Sezeryadigar/E+ via Getty Images

This article was prepared by Shahmi Anas in collaboration with Dilantha De Silva.

Lumen Technologies (NYSE:LUMN) is one of the few high-yield dividend stocks that we hold in our model dividend portfolio at Leads From Gurus. Although the focus of this portfolio is on income, we tend to prefer investing in companies with strong growth prospects along with a reasonable dividend yield as we believe capital gains will make up a sizeable part of our total returns in the long run. Lumen is one of the few exceptions to that rule where we believe dividends will make up the biggest chunk of our investment returns in the long run. Lumen has lost over 18% of its market value in the last 12 months and just over 11% in 2022 – thereby outperforming the S&P 500 Index this year. In this article, we will evaluate the prospects for Lumen to determine whether the company is still a good buy for dividend investors.

Divestitures to curb revenue decline; new growth initiatives in line

Lumen’s most recent quarterly results (Q1 2022) reinforced the ongoing trend of declining revenues in the telecom industry. Total revenue declined 7% year-over-year to $4.7 billion in Q1 2022 from $5.02 billion in Q1 2021, largely owing to enterprises and consumers replacing their voice and DSL lines with better cable, fiber optic, and wireless technologies. Enterprises, in particular, are continuing to benefit from the ability to use shared rather than private networks while making the most of technological advancements that require less bandwidth and enable more efficient routing.

Lumen is in the early stages of a medium to long-term turnaround process where the company is looking at divesting some of its less attractive assets and re-investing the proceeds to enhance its remaining businesses. The company expects to close two major asset sales in the second half of 2022 – the Latin American operations for $2.7 billion which is expected to close in Q3 2022 and the traditional telecom operations in 20 states to affiliates of Apollo Global for $7.5 billion. These divestitures make perfect sense for Lumen as these businesses mainly generate revenue from phone services and slow DSL Internet connections: two businesses in rapid decline.

Lumen is continuing to invest in upgrading copper wires to fiber in its remaining telecom footprint, which will expand its fiber footprint from 2.6 million addresses today to 12 million or more by the late 2020s (Quantum Fiber plan). We believe fiber upgrades will drive significant growth in Lumen’s broadband business, helping it acquire more customers at higher prices. It must be acknowledged, however, that while the divestitures should combat the revenue declines, they will also lower absolute revenue levels in the short term. All in all, the company’s long-term growth initiatives around edge computing and other business-focused services should gradually gain traction, offsetting ongoing declines in legacy enterprise voice services.

Debt, free cash flows, and margins

Lumen carries long-term debt of over $28 billion on its balance sheet and has always had undesirable debt-to-equity ratios ever since the acquisition of Level 3 Communications. But let us contextualize this to gain a better perspective. A concern for the telecom industry is the trend of rising interest rates as a result of the Fed hiking rates to combat surging inflation. This will affect companies like Lumen, which currently carries around $10 billion of floating-rate debt. Despite this, with the planned asset sales mentioned above, the continual rise in interest rates could actually force Lumen’s hand in offloading a substantial chunk of its floating debt which would improve the company’s financial risk profile and in turn create a positive investor sentiment. Assuming both deals are completed as scheduled, Lumen could potentially reduce its debt to around $20 billion by the year-end by allocating a chunk of expected proceeds from the asset sales to reduce its debt burden.

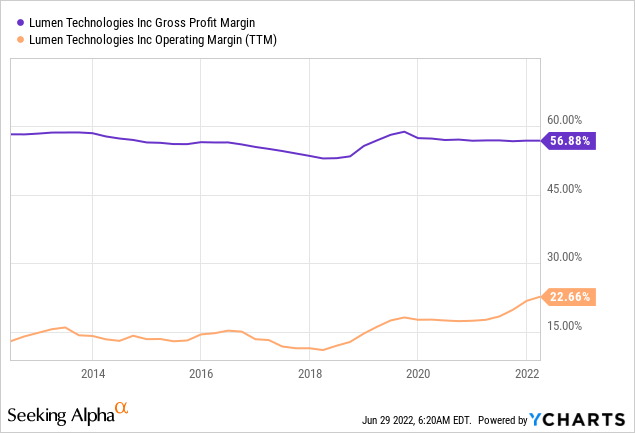

Lumen has a history of generating positive free cash flows through which the company has been paying out dividends to its shareholders, and more recently, debt repayments have been supported through free cash flow as well whenever possible. In the years 2019, 2020, and 2021, the company reduced its debt burden by $0.7 billion, $3 billion, and $1.6 billion, respectively (net of new debt raised and repaid). The company has also showcased impressive cost control measures in recent years amid the decline in revenue, leading to operating margin improvements in 2019, 2020, 2021, and the TTM period leading up to Q1 2022 (see chart below). These expanding margins should keep cash flow relatively stable post-divestiture levels even as revenue declines.

