HJBC

Here at the Lab, we always liked Total (NYSE:TTE), and it was one of our first investments. After having looked at TotalEnergies’ Russian exposure and following up with a note on the Q1 performance, today, the French major oil corporation released its three-month results. There is a lot of news to comment but as we always do our wrap-up: the shorter, the better.

Between April and June, here below the main key takeaways:

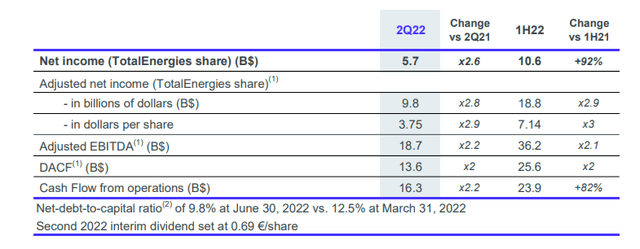

- Starting with the financials, the group’s EBITDA reached $18.74 billion versus the $8.67 billion recorded a year earlier;

- Going down to the bottom line, adjusted operating income stood at $10.5 billion compared to the $4.03 billion achieved in the second quarter of 2021. Total’s two main divisions, exploration-production and integrated gas, renewables & power reached record results. It goes without saying that the French oil major more than doubled its profit taking full advantage of the rise in hydrocarbon prices following Russia’s invasion of Ukraine;

- At the adjusted net income level, the company missed Wall Street analyst expectations as well as at the EPS level;

- Compared to the first quarter of 2022, production was down 4%, mainly due to planned maintenance operations and production reductions suffered in Nigeria and Libya;

- The oil group announced a new share buyback program after the Q2 performance. TotalEnergies said it will target up to $2 billion in share repurchase value in the coming quarter;

- Due to the high energy price, the company has decided to increase the DPS by 5% compared to last year’s previous quarter;

- In addition, the French oil major reported the fact that higher investment will be made, it now targets CAPEX of “around $16 billion” in 2022 versus a previous outlook of $15 billion. Important to note is the fact that renewables energy investment has been maintained at 25% (we are expecting more M&A in the second half of the year);

- In Q2, the company recorded a provision of $3.5 billion linked to the potential impact of international sanctions on the value of its stake in the Russian group Novatek (in which Total holds a 19.4% equity stake). Very important to highlight was the CEO comment in the analyst call: “Russia represents about 5% of our capital employed and cash flow and starting with the Investor Day in September represent our strategic plans for TotalEnergies in future without taking Russia into account. Fundamentally, that will change some volume figures”. In numbers, oil production will decline by almost 2 million oil barrels per day, but this will not impact shareholder remuneration.

Aside from the financial considerations, there is an ongoing debate about the “superprofits” tax. Amendments to the exceptional taxation were brought to the French National Assembly and the texts were finally rejected by the deputies. Under pressure, TotalEnergies has tried to take the lead and announced a few days ago that it will apply a discount of 20 cent per liter between September and November in all its pump service stations. As we emphasized in our recent update on Iberdrola, government intervention is one of the major downside risks.

Conclusion and Valuation

In our tick-box, all checked it out. Therefore, we reaffirm our previous valuation at €60 per share. Our internal team derive a target price based on a 13.5% ROIC over the next two-year period, setting a long view on price per barrel at $65. ROIC valuation was not the only estimate to evaluate Total’s equity value, we cross-reference the major French oil with its closest competitors, such as Equinor (EQNR), Shell (SHEL), and Eni and is evident that the company is trading at a lower multiple on a P/E basis. We believe this is not justified, and we reinforce our buy rating by the higher dividend yield compared to the European majors and the lower financial debt.

The next catalyst is the new strategy update that the company plans to present on the 27th of September – this could review upwards the shareholder remunerations.

The key risks to our rating include:

- Market volatility in oil and gas;

- Macroeconomics slowdown;

- M&A risks;

- The company continued involvement in Russia may result in reputational damage and might further impact its valuation;

- A supertax on profit in countries where Total operates;

- Higher CAPEX requirements.

Be the first to comment