Michail_Petrov-96/iStock via Getty Images

This is my second article focused on Cardinal Health (NYSE:CAH) after “Cardinal Health: Healthcare Dividend Aristocrat – Second Look” (“Second Look“). Since that time, Cardinal Health has outperformed the S&P 500 by ~200 basis points. In this article I evaluate its likelihood of continuing to outperform.

Cardinal Health is replacing its CEO of 5 years with its former CFO

Cardinal Health is replacing CEO Mike Kaufmann, a Cardinal Health lifer. Kaufmann joined the company in 1990. In 2018 he transitioned from CFO to CEO. Kaufmann’s replacement, Jason Hollar, joined Cardinal as CFO in 2020 and followed the well-worn path from CFO to CEO in 09/01/2022.

In its 08/11/2022 release announcing the change, Cardinal Health noted that Hollar had:

…served as Cardinal Health’s Chief Financial Officer since May 2020, leading financial activities across the enterprise, including financial strategy, capital deployment, treasury, tax, investor relations, risk management, accounting and reporting. During his tenure, he has helped Cardinal Health prioritize investments in growth businesses, strengthened the balance sheet, and returned capital to shareholders.

Apparently the move was the result of activist pressure which had been building around the company. A mere few days after he took over as CEO, on 09/05/2022, Cardinal Health entered into a wide ranging agreement with activist investor Elliott Investment Management L.P.

The deal, reported in an 09/05/2022 8-K, gives Elliot significant influence in the company as described with four designated independent directors on a 13-person board. Also noteworthy and likely of key significance in the future direction of the company is the establishment of:

…an advisory Business Review Committee (the “Business Review Committee”) to address the matters contemplated by the Cooperation Agreement and the charter of the Business Review Committee. The Committee has three members: Jason M. Hollar, the Business Review Committee’s chair and the Chief Executive Officer of the Company, the Investor Designee and Akhil Johri. The Business Review Committee, with the assistance of the Company’s legal and financial advisors, will make recommendations to the full Board.

Cardinal operates with a bifurcated business model

Pharmaceutical

Cardinal Health reports its earnings on a fiscal year basis ending 06/30. Accordingly its most recent 10-K is a Q4, 2022 report. In Second Look I explain that Cardinal Health divides its business into two segments, pharmaceutical and medical.

Its resilience rests in its pharmaceutical business which is a reliable growth driver. Its medical sector has been problematic as discussed below.

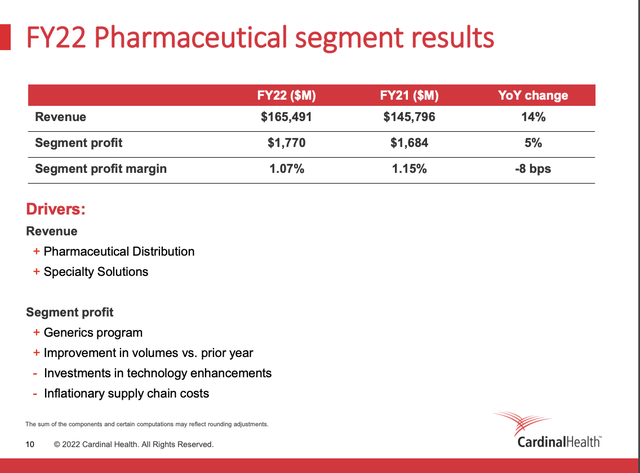

Its Q4, 2022 earnings presentation describes its fiscal 2022 pharmaceutical segment results as follows:

Its outsized revenues of $165 billion, with a low single digit profit margin, are typical for a wholesale distributor model. The wholesale market accounts for some 92% of prescription drugs in the US. AmerisourceBergen (ABC), McKesson Corporation (MCK), and Cardinal make up an oligopoly controlling >90% of this large market. Cardinal is the smallest of the big three drug wholesalers in the US.

Although it is the smallest of the big three wholesalers in terms of volume, it holds its own in terms of its share performance over a 1 year time frame but falls behind on a 5 year review. It is this five year metric, plus Cardinal’s struggling medical segment, that likely drew attention of Elliot.

