metamorworks/iStock via Getty Images

“We can easily forgive a child who is afraid of the dark; the real tragedy of life is when men are afraid of the light.”― Plato

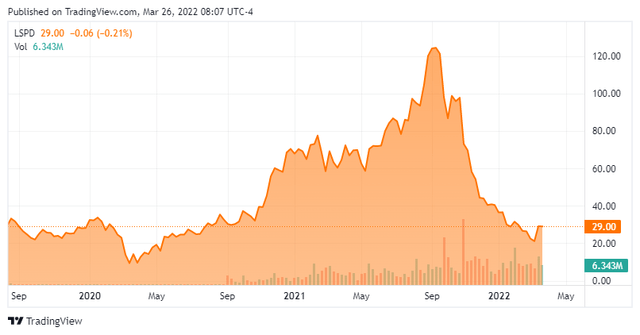

Today, we can put another SaaS stock in the spotlight called Lightspeed Commerce (NYSE:LSPD). Like most of the sector in recent months, the shares have been taken out behind the woodshed and beaten like a rented mule. Is the sell-off overdone? We attempt to answer that question via the analysis below.

LSPD – Stock Chart (Seeking Alpha)

Company Overview:

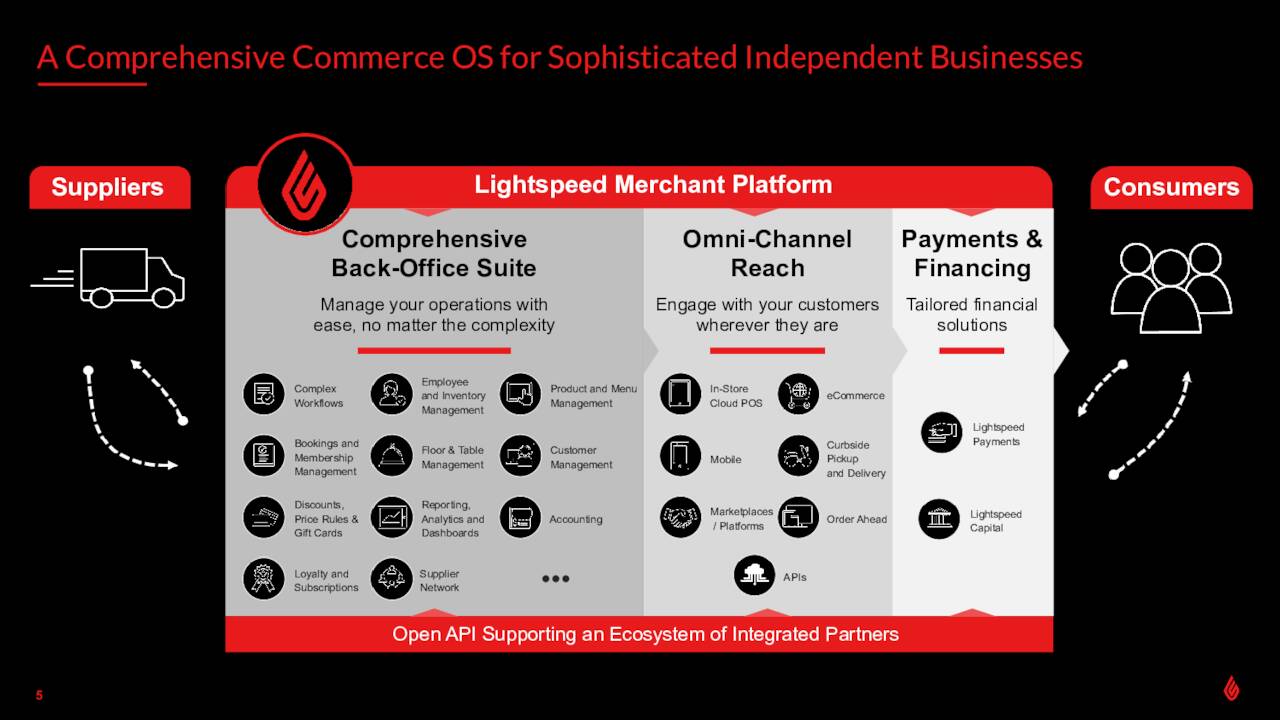

Lightspeed Commerce is based in Montreal. Its services allow its clients to engage with their consumers, manage their operations and accept payments among numerous capabilities through the company’s SaaS platform and offerings.

