grinvalds

The advent of connectivity and mobility has spurred digital data consumption in recent years, with internet access becoming a “form of utility” if anything. There are currently more than one billion household broadband connections, and an installed base of more than five billion smartphones worldwide, fuelling global data consumption growth at a five-year CAGR of close to 30%. The accelerating penetration rate of high-speed connectivity in recent years has also altered consumer preference in how they choose to consume media and entertainment, with demand shifting towards digital formats like video streaming – especially during the pandemic when people “spent more time at home and more time online”.

While streaming has become one of the fastest growing industries in today’s era of digital transformation, pioneers like Netflix (NASDAQ:NFLX) are now facing stiff competition from legacy broadcasters and media giants that have engaged in “megadeals” to consolidate content libraries and promote their respective streaming services. Specifically, key rivals Disney (NYSE:DIS) and Warner Bros. Discovery (NASDAQ:WBD) are gradually eroding Netflix’s industry-leading market share garnered over the years through its first-mover advantage. The two legacy media and entertainment giants are not only expected to benefit from a rapidly expanding video streaming market that is expected blossom into an $80+ billion industry by mid-decade, but also persistent demand for “traditional TV and home video that will continue to account for the largest share of total consumer revenue [in media and entertainment], even as the segment declines at a 1.2% CAGR” over coming years.

The following analysis aims to walk through key qualitative considerations including market share, top-line growth strategy, and content advantages for Netflix, Disney and WBD’s streaming businesses and gauge their implications on the respective stocks’ valuation prospects.

Market Share by Subscriber

Netflix is likely the most adverse to competition out of the trio at the moment, given its penetration in North America is “nearing a ceiling” while overseas expansion efforts in emerging markets are still in the early stages of ramping up. On one hand, Netflix is subject to market share erosion in its core North American market by incumbent offerings like Disney’s Disney+, Hulu, and ESPN+, as well as WBD’s HBO Max and Discovery+, which have been offering comparatively more content for lower prices since launch. Meanwhile, on the other hand, Netflix is exposed to significant competition in emerging markets from Disney and WBD’s offerings as well, alongside local streaming service providers with no benefit of a first-mover advantage to back pricing and margin expansion. In other words, while Netflix had previously benefited from a “monopoly-like” positioning with little competition to erode its pricing power, which supported a favourable yearslong margin expansion trajectory, the D2C streaming pureplay is now in the early stages of market share loss.

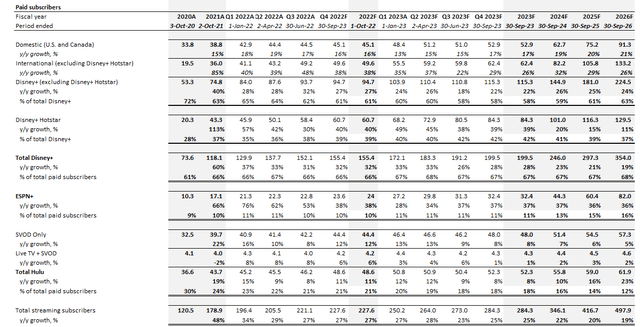

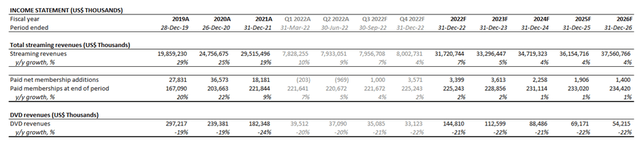

This is further corroborated by Disney’s recent achievement in reaching 221.1 million paid subscribers across its portfolio of direct-to-consumer (“D2C”) streaming platforms, beating Netflix’s 220.7 million reported as of June 30th. This has allowed Disney to take the crown on D2C streaming by subscriber count, though its quarterly average revenue per user (“ARPU”) still falls short of Netflix’s, which currently offers the most expensive monthly streaming rate.

Trailing the two is WBD’s D2C streaming business, which primarily consists of HBO Max and Discovery+. WBD reported a little over 92 million total paid subscribers as of June 30th, including approximately four million subscribers that are currently signed up on both HBO Max and Discovery+, which will eventually merge beginning summer 2023. The newly combined media and entertainment giant currently projects its total paid subscriber base to exceed 130 million by mid-decade, which is a far cry from Disney’s target of 230 million to 260 million for Disney+ alone by 2024.

Top-Line Growth Strategy

D2C streaming revenues are primarily driven by subscription fees and advertiser spending. This ultimately points to one thing – the greater the subscription base, the better the reach to entice advertiser spending while also benefiting from fee volume on member sign-ups.

Let’s take a look at some of the key market considerations for digital ads on D2C streaming platforms:

- Digital advertising currently accounts for more than 60% of total ad spending, and the figure is expected to expand further at a 11% CAGR through 2030. This makes favourable tailwinds for the burgeoning D2C video streaming industry, which already houses about a quarter of total ad spend in the U.S. alone. Specifically, ad distribution through video streaming services is expected to exhibit the fastest growth compared to other distribution channels at an annual rate of more than 30% beginning 2023 to align with the rapid migration of consumer TV viewership from linear platforms to on-demand digital platforms.

