HJBC

TotalEnergies S.E. (NYSE:TTE) has not been an immediate beneficiary of the European gas crisis. The company took the unusual decision to remain in Russia after that country’s invasion of Ukraine. The stock price has performed tepidly year-to-date. However, the characteristics of the European energy crisis suggest that TotalEnergies will be a key part of any solution, and that its decision to stay in Russia may prove to be a wise one. With a free cash flow yield of 19.3%, the stock is very attractive.

TotalEnergies History of Profitability

TotalEnergies’ operational performance is exceptional. Despite revenues falling from over $234 billion in 2012, to more than $184 billion in 2021, its profitability has increased throughout the last decade, with net income rising from around $13.65 billion to more than $16 billion in the last decade. TotalEnergies has compounded free cash flow by more than 9% between 2012, when it earned nearly $7 billion in FCF, and 2021 when it earned $16,465 billion in FCF. According to the company’s H1 2022 results, FCF for the first half of the year was more than $20 billion, compared to $6,537 billion in the same period last year, while net income was up 92% year-over-year, from $$5.5 billion to some $10.6 billion. The return on average capital employed (ROACE) has grown from 15.5% in 2012, to 13.9% in 2021, rising to 23.1% in H1 2022.

Yet, the market in the year-to-date has remained largely oblivious to its underlying success. In the trailing twelve months – TTM, TotalEnergies is up 14.17%, but the stock is down 0.27% year-to-date, at time of writing.

Source: Google Finance

This is especially remarkable given that energy stocks have been big winners in the market. Dragging down TotalEnergies’ position seems to be its stance on Russia, a stance which may prove beneficial in the long run given the peculiarities of the European energy crisis.

The European Energy Crisis

Russia has responded to Western sanctions and the prospect of a price cap on Russian energy prices with what amounts to reverse sanctions by stopping the flow of gas through the Nord Stream 1 pipeline that supplies Europe’s largest economy – Germany. Russia has indicated that gas supplies will only resume once Western sanctions are removed. Since then, the euro has slumped to a 20-year low against the U.S. dollar, the British pound has fallen, European markets have tumbled, and the price of gas has rocketed. The latest Gas Supply Status Report by German energy regulator, the Bundesnetzagentur, shows that Germany is close to meeting its storage target and is largely prepared for the coming winter, with the total storage level at 85.55%.

However, Germany, and indeed the wider European community, face a severe energy crisis after the winter and in the years to come. Strategic goals must always be understood as those which compel a country to suffer maximum economic damage to achieve them. Russia will suffer whatever price it has to secure Ukraine within its orbit, and the European Union will pay whatever price it has to maintain the pre-Russo-Ukrainian War political status quo. Two things must be realized: Firstly, Russia is Europe’s best source of gas and every other source is more expensive, and time-consuming to achieve, therefore, although the European Union will work to secure alternative sources, some resumption of gas flows from Russia should happen in the event of peace; secondly, despite that, the European Union will have to diversify supply to friendlier countries, such as the United States and Canada, and find sources within the European Union, to meet demand. The second part means that North American suppliers will and have of course benefited from the crisis. However, in the long run, solutions will have to be European.