Medical

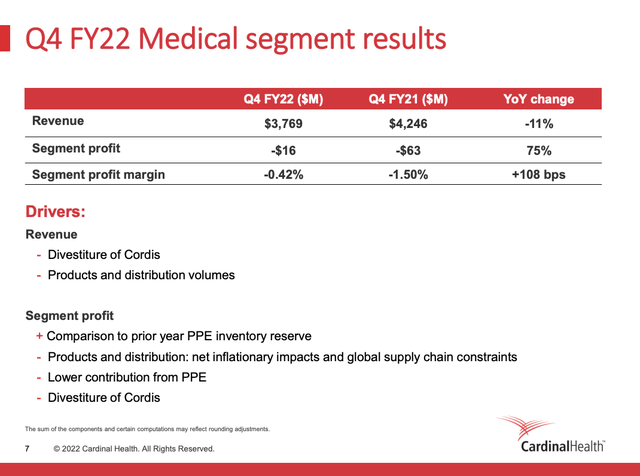

Cardinal’s second segment is its medical sector. As shown by its results’ slide from its Q4, 2022 earnings presentation below, fiscal year 2022 was pretty much of a downer:

While its pharmaceutical sector showed the modest level of profits associated with a wholesale business model, Cardinal’s medical segment showed a loss. Such a situation for a mature company reflects a failed business model. Its number one driver in terms of revenue was stated as its divestiture of Cordis.

Cordis was a manufacturer and supplier of cardiology and endovascular devices which Cardinal acquired from Johnson & Johnson (JNJ) in 03/2015 in a deal valued at ~$2 billion. The deal closed towards the end of calendar 2015. Cardinal announced its closing in 10/2015 with enthused proclamations of how it would combine with Cardinal’s other offerings:

…to offer high-quality, daily-use products; reliable, trackable inventory and logistics; and deep analytic capabilities that will result in a comprehensive offering for the entire episode of care. This multi-dimensional set of solutions will become increasingly important with emerging value-based payment models.

Such was the dream. Things did not turn out that way. The reality of combining the businesses turned out to be entirely different. Initially Cardinal put a brave face on the situation, as for example CEO Barrett discussing Cordis during its fiscal Q1, 2018 earnings call:

We also had to do some work in that integration with a third-party, which is the partner that sold us the product line. So that requires a lot of interfaces, moving parts and great disciplines. And I think we’ve, over the course of the year, honed that increasingly.

By fiscal Q3, 2018 Cordis issues were no longer tolerable. CEO Kaufmann opened the call as follows:

Let me start by saying we recognize that today’s results did not meet your expectations or ours. The biggest variable driving these results was some unanticipated disappointing performance from our Cordis business which masked an otherwise better than expected quarter.

During 50 subsequent mentions, the Cordis situation was laid bare with all its warts, including:

- tax issues

- coordination of inventory with product demand

- managing international operations

When asked how long it would take for Cardinal to pull the plug on Cordis, Kaufmann was unable to provide a time line. As events unfolded it took a while to work out; Cardinal was finally able to reach an agreement to sell it to a private equity firm for ~$1 billion in 03/2021; the deal closed a few months later in 08/2021.

As matters now stand with the closing in its rearview mirror, Cardinal Health is far from home free. Now it has a new litany of horrors besetting its Medical segment as described below during its Q4, 2022 earnings call (the “Call“) including:

- lower PPE sales,

- lower lab testing volumes,

- inflation,

- global supply chain constraints.

Cardinal’s guidance for fiscal 2023 reflects continued positive results for pharmaceutical and challenges for medical.

Pharmaceutical segment guidance

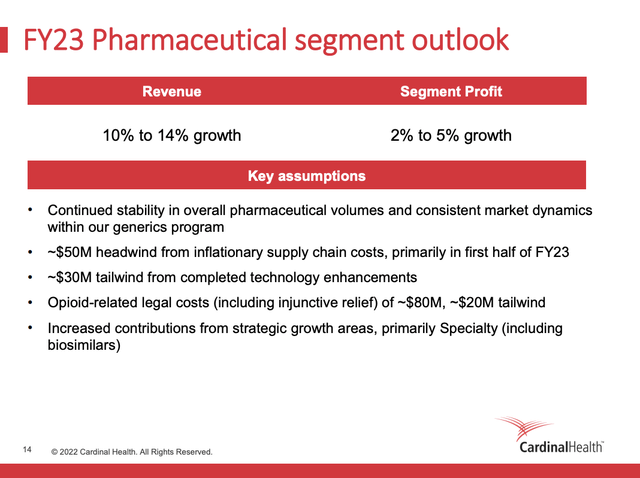

Seeking Alpha’s quant ratings system gives Cardinal Health a rare “A+ for growth as I write on 09/25/2022. This is a strong leap up from its “F” back in early 08/2022. Its healthy outlook for 10-15% pharmaceutical revenue growth as shown by its 08/11/2022 presentation outlook slide below is likely the explanation:

Cardinal’s pharmaceutical segment is the gift that keeps on giving. The referenced market dynamics in its generics programs are described in the Call. It refers to tailwinds from improved volumes partially offset by headwinds from technology enhancements and inflationary supply chain costs.

