Tim Boyle

Background

Topgolf Callaway Brands Corp. (NYSE:MODG) is a well-known company in the golf industry. The company’s products include golf clubs, golf balls, golf, and lifestyle apparel, and other accessories. You can find MODG’s products in approximately 120 countries worldwide. The company sells its products through golf retailers, sporting goods retailers, online retailers, mass merchants, department stores, third-party distributors, and mail-order companies. MODG was founded in 1982 and now employs over 24,000 people and is headquartered in Carlsbad, California.

MODG is a result of Callaway Golf purchasing Topgolf Entertainment in 2021, and in September 2022, the company changed its name to Topgolf Callaway Brands Corp. The company organizes itself into three segments: Topgolf, Golf Equipment, and Apparel/Gear. First, of course, the Topgolf segment operates Topgolf venues which are fun driving ranges that use technology-enabled hitting bays which use Toptracer ball-flight tracking technology. Topgolf venues also have multiple bars, dining areas, and event spaces.

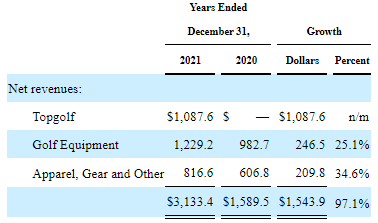

The Golf Equipment segment makes money by selling drivers, fairway woods, irons, wedges, putters, and complete sets through the Callaway and Odyssey brands. In addition, this segment also sells Callaway and Strata golf balls. The Apparel, Gear, and Other segment offers its customers golf shirts, golf pants, golf shoes, golf bags, gloves, hats, and other accessories, including sunglasses, socks, and even underwear. These products fall under the Callaway or TravisMathew brands. The table below shows a breakdown of revenue by segment.

MODG 10-K 2/10/2022

Growth Drivers

Of MODG’s three operating segments, the segment with the most growth potential is Topgolf. Calloway Golf acquired Topgolf in March 2021 so we are still in the early days of this new combined company, but Topgolf is already the company’s largest segment by revenue. In the latest 10Q, management expects Topgolf to account for more than half of MODG’s EBITDA by 2025. The main growth engine for the Topgolf segment will be opening new venues. 2022 has been a banner year for Topgolf, as 11 new venues are scheduled to open by the close of Q4, representing the newest venue openings in the company’s history. In the company’s most recent conference call, management had this to say about all the new venue openings,

Eight of the owned and operated venues will open in the second half of this year, an impressive accomplishment, but also one that will lead to lower operating margins in the second half, mostly in Q4 due to the pre-opening expenses associated with these openings. Our pipeline for future venues remain strong and is developing according to plan.

With more than half of new venue openings occurring in the year’s second half and a strong pipeline for future venue openings, this indicates that Topgolf is growing at an increasingly faster rate. As of September 30, 2022, Topgolf had 72 company-operated venues in the US, with 12 more venues under construction. In addition, there are three more company-operated venues in the UK, with one more location under construction. There are also five franchised venues in Australia, Mexico, UAE, Thailand, and Germany, with one more franchised location under development in China.

Another growth driver from the Topgolf segment is its licensing business. Topgolf licenses its Toptracer technology to independent driving ranges and franchised venues outside the US. Toptracer is an advanced practice tool for golfers. It provides players with valuable and engaging data that helps them improve their game. It also allows golfers to play fun games at the driving range, like Angry Birds. Toptracer has an installed base of over 19,000; in MODG’s second quarter, it installed a record 2065 Toptracer bays.

I expect MODG to continue to open new Topgolf venues and install more Toptracer bays as they show no signs of slowing down. One of the best aspects of Topgolf is that it introduces the golf game to new people. Golf is a niche game, so the newer golfers Topgolf attracts, the more experienced golfers develop, and more golfers mean increased demand for MODG’s equipment and apparel products. Therefore, MODG is doing an excellent job of increasing its customer base.

Hazards

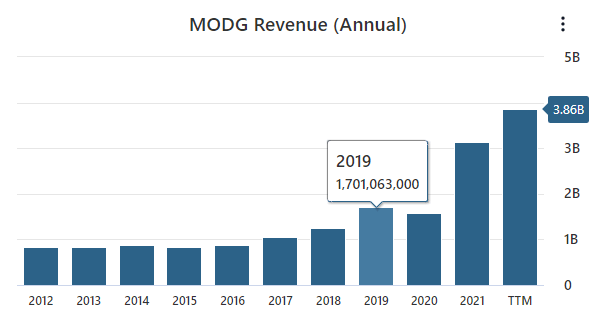

MODG faces many challenges. Among them is the success of MODG depends on the golf game’s popularity. If the number of golf rounds played per year or the number of golf participants declines, then MODG revenues will follow suit. During the COVID-19 pandemic, we saw a lot of pandemic winners and losers, and the golf industry was one of the biggest winners. One of the best ways to combat the COVID-19 virus was social distancing, limiting the number of recreational activities people could do. However, playing golf was one recreational activity that people could do with their friends while simultaneously socially distancing. As a result, the number of rounds played and people playing golf exploded, and so did MODG’s revenue. The chart below shows MODG revenue before and after the pandemic.

