simonkr/E+ via Getty Images

Investing in Oil & Gas Majors, such as Exxon Mobil (NYSE:XOM), has not been for the faint-hearted. As a highly cyclical business, also marked by significant political and macroeconomic risks, XOM has been facing crisis after crisis in recent years.

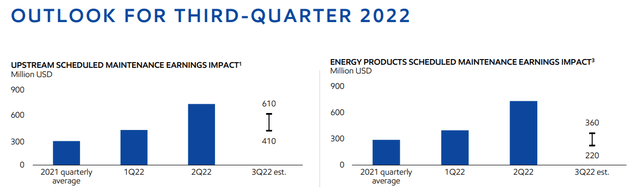

This, however, has changed in the past two years and the company is now experiencing what some market commentators are seeing as peak profitability. Just last quarter, XOM’s management reaffirmed their strong outlook for the third quarter of this year.

Exxon Mobil Investor Presentation

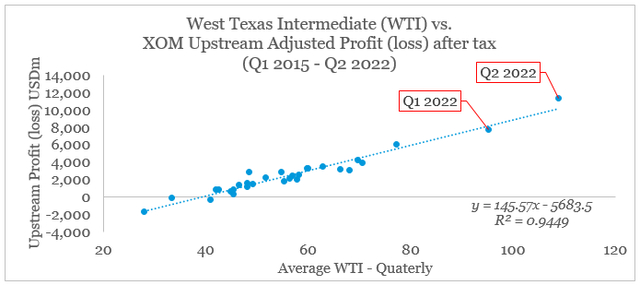

As expected, this has been largely driven by the strong results of the upstream segment, which are highly dependent on outside factors related to oil prices. As we see in the graph below, Exxon’s quarterly earnings of the upstream segment exhibit extremely strong relationships with the quarterly Crude Oil WTI prices.

prepared by the author, using data from SEC Filings and FRED

Naturally, this leads to more and more trend-followers joining the ranks of Exxon Mobil’s shareholders which creates additional short-term risks for the company’s share price.

What I mean by that is that a large number of market participants are simply following the most recent trends and developments and by doing this are exacerbating momentum trades, which for many leads to disappointing long-term results.

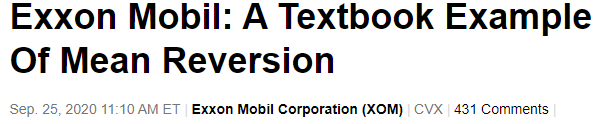

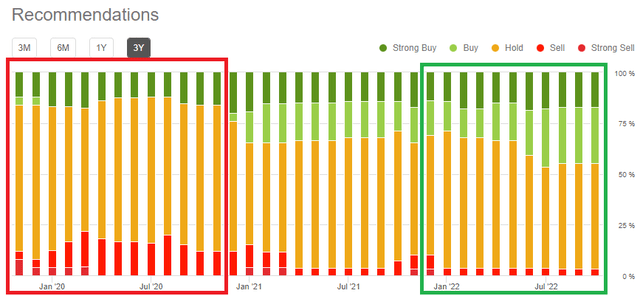

In that regard, the tables have turned sharply in the past few years, as market sentiment for Exxon was down to Earth back in 2020 when I outlined my investment thesis for the Oil Major.

Seeking Alpha

At the time it was almost impossible to conceive a bullish thesis on the company by simply following market developments and recent share price performance.

Also during this period, the sentiment around high-growth tech names was near all-time highs, which was once again a major red flag for long-term shareholders.

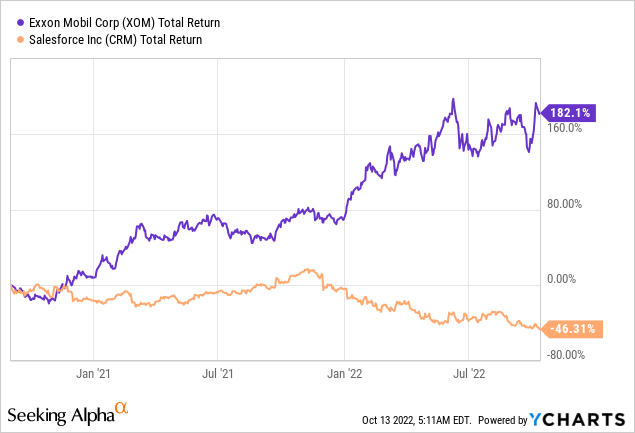

Since then, Wall Street’s analysts have also embraced the trend-following and as a result bearish ratings on XOM are slowly turning into ‘strong buys‘.

Seeking Alpha

As before, this does not mean that long-term investors should follow the heard and pile into the oil & gas sector at current elevated levels even though the long-term investment thesis for Exxon Mobil remains strong.

