FinkAvenue

Introduction

Lululemon (NASDAQ:LULU) is my favorite apparel stock on the market today. I like the products they sell and I wear them a lot. Above all, I like the growth story of Lululemon as the company has exceptional management and continues to deliver on growth promises. This makes me feel confident that they will be able to execute on their current targets for 2026.

We are dealing with tough economic conditions at the moment with extreme inflation levels, rising interest rates, and a high chance of a recession in the near term (although it looks like it is going to be a shallow one). This has put a lot of pressure on stocks, and growth stocks in particular, so far this year. Lululemon is down by just over 6% YTD, making it an outperformer compared to the general market. This outperformance seems to be driven by strong growth plans and solid performance despite economic turmoil. We recently saw quarterly results from Nike (NKE) resulting in a double-digit drop in a single day as the result of inventory issues. Investors are on their toes and any reason to doubt a company seems to result in a selloff. Lululemon will be reporting its earnings this week and a lot of investors will be focused on these earnings to see whether Lululemon remains resilient under current circumstances.

Although near-term weakness is the dominant factor on investors’ minds, I think we should keep our eyes on the long-term potential and look for bargains on the market today. Lululemon has amazing growth plans and is well-positioned to execute on them.

In this article, I will take you through the company’s background, fundamentals, financials, performance, opportunities, and risks. This is my initial coverage on Lululemon after owning the stock for many years, and I will continue to do so. By the end of this article, we should be able to determine whether Lululemon is a long-term buy at current prices or whether you should potentially wait for some stock price weakness as the market might not have bottomed yet.

Lululemon Athletica

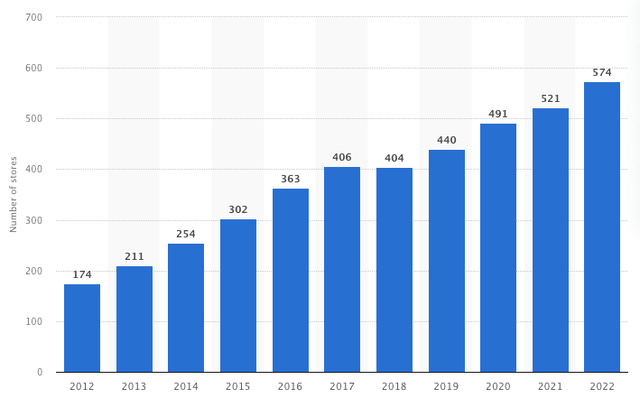

Lululemon is a Canadian athletic apparel multinational with its headquarters in British Columbia and incorporated in Delaware, US. Lululemon was founded in 1998 and started as a retailer of yoga pants and other yoga wear and accessories. Today, Lululemon has expanded to other athletic wear such as tennis and golf. It also sells lifestyle apparel and personal care products. The company has 600 stores internationally and is a big online seller as well. Lululemon has been growing this store count at a strong pace as the company more than doubled its total stores since 2014.

Lululemon store count (Statista)

Where Lululemon distinguishes itself from the competition product-wise is through its self-made fabrics, which are designed in a research & development lab called “whitespace”, located in its headquarters. This lab has over 50 employees including scientists and psychologists. Another reason for the great performance of Lululemon over the last 20 years is because of its focus on a single product category, women’s yoga apparel. Through this focus, it managed to create a solid customer base thanks to its incredible products which then gave it a basis to expand into other categories. Yet, still today, its women’s apparel continues to grow at an incredible pace.

Now I don’t want to go too deep into their products, despite my sheer enthusiasm for them. For any investor considering investing in Lululemon, it is important to know why people would or should buy Lululemon products over Nike or adidas (OTCQX:ADDYY) for example. As mentioned above, this is thanks to a strong focus and differentiating product quality. Lululemon products are generally more expansive compared to other apparel brands, but this seems to be no problem for Lululemon. Having a customer base that has a little more to spend might even make them more recession-resistant as it is most of the time the lower class who gets hit by a recession.

Lululemon can, of course, not grow at such a rapid pace by just limiting itself to a few categories and expanding its store count. The company has a successful strategy in place called “the power of three 2x“. The “2x” in the name is because Lululemon already launched this strategy before. It was so successful that they felt like they could manage to accomplish the same targets again. Last time out, Lululemon even managed to complete the 5-year plan in just three years – an incredible performance. By using this strategy, Lululemon managed to grow revenue from $3 billion in 2018 to $6.25 billion by 2021. It should be mentioned that the covid-19 pandemic most likely was a strong additional tailwind for Lululemon which made it possible to achieve their goals two years earlier. The covid-19 induced lockdowns caused for more people to work from home and wear what they like the most. Yoga wear is probably the most comfortable clothing there is, so sales grew at a faster pace for Lululemon as a result. In addition to this, Lululemon was already selling a lot through their digital channels and therefore did not see a sales slowdown from the closing of their stores during lockdowns.

Now, of course, good quality products and a strong user base create a strong moat that is of high value to shareholders. But, even more important for a growth company like Lululemon are the strategies in place to drive revenue growth for the next few years. The new power of three 2x is supposed to double revenue from $6.25 billion in 2021 to $12.5 billion by 2026.

So, what are these three ways of expanding the business that were so successful in the past?

Product innovation – double men’s revenue by 2026

With the company having focused for most of its existence on women’s apparel, the company still has a long runway of growth when it comes to the men’s segment. For this reason, Lululemon believes it can double its revenues from the men’s segment by 2026. It makes sense for Lululemon to focus on a growth area such as this one, and when comparing revenue from both gender segments, strong growth in men’s seems very achievable. Also, the company plans on continuing to grow women’s and accessory segments driven by product innovation. The company still sees a lot of potential within other new product categories such as core performance (run, train, and yoga) and new opportunities in which it has recently expanded (tennis, golf, hike).

Guest experience – double digital revenue by 2026

After tripling its digital revenue between 2018 and 2021 as part of the power of three strategy, Lululemon expects to be able to double digital revenue again by 2026. Lululemon wants to accomplish this by creating world-class experiences – building on its guest relationship and building a stronger connection with its customers. The company plans on doing this through new customer programs like the earlier announced “Like New” expansion, the brand’s first trade-in and resale program. In addition to this, Lululemon wants to launch new membership programs. Lululemon plans of using these ways to leverage a stronger engagement with its customers, create a community, and an immersive fitness marketplace. I think it’s great to see a company focus on the connection with its customers and I am sure it will pay off. Increasing digital channels and the increase of internet shopping as a whole make it seem like doubling digital revenue should be accomplishable. Of course, this will not be as easy as it was with the previous strategy as this was driven by a covid-19 related digital shopping spree. Yet, the shift towards digital shopping is still on the move and so I believe Lululemon will benefit from its focus on digital.

International expansion – quadruple international revenue by 2026

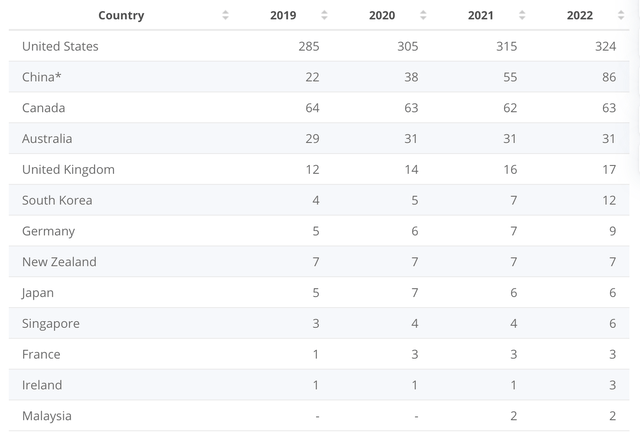

As part of its power of three x2 growth strategy, Lululemon expects to quadruple its international revenues again by 2026 compared to 2021. Lululemon has a significant runway in both new and core markets as most stores are located in North America as shown by the graph below.

Lululemon store locations by country (Lululemon)

This gives Lululemon plenty of expansion potential with a lot of markets still undiscovered from a physical store standpoint. Lululemon continues to enter new markets in APAC and Europe, which will be key to reaching its 2026 goals. Lululemon plans on opening its first stores in Italy and Spain within the next few years. Besides expanding to new markets, there is also still plenty of growth potential for mainland China as this has a huge and growing market for sports apparel. The sports apparel market in China is growing at an 11% CAGR, while the US market is only growing by a 2.5% CAGR. Loads of expansion opportunities left for Lululemon make me feel like Lululemon should be able to achieve its growth goals for international revenue. This will also be a massive growth driver for revenue in general. It is hard to argue against the expansion opportunities.

