Andrey Mitrofanov

Dear readers/Subscribers,

Tomra (OTCPK:TMRAY), or TOMRA ASA, is a Norwegian company in a very appealing sector. One you should consider really investing in. The company’s primary area of business is Reverse Vending Machines for various sectors. The company has tens of thousands of machines installed across the world, which actually makes Tomra, relatively unknown and Norwegian, a market leader.

Let’s take a look at this market leader and see when you can invest in this business.

Reviewing Tomra AS – What the company is and does

Tomra is rarely – very rarely – anything close to cheap. The company is far too good for that. To give you a picture of where Tomra usually trades in terms of its ADR, the average 5-year P/E is close to 50x – that’s a level that I would never invest in, no matter what the company.

What could possibly justify for the market to even look closely at such a company at such a price?

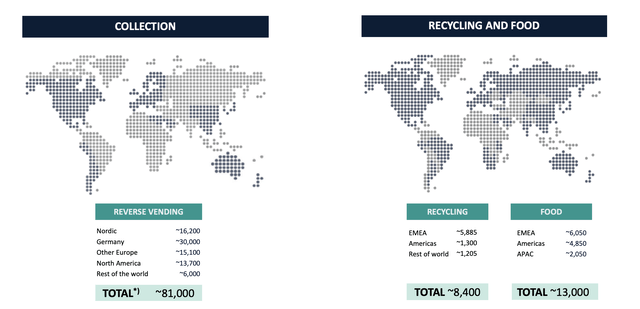

So, Tomra works with Collection, Recycling, and Food. It has 4,600 employees across the world, and it generates annual revenues of close to 11B NOK per year.

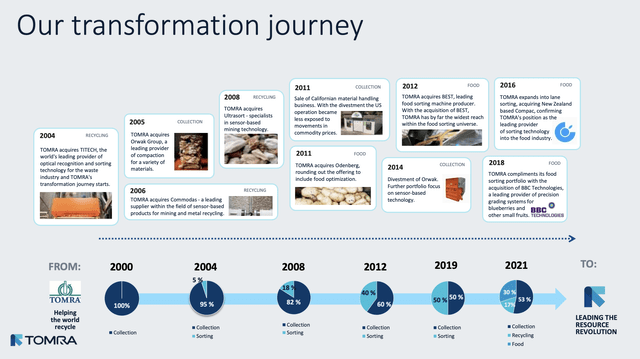

The company’s current journey started around 20 years ago. Someone or a group of people at Tomra had the idea of sensor-based collection technology, and this is what began a transformation from a 100%-based collections company, into what is now also recycling and food.

These three divisions generate a substantial amount of EBITDA – and the revenue/EBITDA splits are very similar, indicating that all of these segments have a relatively attractive overall margin profile.

Products that the company researches, manufactures, and distributes are installed across the world for both segments, across all continents.

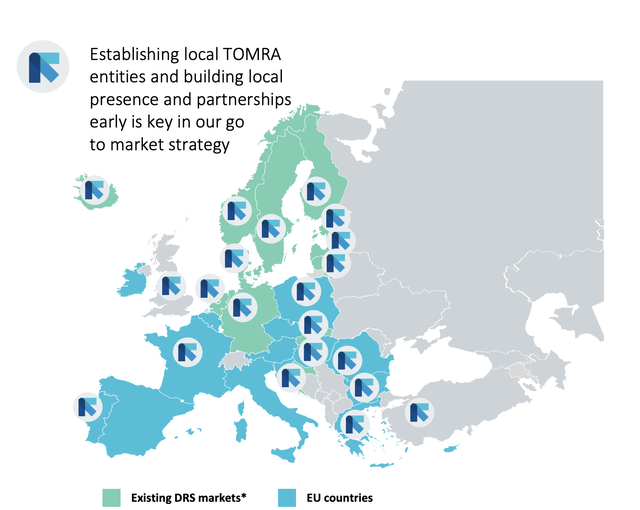

Tomra is the world leader in reverse vending, with 50 years of experience. The company’s products collect 44 billion containers per year and are represented in over 60 nations officially. The company’s main deposit markets are Scandinavian and Benelux/Germany, with nations in the Baltics, Australia, and several US states like Oregon, Cali, Maine, Connecticut, and others starting to adopt the machines – several markets are coming, such as Scotland, Ireland, Austria, Romania, and many others.

The way that the system works, Tomra can actually reinvest so-called unredeemed deposits and material revenue within the system to cover their own costs. In some nations, such as Scandinavia, and the home market of Norway, over 80% of the costs of the system are already covered by unredeemed deposits or/and material revenue.