Over the short-term Exxon Mobil’s upside appears limited and any meaningful increase in the company’s share price will be highly dependent on even higher oil prices or new geopolitical events. Contrary to the 2020 period, the company appears fairly valued at this point.

Having said that, Exxon Mobil alongside other high quality oil majors remain solid long-term investments in my view. XOM in particular, is in a good spot to lead in terms of high return on capital and investments in new low carbon solutions relative to its peers.

Source: Seeking Alpha

Not All Oil Majors Are Created Equal

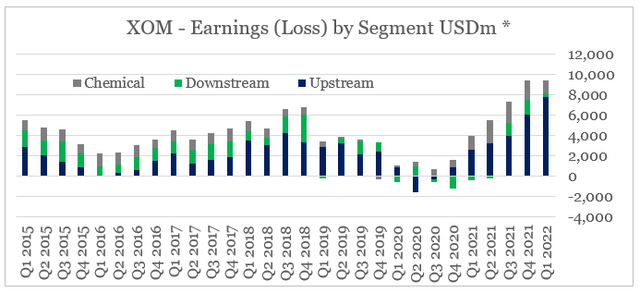

As we saw above, oil prices and factors outside of Exxon Mobil’s management control are a major factor impacting earnings from the company’s upstream segment, which is by far the largest contributor to overall profits.

prepared by the author, using data from SEC Filings

* adjusted for impairments

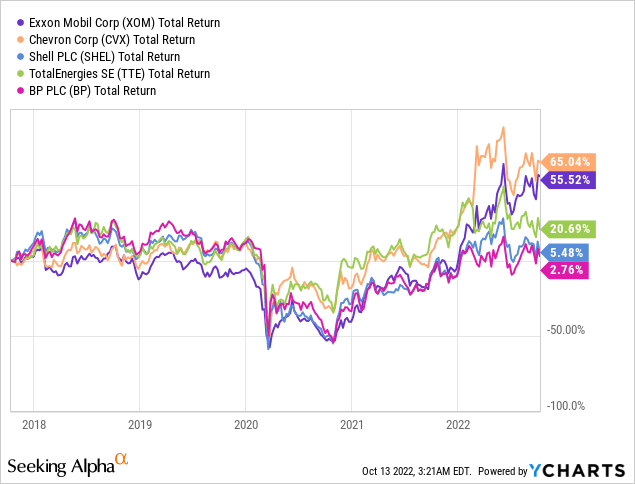

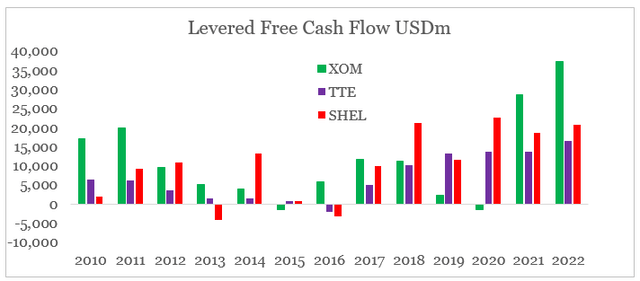

This, however, does not mean that selecting individual oil & gas companies is a futile exercise since the U.S. based Oil Majors delivered far superior returns during the past 5-year period.

The reason for that is Exxon Mobil’s superior free cash flow profile to its major European peers.

prepared by the author, using data from Seeking Alpha

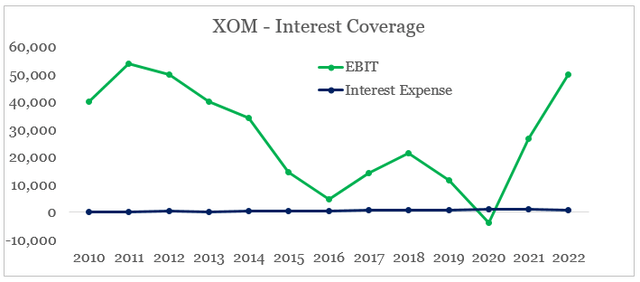

As I have shown previously, the company also has a much stronger financial positioning with lower debt-to-assets ratio and much higher interest coverage when compared to its overseas competitors. As a matter of fact, Exxon Mobil’s financial health profile has improved considerably since then.

prepared by the author, using data from Seeking Alpha

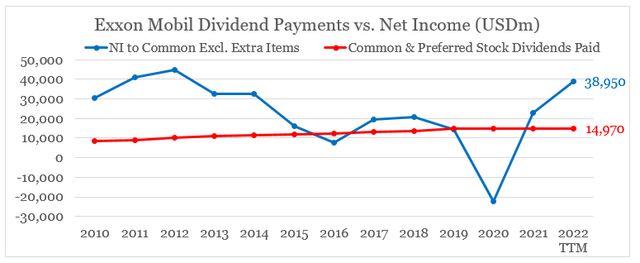

While speculations about an ‘upcoming dividend cut’ were to be found everywhere back in 2020, such an event appears far less likely today.

