Fokusiert

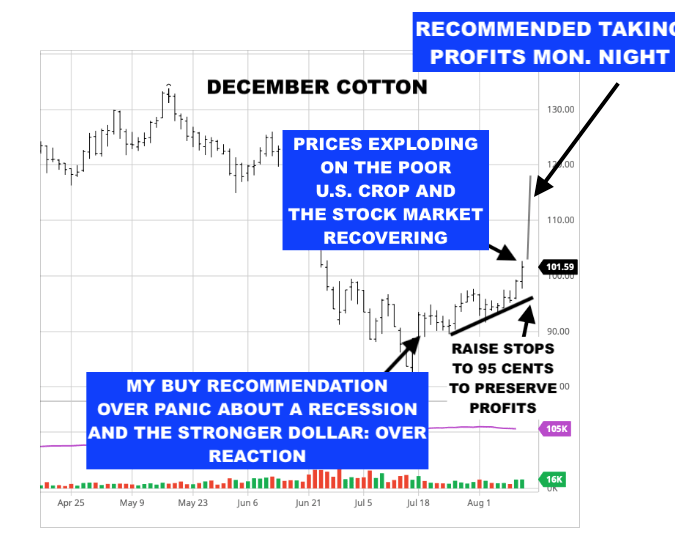

One of our successful trades for clients was buying December cotton several weeks ago on the historic Texas drought, lower U.S. crop ratings, and a rebound in the outside markets. You can see below in my report how my Spider was bullish on cotton a few weeks ago before the massive upward explosion in prices. Feel free to see our track record and different newsletters here: Weather Profits – Best Weather, Inc | Jim Roemer.

We also have several successful soybean option strategies I recommended in the face of other meteorologists calling for doom and gloom heat and dryness a week or two ago, through the rest of August: Wrong!

But… will soybean and corn demand kick in after this grain sell-off? Is it possible corn and soybean yields will be lower, even in the midst of more rains coming to Iowa and the western corn belt? Will La Niña hold on this winter (South American summer) and mean a bull market in grains? If so, how do you play it? That is where we come in helping you sort through all the news and confusion out there.