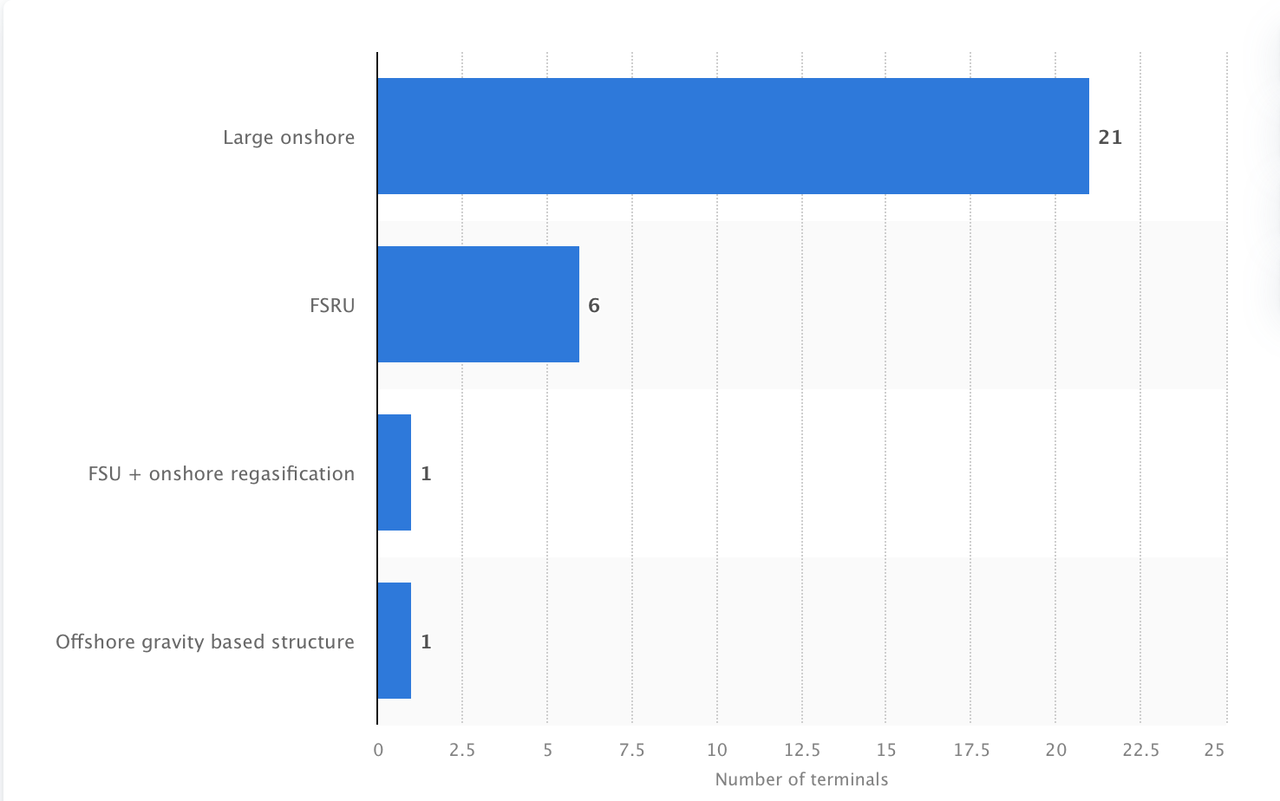

The Groningen gas facility in The Netherlands, Europe’s largest, began its phasing down operation last year, and Europe has only a few LNG import terminals, with just six being floating storage and regasification units (FRSU) terminals.

Source: Statista

Despite president Joe Biden’s compact with Europe, and EU commissioner Ursula von der Leyden’s assurances, there’s no viable LNG solution to quickly resolve the energy crunch in Europe. Russia, prior to the Russo-Ukrainian War, supplied about 40% of European gas needs, 20% of the LNG share in 2021. LNG is 20% of gas imports. In 2021, the United States supplied 28% of LNG imports, and Qatar supplied 20%, with Nigeria (14%) and Algeria (11%) the other major suppliers. The United States, now the world’s largest LNG exporter, is already producing at or near capacity, along with Qatar, the second largest exporter, and Australia, the world’s third largest exporter. In January, LNG imports tripled compared to January last year, yet, despite the surge in imports from the United States, the logistical challenges of importing gas from the United States and other regions is so great that European gas imports have declined. If the United States could meet European demands and do so cheaply and quickly, there would be no gas crisis.