The company considers the current and coming legislative outlook for initiatives like the ones that Tomra does to be very attractive, and conducive to the expansion of the company’s offerings in most areas. Singapore is becoming the launchpad for Asia, and Tomra is pushing into LATAM as well. EU is probably one of the best geographies though.

The company is a very clear leader in the global reverse vending machine market. Any competitor is significantly smaller in terms of what markets they’re in, and the company has significant, worldwide business expertise to bring to the table in any of the projects they work in. The company has a proven track record with an attractive sales and service model that includes both upfront sales revenues as well as service revenues. The company’s machines have a proven track record in terms of reliability.

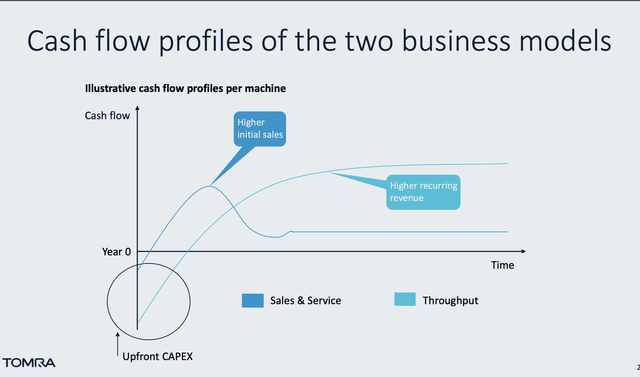

The way the company’s cash flow works is very attractive in terms of initial sales and recurring revenue, with recurring revenue staying high and higher even as the initial sales and service revenue decline to lower levels.

Furthermore, the company has proven the scalability of its business model and is continually improving its models and products which now include things like kiosks, entire centers, automated depots, over-the-counter solutions, and scheme apps.

The company has a clear supply chain which, unfortunately, includes China, but otherwise has a strong Europe focus with the goal of being able to deliver 30,000 units on an annual basis. 500 billion empty containers are handled by TOMRA on an annual basis.

The combination of strong legislative pushes with Tomra already being a market leader, and the good visibility for global moves towards exactly what Tomra is working with – the circular economy, makes the company an absolute blockbuster in terms of investment appeal – at least in theory.

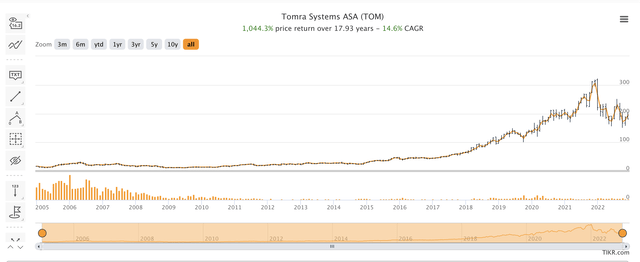

Tomra investors have enjoyed very strong returns. Since 2005, the company’s investors have averaged around 14.6% CAGR to a total of 1044,3%, even with the most recent set of share price declines.

Tomra RoR (Tikr.com/S&P Global)

Tomra does not pay for an S&P, Moody’s, or Fitch rating. Instead, it works with a German company, Scope GmBH, for credit ratings. The company has assigned an A-/Stable rating to Tomra, and while this safety can’t measure up to ratings by the former, it still is a decent sign. I would also point out that Tomra has very low debt, and there is really no fundamental risk to the company worth mentioning. It doesn’t overpay its dividend, and it doesn’t stretch any of its safeties to any particular degree.

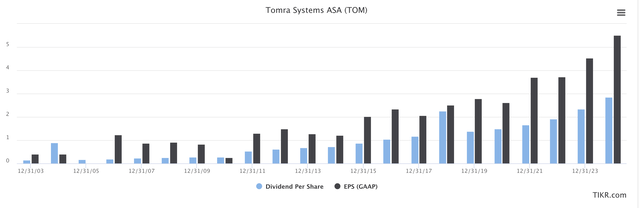

Tomra tries to offer dividend stability and usually does so relatively well. There have been some cuts and freezes, but overall this is a company that wants to reward shareholders and does so.

Tomra earnings/Dividends (TIKR.com/S&P Global)

The current yield for Tomra is as always low, and the company currently yields around 2%. It’s been as low as 1% before, so 2% is actually pretty decent from a historical context – and growth is in the books.