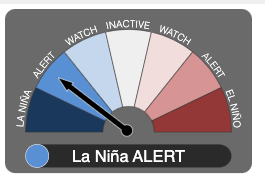

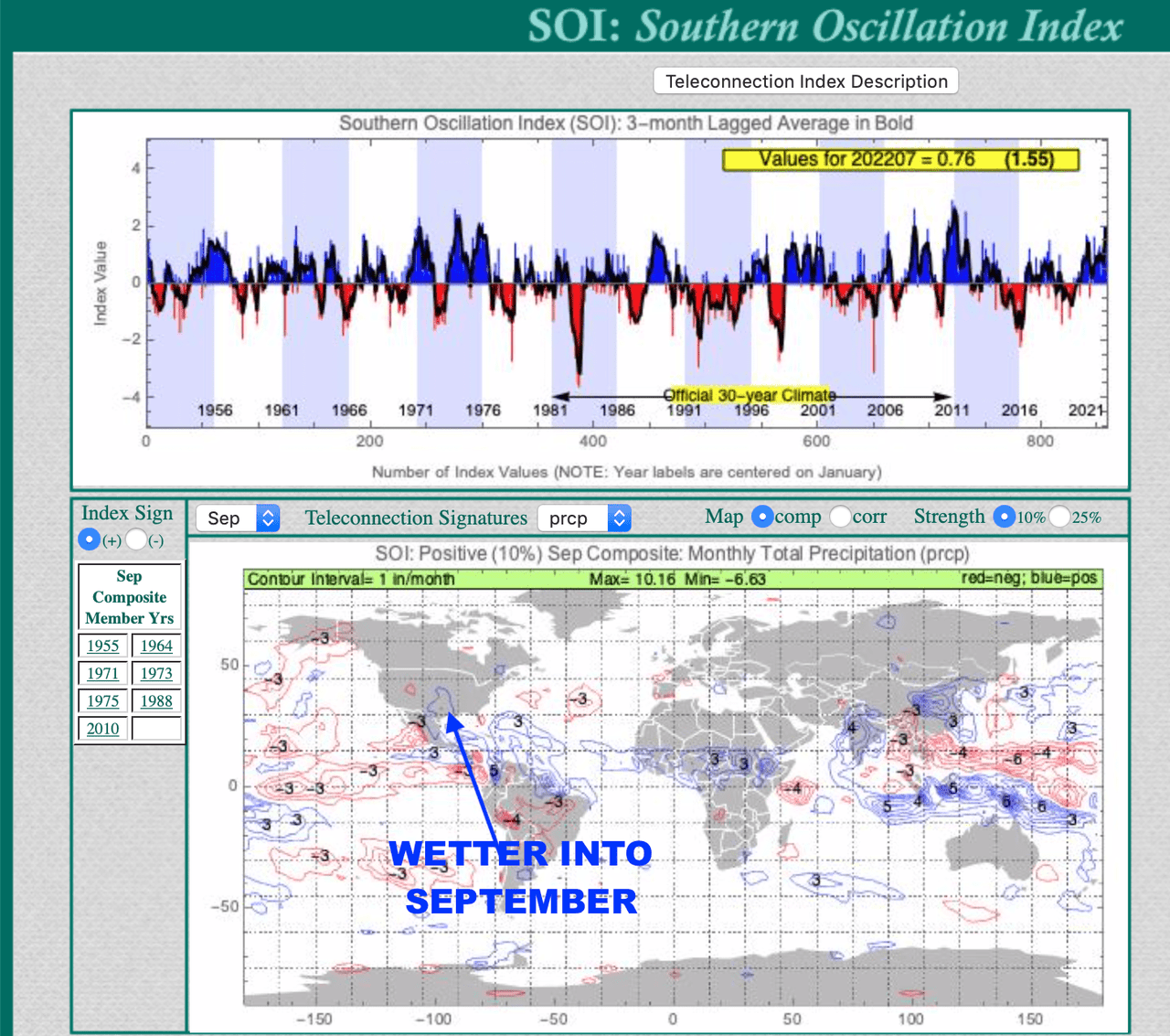

At any rate, we recommended to our clients, after two limit-up moves, to take huge profits on Monday night. La Niña is alive and well and in contrast to some scientists and meteorologists out there, La Niña is NOT weakening and any talk of El Niño is ridiculous at this point. In fact, a new La Niña warning was just issued, something I have been suggesting since last spring.

La Nina is alive and well (Australian Meteorology)

While Texas only produces roughly 5-10% of the world’s cotton crop, a sharp reduction in cotton acreage was indeed confirmed by the USDA last Friday.

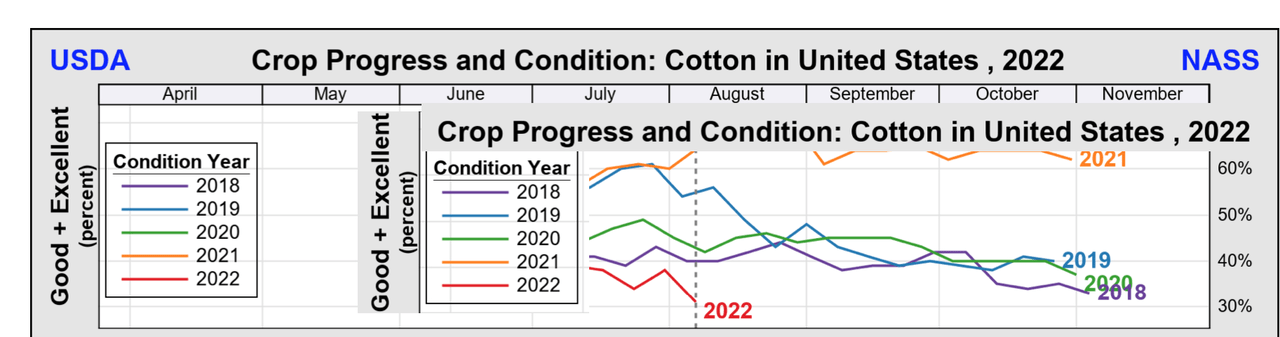

Notice how poor U.S. cotton crop conditions have been this summer due to La Niña.

The recent cotton previously exploded (USDA)