Investors, in our opinion, need to keep a close eye on profit margins and free cash flow levels of the company to identify potential inflection points in Lumen’s story. From what we are seeing today, despite the looming risks on the horizon resulting from the company’s massive pile of floating rate debt, Lumen has what it takes to come out of this difficult period in shape.

There is light at the end of the tunnel

The main risk for an investor today is the company’s declining revenue trend and the concern that this will continue indefinitely, forcing Lumen to reconsider its stance on shareholder distributions. However, Lumen’s upcoming asset sales are likely to improve its revenue mix toward higher-growth businesses, giving room to transform its business through product evolution and expand its fiber network to homes and small businesses, positioning it for strong broadband revenue growth in years to come.

From an industry/competitive standpoint, Lumen’s fiber holdings make it one of the biggest communications infrastructure providers in the U.S., and despite Lumen not being the leader in the industry, we do not expect the company to lose much of its ground to competitors given the wide array of services it offers globally to its enterprise clientele and the growing importance of a connected world today. We do, however, believe that the likelihood of Lumen capturing much ground from top players such as Verizon Communications Inc. (VZ) is negligible. In simpler terms, we expect Lumen to hold its ground in an oligopolistic market while focusing on cost efficiencies and a better revenue mix to drive earnings growth.

Assuming the planned investments will pay off as expected, Lumen could return to growth in 2024. A return to revenue growth, continually expanding margins driven by cost efficiencies, together with a reduced debt load could propel shares of the company significantly higher from the current levels, making LUMN stock’s recent downward trend a good buying opportunity for investors who are willing to hang on for a while. In the meantime, investors can reap the benefits of the generous dividend the company promises to sustain during the ongoing restructuring. To quote CEO Jeff Storey:

Growth is the principal long-term driver of improved shareholder returns, but we believe shareholders should be rewarded as we transform our company to drive that growth and believe returning cash to shareholders in the form of a dividend is a very important part of our overall value proposition. We do continue to expect an elevated dividend payout ratio as we execute on our Quantum build plan, but also expected to normalize over time as growth improves and Quantum investments normalize in the out years of the plan.

Is Lumen stock undervalued?

We are big fans of using discounted cash flow models to find undervalued bets, and since we mostly focus on growth companies, using DCF models makes a lot of sense as we are able to adjust for expected growth to a higher degree in comparison to relative valuation models. For Lumen, however, we thought it would make more sense to use a dividend-based approach to update our target price.

We are not using a traditional dividend discount model but a customized model that uses adjusted dividends. There are many steps involved in the calculation process, and we will start by calculating the income retained by the company to use as a baseline to understand the required retention ratio for Lumen (please note the use of financial terms in the below table may not be GAAP comparable).

| Net income to shareholders (TTM) | $2.157 billion |

| Cash dividends paid (TTM) | $1.064 billion |

| Retained earnings | $1.093 billion |

| Retention ratio | 50.7% |

In our base-case scenario, we believe the company would have to retain around 15% of its net income. With that, the next step is to calculate the excess income retained per share.

- Required retention ratio = 15%

- Net income (TTM) = $2.157 billion

- Required retained income = $324 million

- Retained income in TTM = $1.093 billion

- Excess retained = $769 million

- Shares outstanding = 1.033.1 billion

- Excess retained income per share = $0.74

With this, we calculate the adjusted dividend as $1.74 per share. To calculate the intrinsic value of Lumen shares, we used a perpetual growth rate of just 0.3% based on our above discussion of the company’s growth prospects and a cost of capital of 12.5%.

Based on these assumptions, the intrinsic value of Lumen stock comes to $14.34, which implies an upside of 27.4% from the current market price of $11.25.

With these findings, we rate Lumen stock as undervalued today. That being said, Lumen is not the typical stock that would end up in a risk-averse income investor’s portfolio, but we believe LUMN is a good bet for income investors with a long investment time horizon who look for a combination of high income and capital appreciation.

Takeaway

Lumen stock yields close to 9% today, and we believe the company is moving in the right direction although it will come under pressure in the coming months due to its massive debt pile. We believe Lumen is still a good pick for income investors at these prices, but LUMN is certainly not for every investor.

Be the first to comment