PeopleImages/iStock via Getty Images

Investment Thesis

Madrigal Pharmaceuticals (NASDAQ:MDGL) shares traded as high as $300 for a brief period between May and July 2018, after the Fort Washington, Pennsylvania based biotech’s lead candidate MGL-3196 – now known as Resmetirom – met primary and key secondary and exploratory endpoints in a Phase 2 study in patients with non-alcoholic steatohepatitis (“NASH”).

According to Madrigal’s press release at the time the study showed:

- sustained highly statistically significant reduction in liver fat based on MRI-PDFF in MGL-3196 treated as compared with placebo patients;

- sustained statistically significant lowering of multiple atherogenic lipids including LDL-C, ApoB, triglycerides, ApoCIII and lipoprotein (a);

- lowering and normalization of liver enzymes;

- statistically significant resolution of NASH that is correlated with reduction in liver fat on MRI-PDFF and provides evidence for efficacy at an approvable endpoint for Phase 3 development in NASH.

Madrigal stock hit the heights partly because the data made it look like a frontrunner in the “NASH Dash” – a competition amongst a large number of Pharma and biotech companies to develop the first drug to successfully treat the liver disease – and partly because the strong study data made Madrigal a potential acquisition target for a Big Pharma concern, given that the market for NASH drugs is independently estimated to be a potential ~$25bn market.

No takeover occurred however, and although Madrigal initiated its Phase 3 study of Madrigal in 2019, its stock price rapidly receded as hype around a potential NASH approval died down, whilst investors waited patiently for Phase 2 data.

Today, despite being promised for the fourth quarter of 2022, that Phase 3 data has still not arrived in full, and Madrigal’s share price currently trades at $64 – down 40% across a five-year period, and 13% across the past 12 months.

Although rumors are circulating that data could arrive any day now, most of the speculation appears to be negative, the thinking being that management must have been in possession of final data from the 900-patient, 52 week study for months now – if the data was positive, why not announce it?

Although no other drugs have been approved to treat NASH while Madrigal has been working on its MAESTRO-NASH study, the emergence of 2 new drugs that target both obesity and Type 2 Diabetes – Novo Nordisk’s (NVO) (Semaglutide), marketed as Wegovy for obesity and Ozempic for Diabetes, and Eli Lilly’s (LLY) Tirzepatide, marketed as Mounjaro in diabetes and likely soon to win approval in obesity – has potentially changed the landscape.

Both of these drugs are expected to make peak sales >$20bn per annum, and both Novo Nordisk and Lilly will likely seek to expand the label into NASH. Although Semaglutide failed to outperform placebo in a Phase 2 NASH study in July, management remains confident it will work and has already initiated a Phase 3 study, whilst Eli Lilly is also conducting studies.

The FDA criteria for approval in NASH is tough, being either ≥1 stage in fibrosis with no worsening of NASH, or improvement in NASH resolution with no worsening of fibrosis, whilst an approval in Europe may require both of these endpoints to be met.

Akero Therapeutics (AKRO) recently released data from a Phase 2b study of its NASH candidate Efruxifermin, with >40% of high dose patients experiencing at least a one-stage improvement in liver fibrosis with no worsening of NASH by Week 24, compared to 20% within the placebo group.

Akero’s share price rose by >200% in response, which shows that despite the data delays, Madrigal still has everything to play for, and could still reward shareholders with triple-digit percentage gains on positive data.

Given its current $1bn market cap valuation, plus the fact that Resmetirom is Madrigal’s only clinical stage asset of note, the losses investors may incur if MAESTRO NASH does not meet its endpoints are also substantial.

When we additionally consider that Madrigal made a net loss of $209m across the first 9m of 2022, and has a cash position of only $153m, the risk of investing in this biotech is likely too high for most investors, despite the rewards on offer.

Nevertheless, in the remainder of this note I will try to discuss Madrigal’s opportunity objectively, outlining progress to date, market opportunity, red flags, and what the prospects for Madrigal’s share price are based on different scenarios.

NASH and Resmetirom

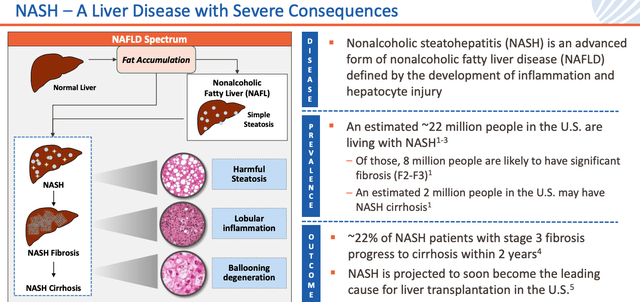

Introduction to NASH (Madrigal presentation)

As we can see from the above slide from a recent Madrigal investor presentation, NASH is a dangerous condition that can lead to liver fibrosis, cirrhosis, and ultimately cardiovascular disease and liver cancer, and it affects some 22m people in the US, with 2m people suffering from NASH cirrhosis.