prepared by the author, using data from Seeking Alpha

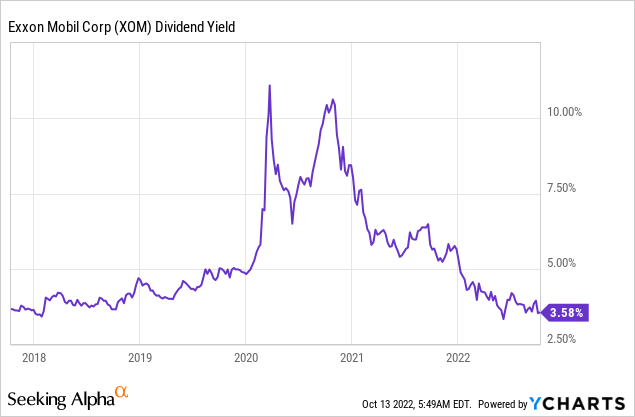

Unfortunately, however, the near double-digit dividend yield opportunity that was present back in 2020 is gone now.

The Issue of Investment Horizon Mismatch

One major misunderstanding of investors in the oil & gas sector is the horizon mismatch.

Although extreme short-termism in the equity markets is a widespread problem, the energy sector has been by far the worst hit in recent years. What I mean by that is that high return on capital investments that also secure the strongest competitive advantages in the industry have exceptionally high-time horizons which are often at odds with equity markets’ obsession with quarterly numbers.

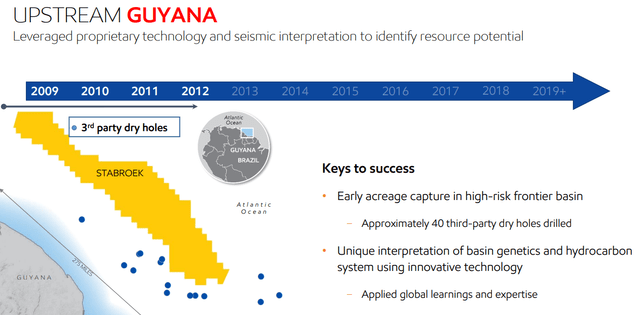

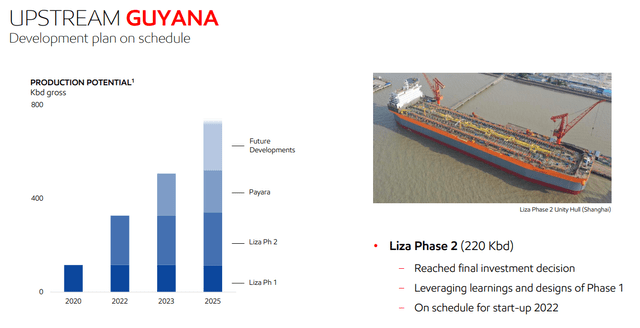

For example, the multi-stage project of Exxon Mobil in Guyana begun in 2008 with the initial oil & gas exploration activities.

Exxon Mobil Investor Presentation

With the overall development being divided into a number of projects, such as Liza 1 and 2, Payara and Yellowtail, the benefits from the huge initial investments are reaped across a very long period of time.

Exxon Mobil Investor Presentation

This is the reason why the energy market as a whole is prone to periods of supply glut and shortages and is also at odds with time horizons of most investors in the equity market.

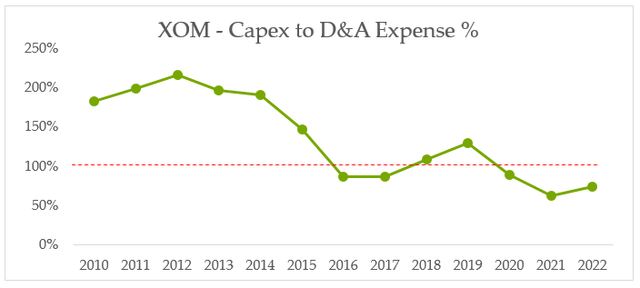

As a result of these previous investments, Exxon Mobil was able to cut its capital expenditures in recent years and thus preserve its free cash flow.

prepared by the author, using data from Seeking Alpha

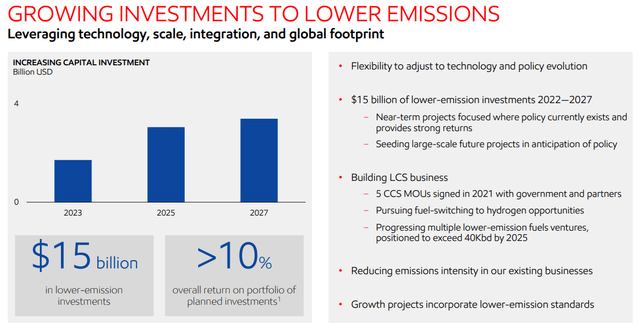

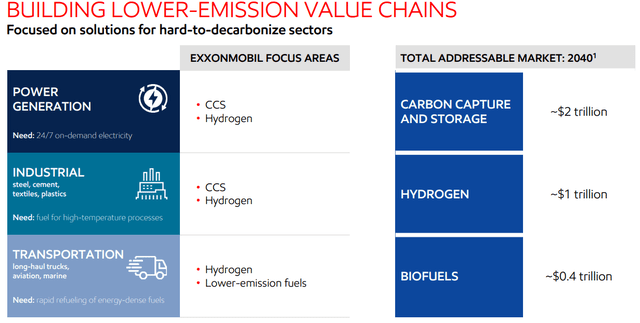

While doing that, the company is also setting the stage for its next multi-decade projects in lower emission areas, such as carbon capture and storage, hydrogen and biofuels.

Exxon Mobil Investor Presentation

Exxon Mobil Investor Presentation

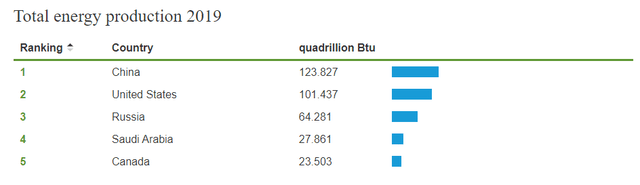

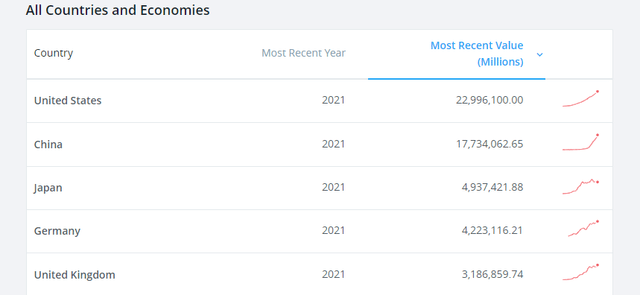

Lastly, this long-term investment horizon in the energy space has also brought up another mismatch in the sector and namely the geographical mismatch between producers and consumers. After years of intensifying globalization trends that are now reversing, the list of the Top 5 energy producers of the world became very different from the Top 5 consumers (see graphs below).

EIA

GDP (current US$) (Worldbank)

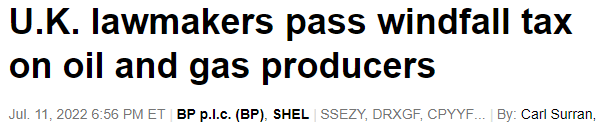

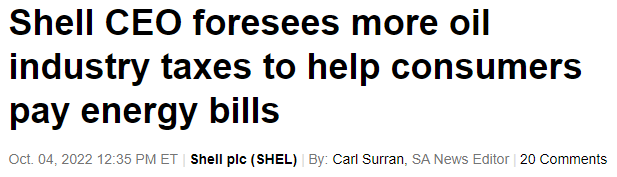

This wasn’t much of a problem in a heavily globalized world, but as we see as of late has turned into a major issue for Europe in a more polarized world. While this creates an opportunity for U.S. producers, their European counterparts also face increased political pressure.

By embracing the mantra of privatizing losses of the past decade and now nationalizing profits, governments are also falling victim to appeasing short-term issues at the expense of long-term competitiveness of their industries.

Seeking Alpha

As a result, management teams of oil & gas companies have no other choice but to comply with such measures.

Seeking Alpha

And with that likely sacrificing the competitiveness of the businesses under their management.

Seeking Alpha

Conclusion

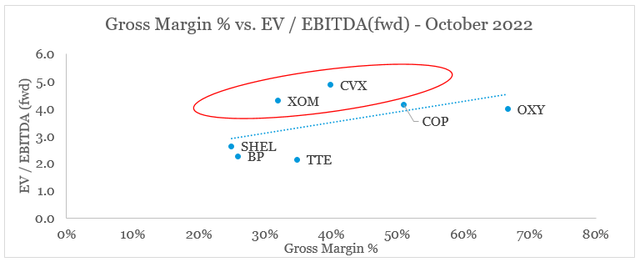

In spite of returning more than 200% since I first covered it, Exxon Mobil remains well-positioned to deliver superior long-term results. Its competitive positioning is also the reason why it trades at a premium to its major peers with the exception of Chevron (CVX).

prepared by the author, using data from Seeking Alpha

As profits soar, however, Exxon is also likely to experience short-term volatility on the back of more momentum and narrative-driven investors entering the sector.

Be the first to comment