_ultraforma_

Thesis

Despite its valuation discount, Citigroup Inc. (NYSE:C) has continued to underperform its peers represented in the Financial Select Sector SPDR ETF (XLF). Its net interest income [NII] has also benefited tremendously from the Fed’s rapid rate hikes. However, the weakness in its non-interest revenue mitigated it in Q3, as its Investment Banking [IB] segment vastly underperformed.

As such, we believe the recent Bloomberg report suggesting that Citigroup and its peers are considering cutting their bonus pools for its IB segment this year by “as much as 30%” is constructive.

Also, the bank remains in transition, with its Institutional Clients Group [ICG] still recovering. Despite that, we postulate significant damage has already been priced into C at its October lows. However, we believe the risks of a more significant economic downturn impacting banking stocks have also risen, given the recent stronger-than-expected employment report.

While Citigroup could continue to benefit from the Fed’s rate hikes, we believe it could face more challenging comps in FY23, lessening the tailwinds that drove its EPS accretion recently. In addition, a weaker-than-expected earnings environment could lead to a higher reserve build moving forward. Therefore, we believe that the forward estimates for Citi and its peers could be at risk, as we think Wall Street analysts have yet to reflect a significant downturn for the banks.

With C last traded at an NTM normalized P/E of 7.4x (Vs. 10Y average of 9.7x), we believe it seems undervalued. However, the critical question that investors need to ask is whether C represents a value trap to avoid or one that has tremendous potential for re-rating moving ahead relative to its peers.

Our price action analysis suggests that C bulls have yet to muster significant strength to retake its August highs, even though the XLF has re-tested its August levels. Hence, the relative price action underperformance is surprising, as C trades at a discount against its peers’ median.

Hence, we believe it’s appropriate to be slightly cautious for now, as we didn’t get the robust recovery we had anticipated from our previous article.

Revising from Buy to Hold for now.

Citigroup: The Market Needs More Convincing

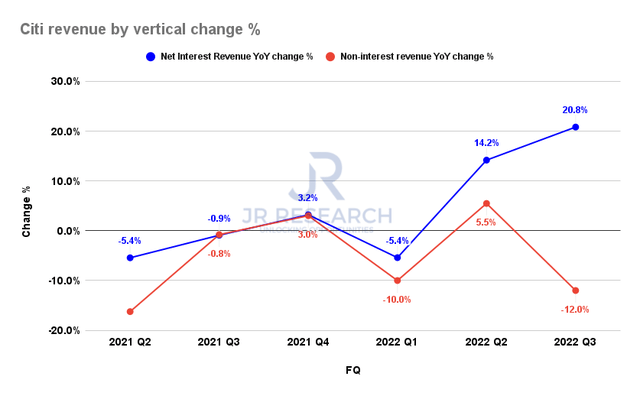

Citi Revenue change by vertical % (Company filings)

Despite posting a remarkable 20.8% gain in NII in Q3, Citigroup delivered a 12% decline in non-interest revenue, led by IB’s 64% drop.

However, we could cut Citigroup some slack on that, as the moderation in IB has impacted the whole industry, given the market volatility and a bear market.

However, Citi’s relatively weak execution in its Markets and Personal Banking & Wealth Management [PBWM] segment suggests that it’s insufficient to mitigate the headwinds in the smaller IB business.

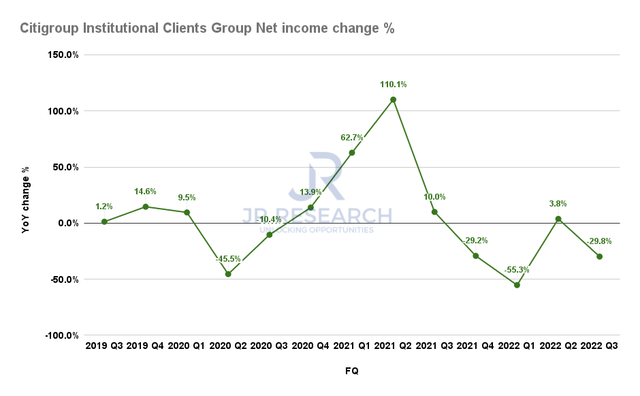

Citigroup ICG Net income change % (Company filings)

As such, the weak net income performance in its ICG segment was not surprising. Citi delivered a 30% YoY decline in ICG net income after a brief lift from Q2’s 3.8% uptick. Citigroup’s ACL reserve build for Q3 ($370M) remained relatively consistent with Q2’s $375M.

However, we postulate that Citigroup and its peers could face more significant macro headwinds moving ahead as the NII tailwinds level off by H1’23.

