piranka/E+ via Getty Images

Investment Thesis

Hewlett Packard Enterprise Company (NYSE:HPE) is an IT firm headquartered in Spring, Texas. In this thesis, I will be analyzing the impact of HPE’s exit from Russia and Belarus and its outperformance by the Intelligent Edge segment of HPE. I will also discuss some risks that HPE currently faces, including a decline in revenue growth in some segments. HPE is an excellent edge-to-cloud company and has shown strong growth in the order book in recent quarters, but after considering all the risk factors and future outlook, I assign a hold rating for HPE.

Company Overview

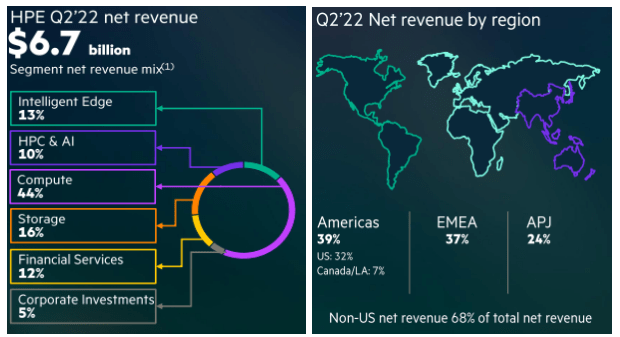

HPE has classified its business into six segments: Intelligent Edge, HPC & AI, Compute, Storage, Financial Services and Corporate Investments. These different business segments operate under unique brand names or platforms. Intelligent Edge operates under the Aruba brand and provides wired and wireless local area network (LAN), software-defined wide area network and network security to businesses. HPC & AI provides hardware as well as software solutions which are customizable as per the client’s requirements.

HPE Apollo and Cray are the main brands under which HPC & AI operates. Compute is the single largest segment of HPE in terms of revenue; it is responsible for workload management and optimization for high-performance applications. Compute business works through HPE ProLiant servers and provide services to complement the workload optimization. The storage segment provides storage-as-a-service through HPE GreenLake edge-to-cloud platform. I believe the storage business has great potential in future, given the high dependency of organizations on data. Financial services and corporate investment are primarily advisory and consultation segments that help businesses with investment and cost management.

Investor Relation

Compute takes up the majority of the revenue share at 44%, followed by storage at 16%, Intelligent Edge at 13%, Financial Services at 12%, HPC & AI at 10% and Corporate Investment at 5%. HPE estimates the Intelligent Edge share to increase in future, given the strong demand it has been experiencing in the last few quarters. When it comes to the geographical distribution of the revenue, the North American region tops the list with 39%, followed by the EMEA region at 37% and the Asia Pacific and Japan at 24%.

Impact of Russia and Belarus Operations Shutdown

HPE, in late February, suspended the delivery of products to Russia and Belarus due to the Russia-Ukraine conflict at the time. On June 1st, HPE released an official statement confirming the permanent shutdown of its operations in Russia and Belarus. HPE reported $126 million in charges and expenses relating to this exit in Q2 2022, and the management expects less significant charges in Q3 2022 relating to the departure from Russia and Belarus.

As per my analysis, the impact of this exit was not significant, but still it caused a dent of around $0.3-$0.4 per share in EPS of the firm, this comes out to be 10% of EPS reported by HPE. The Russia-Ukraine war has not only caused revenue loss from Russia but also from the European Countries due to the economic slowdown all across Europe, mainly due to this war. I expect the Q3 impact due to the Russia and Belarus exit to be in the range of $0.3-$0.5 per share, but we have to wait till the official results are announced, and then I can analyze the impact in detail.

Intelligent Edge Outperformance

Intelligent Edge showed a robust 9% growth in Q2 2022 y-o-y, and the order pipeline increased 35% as compared to Q2 2022. I believe Intelligent Edge will take up an even significant revenue share in FY23 due to the as-a-service model being implemented by HPE to increase its client base. As per this model, the clients will pay only for the services they use instead of paying for the complete package. This strategy will help HPE widen its market presence by reducing the cost burden on the clients. According to my analysis, intelligent Edge currently has gross margins, which can go up to 15.5% from Q4 2022, given the positive response and growth of Intelligent Edge as-a-service model.

Additional Positive Features

Strong Dividend Yield: HPE declared a $0.12 dividend per share in Q2 2022. As per the current price, the dividend comes out to be 3.45%. The company has been consistent in paying dividends for the past few years. Even at the current level, the dividend yield looks attractive. I believe there is a scope for dividend growth in FY23 as the margins improve with improvement in supply as well as material procurement costs.

