Petrovich9/iStock via Getty Images

Gold: The Fear Asset

Gold has been a precious asset for centuries, from Ancient Egypt and the Roman Empire to the turn of the century gold rush. Today, when the markets are volatile and fears of recession abound, the idea of possessing physical gold is back in the headlines.

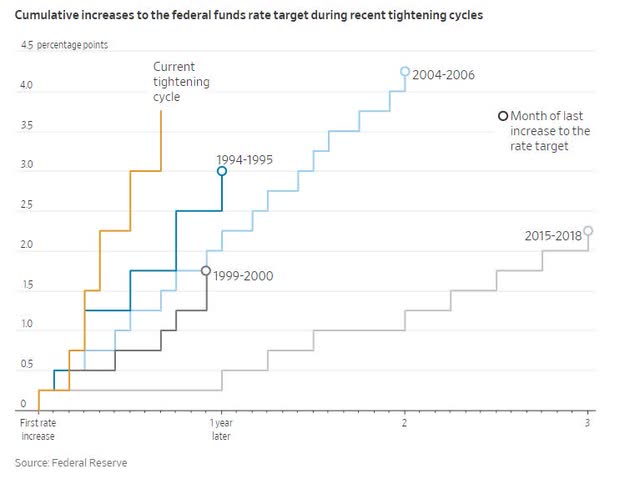

The Fed has increased the interest rate multiple times this year. As we approach this week’s Fed meeting, which anticipates another rise in rates, gold stocks that experienced a sharp decline this year are rising along with recession fears. The Federal Funds rate has increased at varying rates over the years, and Jerome Powell has indicated a target benchmark rate increase of 0.5 points, which would make it a 15-year high of 4.25% and 4.5%.

Federal Funds Rate Increases (Federal Reserve, WSJ)

Because the Fed continues to tighten, many economists and investors believe it could spur a recession well into 2023, contributing to decreases in consumer spending and investments, layoffs, and curbed hiring.

In a Wall Street Journal interview, Bank of America’s Head of Global Economics Research, Ethan Harris, shared:

“Getting inflation down to 3% or 4% should not be all that hard…Getting close to 2% in the next couple years will be much harder and may not even be doable…People don’t understand this (2023) will be a very different recession…This is one where they’re willing to deliberately create a recession, and they’re not going to cut right away.”

Fears of financial collapse and pain to portfolios have investors flocking to safe-haven investments like gold as “inflation insurance.” Gold, prone to this year’s volatile price swings, is surging back and offers benefits that may make it an optimal investment.

Is gold a good investment now?

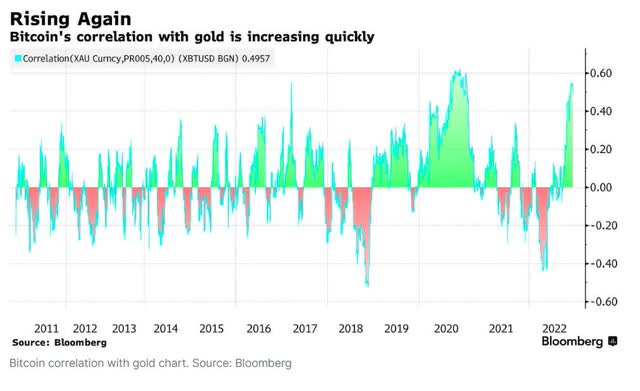

Supply pressures, the lingering effects of COVID, and inflationary costs are key drivers behind the rise in commodity prices, which include strong demand for raw materials. As economies slow toward contraction, investors tend to become defensive or go to cash. As a result of surging costs and higher-than-expected inflation, bonds have not performed as well as they usually do in a decelerating economy. As investors are unsure of what 2023 holds, investments like gold, silver, and copper – which have all experienced volatile price swings – are rising. And where the likes of Bitcoin (BTC-USD), aka “digital gold,” has been compared and correlated to physical gold as showcased in the chart below, both offer safe-haven characteristics free from the decisions of central banks and government.

Bitcoin vs Gold Correlation Chart (Bloomberg)

When you factor in that three of the most significant investment houses, Bank of America, Morgan Stanley, and Goldman Sachs’ are looking to a recession in 2023, gold is primed for a rally. Anticipating substantial volatility with a possible 25% decline in the S&P 500, BofA stated:

“Our 2023 outlook is for a year of two halves: near-term downside risk amid a recession, earnings cuts, and QT / persistent inflation driving the S&P 500 to as low as 3000, then a snap-back as uncertainty, rates volatility, and earnings revisions improve.”

In discussing the S&P 500’s 200-day moving average and target range of 4,000 to 4,150, Morgan Stanley’s Mike Wilson stated last week:

“From a very short-term perspective, we think 4150 is the absolute upside this rally can achieve, and we would not rule that out over the next week or so…Conversely, a break of last week’s lows (3938), which coincides with the 150-day moving average, would provide some confirmation the bear market is ready to reassert the downtrend in earnest.”

And as supply pressures exacerbated by Russia’s invasion of Ukraine have pushed materials to the top of lists as a hedge against inflation, there are several reasons gold makes for a solid investment – pun intended.

-

Inflation Hedge – Costs are surging alongside rising inflation. As the Federal Reserve continues to hike rates, eating into the dollar, investors may want to consider investing in gold which often maintains its value and sometimes appreciates as the dollar depreciates. Gold has the potential to outvalue inflated paper currencies.

-

Safe Haven – We’ve all seen the movies where physical gold is kept in a safe or safety deposit box. Physical gold is an asset that tends to maintain its value over time, serving as an insurance policy when interest rates impact other currencies. Gold is also relatively easy to buy and sell.

-

Portfolio Diversification – To help reduce risk and undermine market volatility, a diversified portfolio that holds assets like gold tends to be negatively correlated with the stock market.

-

Gold Prospecting – Locating gold is often associated with finding other commodities or minerals associated with gold deposits that can be very lucrative.

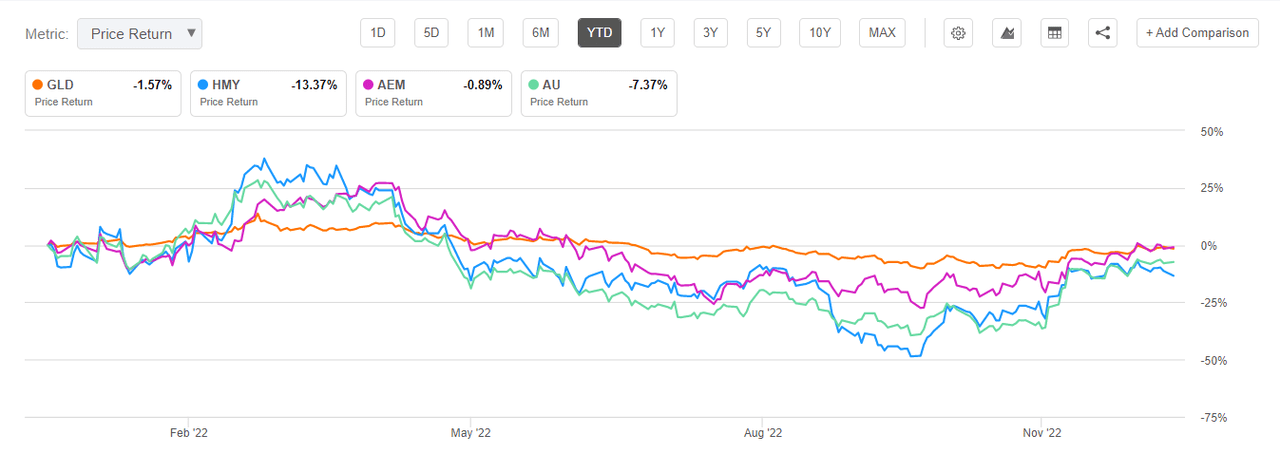

Although my three stock picks are down YTD, with the SPDR Gold Trust ETF (GLD) outperforming Harmony Gold and AngloGold Ashanti, getting ahead of a potential rally is better than being behind.

YTD Price Return of HMY, AEM, AU vs. SPDR Gold Trust ETF (GLD)

Year-to-Date Price Return of HMY, AEM, AU vs SPDR Gold Trust ETF (GLD) (Seeking Alpha Premium)

With strong fundamentals and tremendous momentum, the three stocks I have selected are all rated Buy according to my quant rankings, offering solid growth and EPS, excellent cash from operations, and stand to benefit from a contraction.

1. Harmony Gold Mining Company (NYSE:HMY)

-

Market Capitalization: $2.18B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 12/12): 33 out of 280

-

Quant Industry Ranking (as of 12/12): 2 out of 47

The largest gold producer in South Africa, possessing some of the world’s premier and newest gold-copper regions, Harmony Gold Mining Company (HMY) engages in the exploration, extraction, and processing of materials and commodities like gold, uranium, silver, and molybdenum deposits. Headquartered in South Africa with additional operations in Papua New Guinea, Harmony recently announced the acquisition of a near-term project in Queensland, Australia, known as the Eva Copper Project. Despite the volatility in gold prices and increasing production costs, Harmony has been positioned well financially, allowing it to add a potential 10% to 15% more gold production in diversifying its revenue streams while increasing long-term value.

Harmony Gold Valuation & Momentum

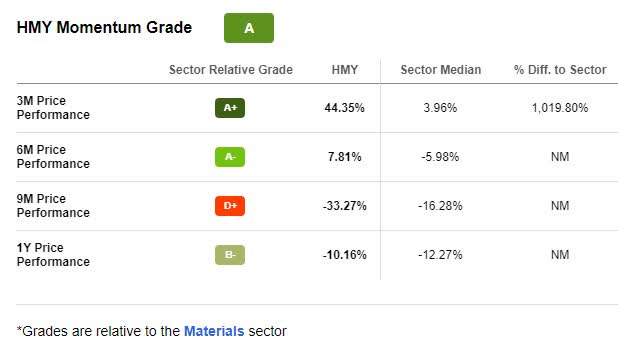

Momentum signals for HMY are strong and lean towards an upward trend. As we look at the three-month, six-month, and one-year performance, underlying figures support the overall A momentum grade.

HMY Momentum Grade (Seeking Alpha Premium)

Not only is Harmony on an uptrend, but its valuation also comes at a relative discount, showcasing a forward P/E ratio of 8.21x compared to the sector median of 13.42x, forward EV/Sales of 0.86x, a difference to the sector of -40.42% and forward Price/Sales also a -26.05% difference to the sector. Despite a fall in EPS for Q4 2022 amid lower FQ1 gold production, revenue beat by more than 3%.

HMY Growth & Profitability

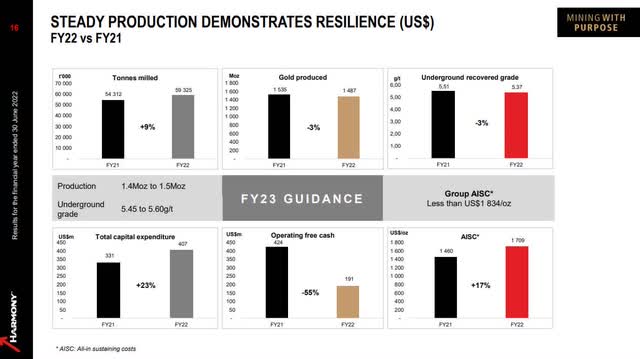

Despite multiple mining operations and some of the largest gold deposits globally, Harmony Gold Mining has been grappling with lower FQ1 gold production after the closure of its Bambanani site and increasing costs but remains on track to meet 2022 production and its full-year guidance. By focusing on operational free cash, organic growth, and capital expenditure, HMY is on a mission to enhance margins.

Harmony Gold Mining FY22 vs FY21 Production (Seeking Alpha Premium)

HMY’s ore reserves and resources present vast mineral opportunities in gold and copper. With a recent investment in the Eva Copper Project, Harmony is expected to supply 65,000 tonnes daily to increase its free cash flow starting in 2023. According to Harmony’s Form 6-K, Harmony posted solid results that included GAAP EPS of -$0.08 and revenue of $2.8B, which beat by $130M. After improving its operations for a 17% gain in operating free cash flow, Harmony Gold could be music to investors’ ears, along with my next pick.

2. Agnico Eagle Mines Limited (NYSE:AEM)

-

Market Capitalization: $23.17B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 12/12): 37 out of 280

-

Quant Industry Ranking (as of 12/12): 3 out of 47

Toronto, Canada-based Agnico Eagle Mines Limited is engaged in exploring, producing, and selling gold deposits in Canada, Mexico, and Finland. Offering quality precious metals a substantial production increase of nearly 816,800 ounces for Q3 2022, AEM is extremely profitable and offers a handsome dividend, sure to make investors happy.

AEM Stock Valuation & Momentum Grade

Offering a C- Valuation grade, Agnico comes at a relative discount. Solid liquidity and an average 10- and 90-day trading volume near 3M indicates that investors are actively purchasing this stock, despite a forward P/E ratio of 32.80x and forward EV/Sales of 4.11x, which are a bit stretched.

AEM Stock Momentum (Seeking Alpha Premium)

Given its 1.38x forward price to book, a -28.86% difference to its sector peers, AEM is trading at a discount, but some prudence is required when investing at this price. Year-to-date, the stock is down just under 1%, but over the last year, the stock is up over 5% with a recent three-month rally, indicating the potential for a portfolio.

AEM Growth & Profitability

Agnico Eagle showcased tremendous gold production for the third quarter, representing a 57% year-over-year growth. With an EPS of $0.52 beating by $0.09 and revenue of $1.45 beating by $15.82M, the company is on track to meet guidance of 3.2 to 3.4 ounces to close out the year, despite the headwinds posed by increasing costs amid the heights of inflation. Additional Q3 highlights include 817,000 ounces of production and a quarterly net income of $0.17.

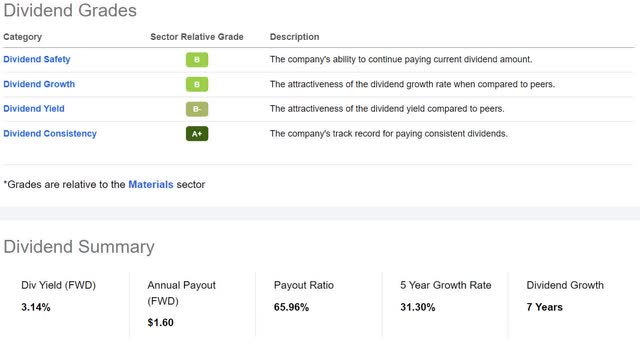

AEM Dividend Scorecard (Seeking Alpha Premium)

AEM is a dividend aristocrat. Having paid shareholders a dividend since 1983, its forward yield of 3.14% offers a modest yet beneficial stab at inflation. In addition to debt repayments of $100M, Agnico offered $42.6M of share buybacks, including ~1M in Q3 and a quarterly dividend of $0.40.

With continued development, a focus on remaining on budget, and new exploration projects, it should come as no surprise when Agnico Eagle President and CEO Ammar Al-Joundi said:

“On the operational side of it, we are targeting $130 million a year. I will tell you we have identified more than $130 million a year of opportunities, but not everything you identify happens. We remain confident on the $130 million a year. We said it’ll take a couple of years to get there and we are going to exceed our expectations for 2022.”

As Agnico CEO’s outlook remains confident in its company, I remain confident that my quant ratings have selected solid picks, including my final gold stock, AngloGold Ashanti Ltd.

