jetcityimage/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am always on the lookout for either increasing my current positions or looking at new positions that can fit my strategy. Right now in my portfolio, I lack some exposure to healthcare, and while I have several positions in pharmaceuticals and medical devices, I don’t have much exposure to health insurers besides CVS (CVS).

I looked at UnitedHealth (NYSE:UNH) back in 2021. I found the company to be a decent addition to a dividend growth portfolio and rated it a hold. Since then the company has been outperforming the broad market due to the higher volatility. Following a 30% increase in the share price, I decided to take another look at the company.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, UnitedHealth Group operates as a diversified healthcare company in the United States. It operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services. The Optum Health segment provides access to networks of care provider specialists, health management services, care delivery, consumer engagement, and financial services. The Optum Insight segment offers software and information products. The Optum Rx segment provides pharmacy care services and programs.

Wikipedia

Fundamentals

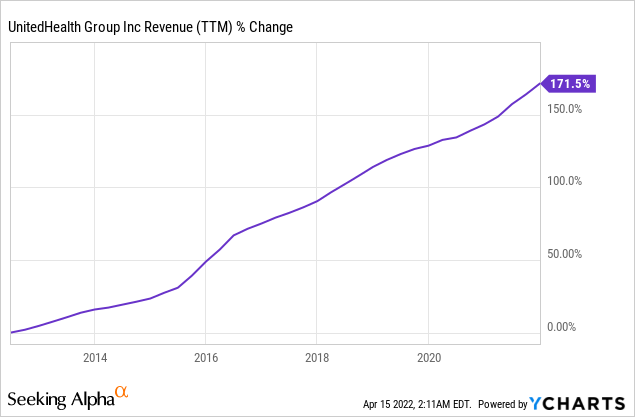

Sales over the last decade have almost tripled. What is even more impressive is how steadily sales have increased. Health insurance is a very basic necessity for most people; thus the company grows revenues steadily. The growth is both organically and through M&A and this trend is expected to continue in the foreseeable future. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects UnitedHealth to keep growing sales at an annual rate of ~9.5% in the medium term.

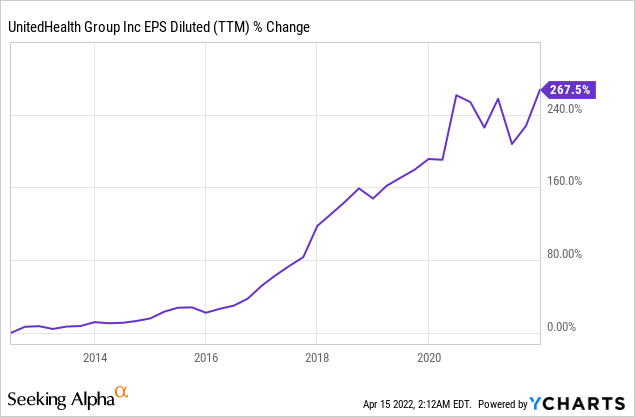

The EPS (earnings per share) has almost quadrupled over the last decade. The company struggled through the pandemic as it was not able to be as profitable as it was in the past. During the pandemic its medical loss ratio peaked, and today it stands at 84% when before the pandemic it was hovering around 70%. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects UnitedHealth to keep growing EPS at an annual rate of ~14% in the medium term. Analysts expects that the medical loss ratio will decrease in order to achieve better profitability as the EPS growth forecast is higher than the sales growth forecast.

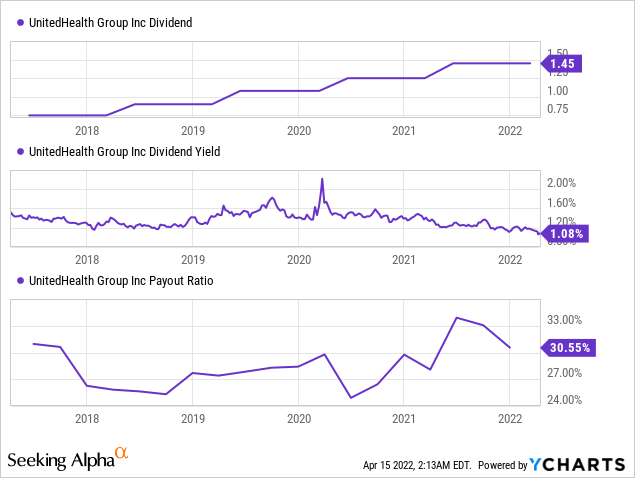

The company has paid a growing dividend since the financial crisis of 2008-9. Before these twelve years, the company has paid dividends without reducing them for more than twenty years. The dividend yield is not high at 1.1%, but it is extremely safe with a payout ratio of 30%. The company is expected to increase the dividend once more in June, and investors should expect a 10-12% increase which will be in line with the EPS growth.

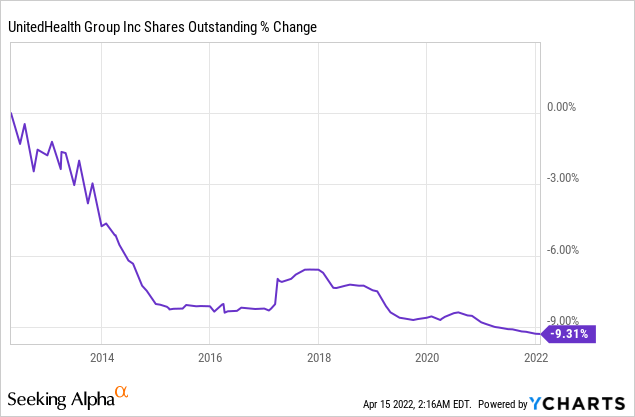

The number of shares outstanding has been decreasing over the past decade. Over the last 10 years, UnitedHealth bought more than 9% of its shares. In the past, the company has been buying shares more aggressively, yet even today it is gradually retiring shares. Buybacks to supplement dividends while the EPS is growing is always an advantage.

