Justin Sullivan

Due to growing challenges in the digital advertising market, Meta Platforms (NASDAQ:META)’s Q2’22 earnings did not meet expectations. Still, Meta reported a sequential increase in its daily active users and guided for lower operating expenses in FY 2022. While challenges are growing for Meta’s advertiser-dependent business model, the firm’s valuation has been driven so low that I don’t see Meta as a value trap. The metaverse offers a long-term growth and diversification opportunity for Meta and the risk profile, at this point, is actually skewed to the upside!

Meta’s Q2 miss is not that bad

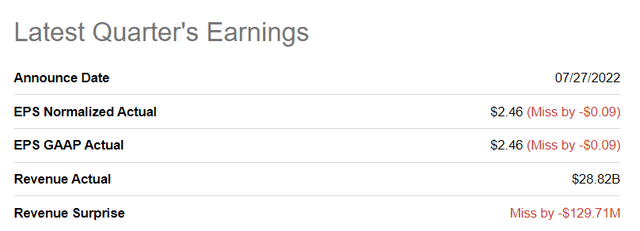

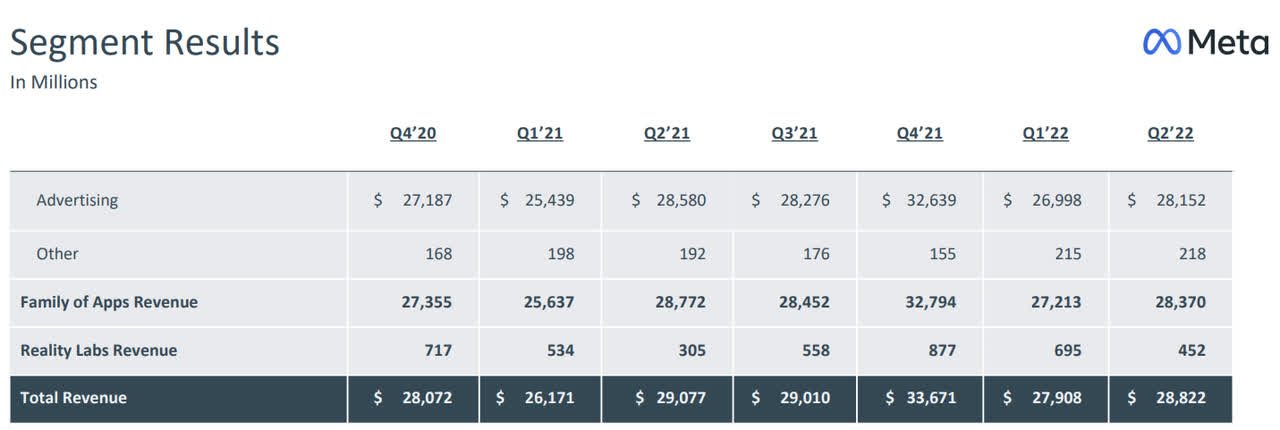

Meta missed expectations on the top and bottom for its second-quarter with reported EPS of $2.46 and revenues of $28.82B. The misses were not large, but they raised concerns that Meta was headed for a larger down-turn in the advertising market.

Seeking Alpha – Meta Q2’22 Results

Meta generated $28.82B in revenues in Q2’22, showing a decline of 1% year over year due to an increasingly difficult advertiser market. Advertising revenues in Q2’22 were $28.15B and also showed a decrease of 1% compared to the year-earlier period. The decline in revenues was the first ever for Meta as a public company and it raises concerns, together with the firm’s Q3’22 outlook, that the advertising market is just beginning to slow down.

The advertiser slump from which Meta suffers has two root causes:

- One root cause lies in Apple’s iOS update from FY 2021 which restricts marketers’ ability to track the online purchase behavior of consumers. This change in advertiser policies makes ad campaigns less effective and therefore more expensive for marketers.

- High inflation is starting to impact how consumers spend their dollars. With inflation soaring above 9% in June, consumers are adopting more careful spending practices. With consumers reducing spending, advertisers compete for less sales which reduces the effectiveness of ad campaigns as well.