Wall Street Analysts Don’t Seem Prepared For A Significant Banking Downturn

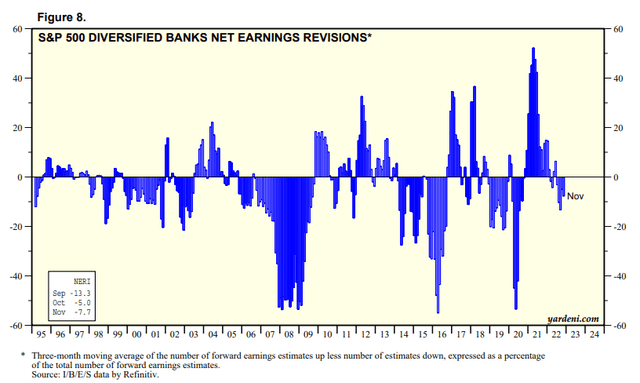

S&P 500 Diversified Banks industry net earnings revisions % (Yardeni Research, Refinitiv)

As seen above, analysts have revised the banking industry’s net earnings downward through November. However, the extent of the revisions suggests that analysts don’t expect a significant impact on Citigroup and its peers’ earnings relative to previous deeper downturns.

Also, the average provisions for losses as of Q3 suggest that banks have prepared for a weaker 2023. However, according to FactSet data, the provisions for loan losses remain well below pandemic highs.

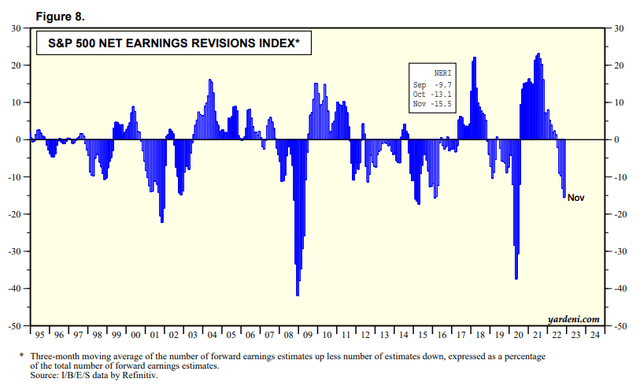

S&P 500 net earnings revisions % (Yardeni Research, Refinitiv)

Furthermore, downward revisions in the banking industry’s earnings seem more optimistic than the market’s downgrades. Hence, we assess that banking industry analysts believe Citigroup and its peers could emerge stronger than the broad market in 2023.

However, we believe the thesis could be tested at the upcoming December FOMC conference.

The Fed Could Return To Spook C’s Investors

With a robust employment report on Friday (November 2), we believe investors need to be prepared for a more restrictive policy stance than what the market could have priced in for now.

The market had already priced in a 5% terminal rate exiting H1’23. However, the forward curve of the Fed Fund rates suggests that it could move into the cutting phase subsequently.

Hence, the critical question is whether the curve needs to be repriced accordingly if the Fed intends to hold its restrictive rates at a higher level to combat sticky wage-driven inflation. As such, it could impact C’s earnings projections in H2’23, as the NII growth tailwinds should have normalized, given tougher comps against H2’22.

We should get more clarity from the Fed’s updated dot plot in less than two weeks, which could provide clues to C’s near- and medium-term directional bias.

Is C Stock A Buy, Sell, Or Hold?

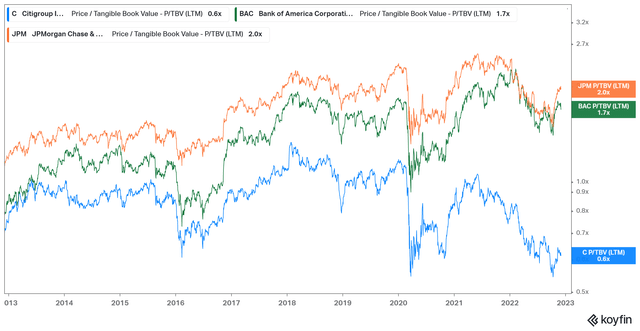

C TTM TBV multiples valuation trend (koyfin)

C’s TTM tangible book value multiples remain well below its closest peers, as seen above. However, we believe the market has gotten it spot on, given Citigroup’s weaker execution in driving earnings accretion.

Therefore, C’s investors need to be very confident in the bank’s execution to turn this around, even though we believe the market has likely reflected significant risks.

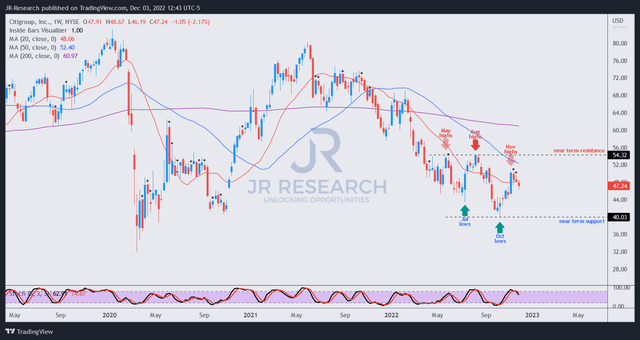

C price chart (weekly) (TradingView)

C has recovered remarkably from its October lows but failed to re-test its August highs.

Also, its momentum has moved off from the overbought levels, with the pullback from its recent highs. Therefore, we prefer to wait and assess the strength of C buyers supporting the retracement, which could determine its near-term directional bias.

Hence, we believe it’s appropriate to be patient for now, as the S&P 500 (SPX) (SP500) also looks well-primed for a pullback from its recent highs (as we highlighted in a recent article). Thus, a potential broad-based pullback should subsequently improve the reward/risk profile for C buyers.

Revising from Buy to Hold for now.

Be the first to comment