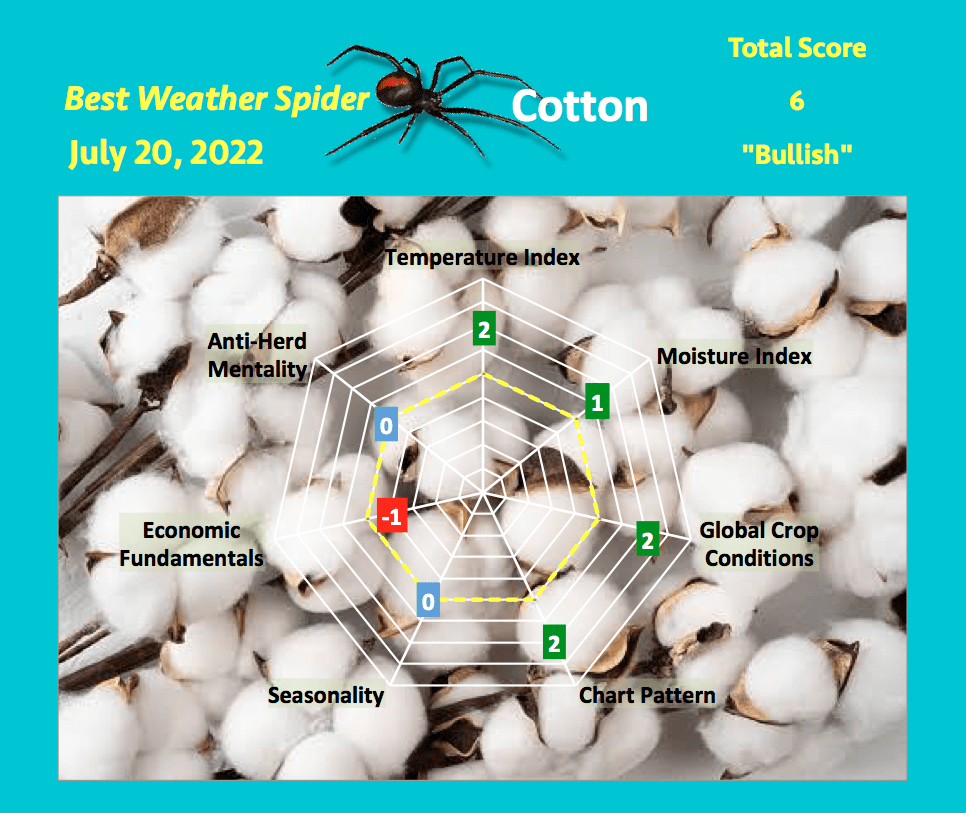

This is why prices soared more than $12,000 a contract in three weeks until Wednesday’s profit-taking sell-off. The “anti-herd mentality” is a -3 currently (bearish), with too many people long the market. This Spider, however, was sent to clients nearly a month ago before the major move-up.

Unique Jim Roemer Weather Spider (Weather Wealth newsletter)

The biggest winning commodity trade of summer in our newsletter (www.bestweatherinc.com)

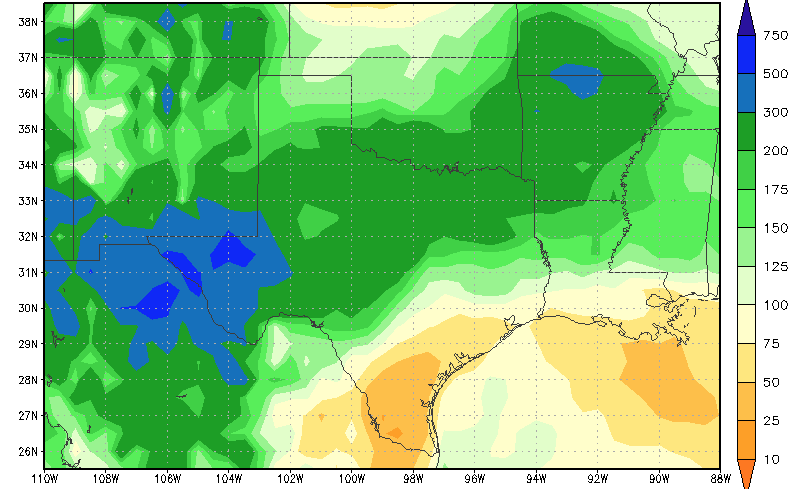

Earlier on Wednesday, I put out a new recommendation in cotton with a change in my Spider and prices collapsed. The reason: notice the drought easing rains predicted for Texas the next week or two with 150-300% of normal rainfall. Of course, these rains cannot change the terrible abandoned acreage situation in Texas, but it will stabilize yields both in Texas and the Delta. Is this just a short-term reaction in an overall bull market?

Drought to ease next 10 days in Texas (Weather Wealth newsletter)

Notice the rainfall forecast from Climate Predict (my in-house analytic software) for late August and September when La Niña is present. In contrast to typical hot, dry summer weather during La Niña events, the trend tends to be wetter in the fall. Part of this has to do with the hurricane season which typically is more active in the Gulf. In fact, we will be watching for one possible storm in the Gulf around August 28th. This may have impacts on energy, natural gas, and cotton trading, later on.

CLIMATE PREDICT WEATHER SOFTWARE BY Jim Roemer (www.bestweatherinc.com)

So… what is our longer-term view and how did we also call the easing of the western corn and soybean belt drought, very early, close to 10 days ago? What kind of strategy positions should you execute?

Conclusion:

We turned more bearish on many agricultural commodities following stellar summer bullish moves. However, markets such as cocoa (NIB) are grossly oversold, and La Nina could mean a potential bull market in (CORN) (SOYB) and other markets if the South American summer has a repeat of global weather problems. For now, using out-of-the-money call options to sell on improved global weather, was our advice over the last week or two for Weather Wealth clients.

Natural gas (UNG) prices will be much more sensitive to weather events later this fall and winter and depending on what La Nina does. Right now, the extreme European summer heat and Russian export restrictions are creating a major bull move in prices.

Be the first to comment