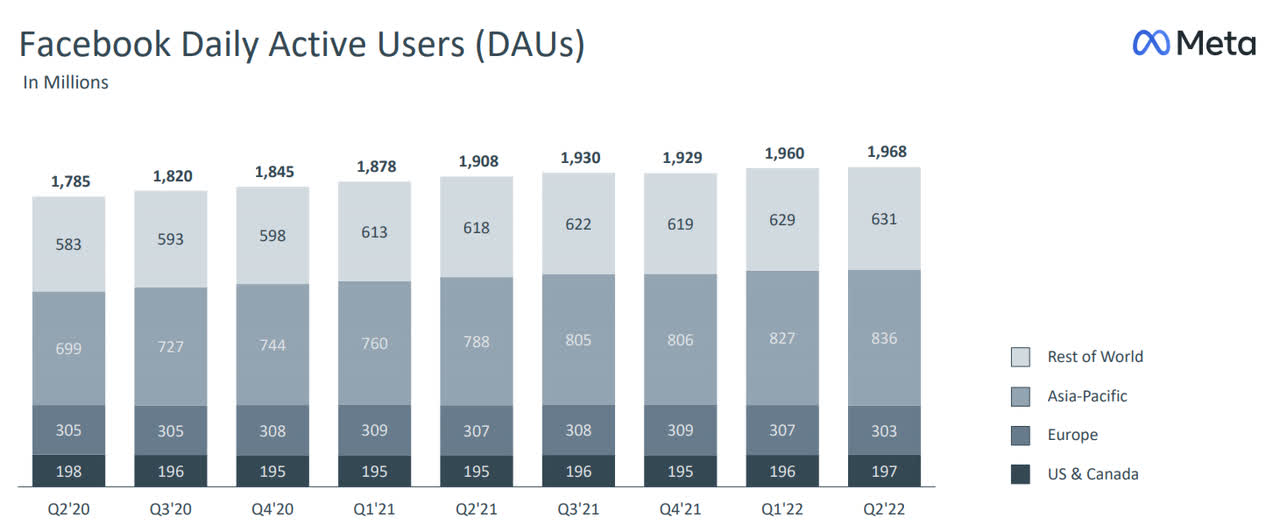

Although Meta’s advertising business slowed in Q2’22, Meta reported an increase in daily active users/DAU — which is a key metric for social media platforms. Meta’s DAU acquisition in Q2 was a lot better than I expected: my estimate was for 2-3M new daily active users while Meta reported an 8M DAU increase to a record 1.968B. The user trend, despite the drop-off in Q4’21, remains decidedly positive.

Metaverse provides growth and diversification opportunity

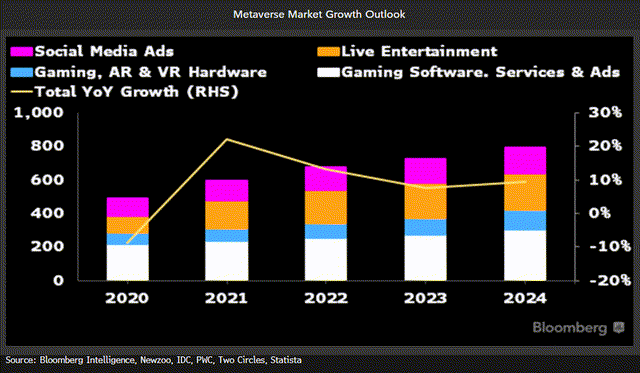

Facebook got its start in the social media business by relying on advertising, but going forward Meta will be a more diversified enterprise that can capitalize on the metaverse growth opportunity. The metaverse — which loosely speaking is a connection of virtual worlds and provides users with immersive virtual experiences — offers a huge opportunity for Meta and other companies that engage users with their AR and VR products. According to Grayscale Research’s Metaverse Report, the metaverse could evolve into a $1T revenue opportunity with companies like Meta primed to take a large share of this rapidly expanding market. Bloomberg is a bit more conservative and places an $800B value on the metaverse opportunity.

Bloomberg: Metaverse Growth Outlook

Whether the market size is $800B or $1T, Meta is already investing heavily into the metaverse. Earlier this year, Meta announced how it was going to monetize the metaverse: by charging metaverse vendors a nearly 50% fee on virtual asset sales, such as NFTs.

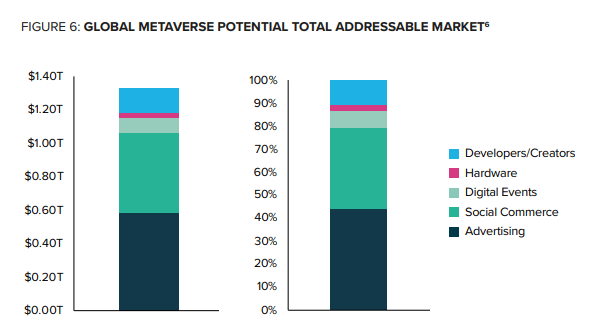

Meta currently generates a negligible amount of revenues from its Reality Labs segment, which includes metaverse products and apps. In Q2’22, Meta generated just $452M in revenues from this rapidly evolving business. Longer term, I see the metaverse replace a good portion of Meta’s traditional advertising business and grow the Reality Labs segment to a 15-20% revenue share. Advertising will remain important for Meta even in the metaverse, however: it is estimated that advertising spending in virtual worlds will account for nearly half of the metaverse’s estimated market size.