- Yet, advertising remains a highly cyclical industry. Given the current macro uncertainties spanning protracted pandemic disruptions, record-high inflation, and intensifying geopolitical tension, global ad spending growth is expected to slow in the current year to 9% compared to 2021’s 23% (U.S. +26% y/y).

The following will review how Netflix, Disney, and WBD seek to monetize its respective D2C streaming subscription bases:

Netflix:

- Pro: Despite increasing churn at Netflix, particularly at its core North American market, the company continues to benefit from a higher ARPU on its global subscription base of more than 220 million. This is primarily a courtesy of years in benefiting from a first-mover advantage that has allowed Netflix to optimize pricing and operating margins. The roll-out of an ad-supported tier earlier next year will also allow Netflix to cater to a market of budget-conscious consumers that might have previously been a subscriber but has cancelled as a result of increasing availability of better-for-value options – more than half of streaming subscribers today have shown preference for a cheaper, ad-supported service.

- Con: Yet, Netflix lacks the edge on benefiting from video streaming ad demand still. While it is planning the roll-out of an ad-supported tier in early 2023, the endeavour will still take time to ramp-up and scale to a place that is competitive with Disney and WBD. Setting up the related technology stack, and working out its content release strategy to line-up with advertisers’ preferences are also expected to have a negative impact on margins in the near-term, which comes at an unfavourable time as investor confidence is already dwindling on Netflix’s subscription declines. However, we view Netflix’s strategic partnership with Microsoft (MSFT) on the roll-out of its ad strategy to be a prudent move, given the latter is the only cloud solution provider that has limited exposure to video streaming.

Disney:

- Pro: Disney’s advertising revenue from its D2C services continue to be a core growth driver for the segment, underscoring the competitive advantage of its expansive subscription reach. The planned roll-out of an ad-supported tier on Disney+ starting in the U.S. next summer will also fuel further advertising revenue growth for Disney’s D2C segment. In contrast to Netflix’s case, Disney+’s ad-supported tier roll-out is expected to scale faster with a comparatively lower investment outlay given the ability to leverage experience and existing ad distribution technology stack from Hulu and ESPN+.

- Con: Yet, Disney falls behind Netflix in terms of its ARPU. Despite having surpassed Netflix’s subscription base in the second quarter by a smidge, Disney’s quarterly D2C subscription fee revenue barely makes 50% of Netflix’s. This is consistent with the company’s focus on penetrating the emerging Indian D2C streaming market – Disney+ Hotstar, the company’s India-based D2C streaming platform, currently accounts for approximately 40% of global Disney+ subscriptions and more than a quarter of Disney’s total D2C subscriptions, while also representing one of the fastest growing platforms in its portfolio of streaming offerings. In order to remain competitive in India, Disney currently offers its Disney+ Hotstar subscriptions at less than $1 per month while making available a wide range of content spanning iconic Disney franchises and local language-based favourites. While Disney+ is not expected to become profitable until 2024 when the service is estimated to reach a global subscription base of more than 230 million, we expect the platform’s substantial reliance on the Indian market to remain a pressure factor on margins.

WBD:

- Pro: We view WBD to be a hybrid of Netflix and Disney when it comes to optimizing monetization on its subscription base through fees and ads. Although WBD’s combined subscription base across HBO Max and Discovery+ is meaningfully lighter compared to Disney’s and Netflix’s, it already benefits from robust demand and margin expansion through scale across its streaming ads business. Today, more than half of HBO Max subscribers are signed up on the ad-supported tier, underscoring consumers’ price sensitive behaviour when it comes picking a winner within the increasingly saturated streaming landscape. WBD also benefits from diversified subscription revenue growth by leveraging its newly combined Discovery and WarnerMedia content libraries, which enables optimized penetration within the increasingly competitive landscape through catering to different consumer preferences and budgets. As mentioned in our previous coverage, the amalgamation of both WarnerMedia and Discovery’s content libraries is a critical enabler of price discrimination within the on-demand video streaming market – something that Disney has proven through success observed across its diversified portfolio of D2C offerings spanning Disney+, Hulu and ESPN+ (as well as their respective sub-tier offerings, such as ad-enabled option vs. regular).

- Con: As mentioned in the earlier section, WBD’s subscription base is substantially smaller compared to Disney’s and Netflix’s, which explains the nominal contribution of ad revenues to its D2C sales mix. Yet, WBD’s D2C ad revenue stream has been demonstrating momentum in recent quarters, as demand for HBO Max and Discovery+ continues to ramp-up. In the meantime, we expect WBD’s D2C margins to remain volatile as the company works on smoothening out the post-merger transition to optimize both cost and sales synergies from the transaction going forward. This is further corroborated by the company’s recent decision to pull the plug on high-profile projects including CNN+, Batgirl, and direct-to-streaming films to improve long-term profitability.