3. AngloGold Ashanti Limited (NYSE:AU)

-

Market Capitalization: $7.86B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 12/12): 40 out of 280

-

Quant Industry Ranking (as of 12/12): 4 out of 47

AngloGold Limited was founded in 1998 and became the first South African company listed on the New York Stock Exchange (NYSE). As one of the largest gold mining companies in the world, AU is an independent gold producer with shareholders that include some of the world’s most significant financial institutions. Like the other two stock picks, AU has experienced volatility amid rate hikes and higher costs. Despite AngloGold trending higher as it trades above its 200-day moving average, some prudence is needed when buying the stock at its current price of $18.59 per share, given its ‘D’ valuation grade.

AU Stock Momentum Grade (Seeking Alpha Premium)

Despite its current price, Anglo’s quarterly price performance outperforms its sector median peers, and the company continues to reinvest in its global projects for growth.

AngloGold Stock Growth & Profitability

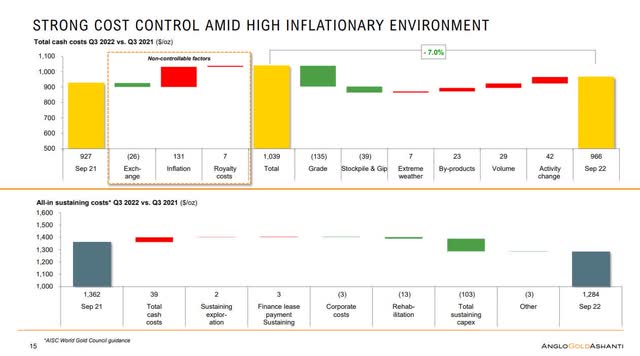

Following Russia’s invasion of Ukraine, Anglo has experienced some disruptions in supply chains and key supplies impacted by inflation pressures, including the oil and lubricants needed to operate and ammonia-related products like explosives and cyanide for mining. Despite these headwinds, AngloGold managed to increase Q3 production by 20% to 738,000 ounces from 613,000 oz for Q3 2021. With a solid balance sheet, nearly $2.5B in liquidity, and a free cash flow of $169M for Q3 versus the prior Q3 2021 of $17 million, CEO Alberto Calderon said, “We’re focused on regaining competitiveness versus our peers, and we still have some way to go before we will be satisfied.”

AngloGold Stock Q3 2022 vs Q3 2021 Total Costs (AngloGold Q3 2022 Investor Presentation)

With strong cost controls in place to maintain its group guidance on total cash costs at $925/oz to $1,015/oz and for AISC at $1,295/oz to $1,425/oz, highlighted in its Interim 2022 Results Report:

“Management anticipates that most of these inflationary pressures are catered for in the current guidance range, we remain aware of the ongoing cost pressure experienced by the Company specifically and the industry in general. Total capital expenditure group guidance remains unchanged between $1,050m and $1,150m, with sustaining capital expenditure between $770m and $840m and non-sustaining capital expenditure between $280m and $310m. We continue to progress our reinvestment program aimed at pursuing key growth-driven brownfield projects across the portfolio.”

As the company continues to progress and push for growth-driven projects, consider this stock with solid fundamentals for a portfolio and the other two gold picks, which may serve as an inflation hedge.

Is your investment as good as gold?

Many material stocks and commodities have been in global short supply. Investing in stocks that include precious metals is a unique way to try and capitalize on rising costs as an inflationary hedge and a way to diversify a portfolio.

Fear of recession is creating buy opportunities, and over the last six months, HMY, AEM, and AU have been on an uptrend. While past performance is no guarantee of future results, according to my quant ratings which take the fear out of investing, these stocks are rated buy, offering solid valuation frameworks and growth and profitability. Gold can be seen as a defensive asset, with gold stocks that could benefit in the current inflationary environment. Over the last month, as investors have been looking for safe-haven investments, consider Top Material Stocks. You can also create your own screen to help achieve diversification into desired sectors you like for a quantitative view of your stocks.

Be the first to comment