Resmetirom is a thyroid hormone receptor (“THR”) β-selective agonist, administered orally and once daily. It is proven to improve key measures of liver and cardiovascular health such as liver fat, LDL cholesterol, triglycerides, Apolipoprotein B-100 – a protein that carries fat and cholesterol around the body – and other fibrosis biomarkers.

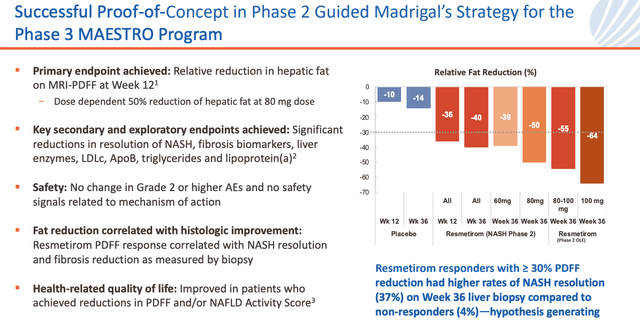

Resmetirom Phase 2 study results (investor presentation)

Above are the Phase 2 study results that sent Madrigal’s stock price soaring back in 2018, and prompted so much optimism. These data remain some of the best generated by any NASH targeting drug.

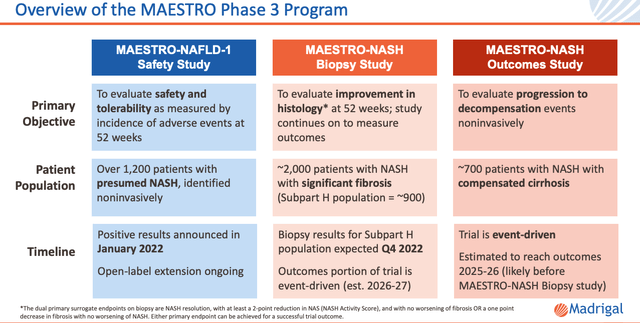

Resmetirom Phase 3 Study Design (investor presentation)

Finally, above is the study design for the Phase 3 MAESTRO Studies. As we can see, there are 3 different kinds of study, and we already have positive data from the first, MAESTRO-NAFLD-1.

I discussed this data – released in January this year – in a previous note on Madrigal for Seeking Alpha at the time. This study was primarily focused on safety and met its primary endpoint, with Resmetirom being found to be safe and well-tolerated at 52-weeks in a population of ~1,200 patients.

There were encouraging signs of efficacy too, across most of the measures mentioned above – notably a reduction in liver fat – but this study did not take liver biopsies and the efficacy data will not be sufficient for an FDA approval.

That approval-worthy data is expected to come from MAESTRO-NASH, which does include biopsies, and has enrolled ~2,000 patients. This study has dual primary endpoints of:

NASH resolution, with at least a 2-point reduction in NAS (NASH Activity Score), and with no worsening of fibrosis OR a one point decrease in fibrosis with no worsening of NASH.

Dual primary endpoints means that the study need only meet one of the 2 criteria to be considered a success, and seems to be consistent with the FDA’s approval criteria. Theoretically, at least, as soon as we have MAESTRO-NASH results, we will know whether or not the drug is worthy of a full approval.

The third study, MAESTRO-NASH Outcomes, has been, according to management:

Designed to assess the rate of disease progression in early NASH cirrhosis patients and enhance the statistical power of MAESTRO to assess clinical benefit

Liver biopsy is not an endpoint in this study and according to Madrigal:

FDA has publicly stated that an outcome study in NASH cirrhosis patients can support full approval in non-cirrhotic NASH; Madrigal met with FDA to confirm the strategy and study design.

Apparently, then, MAESTRO-NASH Outcomes may avert the need for a Phase 4 confirmatory study of Resmetirom, and expand the approval label to include compensated cirrhosis due to NASH – which represents 85% of the ~2m patients in the US who have NASH with Cirrhosis.

Will MAESTRO-NASH Data Ever Arrive?

As mentioned, rumors have been circulating that the key MAESTRO-NASH study data may arrive imminently, given it is apparently several months since the last patient completed the trial.

It is difficult to think of many reasons for delaying positive data for such a long time, but not hard to come up with reasons for a delay if the data failed to hit the mark. With that said, judging the results based on how quickly they are released may also be presumptuous, so shareholders, prospective investors, the market and analysts have little choice but to wait for an update from management.

The last communication from management came on 3rd November in the form of a press release discussing 2 upcoming presentations at the American Association for the Study of Liver Diseases, neither of which contains the results from MAESTRO-NASH. Madrigal CEO Paul Friedman does state in the release however that:

The Madrigal team is focused on delivering topline data from the pivotal MAESTRO-NASH biopsy study in Q4 2022. Positive results from the study would allow us to finalize our new drug application for resmetirom, with the goal of filing for Subpart H accelerated approval in the first half of 2023.