In the Call it describes its productive specialty pharmaceuticals as:

…oncology and emerging therapeutic areas driven by our offerings, including the …[Navista] TS [tech solutions]. We announced a tuck-in acquisition of the Bank care GPO [group purchasing organization] and investment in their main services organization. These will further strengthen Specialty Solutions cornerstone rheumatology GPO, which offers innovative office management solutions and robust specialty drug access to over 1,300 rheumatology providers nationwide.

Its reduced opioid litigation costs are good news. Second Look describes the general outline of this hydra-headed litigation. There are reasons to hope that a National Settlement to which Cardinal is a party will see an ongoing reduction of risk and legal expense for this. Unfortunately as described in Cardinal’s 10-K, it was not a settlement with all of Cardinal’s opioid claim plaintiffs.

Medical segment guidance

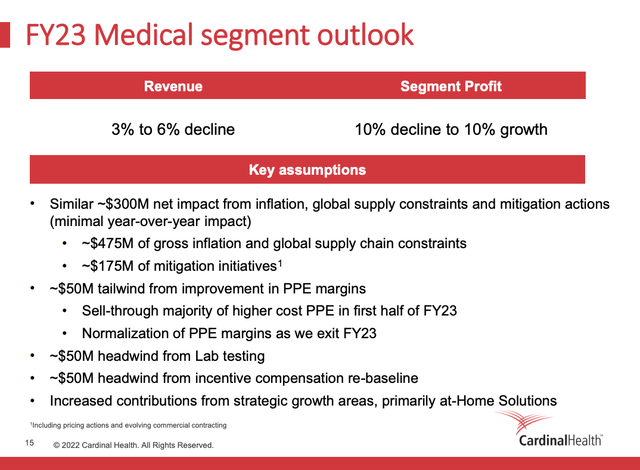

Cardinal’s pharmaceutical segment is on record as guiding for meaningful revenue growth with modest segment profit growth. As is becoming an unfortunate rule for the medical segment, its outlook is not so rosy per Cardinal’s medical outlook slide below:

When one nets out the various headwinds and tailwinds and then considers the general quarterly turnover for the segment of $3.7 billion, it appears that its troubles are endemic. In checking the Call, one is reminded that revenue is impacted by the Cordis divestiture. For some reason that is not mentioned on this slide.

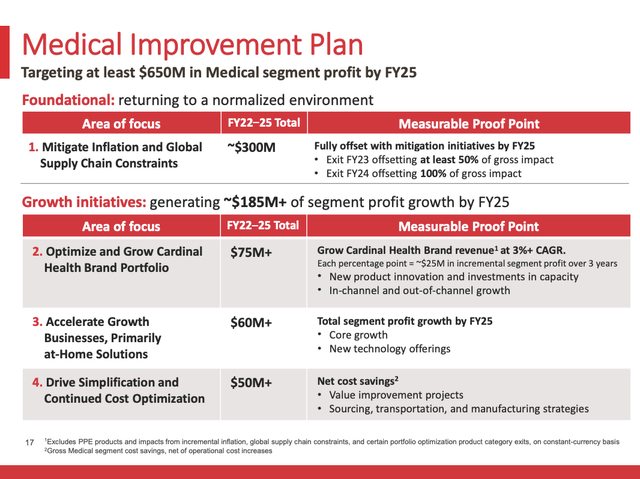

Before throwing up one’s hands and saying a pox on medical, consider that Cardinal is targeting:

…at least $650 million in Medical segment profit by fiscal ’25, driven by the medical improvement plan that we are introducing today.

It has a plan which it describes at slides 15 (providing a profit bridge to show plan detailed expectations) and slide 16 below:

Conclusion

Cardinal Health is a nice conservative pick for dividend growth investors with a significant spoiler in its medical segment. Its ~12.5 PE is in line with AmerisourceBergen’s ~12.5 and McKesson’s ~14. In today’s uncertain market I label it as a hold, but one I will be watching to see how it resolves its medical sector travails.

Be the first to comment