courtneyk/E+ via Getty Images

Things done well and with a care, exempt themselves from fear. – William Shakespeare

In today’s report, I reflect on the market highlights and data of the first quarter. I’ll also offer a few thoughts on which trends will continue, which may slow, and what trends might strengthen. We turn the page and enter Q2. My plans in preparation for the next couple of months haven’t changed.

Here’s What Made You Money In Q1 … Will It Continue?

It’s hard to believe we are only a quarter of the way through 2022! So much has happened already and the year is just getting started. Investors watched risks rise sharply in the first quarter, and overall leadership in the quarter had a more cyclical tilt.

On a relative basis, this was the worst start to the year for Growth stocks in decades. Growth gave back the entire COVID P/E premium in just a few short months. It wasn’t just the HIGH PE stocks that were under pressure. Names like AAPL (-16%), MSFT (-21%), GOOG (-19%), etc. were all under pressure.

Now that we’ve seen the excesses wrung out of the growth names when it comes to “valuation” the playing field has leveled considerably. An investor now has to make decisions based on a view this anti-growth trend could start to at the very least moderate. Growth stocks tend to come back into favor as the narrative shifts from a focus on higher rates and higher inflation (i.e. Q1) to an awareness of slowing growth.

The stage might be set for “quality/profitable” growth companies to reassert themselves. After all, in a slow-growth environment do I want to own a company growing at 3%-5% which has rising input costs that they may not be able to pass on to consumers? OR do I want to own a company growing 15%-20+% that has much fewer input costs, innovating to keep costs down, and their services and products will assist others in keeping costs in check?

Of course, valuation does come into play as well as does investor sentiment. If a group is out of favor it may stay that way for a while. The question you have to ask is are you willing to wait? Are you dealing with short-term money (1 year) or investing with a 3-5 year or more time horizon?

We’ve seen more interest recently in the HIGH PE growth areas (ARKK) of the market as well, but how long that continues is anyone’s guess. Therefore their road back will a long and winding one. At times like these, we always see investors flock to the “defensive ” names because they want to feel “safe”.

The problem is when we take a good hard look at “valuation” many of those stocks are well above their historical norms. Should a SLOW growth utility company trade at a multiple that is HIGHER than the average stock in the S&P? That is a function of sentiment driving momentum, but over the long haul (I’m not talking about 20-30 years) they too will come back to reality. All of these crosscurrents make this such a tricky environment now. If an investor doesn’t KNOW themselves and doesn’t know their strategy, they are going to be under a lot of pressure in the coming months.

In 2021, I made adjustments to add cyclical and value exposure, and that has worked out very well. BUT there was a reason not to divest portfolios of the growth names, simply because “quality” will always rise to the top.

Taking a look at Q2, we could start to see the recent HOT momentum sectors (Energy, etc.) start to cool off. I don’t think I’m going out on a limb by saying that since at some point ALL HOT trends cool off. However, cooling off doesn’t mean ending and reversing. The energy trade was up 37%, commodities +25% in Q1, so what I’m trying to say is we shouldn’t expect that type of performance in Q2. We have to be aware that some or all commodity prices may have peaked for now, BUT that doesn’t mean a price crash is coming. When looking at these sectors, my advice lately has been to be more inclined to invest in dividend names. If the trend slows you will be get paid to stay on board, and with inflation at these levels, I still believe it’s prudent to remain in these trends.

Slowdown Yes, Recession No

Despite the energy and interest rate headwinds taking economic growth down my “Recession Risk” probability model does not see a downturn in 2022. However, the recent price action in the Financials, Transports, Semiconductors and Small Caps all give me pause. All are signaling a slowdown in the economy and unless we see better price action to reverse these signals the recession forecast may have to be adjusted. On top of that, exogenous shocks (e.g., Covid, Ukraine) remain unforecastable.

- Healthy consumers/corporations, friendly banks, and lots of slack are at the moment offsetting the energy/rate headwinds dominating headlines.