MODG data by Stock Analysis

As you can see, MODG’s revenues snowballed in the years following the pandemic. However, now that we are settling into a new normal, there is a risk that the number of rounds played and golfers playing regresses to pre-pandemic levels, resulting in a reduction in demand for MODG’s products.

In addition, the popularity of golf magazines, cable channels, and other media, television coverage of golf tournaments, and golf event attendance directly affect the demand for golf products and apparel. The rise of LIV Golf has been a disruptor in the golf industry. The Saudi-backed LIV Golf League has been poaching top talent from the PGA, the predominant golf tour. LIV Golf may be good for the players cashing in by switching from the PGA to LIV Golf. However, I feel splitting the talent pool of A-list golfers between multiple golf tours is terrible for the game overall because it has significantly watered down the PGA product, and there is currently no great way to way to watch LIV golf since doesn’t have a major TV deal.

Ultimately, what is bad for golf is bad for MODG. As the game’s popularity suffers, so does the demand for MODG’s products. LIV Golf was founded in 2021, so its full impact on the golf industry is yet to be determined, but investors should consider it before purchasing shares of MODG.

Valuation

We will run a comparative and discounted cash flow (“DCF”) analysis to place a value on MODG. To begin, we will start with the comparative analysis and look at the highest, lowest, and median price-to-earnings ratios the market has paid for MODG over the past five years, which are 25.24, 17.15, and 13.08. We will also look at the sector median P/E, which is 13.29. Finally, we will multiply these ratios by the average analyst estimate of 2023 earnings, which is $0.87.

| Scenario | P/E | 2023 Earnings Estimate | Intrinsic Value Estimate | % Change from Current price |

| Bear Case | 13.08 – 2018 P/E | $0.87 | $11.37 | -44.34% |

| Median | 17.15 – 5-year median | $0.87 | $14.92 | -26.97% |

| Bull Case | 25.24 – 2019 P/E | $0.87 | $21.95 | 7.44% |

| Sector Median Valuation | 13.29 | $0.87 | $11.56 | -43.41% |

On a comparative analysis, MODG appears to have a more significant downside than upside by a wide margin. No scenario observed through this analysis would give investors an adequate return on capital. However, a couple of scenarios would give investors a disastrous return if those came to fruition. If next year’s earnings estimates materialize and the market applies the multiple seen in 2018, investors would likely lose almost half their investment in the company. There is little to like about the results from this comparative analysis. The bullish case only produces a 7.44% return from MODG’s current share price. However, this is just one analysis, and it is essential to use multiple different valuation techniques when estimating the intrinsic value of a stock.

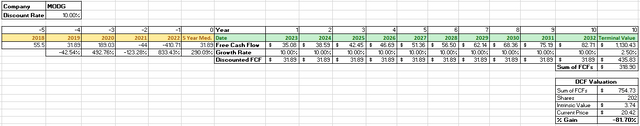

Turning to the discounted cash flow analysis, we will begin by taking the median of the last five years of free cash flows, which is $31.89 million. Based on what we have seen from Topgolf, I am bullish on MODG’s growth over the next decade; therefore, we will apply a 10% growth rate for the next ten years, followed by a 2.5% growth rate into perpetuity, to figure out the terminal value. We will then use a discount rate of 10%. With these inputs, the DCF analysis gives us an intrinsic value of $3.74, representing a downside of -81.70% from MODG’s current share price. As I suspected, MODG is not trading at an appealing valuation based on a comparative and DCF analysis.

Summary

In many ways, the future of MODG is tied to the future of the golf game. If more golfers play more golf per year, then demand for MODG’s golf equipment and golf apparel will increase accordingly. However, if the last couple of years represent the peak of the golf game and the industry returns to pre-pandemic levels, this would be bad news for MODG shareholders. LIV Golf has proven to be a formidable opponent to the PGA, and I cannot see a scenario where two professional golf tours dividing the talent pool of the world’s best golfers turn out to be good for the game. On the bright side, the acquisition of Topgolf will be a tailwind for years to come as more venues open and more people are introduced to the golf game, but even with that growth, shares of MODG are just priced too high for investors to see a good return. I will pass on MODG for now, but if you disagree, please let me know in the comments below. Thank you for reading!

Be the first to comment