David McNew

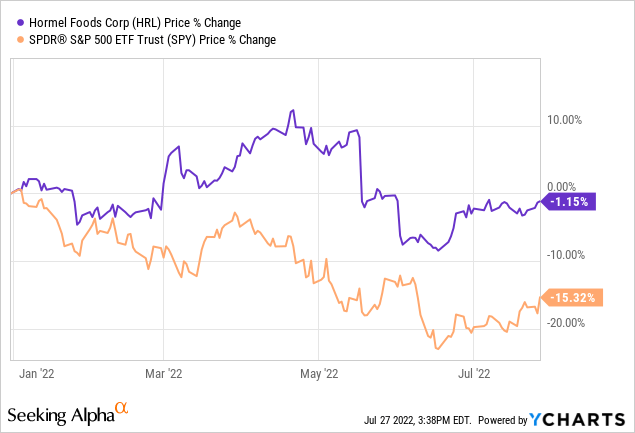

Hormel Foods (NYSE:HRL) has lost about 1% of its market value year-to-date, while the broader market has declined by more than 15% in the same time period.

In our opinion, HRL’s outperformance is justified in the current market environment, however, before we can recommend investing at the current price levels, we have to make sure that the stock also appears attractive from a valuation perspective. In this article, we will take a look at what macroeconomic factors could improve and worsen HRL’s financial performance in the near term.

We will start our analysis by looking at the consumer sentiment, more precisely at how HRL and its stock has performed during times of low consumer confidence.

Performance during times of low consumer confidence

Before we start our analysis, let us briefly define what consumer confidence is and how it can potentially impact the financial performance of different type of companies in different sectors.

Consumer confidence is often defined as a leading economic indicator, which is used to predict near-term changes in the spending behaviour of the consumer. A low or declining consumer confidence could be a signal that people are getting more and more reluctant to spend larger sums of money, as their financial outlook became more uncertain. Such a behaviour can result in a lower demand for durable, discretionary, non-essential items. Services may also be impacted as people are likely to cut spending on services by switching to lower-cost alternatives, if available and switching costs are low. On the other hand, firms in the consumer staples sector, especially in the packaged food industry are not expected to be severely affected, as the products they sell are considered to be essential.

So how consumer confidence has actually developed in the United States recently?

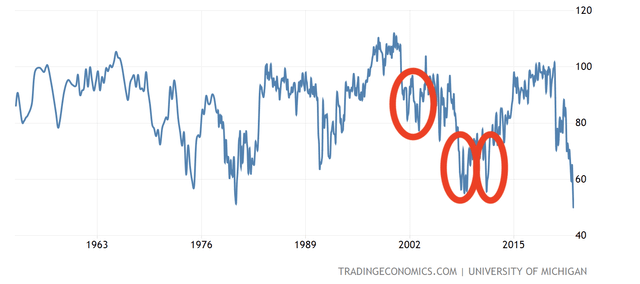

U.S. Consumer confidence (Tradingeconomics.com)

Consumer confidence in the U.S. has been steadily declining over the past months, falling even below levels that were recorded during the 2008-2009 financial crisis. Although consumer spending has remained high in the first half of 2022, we expect the spending to slow in the second part of the year. But would it severely impact HRL’s performance?

We will look at three periods from the last 20 years, characterised by low consumer confidence, marked by the red circles on the chart above.