Content Advantage

In addition to market share loss, Netflix might also be falling behind on the content arms race against Disney and WBD, which boasts two of the largest content libraries with iconic franchises. While media giants like WBD and Disney have slowed content investments with the adoption of a “quality over quantity” mentality to satisfy investors’ change of preference from “growth at all costs” to profitability and cash flow generation under today’s rocky economy, it is a much easier feat for them than it is for Netflix.

Because of the wide range of content distribution channels that Disney and WBD benefits from – spanning broadcasting, linear networks, theatrical, third-party distribution licensing, and D2C streaming – the two media giants are able to maximize returns on content investments. This is further corroborated by WBD’s recent decision to bring back the legacy “windowing” strategy in replacement of ex-WarnerMedia management’s pioneering launch of direct-to-streaming films to “maximize monetization on investment dollars spent”. Meanwhile, Netflix really has one distribution channel to monetize its investment dollars from – Netflix. And this continues to make a margin and growth disadvantage to the streaming pioneer.

Which of NFLX, DIS, and WBD is a Better Buy?

Of the three contenders, WBD currently trades at the lowest multiple despite demonstrating resilient growth and long-term profitability across the broader business beyond just D2C streaming. The stock currently trades at a forward EV/EBITDA multiple of 8x, while Netflix and Disney trade at 19x and 16x, respectively. Admittedly, WBD’s valuations may be weighed down due to its highly leveraged balance sheet and exposure to a declining linear TV business. Yet, it continues to demonstrate favourable progress in restoring sustained growth post-merger and expanding profitability and free cash flows over the longer-term. This is a similar case to Disney’s multi-channel media and entertainment business model and capital structure, yet Disney still trades at a relatively significant premium that is closer to Netflix’s.

The WBD stock’s recent struggle in regaining momentum could also be due to investors’ wilting confidence after the company slashed its free cash flow guidance for the year due to ongoing efforts in integrating the newly merged company. In the four short months post-merger, WBD has literally “ripped the bandaid off” on multiple high-profile investments as mentioned in the earlier section to right its strategic focus on sustained long-term profitability. As discussed in a previous coverage, we remain optimistic that the near-term pains at WBD will pay large dividends in the long-run, as it continues to maximize post-merger synergies and reduce leverage to better compete against peers from both an operational and fundamental perspective.

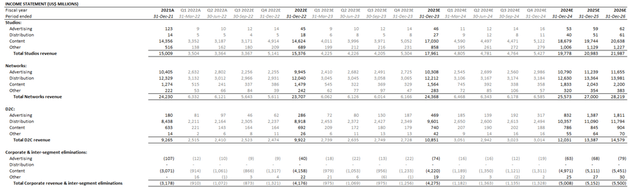

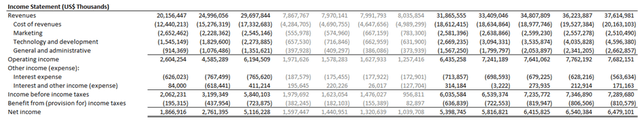

WBD Financial Forecast (Author) WBD Financial Forecast (Author)

WBD_-_Forecasted_Financial_Information.pdf

Author’s Note: Please see here for further detail on forecast assumptions applied for WBD.

Meanwhile, we consider Disney to be uniquely positioned for further momentum as investors look to favourable progress at Disney+ towards profitability and helping the company’s broader D2C streaming business maintain market share gains. Third Point’s recent investment into Disney, as well as portfolio manager Dan Loeb’s personal comments regarding the value that would be unlocked by spinning off ESPN+ and buying 100% of Hulu ownership to support ultimate integration into Disney+. This has also highlighted the favourable performance that the company has demonstrated in penetrating the D2C streaming market.

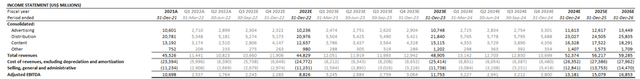

Disney D2C Forecast (Author) Disney D2C Forecast (Author)

Disney_-_Forecasted_D2C_Financial_Information.pdf

Author’s Note: Please see here for further detail on forecast assumptions applied for Disney’s D2C segment.

As for Netflix, we expect volatility to remain the theme, as investors continue to look for evidence in supporting the underlying business’ prospects in restoring growth through monetization strategies that the company once shunned – including paid sharing, an ad-enabled option, and other entertainment features such as gaming. While Netflix remains an expanding and profitable business, the stock’s latest decline is likely a reflection of investor exits after the company verified that it has failed to turn its first-mover advantage in streaming into a moat, which is evidenced through continued churn in recent quarters.

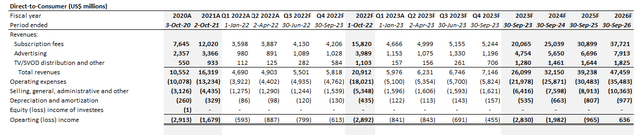

Netflix Financial Forecast (Author) Netflix Financial Forecast (Author)

Netflix_-_Forecasted_Financial_Information.pdf

Author’s Note: Please see here for further detail on forecast assumptions applied for Netflix.

Be the first to comment