecard, Delta Air Lines has an overall score of 30 out of 100 points. This means it’s classified as an unattractive investment in terms of risk and reward.

Delta Air Lines fails to achieve a very attractive rating in any category. Only for Profitability (60/100) is it rated as attractive with a score of 60/100. This comes as a result of its relatively high Return on Equity of 23.57%.

The company is rated as moderately attractive in terms of Economic Moat (40/100). In the categories of Financial Strength (35/100) and Growth (32/100) Delta Air Lines is rated as unattractive. For Valuation (16/100) and Expected Return (0/100), it receives a very unattractive rating.

Delta Air Lines unattractive rating in terms of Financial Strength is particularly due to its high Debt to Equity Ratio of 883.52%, as well as a low Current Ratio of 0.66, low Quick Ratio of 0.53 and low Cash Ratio of 0.41.

The company’s unattractive rating in terms of Growth can mostly be attributed to having a low Average Revenue Growth Rate [FWD] of 4.88% and Average EBIT Growth Rate [FWD] of -7.47% over the last 5 years.

This unattractive overall rating (30/100) in terms of risk and reward is a strong indicator that investing in Delta Air Lines comes with enormous risk factors. In my opinion, the reward is simply not worth the high risk. Therefore, Delta Air Lines receives my sell rating.

Risk Factors

I see a lot of different risk factors when evaluating whether to invest in Delta Air Lines or not:

One of which is the company’s high Debt to Equity Ratio of 883.52%, which demonstrates its high financial leverage. This high Debt to Equity Ratio is a strong indicator that investing in the company is a risk. Its low Current Ratio of 0.66, low Quick Ratio of 0.53 and low Cash Ratio of 0.41 are all indicators that the company could at some point have difficulties in meeting its short-term obligations.

Another risk factor I see when investing in Delta Air Lines is the fact that the company’s business results are highly dependent on the price of aircraft fuel. Increases in the cost of crude oil could have an adverse effect on the company’s operating results. Over time, fuel prices have been highly volatile. Proof of this is the fact that from 2019 to 2021 the company’s average annual fuel price per gallon varied from $1.64 to $2.02. Year to year variations ranged from a decrease of 19% to an increase of 23%, as according to the company.

Additionally, Delta Air Lines has a significant amount of existing fixed obligations (which includes, among others, aircraft lease and debt financings, leases of airport property and other facilities). A disruption to its business operations (which could be, for example, caused by another pandemic) might see a situation in which the company isn’t able to meet its obligations.

The fact that consumer behavior regarding flying has changed as a result of the pandemic poses a further risk for the future of the airline industry. It can be assumed that the number of flights will not return to pre-pandemic levels in the future due to companies having recognized the advantages of virtual meetings and are therefore more likely to save on travel expenses. As according to Reuters, Amazon (NASDAQ:AMZN) alone saved $1 billion in travel costs during the pandemic.

The risk factors mentioned above strengthen my belief that the reward of investing in the company is not worth the risk. Which is why Delta Air Lines receives my sell rating.

The Bottom Line

There are many risk factors involved when investing in the airline industry in general, and particularly when investing in Delta Air Lines: the company’s high Debt to Equity Ratio of 883.52% demonstrates a high financial leverage and provides us with a strong indicator in regards to high investment risk. Furthermore, the company’s low Current Ratio, Quick Ratio and Cash Ratio shows that it might not be able to meet its short-term obligations at some stage in the future. In addition to that, the high dependency on the price of crude oil is another risk factor. The fact that the company has a significant amount of existing fixed obligations means that its profits could decline significantly in the case of decreasing revenues.

In my opinion, the reward is not worth the risk when deciding whether or not to invest in Delta Air Lines. Therefore, I rate the company as a sell. My investment thesis is also supported by the results of the HQC Scorecard, which rates Delta Air Lines as unattractive (only receiving 30 out of 100 points) in terms of risk and reward.

Author’s Note:

If you found this analysis of value, I would appreciate it if you could follow me (by pressing the “Follow” button) and if you could also press “Like this article” just below the article. If you have any questions regarding this analysis, feel free to leave a comment below. Thank you very much!

Be the first to comment