Secondly, the greatest number of LNG terminals are located in Spain, which isn’t very helpful to Germany, which does not have any LNG import terminals. Spain poses an additional problem in that it lacks the pipeline infrastructure to move gas to Germany. That implies inflation. The Current measures are emergency measures, and they’re not sustainable: Ways have to be found to get gas to Germany, and, ultimately, to get some inflow from Russia. Even with its more heightened rhetoric, Europe has not said that it will never import gas from Russia again, and the 2027 gas import ban reflects the difficulties of a transition away from Russia. Accepting the present solution is a commitment to permanent inflation. Although Russia will never again be the primary supplier for the European Union, in the long run, it will play a role because without Russia, Europe has to accept inflation and an end to the era of prosperity.

TotalEnergies Russian Gamble

The company’s recent travails can be linked to uncertainty about its Russian operations, a 19.4% stake in Novatek, a 20% stake in the Yamal project and a 10% stake in Arctic LNG 2. The company’s statement on the war explained that while it will remain in Russia, it will not provide new capital for projects there. Recently, advisors to Ukrainian president, Vlodomir Zelensky, asked the company to either reject €440 million worth of dividends from its Russian operations or use the money for the reconstruction of Ukraine. The company is under some pressure to divest itself of its Russian assets, especially given that other Western oil companies have left Russia. However, so long as Europe needs Russian gas, the French company is likely to remain in Russia. Nevertheless, the company recently sold its 49% stake in the Terneftegaz joint venture to Novatek, after allegations that the facility was being used to supply jet fuel to Russia’s military.

French newspaper, Le Monde, speculated that TotalEnergies unofficial position seems to be that it will not panic and sell its assets, instead, choosing to see what happens with the war and a new dispensation. The company is able to claim that it’s only a minority partner in its Russian operations, while reaping the dividends of continued operations. If the company is right, then some resumption in trade before the 2027 ban on gas imports will lead to the company enjoying the benefits of taking this position. If the European Union does implement a ban, TotalEnergies will be able to sell its stake to its partners at higher prices than it would have had it panic-sold at the start of the war.

TotalEnergies may feel that even if Russia is no longer a prime player in Europe, the pivot of Russian energy supplies to Asia will mean that the company continues to make money off its Russian assets.

TotalEnergies FRSU Deal

New terminals will take years to build, whereas FSRUs can come online as early as this winter. TotalEnergies announced a deal to supply Germany with one of its two FSRU units to Deutsche ReGas. The FRSU will be used in the import terminal in Lubmin, near there the Nord Stream 1 and 2 pipelines make landfall. The FRSU will be able to supply 5% of Germany’s gas needs. The company is also in talks with the French government to install an FSRU unit in Le Havre.

According to Statista, there were just 48 FSRUs in the world in 2021. The nature of FSRUs is that they are not a one-size-fits-all, and that restricts supply further. According to Natural Gas Intel, FSRU rates have gone up 50% since the war began, with rates at between $150,000 and $180,000 a day, with some reaching $200,000 a day. At the lower end, the German and French deals could earn TotalEnergies over a billion dollars a year in revenue. Precise details of the deals have not been made public, so these are of course, crude speculations.

Valuation

In the TTM period, TotalEnergies had an FCF of $29,984 billion. This gives us an FCF yield (FCF/enterprise yield) of 19.3%. More precisely, 19.3% of the value of the business is in the form of FCF, compared to an FCF yield of some 1.5% for the 2,000 largest companies in America, according to data from New Constructs. The company’s FCF is 13 times cheaper than that of the average firm in that group of 2,000 businesses.

Conclusion

TotalEnergies has been a laggard in the energy markets at a time when energy stocks have led the stock market. A lot of that has to do with the company’s continued presence in Russia, which has created a lot of uncertainty in the business. However, the nature of the European energy crisis is such that it’s hard to envisage a permanent solution that does not include some accommodation with Russia. In addition, TotalEnergies is a key FSRU supplier and is well poised to be part of the solution to the crisis. The company’s FCF are trading at 13 times cheaper than those of the general market, providing investors with a healthy margin of safety.

Be the first to comment