Valuation

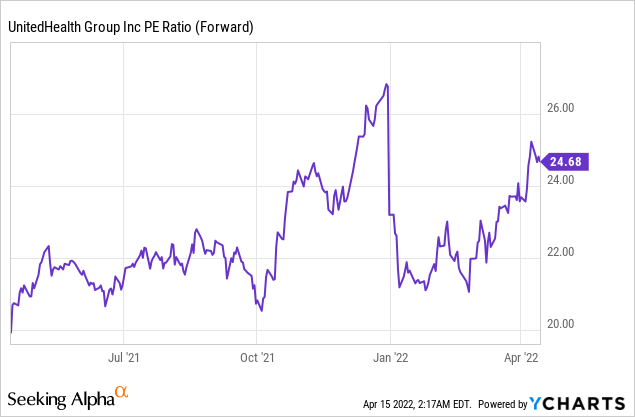

The P/E (price to earnings) ratio of UnitedHealth stands right now at 27 as the company’s price is close to its all-time high. This is almost the highest valuation for the company in the last twelve months. The current P/E ratio seems high as it trades for a higher valuation even when compared to big tech companies like Alphabet and Meta.

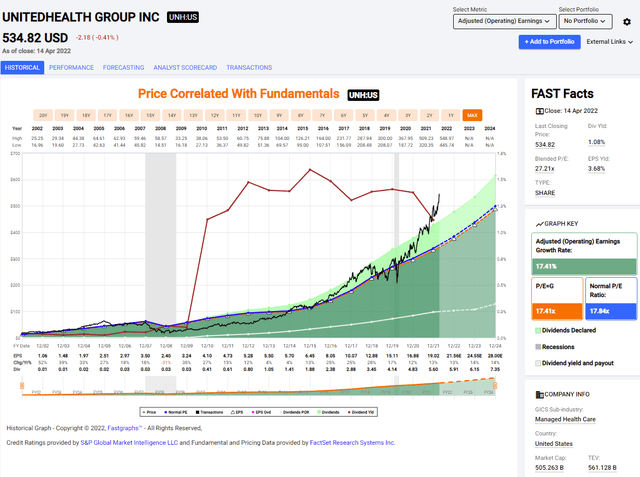

The graph from Fastgraphs.com emphasizes the idea that the company is trading for a premium. The blue line represents the average valuation, which equates to a P/E ratio of 18, and since the pandemic, we see detachment even though the company is expected to grow slower than it did over the last twenty years. The company will have to justify the current premium by executing very well.

To conclude, even with COVID still around UnitedHealth manages to keep growing. The company grows both sales and EPS, and it is fueling significant growth in dividends with some buybacks. The company is trading for a premium even when the forecasted growth rate is lower than the average growth in the past decade. Therefore, the company will have to execute well to maintain the premium.

Opportunities

There is a strong demand for health insurance in the United States. Healthcare is extremely expensive and with private insurance being the most prominent option, there is room to grow as there are still millions who are not insured. In addition, the company can also cross-sell additional services to its current clients and try to increase its market share.

Diversification is another significant opportunity. The company is not only an insurer. It also owns Optum Health which accounts for almost 50% of the revenues. Optum is a pharmacy benefit management so it helps UnitedHealth’s clients save money on drugs and other services. The company is enjoying significant growth in this service as the quote below shows.

Compared to a year ago, we are adding over 1 million more people to Optum Health, supporting 30% more patients in value-based relationships, providing over 20 million more prescriptions, and serving 1.5 million more people across our health benefit offerings.

(John Rex – Chief Financial Officer, Q1 Earnings)

COVID is slowly subsiding due to better treatments and the continuous development of vaccines. Therefore, it will help UnitedHealth improve its medical loss ratio which peaked at 84%. This improvement alone will have a positive effect on the company’s profitability in the short term as medical expenses get back to normal.

Risks

The regulation is a significant risk. While regulation can be both positive and negative, it is the uncertainty around it that can hurt stock performance. Almost every member of congress has an opinion about regulating healthcare. The company has to prepare for different scenarios with upsides and downsides, and political decisions may have a significant impact on the bottom line of insurers.

Competition and inflation are other risks. The healthcare sector is not extremely competitive as it is hard to penetrate the insurance market. However, in an inflationary environment, even the limited competition can be risky. The company will have to deal with increased labor costs and the increased cost of services by providers, and it may not be able to shift it all to its clients.

As an overall agenda, this is a time where UnitedHealth Group in all of its parts is going to be first and foremost, doing everything it can to protect the people who rely on us from the forces of inflation.

(Andrew Witty – Chief Executive Officer, Q1 Earnings)

The margin of safety when investing in a stock is crucial. It is especially important in volatile times like the ones we have right now. At the current valuation, the company has no margin of safety if it misses the expectations. Therefore, while the company is solid in the long term, it may not be a great investment in the short term if the guidance is lowered or the execution disappoints.

Conclusions

UnitedHealth is a great company. The company has very strong fundamentals and a long track record of increasing sales, EPS, and dividends. In addition, the company has expanded and has plenty of growth opportunities with relatively limited risks. However, the valuation and therefore the lack of margin of a safety risk, are making this investment not that appealing at the current price.

This is a scary situation for defensive companies like UnitedHealth. The company like consumer staples for example is a haven for investors seeking safety. However, when the volatility subsides, investors may seek risk again and the current valuation may not stay. I believe that investors should wait for a 10% for a P/E of 22, or add very slowly and gradually to their position.

Be the first to comment