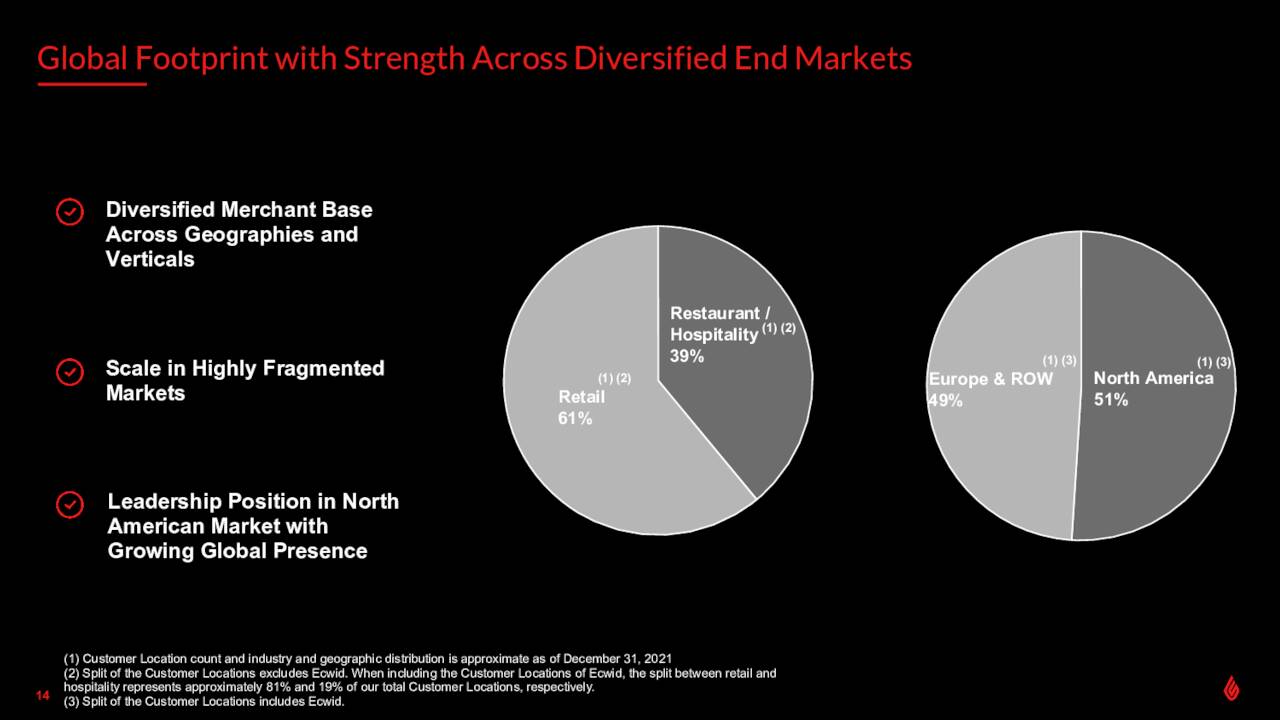

LSPD – Revenue Breakdown (February Company Presentation)

The company’s main customers are in the retail, restaurant and hospitality industries. Business is split pretty evenly, revenue wise, between North America and overseas. Lightspeed’s systems allow merchants to automate their ordering process and consolidate their supplier portals among other capabilities. The stock currently trades around $29.00 a share and sports an approximate market capitalization of $4.5 billion.