- How long that solid eco backdrop remains will determine if Fed tightening could tip the U.S into recession.

We didn’t get downturns when they tightened in 1984 & 1994, (the last secular BULL market) for example. But we did see mid-cycle slowdowns, which translated into growth scares for the market. At the moment this market is in the midst of a GROWTH scare, but this growth scare has real teeth.

- Low corporate debt costs, and easy lending standards, also reinforce a no recession scene in the near term.

There is another “wild card” that will be difficult to forecast the severity of implications on the economy. Consumer confidence is at lows, and it’s something we’ll have to watch very closely.

Consumer Trends

With inflation remaining stubbornly high my view on the consumer and the prevailing trends has not changed. Consumers continue to shift activity to Covid recovery sectors from Covid benefited ones – broadly paying for more services and fewer goods. While the data suggests that trend is in place many of the stocks that should be beneficiaries have gone nowhere. As a sector consumer Discretionary was the second-worst performer in Q1. Here is a trend that could reverse and pick up momentum as the next earnings season unfolds.

Inflation amounts to a terrible form of “tax” on the lower to the middle-income consumer. Food at home for households in the lowest income quintile accounts for about 11% of overall spending (versus about 7% for the highest quintile). By contrast, expenditures on gasoline represent 2%-3% of spending across the board.

Lower-end consumers are getting squeezed, as is clear in the Daily Consumer Confidence Survey. Stimulus is long gone, and inflation has taken away their real savings cushion. High-end merchandise is outperforming the lower-end. Low-end apparel stores are getting hurt by weak demand/foot traffic, as their customers suffer the most from high food & gas prices. “Foot traffic” – in the high-end apparel retailers are outperforming.

While the “overall” view on the consumer has plenty of questions marks, we should start to get some answers with this upcoming earnings season. After the COVID episode that has lasted 2+ years, there are plenty of consumers that are going to dine out, travel, and spend on services for themselves. Carnival Cruise Lines (CCL) just reported the busiest booking week in its history showing a double-digit increase from the previous record.

Speaking of earnings reports, Delta Airlines recently stated; “With a strong rebound in demand as omicron faded, we returned to profitability in March, and the company is expecting “strong free cash flow in the June quarter.”

A Consumer “Shift”

As the data published by Mastercard recently shows, total consumer spending in March at retail (ex-auto) was +18.0% vs. 2019, slightly higher than February, and down from a bit of what appears to be a post-holiday/Omicron spending binge in January. Spending at stores and restaurants rose to a new record in March. I doubt this level of spending growth is sustainable in the long term, but it does highlight the spending power of the consumer despite substantial investor fears following commodity spikes in late February/early March.

However, investors have not seen it that way as they jettisoned the Transport group recently with fears of lower demand everywhere, especially for freight transport. While that fits with the theory that consumers will be shifting their purchasing dollars away from GOODS, it may well be overdone. The consumer is NOT leaving the purchasing scene entirely.

Bottom Line – While we have “issues” to deal with, I can’t stress this observation enough. A consumer under stress is NOT a consumer that is rapidly increasing discretionary purchases like restaurants, airlines, and lodging. This is a consumer that is “normalizing” and moving back “trend line” services expenditures and away from goods. Without proactive/pro-business policies, the question is how long does this last?

At the very least upper-middle and high-end consumers are going to lead the way. That supports the idea that “select” consumer discretionary stocks could stage a big rebound in Q2.

A Confusing Backdrop

I realize there are certain aspects of the Conference Board’s index of Consumer Confidence that continue to send confusing signals. For starters, in the history of the survey, US consumers have never had a more positive outlook on the jobs market as the Jobs Plentiful index rose to its highest level on record.

While sentiment towards jobs is so positive, consumer expectations about the future are incredibly pessimistic with that reading at its lowest level since February 2014. This index experienced a brief uptick early in 2021, but it has quickly reversed over the last 12 months. The fact that sentiment toward the jobs market is so strong while expectations are so weak is very uncommon. But for now, the fact that people are employed and are seeing wage growth with plenty of opportunities around dominates the present mindset.