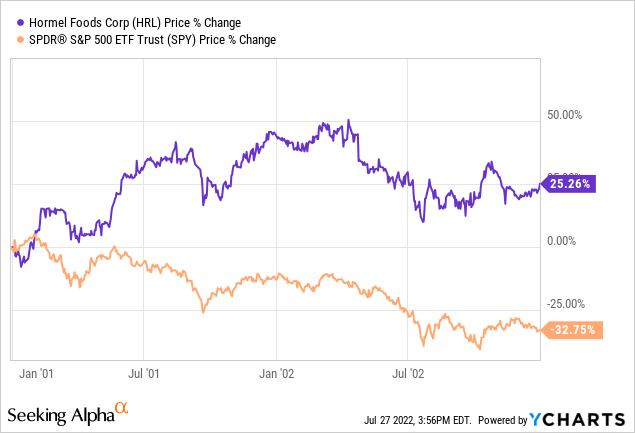

2001-2003

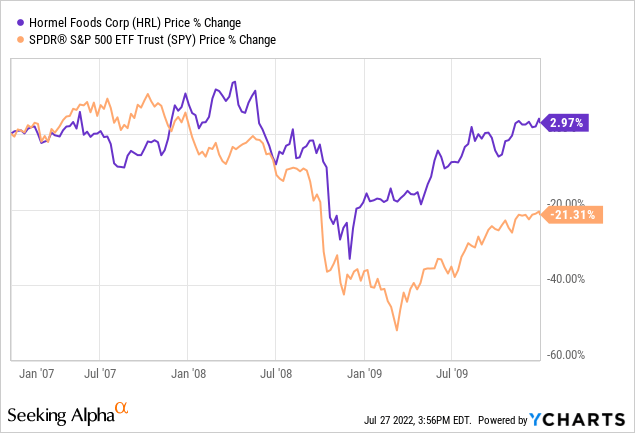

2007-2010

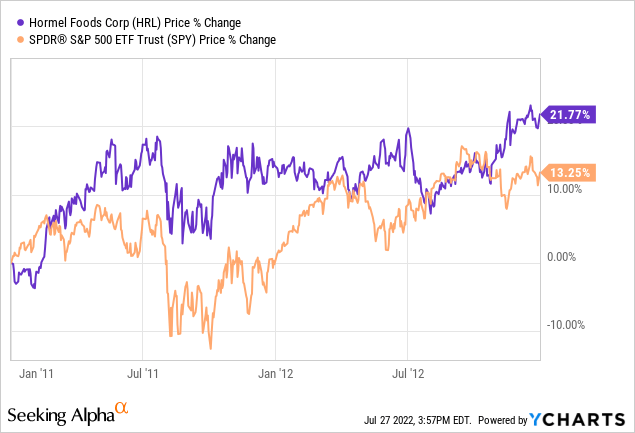

2011-2013

In all three of these periods, HRL’s stock substantially outperformed the broader market. While past performance is not always a good indicator of future behaviour, we believe that in the current macroeconomic environment, Hormel Foods is well-positioned to continue its outperformance as already seen in the first half of the year.

Although HRL appears to be quite attractive from this perspective in light of the current macroeconomic environment, we have to understand what other macroeconomic factors could impact the firm.

Consumer confidence is however not the only macroeconomic factor that could share HRL’s financial performance in the near term. Commodity prices are also likely to have material impact on the performance of the business.

Commodity price impact

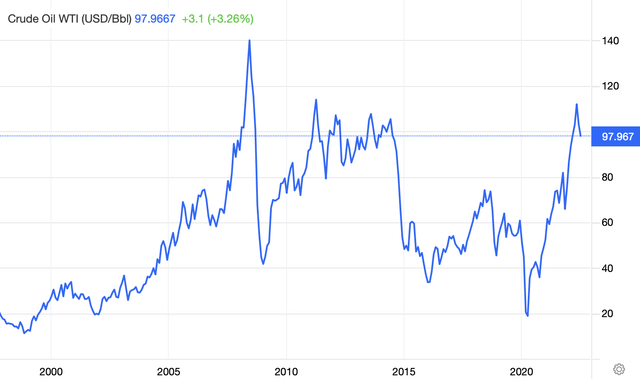

Energy prices have been rising throughout 2022, but they have skyrocketed in the first quarter of 2022, as the geopolitical tension between Russia and Ukraine unfolded.

Crude oil price (Tradingeconomics.com)

Although the oil price seems to have peaked in the past months, the price remains elevated compared to the levels seen between 2015 and 2021. Due to the high uncertainty in the Eastern European region, we expect energy prices to remain elevated for the rest of the year.

High oil prices have been causing a downward pressure on the margins of many firms due to elevated input costs and higher freight costs. Hormel Foods is not expected to be an exception, and we expect the headwinds will remain for the rest of the year.

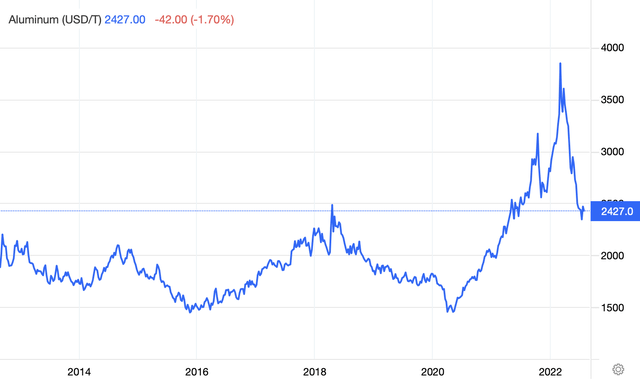

Aluminium prices also often play a big role for firms in the packaged food industry. Fortunately, for these firms, aluminium prices have fallen significantly since their peak in early 2022. If the decline continues, this could have a positive impact on the margins.

Aluminium prices (Tradingeconomics.com)

All in all, the macroeconomic environment remains uncertain, together with the prices of commodities. While HRL has performed historically well during times of low consumer confidence, the question is, is it the right price to pay for HRL?