LSPD – Platform (February Company Presentation)

Third Quarter Results:

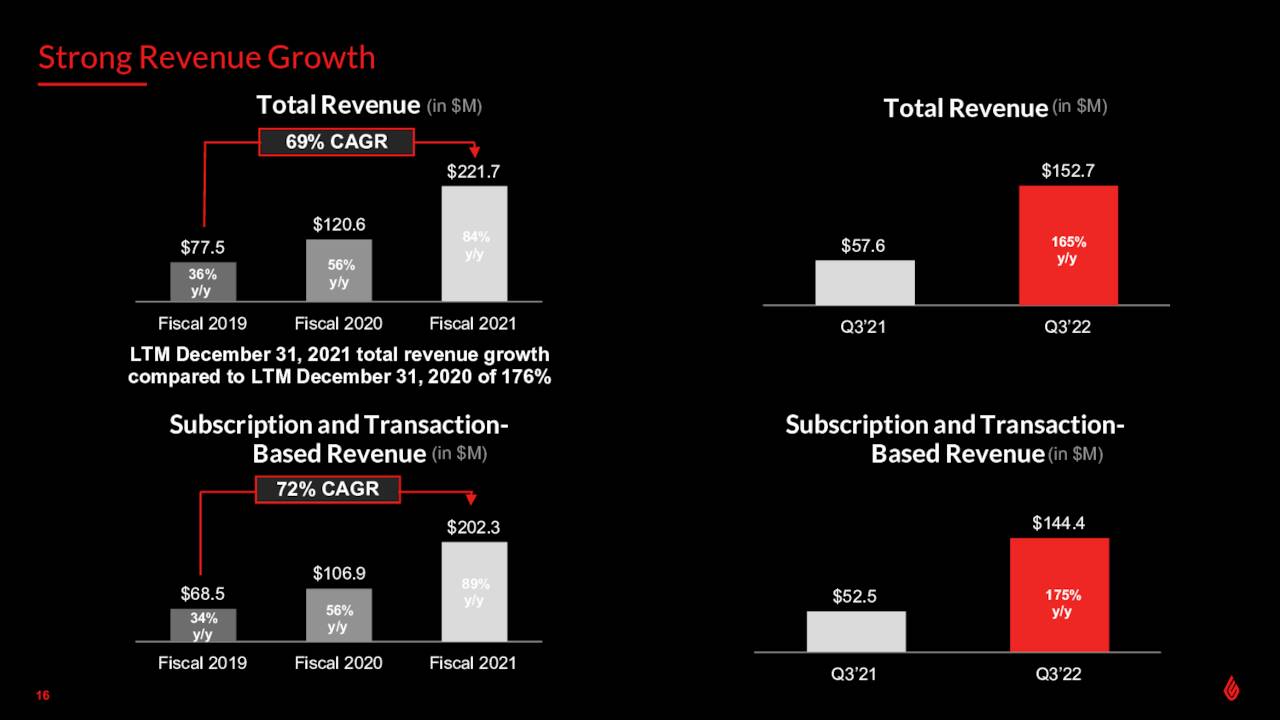

On February 2nd, the company reported third quarter numbers. On a non-GAAP basis, the company lost seven cents a share, in line with analysts expectations. Revenue rose 165% to over $152 million, which nicely beat the consensus estimate. Subscription revenue rose 123% on a year-over-year basis to $68.6 while transaction based revenue soared nearly 250% to $75.8 million.

LSPD – Third Quarter Highlights (February Company Presentation)

Management also slightly upped full year revenue guidance to $540-$544 million which was an increase from its previous outlook of $520-$535 million. Adjusted EBITDA for the year is expected to be a negative $45 million, at the top of previous guidance.