In summary, the fundamental backdrop in the near term is riddled with “issues”. What makes this growth scare so different – is these issues are REAL, they aren’t going away overnight and the MACRO scene will be impacted. That is a NEW wrinkle that investors have not had to deal with for most of this BULL market. It’s part of the “New Era” the equity market has transitioned to.

This is why the TECHNICAL picture MUST be respected and for the most part, it also has to drive investment decisions. Similar to other growth scare periods (2015-2016) good stocks that won’t be affected nearly as much are also being tossed away. This is where the opportunity lies, as I await Q1’s earnings results before making any major changes to strategy.

The Week On Wall Street

The shortened trading week started with another case of the “Mondays” for U.S. stocks as the major averages traded in negative territory all day with the Nasdaq leading the way lower. Along with equities, just about every other risk asset moved lower, including Bitcoin and crude oil. Bonds went down again as well, while yields continue to surge in what has been one of the most relentless moves higher in yields that the market has seen in years.

Given the widening lockdowns in China (23 cities) and concerns of a broader economic slowdown, oil prices came under pressure continuing a trend of weakness from last week. WTI traded below $94 per barrel and flirted with support levels. The only positive, was the Dow Transports stopped going down, and bucked the trend with a small gain for the day.

The drop in crude oil prices was short-lived as prices rebounded back above $100/barrel. Not so for the major indices, however, as the S&P 500 (-2%), DJIA, and NASDAQ (-2.6%) all lost ground in the shortened trading week.

The Economy

Retail sales rose 0.5% in March and increased 1.1% excluding autos. Those follow respective gains of 0.8% and 0.6% in February and January. Most of the sales categories increased. As expected there was a pop in gas station sales, climbing 8.9% after the 6.7% surge previously. General merchandise sales bounced 5.4% after February’s 0.2% dip. Electronics sales jumped 3.3%. Sporting goods sales were up 3.3% as well. Clothing rose 2.6%.

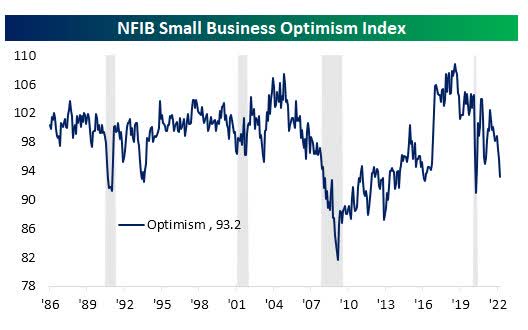

Sentiment on the part of small businesses deteriorated further in March as the NFIB’s Small Business Optimism Index dropped 2.5 points to 93.2. That took out the January 2021 level as the weakest point for the index since the start of the pandemic in the spring of 2020.

NFIB Report (www.nfib.com/surveys/small-business-economic-trends/)

Expectations for the economy to improve and expectations for higher real sales came in at or close to record lows. Behind inflation, cost and quality of labor are the next biggest issues with a combined 30% of businesses reporting those as their biggest problems. Government-related issues were the next most frequently reported major concern.

The preliminary Michigan sentiment report saw a bounce to 65.7 that ended three consecutive declines to 11-year lows. Despite the April rise, Michigan sentiment remains well below the early pandemic bottom of 71.8 in April of 2020.

Consumer and Small Business “sentiment” continues to be a problem that can eventually impact the MACRO scene.

INFLATION

CPI climbed 1.2% in March, but the core rate rose only 0.3% following gains of 0.8% and 0.5%, respectively in February. The former is a little hotter than expected, with the latter a little softer. Those prints brought the 12-month headline up to 8.5% y/y versus 7.9% previously, the fastest rate since December 1981. The ex-food and energy component rose to 6.5% y/y versus 6.4%, not seen since August 1982.

The guts of the reports showed gains in nearly every component and in big ways. Energy prices surged 11.0% on the month versus 3.5% previously and are up 32.0% y/y versus 25.6% y/y. Gasoline jumped 18.3% from 6.6% and is at a 48.0% y/y. Services prices increased 0.7% from 0.5%. Housing costs increased 0.7% as well, from 0.5%, with owners’ equivalent rent up another 0.4%, continuing the string of like-sized gains since September. Food/beverages climbed 1.0%, as it did in February. Transportation prices rose 3.9% with new vehicle prices edging up 0.2%, while used prices fell by 3.8%. Real average hourly earnings posted a 2.7% drop versus 2.5% previously.

NOT a BIG surprise and the Stock Market is for the moment interpreting this as the “peak”. I can go along with the “peak” theory for now BUT the sticky part that I expect will keep inflation higher than normal for an extended period is ENERGY costs. My conclusion is based on the simple fact that there are no proposals or aggressive actions initiated to bring those costs down.

Investors received “part two” of the inflation data this week as well with the PPI report that included a 1.9% PPI surge. That left a climb in the y/y gauge to a 47-year high of 15.2% which marks the largest increase dating back to a 15.9% rise in January of 1975. Back then it was the OPEC oil embargo.

This time around our energy woes are more of the self-inflicted variety, and at the very least the investing public can use the profits from owning energy companies to pay for their higher energy costs.

MANUFACTURING

The Empire State manufacturing index bounced a hefty 36.4 points to 24.6 in April, more than reversing the 14.9 point drop to -11.8 in March. This is the strongest since December’s 31.9. The all-important Prices paid also increased to 86.4 from 73.8.

The Global Scene

CHINA

China port congestion due to COVID restrictions is leaving cargo stranded at their ports. Many areas around Shanghai Port have been effectively under lockdown.

Judah Levine, head of research at Freightos:

Even with the world’s largest port open, the closure of many warehouses, the drop in manufacturing, and the serious disruption to trucking in, out and within the city are expected to cause a significant drop in the availability of goods and port output.”

POLITICAL SCENE

Conversations among Democrats remain ongoing on a potential 2022 reconciliation bill following signals from Senator Joe Manchin that he is open to returning to the negotiating table on a bill targeting taxes, prescription drug policy, and climate/energy investments. This has focused markets on potential tax changes for 2022, picking up on where the Build Back Better bill left off. Supporting increased attention on the 2022 tax agenda is President Biden’s recently proposed FY2023 budget which heavily leans on changes to individual and corporate taxes to fund policies and reduce the federal deficit.

Prospects for a new reconciliation bill remain mixed, with conflicting political objectives among key Democratic lawmakers and a tight window to pass a bill before the focus shifts to midterm elections later this year. We may continue to see tailwinds behind some of these talks driven by energy disruptions and a desire among Democrats to advance political narratives on policy ahead of the midterm elections.

It would appear significant tax changes, such as rate increases and new surtaxes, are probably unlikely in an election year. While the proposals are on the table, as more time goes by they become more unlikely to be enacted. In light of the economic situation that the country is facing today any increase in taxes would mean a total reassessment of the outlook for the economy and equities.

This Tax and Spend “MACRO” issue continues to be an overhang on confidence and the markets in general.

EARNINGS

The Big Banks kicked off the unofficial start of the 1Q22 earnings season this week. Investors are questioning whether the S&P 500 can continue its above-average winning streak of gains. As we distance ourselves from the pandemic, the time of easy comparisons is over as the earnings environment is transitioning to a more normal environment this year.

But even as metrics moderate, even a beat rate of ~5%, which would be in line with the historical average, and could help the earnings growth forecast of 5.2% stretch into double digits. A better-than-expected earnings season could allow corporate fundamentals to overshadow the macro headlines (e.g., inflation, Fed tightening) and help the equity market regain its positive momentum. We’ve heard analysts shout this before but in my view, this time around – Forward guidance will be critical.

Given that the worst of the Omicron surge and Russia’s invasion of Ukraine (and the related commodity prices surges) happened in the first quarter, companies may blame disappointing results on these “curveballs.” But longer-term, insights into expected sales growth, margins, supply chains, capital expenditures, hiring, and more could confirm the expectation of robust corporate earnings growth will “step up to the plate” and keep stock prices resilient.

JPMorgan (JPM) kicked off earnings season on Wednesday:

“We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine. – Jamie Dimon

That’s a good assessment of the economic situation and why the market is still struggling as it re-prices this new era outlook. An issue that has been highlighted for this entire year.

FOOD FOR THOUGHT

Spending

Despite the HOT inflationary backdrop, we’ve seen more efforts to INCREASE government spending. That is more than ever deemed as “popular” with the voting public. After all who doesn’t want a handout. Reducing spending is seen as political suicide (especially in an election year), so the proposals to spend remain a priority. In my view, that is financial suicide for the economy, that takes the stock market, and investors in the stock market and turns them into victims as well.

The dots are being connected and the jigsaw puzzle is slowly being completed. The resulting picture is slowly taking shape and it appears to have an ominous cloud on the horizon.

There is no change in the anti-business climate as some believe inflation is all about greedy corporations. It’s also good to know that other opinions state the Facts. What investors are hearing is quite disturbing. In a capitalist society, the strength of Corporate America drives economic prosperity for all that wish to partake. Corporate Greed isn’t responsible for anything BUT what was just stated.

Handcuff corporations and you handcuff the U.S. economy. The stock market will continue to trend to the downside. Attack and destroy the “wealth effect” and you’ve opened up a door that is going to reveal some nasty surprises.

Sentiment

Sometimes we look at an indicator and just say, “Whoa”. That was MY reaction when I saw the latest sentiment survey from the American Association of Individual Investors (AAII). After dropping to an already depressed level of 24.7% last week, this week’s reading plummeted to 15.8%. To find a lower reading you have to go back 30 YEARS. The last time there were fewer bullish investors in the AAII survey was in September 1992. While 1992 through 1994 (a sideways period in the last Secular BULL market) wasn’t the best period for the stock market, it certainly wasn’t the end of the road either.

The Daily chart of the S&P 500 (SPY)

Churn, Churn, Churn. Up, Down then Up and down again all with a bias to the downside. The directionless S&P 500 continues to send a confusing picture.

S&P 4-14 (www.FreeStockCharts.com)

It’s been the same way for a while now. The index remains volatile in a very wide trading range that is being carved out. That also means the next big move for the market will depend on what breaks first, support or resistance.

INVESTMENT BACKDROP

DEFENSIVES OUTPERFORMING LATELY

Relative strength has come from the more defensive sectors lately- Consumer Staples, Utilities, Real Estate, and Health Care. This leadership is not ideal and provides caution technically beneath the surface- supporting an overall view of likely choppy markets continuing in the shorter term.

RISK-ON LEADERSHIP LAGGING

Along the same lines, the more risk-on areas have seen some technical deterioration lately. For example, relative strength for High Beta vs Low Volatility, Semiconductors, equal-weight Consumer Discretionary, and Transports are moving lower. Once again, this is not an ideal leadership backdrop beneath the surface supporting a view that market choppiness will continue.

The “Four Canaries” that were highlighted last week, Financials, Semiconductors, Small caps, and Transports all were able to take a deep breath this week and eliminate some of the recent dizziness that had heads spinning. However, all remain on “HIGH alert” status, and are far away from issuing an “all clear”.

The 2022 Playbook Is Open For Business

Thank you for reading this analysis. If you enjoyed this article so far, this next section provides a quick taste of what members of my marketplace service receive in DAILY updates. If you find these weekly articles useful, you may want to join a community of SAVVY Investors that have discovered “how the market works”.

BIFURCATED MARKET

The backdrop hasn’t changed much recently. What is “working” continues to “work” and what isn’t continues to frustrate. In the near term, I see no reason to step out and try to be a hero by bottom fishing in the “hope” of catching a winner.

TRANSPORTS

This group was decimated over “fears” that the shipping of “goods” is slowing to a crawl.

This week Delta Air Lines (DAL) did toss some cold water on the “consumer” end of the transport sector as their EPS guidance and forecast couldn’t be more upbeat.

“March bookings were the highest in the company’s history”.

There are some “babies” in this group that have been tossed out with the bathwater. BUT in this schizophrenic market, my strategy dictates that I wait to hear what each company discloses before adding to this group.

The Dow Transports rallied and did HOLD the long-term trendline that was being tested last week, and that is a positive development.

SMALL CAPS

While The Russell 2000 index (IWM) held its own this week, the breathing remains quite shallow as the index remains below the long-term Bullish trend line. It also is below all of the short-term trend lines which are acting as resistance. However, so far in April the index has put in a higher low than March which posted a higher low than February. That price action is something to build on.

SECTORS

CONSUMER DISCRETIONARY

The Sector ETF (XLY) has given back 2.2% of its 4.2% March gain so far in April and remains in a BULLISH configuration. I continue to like “select” opportunities in the dining and leisure space within this group. The consumer looks like they are “hell-bent” on having a good time in the next few months. How long that lasts depends on how the inflation scene plays out. For that reason, my “plays” in this sector are ALL short-term oriented. That follows along with what Mr. Dimon (J.P. Morgan) reported during his conference call.

“Optimistic on the consumer in the short term , BUT ……”

COMMUNICATIONS SERVICES

AT&T (T) announced the long-awaited spinoff of Warner Brothers Discovery. The “new” T shares yield 5.7%. I still expect some disruptions as smaller investors adjust to the new dividend policy and the spinning out of shares in their accounts, BUT I envision institutional interest rising as the complexity has diminished and the uncertainty around the timing and structure of the deal has been eliminated. Due to the above-average yield, Low PE, and a chance for price appreciation, T represents a low beta income selection that fits very well in this uncertain market.

ENERGY

WTI dipped back to support just under $95 and as quickly as it dropped it rebounded sharply to close the week at $102. As I’ve stated this winning “trade” may pause from time to time but it isn’t about to be reversed anytime soon. I continue to add to an overweight position on dips in energy names that offer a BASE + Variable Dividend based on their Free Cash Flow. This sector continues to “work”.

Washington is trying to win the public relations battle concerning pain at the pump by blaming “greedy” oil companies and making it look like they’re doing something to help provide relief (releasing the strategic petroleum reserve, waiving the Federal rule on higher ethanol blends, etc.), but unless the underlying issue is addressed – not enough supply to meet demand – Energy costs will remain a problem for a while.

The Oil and Gas Exploration ETF (XOP) hit more new highs on Wednesday and Thursday. The Energy ETF (XLE) and the Oil Services ETF (OIH) have followed along. For one reason or another (perhaps an anti-fossil fuel bias), I still don’t believe most people are taking these moves serious enough. There exists the potential for these groups to go much higher.

I’ve been in this “trade” since February 2021 and I see no reason to leave this trend today.

FINANCIALS

A sector where sentiment is waning. The Financial ETF (XLF) is down to the lower end of the trading range again. The “Main Street” Regional Banks I follow are managing to hold support. Stocks like Goldman Sachs (GS) which reported stellar earnings are getting dragged down by the “Wall Street” banks and their issues. Since GS doesn’t have those same issues it presents an opportunity. GS now trades at 1.1x book value.

COMMODITIES

This sector along with Energy continues to “work” in this economic backdrop. Base metals, Precious metals, Rare Earths, and Agriculture stocks are all having their day in the sun. The AG complex made new highs this week. Mosaic (MOS) (+90%), Nutrien (NTR) (+50%), and the Agribusiness ETF (MOO) (+12%) are all up significantly this year and they have helped the SAVVY portfolio and SAVVY investors ride out this uncertain market. These kinds of gains will make up for plenty of the CORE underperformers that are in every portfolio.

I added more “lithium” exposure to the portfolio this week, and I’m looking at adding more Rare Earth exposure next week.