To answer this question, now we will take a look at the firm from a valuation point of view, using the Gordon Growth Model.

Valuation

Gordon Growth Model

The Gordon Growth Model is a simple dividend that can be applied to estimate the intrinsic value of dividend paying companies.

The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

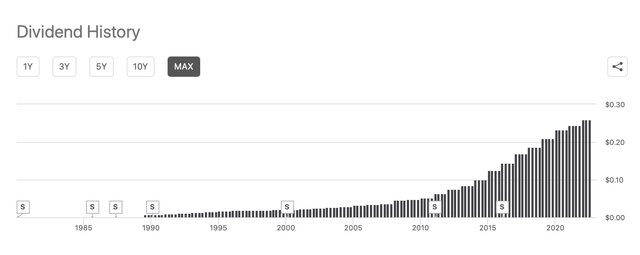

Dividend history (Seekingalpha.com)

As Hormel has been paying dividends for the last 56 years and it has grown its dividends consistently in the last 26 years, we believe the GGM is a suitable valuation method to apply for this firm.

To come up with a useful estimate of the potential fair value of HRL’s stock, we have to make two key assumptions:

1.) What is our required rate of return?

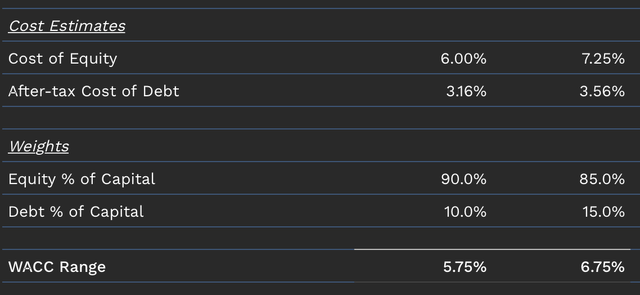

We decided to use HRL’s weighted-average cost of capital (OTC:WACC) for our required rate of return. The current WACC of the firm is between 5.75% and 6.75%.

To stay on the conservative end of the scale, we will be using 6.5% for our evaluation.

2.) What could be a reasonable constant dividend growth rate in perpetuity?

To answer this question, we need to take another look at Hormel’s dividend payment history and try to establish a reasonable long-term trend.

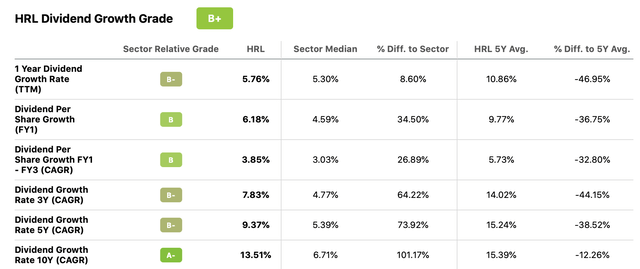

Dividend growth (seekingalpha.com)

Although the firm has been growing its dividends at a rapid rate in recent years, we believe a growth rate in the range of 10% is not a sustainable growth rate in perpetuity.

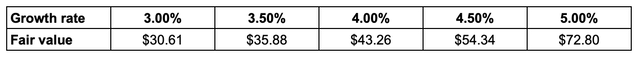

We will be using a range of 3% to 7% to determine the fair value.

The following table summarizes our results.

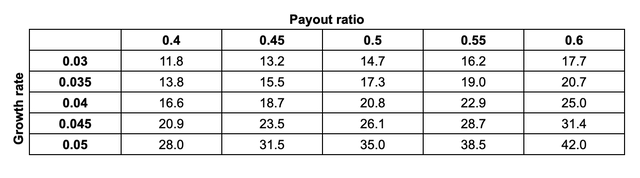

Using the GGM and assuming a dividend payout ratio of 40% to 60% based on historic data, the justified P/E ratio for HRL’s stock can also be calculated.

Hormel’s stock is trading in the middle of the fair value range according to both valuation methods, which could potentially indicate that there is further upside potential.

In our opinion, in the current market environment, HRL could be an attractive defensive play, which pays a safe and sustainable quarterly dividend.

Key takeaways

Hormel has a strong track record of outperforming the market during times characterised by low consumer confidence. One explanation for the outperformance could be that HRL sells essential products, and the demand for such goods can remain relatively inelastic even during times of financial downturns.

There are several macroeconomic headwinds, which may be negatively impact HRL’s financial performance, however, these macro headwinds aren’t particular to Hormel alone, and are likely to affect other firms too.

According to the Gordon Growth Model, the firm appears to be fairly valued, with some upside potential.

For these reasons, we believe HRL could be an attractive buy for investors looking for a safe haven in the turbulent markets, or for investors looking for a safe and sustainable dividend.

Be the first to comment