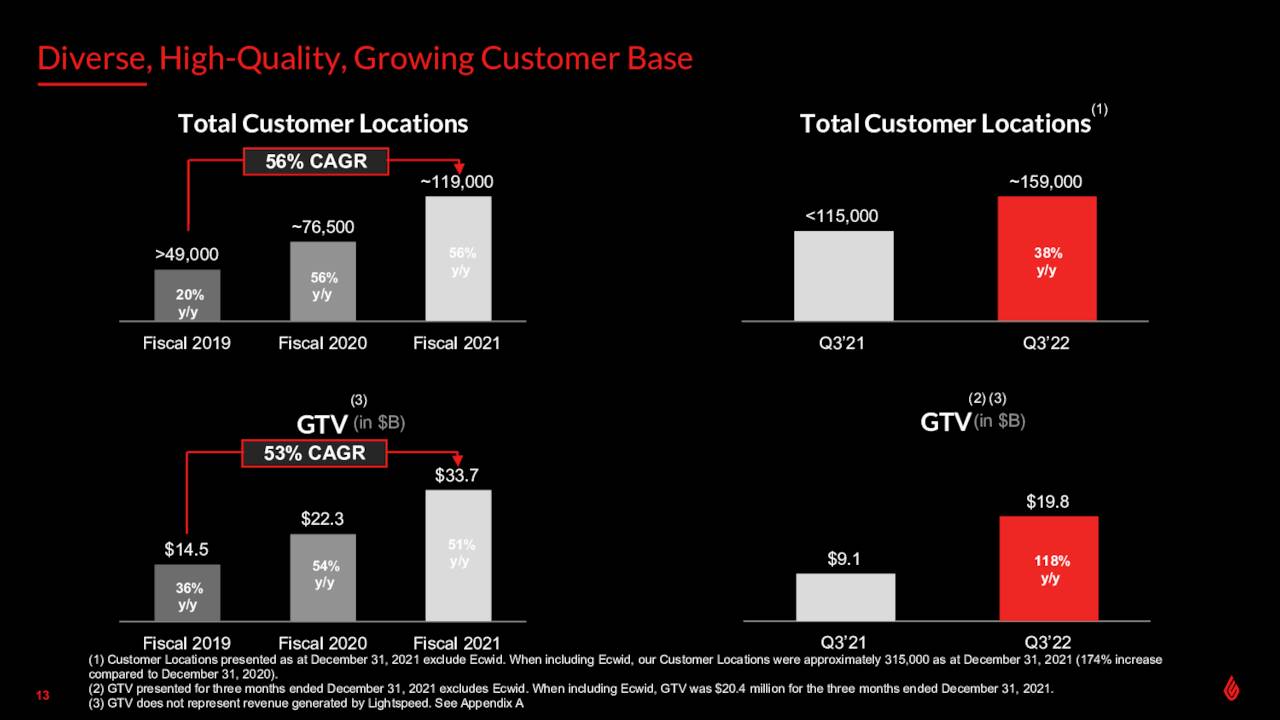

LSPD – Customer Base (February Company Presentation)

