simonkr

I wrote an article in January of last year here, explaining why trading action in steel companies like Cleveland-Cliffs (NYSE:CLF) was signaling expanded risk of a U.S. recession. While the economy is not yet officially in recession, and steel company quotes rallied strongly right after my story was published, deep-cyclical steel firms have turned into flat to negative performers for investors since April 2022.

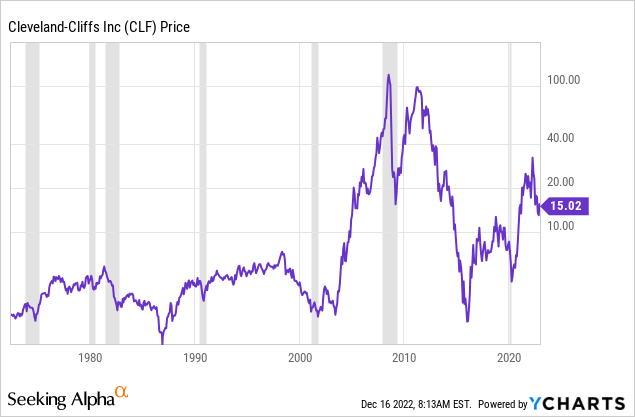

Cleveland-Cliffs is now down almost -15% in price since I wrote on the company 11 months ago. The bad news is 2023 may be another disappointing year of flat to negative returns, considering its consistent track record of suffering during U.S. contractions in GDP output overall Measured from 1971, the below graph (log scale) reviews share price changes vs. recessions (shaded in grey) over 50+ years. Out of the last 7 U.S. recession, Cleveland-Cliffs fell hard all 7 times.

YCharts – Cleveland-Cliffs, Price Changes Since 1971, Recessions Shaded in Grey

So, with signs of recession popping up everywhere in December 2022, especially through the 40-year record spread inversion of the Treasury yield curve (with 3-month rates higher than 30-year durations), now is NOT the time to be a hero and hold an overweight position in CLF or steel equities.

Earnings Implosion

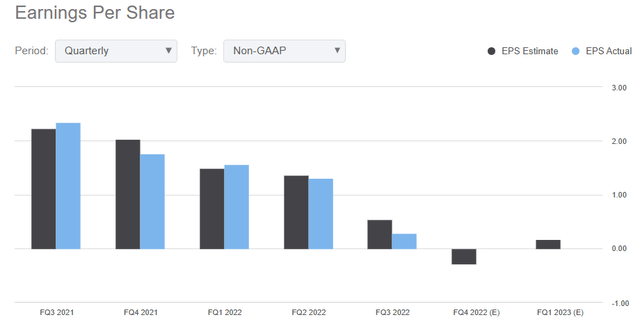

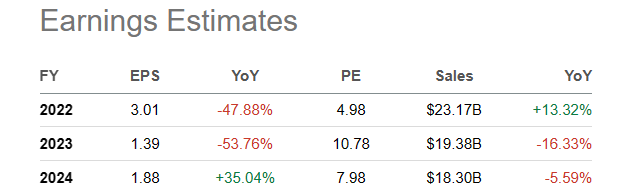

What’s fascinating to me is Wall Street analysts still fail to understand substantial operating losses are likely next year. They are slowly accepting CLF earnings will disappear at the end of 2022 and first half 2023 progress will be nonexistent. Yet, this group of prognosticators is now forecasting a “recovery” in income levels during the second half, which is incredibly improbable. During recessions, steel demand and pricing gets crushed with a lag of 6 to 12 months, while Cleveland-Cliffs has a history of large income drops time and again. I strongly believe the annual estimates for 2023-24 for this industrial commodity business will prove unattainable in another quarter or two, as the global economy slides into recession.

Seeking Alpha – Cleveland-Cliffs Non-GAAP Cash Earnings, Quarterly since Late 2021 with Forward Estimates

Seeking Alpha – Cleveland-Cliffs, Wall Street Estimates 2022-24, December 16th, 2022

Weak Technical Momentum

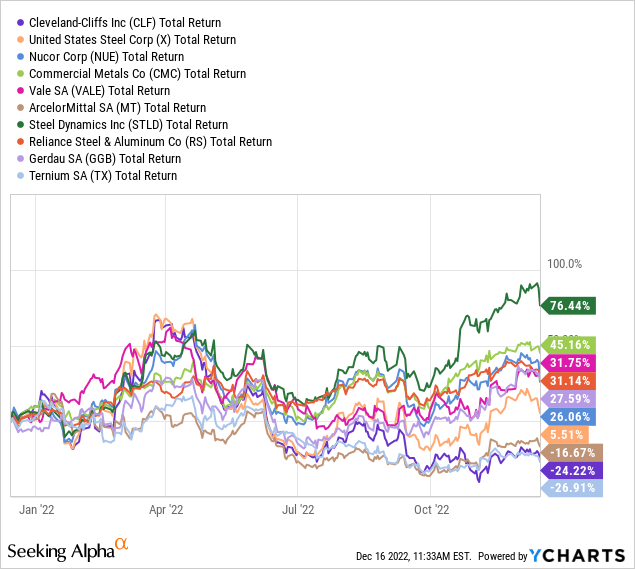

One of the reasons I am picking on Cleveland-Cliffs today vs. other steel names is it continues to be an “underperformer” for shareholder returns since my article last January. On the chart below, I have drawn the weak -24% total return for shareholders over 12 months. Compared to the largest market-cap steel names globally, easily tradeable for American owners, CLF sits close to the bottom of the pack for recent performance. The peer and competitor list includes U.S. Steel (X), Nucor (NUE), Commercial Metals (CMC), Vale S.A. (VALE), ArcelorMittal SA (MT), Steel Dynamics (STLD), Reliance Steel & Aluminum (RS), Gerdau S.A. (GGB), and Ternium S.A. (TX).

