Khanchit Khirisutchalual

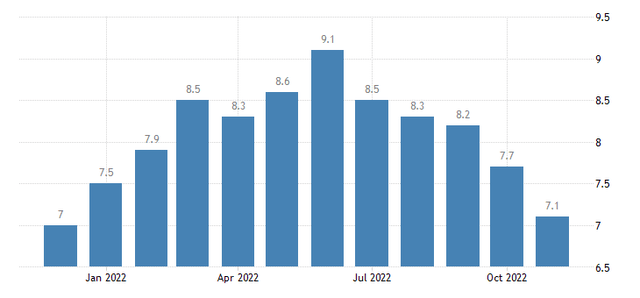

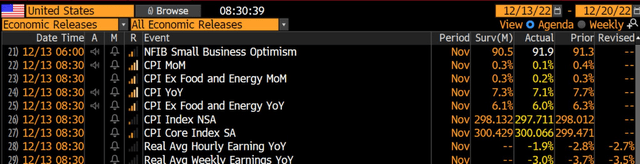

This morning’s CPI report verified higher by just +0.1% on the headline rate from October vs. expectations of +0.3%. The core rate was up two-tenths of a percentage point month-on-month, weaker than the +0.3% expectation. On an annual basis, headline CPI is now +7.1% (+7.3% consensus) while the core rate is +6.0%. It was the biggest monthly drop in CPI since April 2020 at -0.64%.

CPI Rate Back Near Where It Was A Year Ago

CPI Much Weaker Than Expected Across the Board

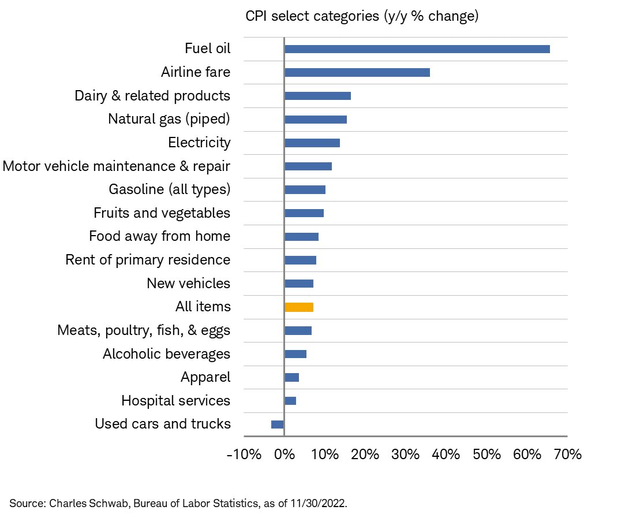

CPI By Category YoY: Used Car Prices In Deflation

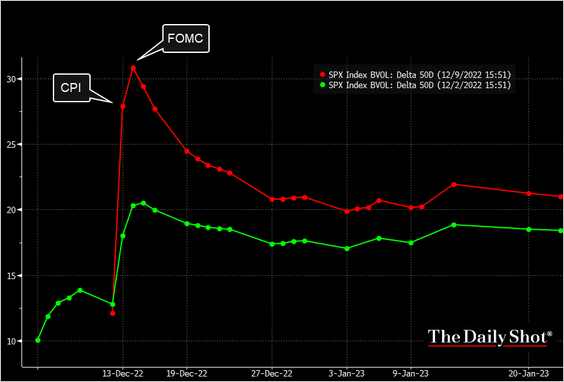

Stocks surged more than 2% immediately after the cooler-than-expected inflation readings crossed the wires. Expect volatility today, which appears to be to the upside, as the VIX forward curve had priced in a nearly three percentage point move in the S&P 500 before the data came out. Recall how stocks moved higher by 5.5% after the October CPI reading a month ago, which followed three straight SPX price changes of more than 2% on prior CPI days. More volatility is still expected tomorrow with the Fed’s interest rate decision. Traders now have confidence in a 0.5 percentage point hike tomorrow.

Big Volatility This Week Before An Expected Quiet Year-End

The Daily Shot

Treasury yields plunged after the 8:30 A.M. data release, with the 2-year note dropping 18 basis points to near 4.2% while the 10-year rate fell below 3.5%. The U.S. dollar index cratered a quick 1%. As a result, oil jumped to near $75 per barrel.

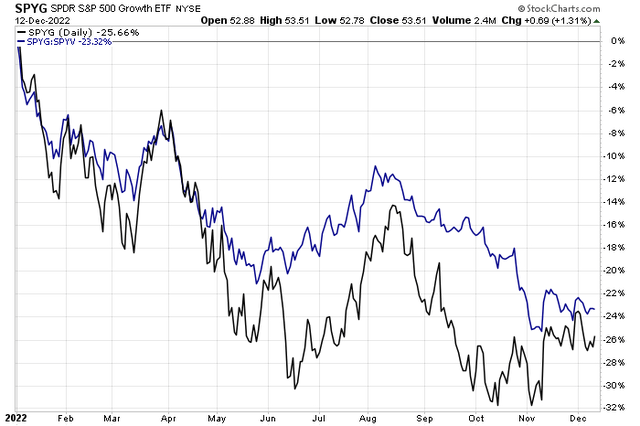

What’s interesting lately is that as interest rates have been on the decline, we have not seen a meaningful relative uptick in growth vs. value. Earlier this year, as interest rates rose, value naturally took the lead against growth. That makes sense as higher-duration growth stocks have future profits discounted more sharply when rates rise compared to value firms, like those in the energy sector, that have near-term profits. It’s good old-fashioned discounted cash flow valuation at work.

Going forward, should rates continue to ease due to less fear of inflation and more concerns about growth, there’s a plausible scenario in which growth makes a relative comeback. The curveball is how much of the style’s economically sensitive areas, like corporate ad spending and enterprise software investments, take a big hit. I assert that eyeing the relative chart of growth to value is important right now.

SPYG: Trending Lower Versus Value Despite Falling Interest Rates Lately

According to SSGA Funds, NYSEARCA:SPYG is a low-cost ETF that seeks to offer exposure to S&P 500 companies that display the strongest growth characteristics. The Index the ETF tracks contains stocks that exhibit the strongest growth features based on: sales growth, earnings change to price ratio, and momentum.

With just a 0.04% annual expense ratio and a 0.02% 30-day median bid/ask spread, it’s an effective and efficient way to gain exposure to large-cap growth companies in the U.S. Moreover, with forecast future EPS growth near 13% and a forward price/earnings ratio of 23, the PEG ratio looks better today than perhaps a year ago when stocks were much pricier. Investors must still monitor momentum trends, and if a recession strikes in 2023, we will likely see valuations compress further.

The growth vs. value trend continues to be lower, so I favor value and even some defensives, such as healthcare. Staples and Utilities appear richly valued at the moment, though.

The Bottom Line

This morning’s much weaker CPI print should allow the Fed to ease on its hike-increasing initiative. That might be a boon to growth shares, which often rely on low and more stable interest rates. I would still like to see momentum pick-up in growth vs. value before going overweight growth stocks.

Be the first to comment