HEALTHCARE

I’ve been recommending investors stay engaged in the Healthcare (XLV) group for a while and I remain bullish on the sector today. After making a new all-time high last week, a slight pullback ensued but the short, intermediate, and long-term trends are all positive. In an uncertain economy, I remain with an “overweight” rating for the sector. This is a group where I don’t mind adding new positions when I find a good candidate.

BIOTECH

This Sector ETF (XBI) continues to give me headaches. The long-term downtrend for the ETF was broken in March and it appeared a rally was in order. That call was premature as the group has instead moved into a sideways pattern after a mini 7% rally that has given back all of that quick gain. So the price action is dictating that I remain patient and slowly accumulate select stocks for what I believe will be a solid rebound for the sector.

TECHNOLOGY

I don’t want to blame all the woes of this group on the “algos”, but there is a strong correlation today between the direction of the 10-year treasury, and the Tech sector (XLK). The 10-year Treasury rises and the “algos” SELL tech, the 10-year falls and the “algos” BUY tech. Investors then act like ‘lemmings’ following the same strategy not realizing that Growth won’t be dead in a slowing economy. It will be in demand. The NASDAQ, NASDAQ 100, and related technology ETFs all present the poorest technical picture in the market today. This “canary” needs to see a change in this backdrop and it needs to see that occur quickly.

Cybersecurity

A couple of weeks ago, I highlighted this sub-sector of technology as a “Theme with tailwinds”. This is a group that isn’t on life support. Cybersecurity has a thriving market and is in demand now with growth potential. Cyber attacks are only likely to become an even greater threat used by terrorists, criminals, and sovereign powers.

The Global Cybersecurity ETF (BUG) is grinding higher (up 4.5% since recommendation) despite a weak market backdrop, and now has the appearance of a potential breakout. A nice way to play the group without the single stock risk.

Semiconductors

This “canary” is looking frail. The Semiconductor index SOXX) went lower for the 3rd straight week. Much of the weakness is all about sentiment toward the group. Taiwan Semiconductor (TSM) beats EPS estimates, raises guidance and the stock sells off. That’s all an investor has to know about sentiment in this frustrating backdrop. This sub-sector falls into the “what isn’t working” category. They may not be in vogue today, but semiconductor companies that are beating estimates and offering a rosy view, need to be accumulated to build a diversified portfolio.

CRYPTOCURRENCY

A risk-off mindset is pervasive now and it’s showing up in the price action of Bitcoin. The week started on a sour note with BTC dropping below support and trading in the 38-40K range.

From a strictly technical perspective, Bitcoin isn’t trading well right now as the benchmark crypto asset has followed a similar playbook to stocks since late 2021: a major downtrend, a failure to make new highs on the rebound (and indeed, an outright rejection at resistance), and now another trip below the support.

Bitcoin 4/12 (www.bespokepremium.com)

A sloppy technical pattern that is similar to the equity market, directionless.

FINAL THOUGHT

Lately, I hear the same rhetoric from some analysts and economists. They are “hoping” inflation has peaked, and they “hope” the Fed won’t have to raise interest rates too much. Plenty of investors find themselves “hoping” the U.S. can avoid a recession. They “hope” that somehow, someway, energy policy will be changed to bring down the cost of what is driving inflation; Energy costs. Then there is the army of market participants that “hope” the spending and tax proposals come to an end. They also are “hoping” the equity market trends that haven’t worked for months in today’s market, somehow change so they can recover massive losses.

If you find yourself in this category of analysts and investors, as the title of the article states, you don’t have a strategy. You might want to start looking around at the facts regarding inflation, energy policy, political malfeasance, et al. They are REAL, not imagined, and those that continue to bury their head in the sand because of their “BIAS” are going to find themselves in quicksand.

Best of Luck to Everyone! Enjoy the HOLIDAY Weekend!

“Our prayers and thoughts should be focused on the plight of the Ukrainian people who are under unimaginable stress.”

POSTSCRIPT

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client’s situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Be the first to comment