YCharts – Large Cap Steel Companies, 12 Month Total Returns

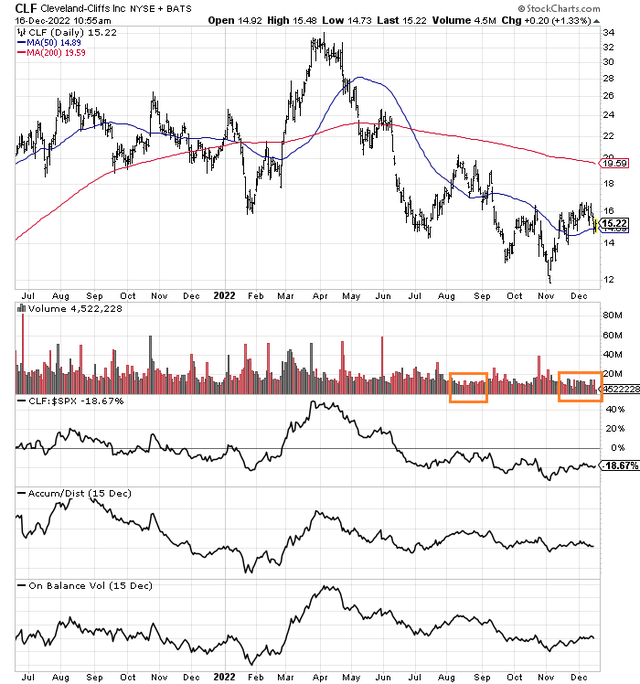

In addition to weak relative strength vs. the sector, CLF is also dropping faster than the S&P 500 over a number of sorting time spans under 18 months. On the year and a half chart of daily price and volume changes below, Cleveland-Cliffs has underperformed the S&P 500 by almost -19%. Following its out-of-the-blue March spike in price (which is a great example of how trading stocks short term can be the same as randomly rolling the dice at your local casino), CLF has suffered a wickedly bad -60% “relative” decline to the S&P 500.

StockCharts.com – Cleveland-Cliffs, 18-Month Chart, Daily Price & Volume Changes, Author Reference Points

Other momentum indicators are “Blah” at best (“Meh” for millennials and youngsters). The primary data point screaming to be cautious in December is weak buying interest volume. On the chart, I have boxed in orange this situation, which is very similar to the failed August bounce in price. Slow trading volume has been a problem for numerous cyclical stocks on Wall Street during November-December. It could be a warning sign the market’s final bear market bottom lies dead ahead into the January to March period.

Final Thoughts

Could CLF rise quickly in price during early 2023, then fall hard later in the year, similar to 2022’s pattern? Perhaps. Could shares tank appreciably under $10 in the first half of the year, then recover back to $15 by December? Possibly. Could shares get demolished under $5 in a severe recession, with high operating losses appearing by the summer? Not out of the question. Will the stock quote skyrocket above $25 soon? Highly unlikely, outside of a takeover bid by a competitor. In the end, when I run a variety of trading scenarios and economic zigzags, I come up with a potential range of minimal gains to large losses during the approaching new year.

Based purely on technical patterns in past recessions, I rate the odds of a $20+ CLF price in 12 months at less than 10%. Honestly, a deep recession driving the share quote under $5 is likely sitting at higher odds nearer 15%. If you want to purchase this steel company and bet on an economic upturn into 2024, I would wait for lower prices under $10. I believe the chances of Cleveland-Cliffs trading under $10 sometime in the first half of 2023 are better than 50/50.

If there is a saving grace for CLF, it is a much-improved balance sheet vs. recent years. With $5 billion in working capital, and a “tangible” book value around $11 per share, the company holds its strongest balance sheet since 2013 at the earliest. The enterprise should be able to survive a recession, meaning a steep price drop below $5 may prove only temporary.

In the end, why not focus on truly conservative and defensive choices for next year. Last week here, I wrote about my smartest risk-adjusted choice for 2023 – Pfizer (PFE). A low valuation, tens of billions in cash piling up on the balance sheet, few liabilities, and a strong dividend distribution story are very attractive traits to own during an economic contraction. Pfizer is the antithesis of Cleveland-Cliffs, including low cyclicality in business sales, high free cash flow readings, decent long-term growth prospects, and a 3.1% dividend yield approaching the same rate as long-term Treasury bonds (3.4% to 3.8%).

From my experience trading stocks over 36 years, I rate Cleveland-Cliffs an Avoid to Sell for the average investor. If you want to own it, be patient for a bigger selloff in the coming months. When the Federal Reserve decides to actually lower interest rates, an effort to save U.S. from recession, it will again be time to consider purchasing the company. That’s my two cents (three with inflation). Take it or leave it, when deciding what to do with CLF.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment