blinow61

Introduction

Shell (NYSE:SHEL) (OTCPK:RYDAF) was originally a Dutch company whose headquarters recently moved to the United Kingdom. Its shares are available on both the NYSE and the London Stock Exchange.

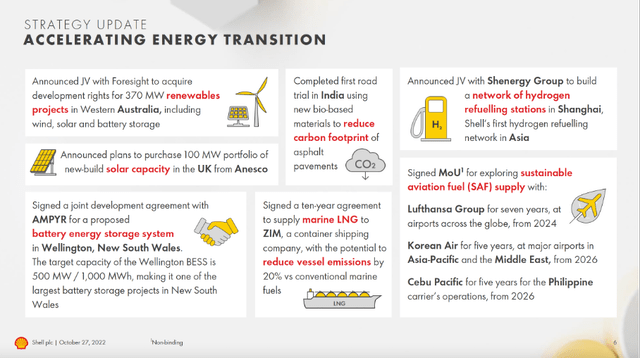

Accelerating energy transition (Shell 3Q22 investor presentation)

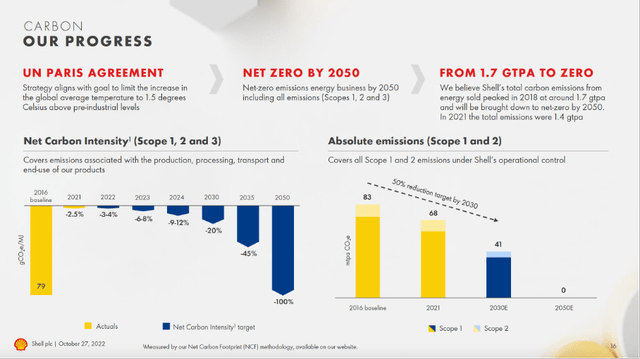

The company is making a strong energy transition, aiming for net zero emissions by 2050. In addition to fuels, Shell offers renewable energy such as solar, wind, hydrogen, biofuels and geothermal.

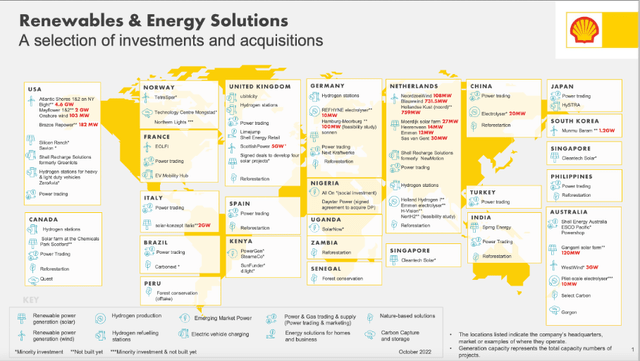

Renewable and energy solution (Shell 3Q22 investor presentation)

Shell is an interesting stock because the fuel market provides constant demand for Shell’s products. In the long term, the boom of EVs will reduce the demand for fuels. Shell responded well to the energy transition by investing heavily in solar, wind and hydrogen power. The stock’s valuation is favorable, and the $4B share repurchase program in the fourth quarter will push the price further up.

Company Overview And 3Q22 Earnings

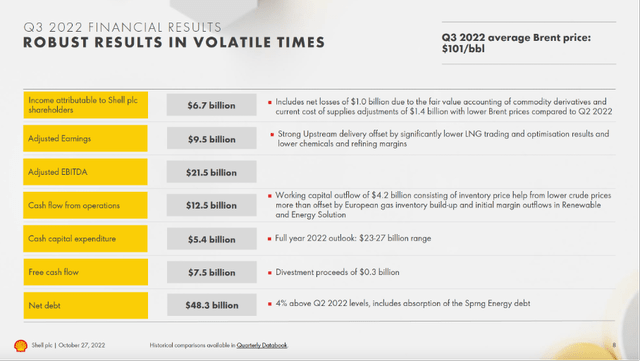

Robust results in volatile times (Shell 3Q22 investor presentation)

3Q22 Earnings came in strong with an adjusted profit of $9.5B. The upstream segment delivered an adjusted profit of $5.9B for the quarter. LNG trading was lower due to seasonality and a volatile and disrupted market as the JKM – EU TTF margin was deeply in the red during the quarter due to the Ukrainian war and restrictions on LNG imports and regasification in the EU.

The result attributable to Shell plc shareholders included net losses of $1B due to fair value measurement of commodity derivatives and ongoing supply cost adjustments of $1.4B at lower Brent prices than in the second quarter of 2022.

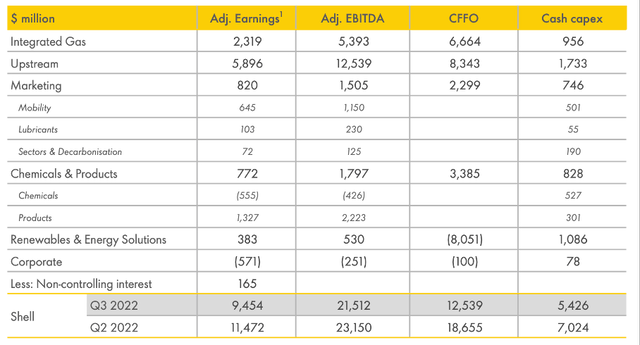

Financial highlights (3Q22 earnings release)

Shell is on track to transform into a climate-friendly company by investing heavily in renewable energy and reducing its carbon footprint. Their goal is to have net zero emissions in Scope 1, 2 and 3 by 2050 by reducing their absolute emissions to net-zero.

Reducing carbon footprint (Shell 3Q22 investor presentation)

Oil Prices

Crude oil rose from its lowest level in 2020 to a record high of about $120 per barrel. Currently, crude oil is in bear market territory and OPEC+ will discuss a possible shift in its supply quota on Sunday, Dec. 4. There are rumors that production will not be cut because of low oil prices and fears of an upcoming recession. A decision of no change in oil production is also likely, which will not change oil prices much.

A Russian oil price cap could boost oil prices, the pronouncement on a likely oil price cap for Russia is scheduled for Dec. 5. The price cap is estimated at $60 per barrel, up from earlier estimates of $65 to $70 per barrel. If the oil price cap is too low, Russia could constrain demand in response, which could increase oil prices. The oil cap will have an immediate negative effect on the financial strength of Russia, which is already in financial trouble.

Crude Oil Brent (Trading Economics)

$20B Returned To Investors YTD

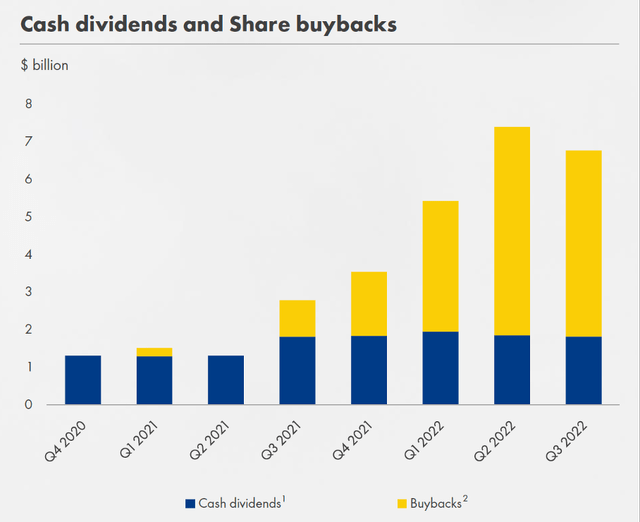

Cash dividends and share buybacks (3Q22 investor presentation)

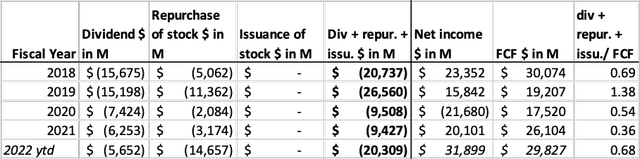

The recent increase in oil prices benefited Shell and resulted in free cash flow of nearly $30B year-to-date. Shell pays a good dividend of $1.98 per share, representing a dividend yield of about 3.3%.

In addition to its dividend, Shell rewards its shareholders with a share buyback program. About 68% of the high free cash flow this year has been distributed to shareholders, of which about 50% is allocated to repurchasing shares. The repurchase of $14.7B shares year-to-date was equivalent to a repurchase yield of 8.2%.

Shell cash flow highlights (SEC and author own calculation)

In late October, Shell announced that it would repurchase $4B of shares in the fourth quarter. This will further boost the share price and increase the dividend per share.

Shell Is Cheaply Valued

The volatile oil price creates strong earnings and free cash flow fluctuations for Shell. Shell’s share price is highly dependent on the oil price and demand for oil, and the stock’s valuation. I do not expect the oil price to remain at these high levels, but to cool to their mean. The rise of EVs and the political movement toward clean fuels are long-term headwinds for Shell. Despite the strong growth of EVs, I see oil as the primary source in internal combustion engines for a long time to come. In addition, oil will continue to be needed for the production of plastics and lubricants. Shell is diversifying into renewable energy with hydrogen production, Shell Energy, and other initiatives. Shell responds quickly to changing markets and that is something investors like to see.

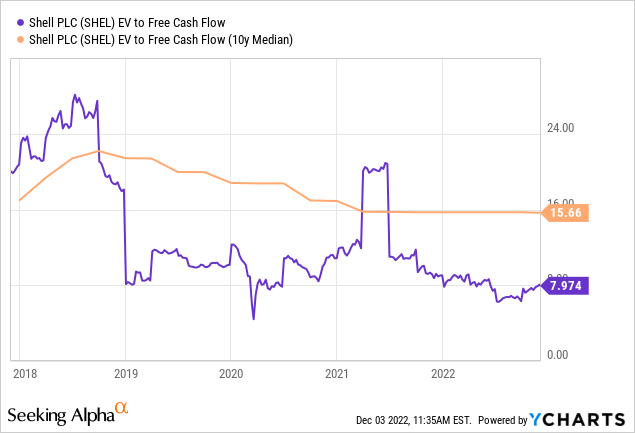

To get a glimpse on Shell’s stock valuation, I calculated the average value of free cash flow over the past 4 years. The average free cash flow offsets the reduction in free cash flow during the low oil price in 2020 and the high oil prices as of today.

Shell’s average free cash flow over the past 4 years is $23B. Current market capitalization is $205B, cash is $36B, long-term and short-term debt is $82B, bringing net debt to $46B. Thus, the enterprise value is $251B. The average EV to FCF value over the past 4 years is 11, which is a very favorable valuation.

Shell’s average EV to FCF ratio over the past 10 years is 16. With a 4-year average EV to FCF ratio of only 11, is cheaply valued at a discount of about 31%.

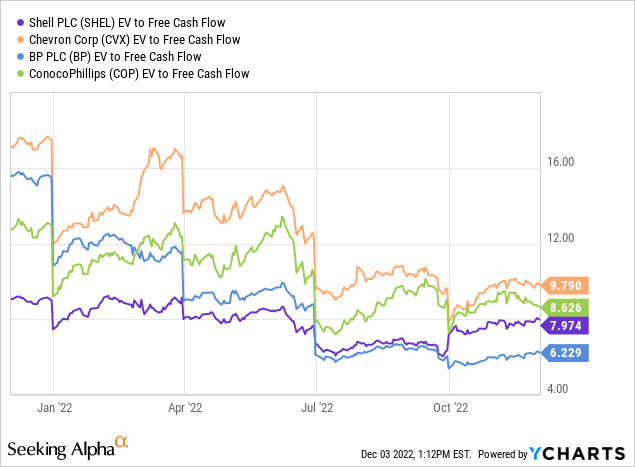

If we compare Shell to some well-known industry peers such as Chevron (CVX), BP (BP) and ConocoPhillips (COP), we see that Shell is one of the cheapest stocks next to BP based on EV to FCF ratio.

Shell has a slightly higher gross profit margin of 20% compared to BP of 17%. Shell has multiple years of positive free cash flows over the past 10 years compared to BP (Shell 9/10 versus BP 6/10). Therefore, I prefer Shell to invest in over BP.

Investors should be aware that Shell is transforming itself into a climate-friendly company as it shifts from fossil fuels to clean fuel alternatives and strives to reduce net emissions. Shell is a stock that is not currently a favorite with ESG-conscious investors because it will take until 2050 for Shell to become an energy-neutral company. Therefore, Shell shares are unlikely to be able to shoot to much higher levels in the near term. I see Shell as a stock that is more likely to be held for its dividends than for share price appreciation.

Key Takeaway

- The company is making a strong energy transition, aiming for net zero emissions by 2050. In addition to fuels, Shell offers renewable energy such as solar, wind, hydrogen, biofuels and geothermal.

- A Russian oil price cap could boost oil prices, the pronouncement on a likely oil price cap for Russia is scheduled for Dec. 5. The price cap is estimated at $60 per barrel, up from earlier estimates of $65 to $70 per barrel.

- If the oil price cap is too low, Russia could constrain demand in response, which could increase oil prices.

- The recent increase in oil prices benefited Shell and resulted in free cash flow of nearly $30B year-to-date. About 68% of the high free cash flow this year has been distributed to shareholders, of which about 50% is allocated to repurchasing shares.

- Shell is one of the cheapest stocks next to BP based on EV to FCF ratio.

- Shell has multiple years of positive free cash flows over the past 10 years compared to BP (Shell 9/10 versus BP 6/10). Therefore, I prefer Shell to invest in over BP.

Be the first to comment