According to Madrigal’s 2021 10K submission, Subpart H refers to

accelerated approval of certain new drug products that have been studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit to patients over existing treatments

To summarize, realistically Madrigal has ~10 more working days available to release data from MAESTRO-NASH if it is to fulfill its promise of data in Q422. If management does not do so, the clamor for some news would likely reach fever pitch, and it could become damaging to the company’s share price.

Even that is not necessarily a problem for management – so long as the data are positive, Madrigal would likely be able to complete a huge fundraising without impacting a skyrocketing share price, just as Akero did when raising $200m back in September.

The Market Opportunity

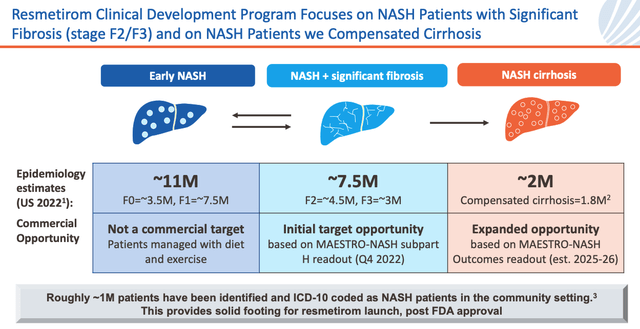

NASH market opportunity (investor presentation)

As we can see above Madrigal management estimate a ~7.5m patient opportunity, with an additional 2m patients in play should the MAESTRO-NASH Outcomes study prove successful.

As mentioned, analysts have issued some very bullish forecasts on the size of the market for a successful NASH drug – $35bn per annum, according to some Wall Street firms – and detailed research (which I was able to find online) suggests there is a likely cost benefit to the drug – the report concludes:

This medication would potentially be cost effective compared with placebo for the treatment of NASH and fibrosis at a WTP threshold of US$100,000/QALY, from a US commercial payer perspective.

The report also discusses a “maximum daily price at which Resmetirom would remain cost effective” of $50 per day, which may imply a list price of ~$18k per annum. Based on Resmetirom picking up <10% of its target population, there appears to be a >$10bn per annum peak sales opportunity in play.

That is consistent with the expectations being placed upon Novo Nordisk’s Semaglutide and Eli Lilly’s Tirzepatide – and it should be noted that to date at least, Resmetirom’s data is superior to either of these drugs when it comes to NASH. There are some caveats to consider however.

Firstly, in order to prescribe Resmetirom doctors may need to order a liver biopsy for a patient, which is an expensive procedure. Would insurers reimburse for both the biopsy and the drug?

Without the former, the latter cannot be prescribed, and although that may change, with Madrigal itself pushing for the use of surrogate biomarkers of NASH, and conducting the Outcomes study, it would certainly affect the market opportunity significantly in the near term and make any commercial difficult and expensive.

Secondly, physicians are known to be somewhat skeptical about prescribing drugs to treat NASH, when patients can guard against the disease simply by making healthy lifestyle and dietary decisions.

Again, that could change in the wake of the Ozempic, Wegovy, and Mounjaro approvals, given the budgets the Big Pharmas have to spend on marketing and “educational programs”, but it should be noted that Madrigal has a miniscule marketing budget itself, although I personally believe that, if the MAESTRO data was a slam dunk, management could likely raise as much as $1bn in the public markets.

It is interesting to note, however, that Madrigal is not subject to much in the way of M&A rumors, and the short interest in the company is quite high, at >17% of the share float, according to MarketBeat. As large as the market opportunity may or not be, it is irrelevant if the drug itself does not merit approval.

Conclusion – The Stakes Are Impossibly High – Don’t Bet Money You Can’t Afford To Lose

Most stock market investors are likely not looking for opportunities as high-risk as investing in Madrigal almost certainly is.

The list of late stage study failures by NASH drug candidates is a long one that includes Gilead Sciences’ (GILD) Selonsertib, Intercept Pharma’s (ICPT) obeticholic acid (“OCA”), and Genfit’s (GNFT) Elafibranor. And these are the drugs that made it to pivotal studies – countless others have tried and failed to make their mark in NASH, which suggests that this disease is very tricky to treat.

Madrigal has been sitting on potentially pivotal late-stage study data apparently for months now and although management still has 10 days in 2022 to produce them, this form of brinkmanship is something of a red flag.

There are good reasons why data may be delayed – double-checking study conclusions, preparing data the way the market, not to mention the FDA, may want to see it, examining subsets of patients – but more often than not positive data are announced sooner rather than later.

There are reasons for keeping the faith in Madrigal – even Semaglutide and Tirzepatide, the supposed obesity wonder-drugs of the next few decades, have not surpassed Resmetirom’s Phase 2 clinical data – but that data was published back in 2018, and 4 years on, the wait for news goes on.

That is not necessarily an eternity in the world of drug development, and as recently as October Akero showed that the NASH market remains very much in play, but my conclusion would be that there are too many red flags in play to risk money on Madrigal shares that you cannot afford to lose.

Be the first to comment