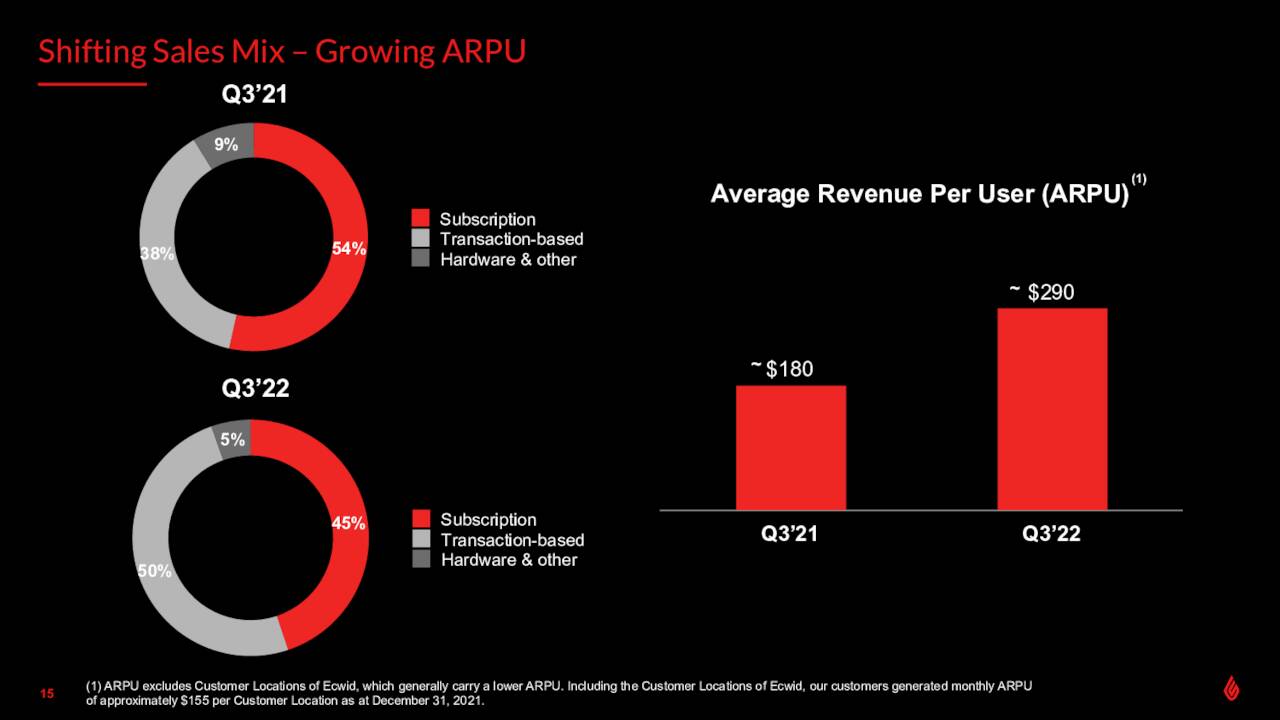

The company appears to done a good job growing both its client list as well the average revenue per user or ARPU.

LSPD – Sales Mix (February Company Presentation)

Analyst Commentary & Balance Sheet:

The analyst community is somewhat mixed on Lightspeed Commerce in 2022. So far this year, three analyst firms including JPMorgan have issued Hold or Neutral ratings while ten including Raymond James and BMO Capital have reiterated Buy ratings, albeit with most containing significant downward price target revisions issued after the company’s latest quarterly results. Price targets now proffered by the ‘optimists‘ range from $40 to $70 a share.

At the end of 2022, which is the end of Lightspeed’s FY2022 third quarter, the company had ~$1 billion in unrestricted cash and cash equivalents on its balance sheet.

Verdict:

A recent article on Seeking Alpha noted that a good portion of the company’s recent revenue growth has come from ‘bolt-on’ acquisitions even as ‘organic’ growth has slowed. These purchases have also significantly increased Lightspeed’s share count. The company recently completed the acquisition of Ecwid which contributed in the following ways to third quarter results.

|

Q3 Summary |

Lightspeed |

Ecwid |

Consolidated |

|||

|

Total revenue ($M) |

$ |

144.9 |

$ |

7.8 |

$ |

152.7 |

|

GTV ($B)[2] |

$ |

19.8 |

$ |

0.6 |

$ |

20.4 |

|

Customer Locations[2] |

~159,000 |

~156,000 |

~315,000 |

|||

|

ARPU [2] |

$ |

290 |

$ |

16 |

$ |

155 |

Subscription and transaction-based revenue grew 175% year-over-year to $144.4 million in the third quarter. A good portion of this was from acquisitions like Ecwid, as well as recent purchases of NuORDER and Vend. Organic growth was 74% which is less than half the top line growth number even if it is still impressive.

Even with the recent huge decline of the stock, the shares are not cheap. LSPD fetches approximately 8.3 times FY2022 revenues, 6.5 times if you want to take cash on the balance sheet into consideration. Given that profitability still seems significantly out in the future, I am passing on any investment recommendation around Lightspeed Commerce at this time. I do have a very small ‘watch item‘ holding in another concern in this SaaS sub-sector called Toast (TOST). Its stock is selling at four times revenues taking cash into consideration and the company is solely focused on the restaurant industry. I posted an article on that name recently.

“Moonlight drowns out all but the brightest stars.”― J.R.R. Tolkien

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment