DarrelCamden-Smith/iStock via Getty Images

We’re nearing the end of the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the first companies to report its results was Torex Gold (OTCPK:TORXF). Unlike many names sector-wide, Torex had a blowout year, beating production and cost guidance despite inflationary pressures. Looking ahead to FY2022, the company expects to see similar production at slightly higher costs and has an aggressive exploration budget. At a current share price of US$13.20, I still see upside to fair value for Torex, but after this ~40% rally, I don’t see enough of a margin of safety to justify paying up for the stock here.

RopeCon – ELG Operations (Company Website)

Torex Gold reported its Q4 and FY2021 results last month and had another outstanding year. This was evidenced by beating production guidance by 4%, beating cost guidance by ~2%, and delivering record gold production of ~468,200 ounces. The solid performance allowed the company to generate ~$98 million in free cash flow and more than $855 million in revenue. Given the significant positive cash flow, Torex ended the year with over $400 million in liquidity, positioning it nicely to fund Media Luna development.

Safety Performance – ELG Mine (Company Presentation)

From a safety standpoint, Torex had another exceptional year, surpassing 6.5 million hours worked without a lost-time injury. As discussed in previous articles, safety performance cannot be understated, and higher safety typically leads to better work morale, which often translates into better productivity rates. In a period where miners are struggling with inflationary pressures, it’s the little things that matter to offset these extra costs, and Torex’s ability to continue delivering in this department is quite encouraging.

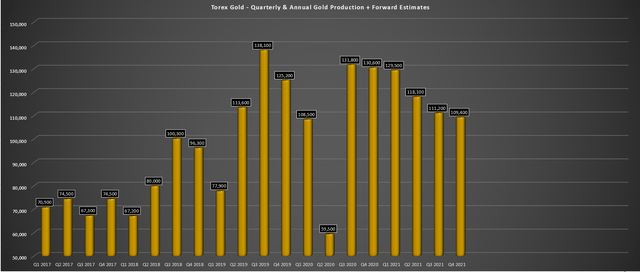

Torex Gold – Quarterly Gold Production (Company Filings, Author’s Chart)

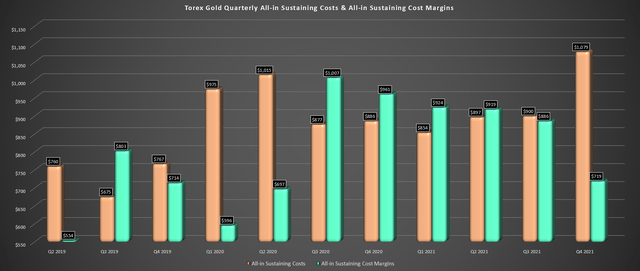

If we look at operating costs below, all-in sustaining costs rose in Q4 to $1079/oz, with inflationary pressures worsening as the year progressed. This was the lowest quarter of gold production for the year (~109,200 ounces), so the denominator was smaller. However, the company delivered on its annual guidance, which matters most, with all-in sustaining costs [AISC] of $928/oz, translating to an AISC margin of ~48%.

Torex Gold – All-in Sustaining Cost & AISC Margins (Company Filings, Author’s Chart)

These cost figures were well below the industry average of ~$1,080/oz, despite the fact that Torex did see elevated reagent costs mid-year due to higher copper/iron levels in ore. Based on the company’s FY2022 guidance midpoint ($1,005/oz), we will see costs rise more than 8% year-over-year. This is mostly attributed to higher labor, reagent, power, and consumables costs. In addition, the company will see higher waste mined due to the El Limon open pit pushback, costs to rebuild its fleet, and slightly lower ounces sold relative to FY2021 levels.

While some investors might be disappointed in the cost increases, this would still place Torex’s costs well below estimated industry average costs of ~$1,100/oz in FY2022. Besides, if the gold price can average ~$1,890/oz or higher in FY2022, which looks doable, this will more than offset the cost increase. Therefore, I don’t see any reason to worry about margin pressure for Torex, and it’s not like this is a company-specific issue, with most companies guiding for at least 5% higher costs year-over-year.

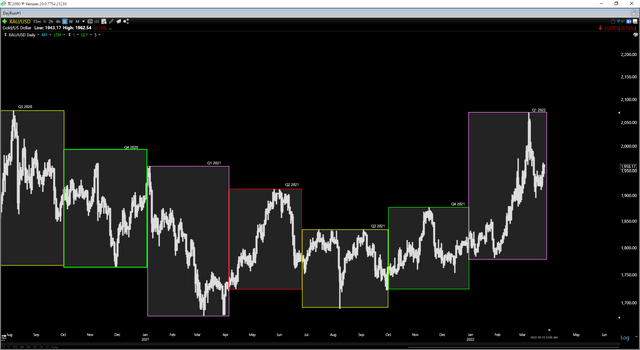

Gold Futures Price (TC2000.com)

Media Luna Development & Exploration

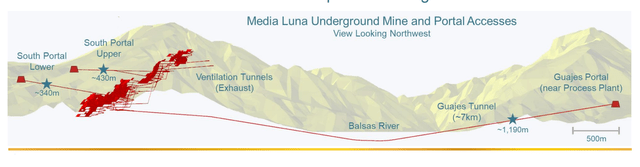

When it comes to Media Luna [ML], the Feasibility Study remains on track for this year, but the company continues to advance development while it awaits final permits and its Feasibility Study results. As shown below, Torex has advanced the Guajes Tunnel by ~1,200 meters as of the end of January towards Media Luna. The company has also advanced the Lower South Portal by ~340 meters and the Upper South Portal by ~430 meters. Torex’s internal plan is to advance at a rate of 6.5 to 7.5 meters per day, with the goal of the first production from ML 2024.

As noted earlier, the company chose to complete a pushback on its El Limon open pit to add ~150,000 ounces to smooth out the transition and avoid having a gap in production, given that open-pit production was set to end in 2023 previously. This was a smart move, and given the company’s solid execution to date, H2 2024 production looks reasonable for Media Luna. The good news is that while there’s not a lot of wiggle room on the end of El Limon open pit production and the start of ML production, financing the project will not be an issue, with more than $400 million in available liquidity as of year-end.

Media Luna Development Progress (Company Presentation)

Moving over to exploration, Torex has budgeted $39 million at its Morelos Property in 2022 alone, which is a very solid budget for a company of its size, especially given that the company does have a very solid resource base. In comparison, companies like Fortuna Silver (FSM) with similar production profiles and a lower mine life have budgeted ~$30 million or ~25% less in 2022, across five mines/projects in Fortuna’s case. In Torex’s case, its exploration budget translates to roughly ~4.6% of FY2022 revenue, above the ideal 4% threshold.

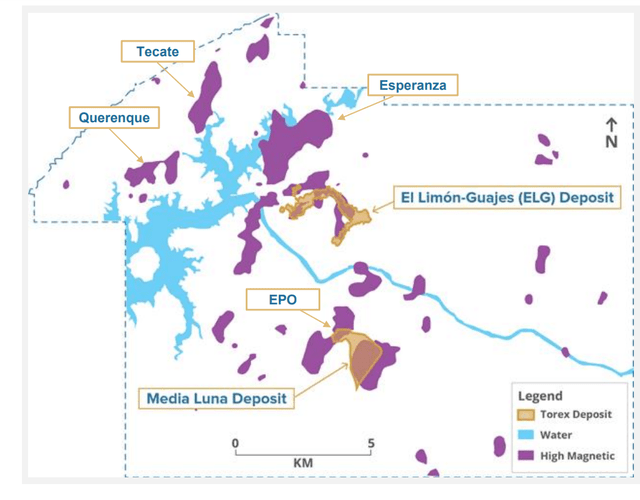

Exploration Upside – Regional Targets (Company Presentation)

Torex announced that it plans to spend $19 million at ML and EPO in 2022, $6 million at El-Limon Guajes Underground, $9 million on regional targets, and $5 million on grade control and definition drilling at El Limon Guajes. It’s worth noting that 75% of the total Morelos property remains unexplored, and there are multiple magnetic anomalies that have received limited work. These include Esperanza, Querenque, and Tecate, which lie northwest of the ELG Mine and the Media Luna deposit.

Torex has already identified 8+ million gold equivalent ounces [GEOs] on its property (including depleted ounces), so I wouldn’t count out some exciting drill results from regional targets. To date, Tecate has seen limited drilling while Teck Resources (TECK) tested Querenque, which comprised hornfelsed Mezcala Formation with minor skarn and granodiorite intrusive which is similar to El Limon, an encouraging sign.

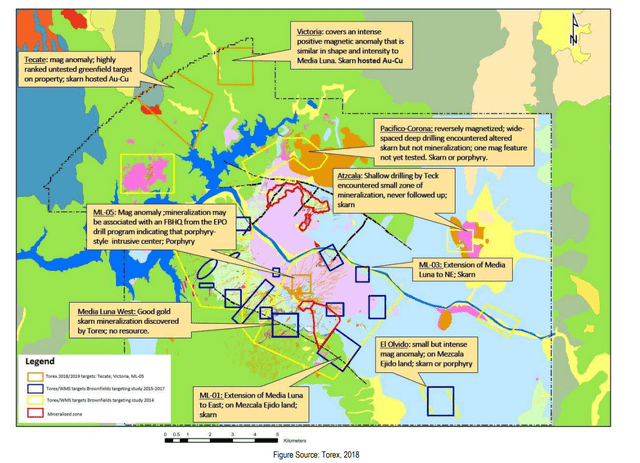

Morelos Property Targets (Company Technical Report)

Outside of these high priority targets, other targets include Modelo, where a ZTEM-magnetic survey was completed, El Cristo (sparsely drilled), Dawson, Atzcala (minor gold intersections at shallow depth), and Victoria, as well as several other targets (17 total). It’s too early to speculate on the potential of a new major discovery. However, given the incredible mineral endowment of the two deposits defined to date (ELG and Media Luna), I am optimistic about the regional potential which could extend the mine life further for Torex. Let’s take a look at the valuation:

Valuation

Based on Torex’s 86 million shares outstanding and a share price of US$13.20, it currently trades at a market cap of ~$1,135 million and an enterprise value of ~$880 million. This translates to a double-digit free cash flow yield (FY2021: ~$98 million), a very reasonable valuation. However, on a P/NAV basis, Torex is no longer offering as much as a margin of safety. This is based on an estimated net asset value of ~$1.36 billion, or a P/NAV ratio of ~0.83x.

While the above metrics are not unreasonable, they are much less compelling from two months ago when I noted that the stock would enter a low-risk buy zone at US$9.20. In fact, even if we assign a P/NAV multiple of 1.0x, which is generous in my view for a single-asset Tier-2 jurisdiction producer, and add $50 million for exploration upside, the fair value for Torex comes in closer to US$16.40. This points to more than 25% upside, which might be attractive to some investors. However, I prefer a 35% discount to fair value to justify buying Tier-2/Tier-3 jurisdiction single-asset producers.

To bake in a meaningful margin of safety (35% discount to fair value), this would require a dip below US$10.70. This doesn’t mean that the stock can’t go higher, and I may be too rigid in my requirements for new entries. However, per my rules, I do not see the stock anywhere near a low-risk buy point at US$13.20. One way that Torex could boost its multiples and command a multiple more in line with its peers is an acquisition to shed its single-asset producer. Still, I imagine the current focus is delivering ML on time and budget, which makes complete sense.

Torex Gold had another outstanding year, and it’s difficult to find a team that has executed this well in the mid-tier space over the past two years. However, with risk related to having to transition from one mine to another on a tight schedule, I struggle to see the value in paying above US$13.20 per share for Torex. Obviously, if the gold price heads back above $2050/oz, the stock could drift towards fair value by year-end above US$16.00. Still, after a 40% rally, I think there are better value opportunities elsewhere in the sector.

Be the first to comment