Grayscale Research: Metaverse Addressable Market By Spend Category

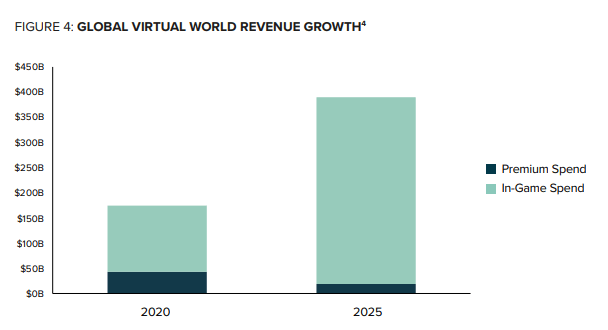

A significant part of Meta’s revenue growth within Reality Labs will come from consumers spending money on virtual goods and especially on in-game purchases which are expected to explode until 2025. Virtual gaming worlds are expected to see a doubling of revenues from $180B in FY 2020 to $400 in FY 2025 with the most pronounced growth coming from in-gaming spending.

Grayscale Research: Virtual World Revenue Growth

Free cash flow

The core value of Meta is represented by its social media/advertising platforms and apps including Facebook, Instagram and WhatsApp. Meta generated 98% of its revenues from its advertiser model and only 2% from its other businesses (VR, AR etc). The slowdown in the advertising business, therefore, exposes Meta’s revenues and free cash flows to growing risks.

Meta’s free cash flow in Q2’22 was $4.45B on revenues of $28.82B which calculates to a free cash flow margin of 15.4%… which is about half of what Meta used to report as FCF margins. The decline in free cash flow is chiefly due to higher operating costs and, more specifically, accelerating investments into the metaverse.

|

in mil $ |

Q2’22 |

Q1’22 |

Q4’21 |

Q3’21 |

Q2’21 |

|

Revenues |

$28,822 |

$27,908 |

$33,671 |

$29,010 |

$29,077 |

|

Operating Cash Flow |

$12,197 |

$14,076 |

$18,104 |

$14,091 |

$13,246 |

|

Purchases of Property/Equipment |

($7,528) |

($5,315) |

($5,370) |

($4,313) |

($4,612) |

|

Payments on Finance Leases |

($219) |

($233) |

($172) |

($231) |

($123) |

|

Free Cash Flow |

$4,450 |

$8,528 |

$12,562 |

$9,547 |

$8,511 |

|

Free Cash Flow Margin |

15.4% |

30.6% |

37.3% |

32.9% |

29.3% |

(Source: Author)

Meta’s valuation is very attractive, despite a deteriorating outlook in the ad business. Meta has a very low P/E ratio right now and it may already account for the expectation that Meta’s revenue prospects are dimming in the short term. Meta is trading at a P-E ratio of 12.9x, based off of FY 2023 earnings.

Cautious outlook for Q3’22

The outlook for third-quarter didn’t help the stock. Meta sees Q3’22 revenues of $26.0-28.5B, indicating an up to 10% drop in revenues quarter over quarter… which suggests that the advertiser market is slowing down hard. To respond to this revenue challenge, Meta is slamming its foot on the cost brake. The social media company expects $85-88B in operating expenses, a down-grade from the previous guidance of $87-92B. The original FY 2022 outlook called for $90-95B in costs.

Risks with Meta

Slowing growth in the important digital advertising business is a key risk for Meta and the stock. A decline in daily active users could potentially compound Meta’s problems and result in top line and free cash flow headwinds that the market may not yet consider. What would change my mind about Meta is if the company would have to deal with persistently lower free cash flow margins and lost more users to rival companies such as TikTok.

Final thoughts

Meta’s revenues dropped for the first time ever on a year over year basis in Q2’22 due to advertisers pulling back from a market that is primed for a longer slowdown. Due to inflation as well as the fallout related to Apple’s iOS update last year, there are material short-term revenue headwinds in Meta’s business. However, Meta keeps generating a ton of free cash flow, the business is valued cheaply based off of earnings and the metaverse opportunity could make Meta less reliant on a pure advertising model going forward. Because of Meta’s low valuation and attractive metaverse growth opportunity, I am a buyer!

Be the first to comment