edb3_16/iStock via Getty Images

Introduction and Thesis

Operating via four separate sites, Solo Brands (NYSE:DTC) utilizes its expertise in direct-to-consumer e-commerce to drive sales in outdoor lifestyle products. Since its founding in 2011, Solo Brands has grown by the addition of three brands, offering adequate diversification, and shows no plans in slowing down this expansion both in new brands and in entering various global markets. Having started with one brand, Solo Stove offering outdoor heating and cooking solutions, they have since been able to offer clothes, kayaks, and paddle boards with multiple site additions.

Each of Solo Brands’ Direct-To-Consumer Sites (Solo Brands Website)

Despite stable revenue streams that are poised to grow substantially in the future according to analysts (69.9% FWD), shares have begun trading at an extreme discount to what Solo Brands has to offer. Add in an improving business model that has clearly outlined company objectives with a promising technical rebound, shares should have no trouble ascending to previous levels once this value is realized.

Catalysts; Driving Future Growth

Down massively from all-time highs achieved near its late-October 2021 IPO, Solo Brands has not shown any radical deterioration in fundamentals that would give reason to it now being considered as a penny stock (sub $5 per share). Despite this fall that many attribute to inflationary concerns among consumers, management appears driven to abide by their five-step growth model which should give way to immense shareholder returns. Chief Executive Officer John Merris has set the company’s focus on the following: product innovation, leveraging customer data, entering new markets, improving customer relations, and continuing acquisitions. In order, we will be looking over each dynamic and see what value can be introduced to Solo Brands and why, together, they lead to a bullish stance.

Product Innovation

Looking to further take advantage of excellent gross margins (currently around 66%), Solo Brands continues development across each of their four brands in order to ensure each customer’s needs, and any gaps within the market, are fulfilled. In fact, each of their four brands have done quite well given a focus on innovation thus far; for instance, their Solo Stove brand recently introduced heat deflectors to their line up and in the words of John Merris:

Our much anticipated heat deflectors, rolled out in the first quarter and we have sold over 26,000 units, which is well ahead of our internal expectations” (Q1 Earnings Call).

Assuming this trend of outpacing expectations to show up in each of the brands, as it already has in Oru recently offering an introductory-level Kayak, catering innovation to customer needs will further revenue growth.

Leveraging Customer Data

Making use of their customer database, containing 3 million shoppers, Solo Brands intends to further their ability to both innovate (understanding customer needs) and bring customers between different sites. So far with the latter, they have had 42,677 customers who have purchased from more than just one of their sites. Recently, there has been continued interest among management to take advantage of this opportunity:

We believe that the investments we are making to mobilize our data should yield significant returns this year and for the years ahead” (Q1 Earnings Call).

Entering New Markets and Building Relations

Having already gained momentum in several regions beyond the United States, such as Canada and certain parts of Europe, Solo Brands is allowing their flagship brand, Solo Stove, to lead the way into new markets; namely, Australia in the third quarter. From there, they intend to slowly introduce new brands into Australia as more customer data is obtained to more effectively market their different outdoor products.

In entering and expanding in these new markets, of which they believe they have under 2% of the market share for each brand, they are looking to form closer customer relations. With those relations, so far, they have boasted a positive referral rate of approximately 40% and with such a large, established, customer base, they are looking to capitalize on these positive interactions to further future sales. Especially as Solo Brands remains committed to expanding its product offerings via new acquisitions, their strong shopper base which consists of 50% returning customers looks to provide generous returns whenever entering a new market.

Strategic Acquisitions

Building upon their intentions to further penetrate the outdoor lifestyle market beyond their 2% share is the potential for future acquisitions that fit into their current portfolio of brands. With that, they would also take advantage of their Net Promoter Score in the 70s indicating they would be able to continue transferring customers from one site to another with relative ease.

We continue to evaluate strategic acquisitions and are enthusiastic about the opportunities we are seeing. Our focus here is unchanged and we look to find unique, disruptive, profitable brands” (Q1 Earnings Call).

Valuation

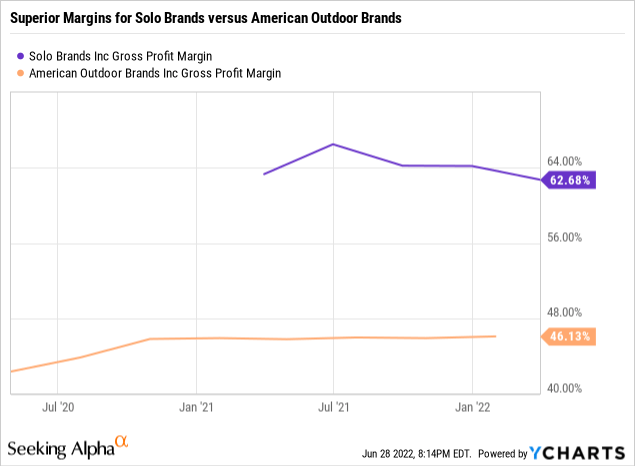

Given the difficulty which comes with utilizing a DCF in the case of a startup, or at least a business that has high levels of cash flow fluctuations, making use of public comparable appears to be the greatest approach in gaining a deeper understanding of how Solo Brands is trading so cheap. A great example of such a peer would be American Outdoor Brands (AOUT) which, like Solo Brands, is over 70% off highs in light of inflationary concerns. Despite this, American Outdoor still trades at a higher multiple of over 6x earnings even with less promising revenue growth entering the near-term future. Add in their less-attractive gross margins, one may see that Solo Brands is being overlooked given its likely-superior fundamentals.

Even after calculating a Net Current Asset Value Per Share (NCAVPS) lower than where shares are trading today ($2.02 versus $4.31), the trend in lowering shares outstanding should aid in the process of placing this number above where shares can be acquired. This strong likelihood comes when looking at the company’s historical reduction in shares outstanding, enabling the NCAVPS to increase comfortably.

Technical Strength; Moving Off Lows

With inflation being the primary culprit in share prices falling heavily from all-time highs achieved following the 2021 IPO, solid earnings since have proven consumers are not abandoning outdoor living products. Especially considering that the products which Solo Brands offers across its various sites are specifically tailored towards the needs of their customers (proven by their substantial customer relations), it is highly unlikely that this trend of impressive sales will let up anytime soon. Foreseeing a bright future fundamentally in Solo Brands, technical analysis reinforces that now is the time to invest in this well-diversified, deep value, stock.

High Probability for a Double Bottom to Initiate Bullish Trend (TradingView)

Seeing that a level of support has been formed around the $4 mark, a secondary rebound off this point would lead to the belief that this is a potential double bottom scenario wherein there is (historically) a 78.5% chance of success that it leads to a bullish trend afterward. Furthering the possibility for a bullish trend is the positive movement in the Moving Average Convergence Divergence (MACD) that appears to have enough momentum for entering a bullish period in the coming weeks and months. Given the technical strength, share price appreciation looks promising both in the short term and eventually, backed by an excellent business model, moving into the distant future.

Risks Moving Forward

Like most other equities, Solo Brands has faced a fair share of inflationary pressure, as reflected in their share price decline since its IPO, a time wherein the dollar has lost 4.65% of its value according to the CPI. And although management has advised that fluctuations in their earnings will persist into the second quarter, they are doubling down on their earlier-proven strategy of growth.

[C]onsumers [are] continuing to feel the pressures of higher inflation, which is impacting their spending. In times like these we believe offering innovation becomes increasingly important” (Q1 Earnings Call).

This dedication to improving the underlying business despite a slight hiccup in sales indicates a long-term focus for management, something that can be appreciated given the current, low, multiple Solo Brands is trading at. Furthering their long-term outlook is the lack of dividend payments, instead, this revenue is diverted to fuel further growth in light of another risk: heightened rates. So far, increasing interest rates have been navigated quite well; namely, their earlier acquisitions (all three of which occurring in 2021) should allow the company to weather (possibly avoid) expensive funding. Eventually, when more cash is on hand (currently $15.9M), the company can comfortably move into additional acquisitions as per their outlined plan.

Final Thoughts

With inflation taking a hit on almost every company in some measure, Solo Brands has seen similar damage to their share price, but not necessarily to their fundamentals. During this time, management has taken steps to ramp up growth prospects and has allowed investors the opportunity to take advantage of this deep value. With technical factors pointing to nearby gains, fundamental factors will more than likely continue this trend well into the future. With that, share prices should have no issue ascending to IPO-level prices and, depending on how management’s plan performs entering the distant future, much higher.

Be the first to comment