Other growth drivers

Of course, besides these three focus areas for growth, existing business segments will continue to be strong contributors to revenue and margin growth as well. The company’s women’s business, store channel, and North American operation will play a crucial role in future growth. Both women’s and North America are expected to generate double-digit CAGRs in revenue until 2026 and, meanwhile, stores are expected to grow in the mid-teens. We can see from its latest financial results that recent growth in women’s is close to being just as strong as the men’s segment despite being significantly bigger.

To complete the financial targets for Lululemon we have to note that management expects to grow revenue at a 15% CAGR between 2021 and 2026. EPS growth will outpace revenue growth as margins expand thanks to a growing business. Lululemon has a great growth outlook and seems poised to meet its targets by 2026, if not sooner (again). Yet, we do have to take into account the possibility of a recession and the influence this would have on consumer spending. Now, as mentioned earlier, I do believe Lululemon will be more resilient than, for example, Nike or adidas as Lululemon serves a higher-income customer base which is less likely to slow spending. I still believe Lululemon will be able to meet its growth goals by 2026 even in the event of a recession by next year, but it is something to take into consideration. It could play an important role when considering what the right price is to buy.

Recent financial results

On the first of September Lululemon announced its 2Q22 results. The company saw revenue grow by 29% YoY to $1.9 billion. Revenue increased by 28% in North America, while international grew by 35% thanks to the continued reopening of stores and expansion plans. Revenue growth of 29% was slightly above the three-year CAGR of 28%, which shows how constant revenue growth remained to be, despite severe economic headwinds.

The company-operated store revenue came in at $930 million, representing a little over 48% of revenue. Comparable store sales increased by 16% thanks to increased store traffic. E-commerce revenue totaled $775.4 million and represented 41.5% of revenue. Both store revenue and e-commerce revenue stayed flat as a percentage of revenue, with both growing at about the same pace. E-commerce saw an expected slowdown of growth as it came in at 30% revenue growth YoY, while the three-year CAGR stands at 53%. Of course, this was driven by covid lockdowns which is a tough comparable to beat as the world has reopened. Online traffic increased, causing a strong increase YoY, nevertheless.

During 2Q22 Lululemon opened 21 new stores with 12 net new stores in the Asia Pacific region, 7 in North America, and 2 in Europe. At the end of 2Q22, Lululemon totaled company-operated stores of 600 compared to 534 at the end of 2Q21. This shows Lululemon is still increasing its store count at a strong pace.

As for gross profit, it should be mentioned that Lululemon keeps reporting incredible margins. Gross profit for 2Q22 came in at $1.1 billion, representing a gross margin of 56.5%. Margins are down slightly compared to the year-ago quarter when gross margins were 58.1%. Still, margins are very high compared to the athletic apparel industry as they are 58% higher compared to the sector average according to seeking alpha. EBITDA margin of 25% is even more impressive as this is 126% above the sector average. A net income margin of 15.6% is higher than the 12% of Nike and over 200% higher than the sector average. Lululemon is incredibly profitable and therefore receives an A from Seeking Alpha Quant for its profitability. Incredible revenue growth, while being very profitable seems to be a perfect combination for any investor and could well be the reason that Lululemon is not down as much as other growth stocks YTD.

Net income for 2Q22 was $289.5 million with EPS of $2.20, growing at a faster 33% YoY.

All in all, it was a very strong quarter for Lululemon, and growth remained to be strong despite economic headwinds. The only small result of these headwinds were slightly lower margins because of an increase in freight prices. Demand remained strong for Lululemon products and Lululemon is not experiencing the same inventory buildup problems as witnessed by Nike. Inventory did increase 85% YoY to $1.5 billion which is inclusive of in-transit inventory. This is not a problematic increase as it is just the result of an easing of the supply chain problems and demand remains high. It is, however, something to keep an eye on over the next couple of quarters.

Outlook for 4Q22 results reported on the 8th of December

Although the goal of this article is not to look ahead to this week’s earnings, which will be reported on the 8th of December, it is important to see what we can expect. Lululemon has guided revenue to be in the range of $1.780 to $1.805 billion. EPS is expected to come in between $1.90 and $1.95. Analyst expectations are a little higher with an EPS projection of $1.96 and revenue of $1.81 billion. This represents 21% and 25.6% YoY growth, respectively. Lululemon has a strong history of beating analyst expectations, but I think expectations are high when considering the current macro issues. If Lululemon would be able to outperform analysts’ expectations without too many inventory problems, the stock could leap forward and analysts would have to adjust their long-term targets.

In the case of an earnings miss, the current valuation will leave little room for forgiveness. The earnings next week will provide an important inside look into the strength of Lululemon. I do not like to make predictions, so I will keep it in the middle for now and leave it completely up to you whether to buy the stock after or before its earnings release. I will wait with buying and check out the financial results first as I currently see more downside risk than upside potential in the short term.

For FY22 Lululemon expects revenue in the range of $7.865 billion to $7.940 billion and continued strong growth rates as it works towards its FY26 targets.

Balance sheet and valuation

Cash and cash equivalents were $498.8 million at the end of Q2 2022 while total debt was close to $1 billion. The strong margins give the stock plenty of cash-generation capabilities. Lululemon is not a company that is focusing on M&A as it continues to grow mostly organically. Therefore, I feel like the current balance sheet is healthy and gives the company ample liquidity to expand, while not having to worry too much about its debt position.

The valuation of Lululemon might also right away be the largest barrier for any investor to invest in this business. Lululemon is currently valued at a forward P/E of 38.59 and therefore receives a D- from Seeking Alpha Quant for valuation. The stock looks to be priced for perfection. Yet, the athletic apparel sector seems to be quite highly valued in general when we look at competitors such as Nike (forward P/E of 37.64).

Analysts are projecting EPS growth of 15% for FY23 – a significant slowdown compared to 27% for FY22. I think this is a fair estimate when considering economic circumstances. At the same time, I believe Lululemon could surprise investors and analysts alike.

I find the valuation a very hard one to judge with this one, as I feel like Lululemon is perfectly positioned for strong growth over the next decade and is in a good position in the event of a recession next year. Looking at the business and growth prospects, this is the best stock I can find in the apparel industry. Still, there seems to be more downside risk at current prices than there is upside potential in the near term. If financial results come in lower than expected by analysts and investors, the stock could well revalue lower. I believe that it is up to investors to consider what your investment horizon is and how badly you want to own this beautiful company.

Risks

One of the biggest risks for most companies right now is a potential recession. As I have said multiple times already, I do believe Lululemon could be relatively recession resilient. This belief might not be true and if this is the case – this would result in a significant growth slowdown and therefore a lot of downside risk as the stock is priced for strong double-digit growth. In addition to this, the high inflation rates are still not great and could have a lasting effect on margins for Lululemon as freight rates remain elevated and fabrication costs need to be priced onto the consumers.

Conclusion

Analyst expectations are projecting revenue to reach $12.35 billion by FY26. This is pretty much in line with management’s goal of $12.5 billion by FY26. So, at least analysts believe that Lululemon could reach its financial 2026 goals. The company has incredible plans for continued growth and is very well positioned to become a threat to industry giants such as Nike and adidas. I like Lululemon for its products, incredible management, strong growth prospects, and international potential. At the same time, the valuation is a difficult one as I feel like the company was way better value at around 30x P/E which it was not so long ago. The recent significant increase in share price has made the stock expensive and therefore has more downside risk than it has upside potential. Therefore, I will repeat what I have stated earlier in this article – if financial results come in lower than expected by analysts and investors, the stock could well revalue lower. Lululemon is priced for perfection right now and in the current economic climate perfection is hard to accomplish.

The current stock price is just too high for me to recommend buying the company right now. I prefer waiting for lower prices with earnings around the corner. I do remain of the opinion that this company is a brilliant investment and highly recommend buying on any weakness in the share price.

I rate the Lululemon stock a hold at the current share price of $386.

Be the first to comment