Increased Orders: HPE reported the fourth consecutive quarter with a 20% increase in total orders. Intelligent Edge led this increase in order book with a 35% increase, followed by Compute with 20% and HPC & AI with a 15% increase. This increase in order has resulted in the company’s highest-ever backlogs in the order pipeline. I believe if the company can execute these orders in Q3 and Q4 2022, it will see record earnings with good profit margins.

Financials

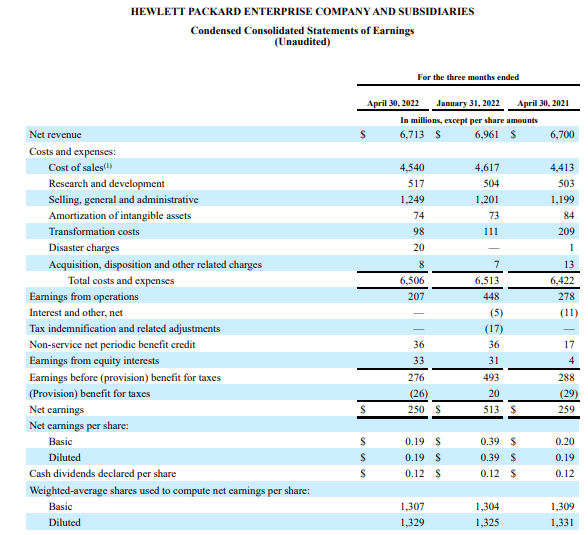

SEC:10Q HPE

The demand for HPE products is cyclical in nature; hence, I will be comparing results on a y-o-y basis. HPE reported Q2 2022 revenue at $6.7 billion, up a negligible 1.5% adjusted for currency. The main reason for this flat revenue growth is the inability to execute orders due to supply chain issues in hardware material procurement. The gross margins stood at 32.7%, a marginal drop from the previous year, which is attributed to the $126 million incurred on exit from Russia and Belarus. Diluted EPS saw no change from the year-ago period at $0.19 as per GAAP. I think the result was flat and doesn’t justify the order growth to be the parameter in judging the firm’s growth trajectory. As per my analysis, the results failed to impress, and even the outlook for FY22 isn’t impressive, with just 3%-4% revenue growth estimate.

Risk Factor

Decline in revenue and profits from important segments: Storage and Financial services both saw a 2% decline from Q2 2022. They make up 28% of total HPE revenue, and a decrease in these segments is not a positive. Compute segment, which accounts for 44% of total HPE revenue, saw just a 1% increase. This means virtually 72% of the total revenue-generating segments saw no growth despite a strong order pipeline. The reason for this decline in growth is the supply chain issues faced by HPE, which they expect likely to continue in the rest of FY22.

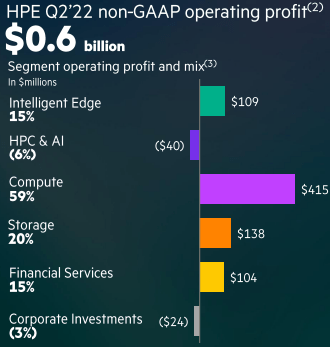

Investor Relation

The profit margins also saw a decline from a year-ago period. As per my analysis, the trend is likely to continue in FY22 with Covid-19 restrictions in China, which is adding to the problems of HPE. Also, the loss in HPC & AI segment is a cause of worry.

Quant Ratings and Valuation

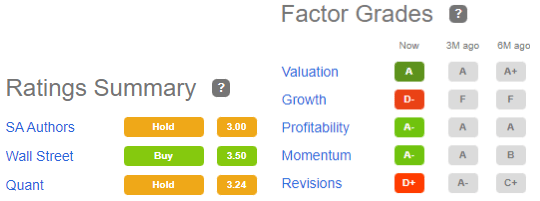

Seeking Alpha

My thesis aligns with Quant Ratings to a great extent. I agree that the firm is discounted in terms of valuation, but the growth factor is the real reason of concern with D- rating. Profitability has also degraded from A to A- in the last three months. Overall, the company has to address a few issues before I can consider it a growth opportunity. HPE is currently trading at $13.92, a YTD decrease of 13.79%. The company has a market cap of $18.1 billion. HPE has corrected itself as per market expectation and is trading at a fair value with a PE multiple of 5x. Compared to its competitors, HPE is trading at a discount, but the supply chain issue limits its growth.

Conclusion

My final thought on HPE is that it is important for them to execute the pending orders while tackling the supply chain issue limiting its growth. For now, the company looks fairly valued and could be a growth prospect for the long term if it delivers on its promises. But the subdued future outlook doesn’t compel me to take any position in the stock at this moment. After analyzing all the growth and risk factors of the firm and considering its current valuation, I assign a hold rating for HPE.

Be the first to comment