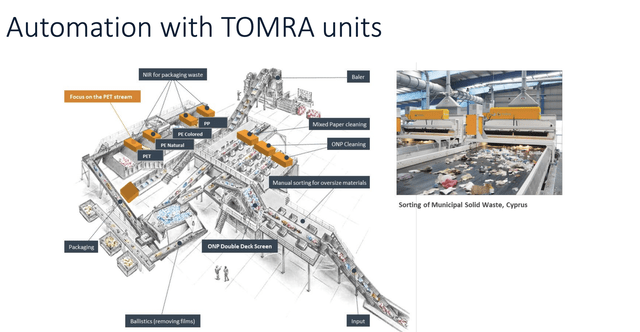

Don’t get the picture that the company only works with smaller units – because the company’s solutions are starting to be integrated into massive sorting systems, like this one in Cyprus.

The company is also working to enter and expand into sensor-based mining in the metal-mining/ore industry, which would be an absolute game-changer for the business and its future appeal. Tomra’s solutions enable the mining industry to rescue its footprint.

Tomra’s solutions “close the loop” for areas like plastic, and are going into textiles, alloys, and even wood.

The simple fact is, Tomra is an opportunity that I missed. I should’ve been investing heavily into the business, instead of small bites. It’s one of those companies I believe you can own, and never really sell (unless we move to insane valuations).

if the company ever dives, I don’t intend to, and I haven’t missed the opportunity.

Those of you that follow my work closely know that my preference or my love for “ESG” is…mild, to put it generously. I don’t particularly care for what I perceive as massive greenwashing that’s currently going on, which I believe in many cases erodes the shareholder value of the underlying companies.

Not so in Tomra’s case. Tomra isn’t greenwashing. Tomra is a profitable business leveraging the current trend for recycling. It doesn’t get a whole lot more attractive or a whole less cyclical than that.

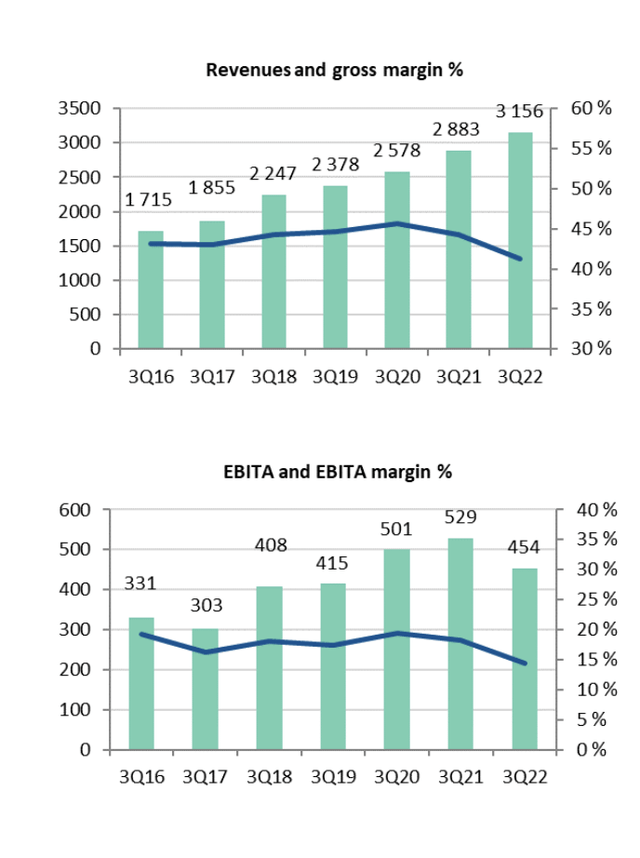

The latest quarter confirms the positive case for Tomra. Revenues continue to grow by 6% for the group, with massive 34% growth in recycling. Gross margins continue to stay above 40%, and while Tomra isn’t immune to CapEx and inflation, it handles it better than most companies do. EBITA is down slightly, and EPS is down slightly, but overall there is stability to company operations. The company has a backlog of over 2.3B NOK at this time, and its delivery performance has stayed absolutely solid here.

Cost inflation is the major headwind the company is currently experiencing – but not to any degree that would hamper the company’s fundamentals – though we are seeing a sharp decline in the margins on a gross basis for the time being.

Let’s see what these trends mean that we should be paying for Tomra ASA.

Tomra’s Valuation

The only reason and I do really mean the sole reason we’re not massively pushing cash into Tomra here is the valuation. With margin drops affecting the company, this also affects how we should discount the business. And the issue really is how high the premium for Tomra is.

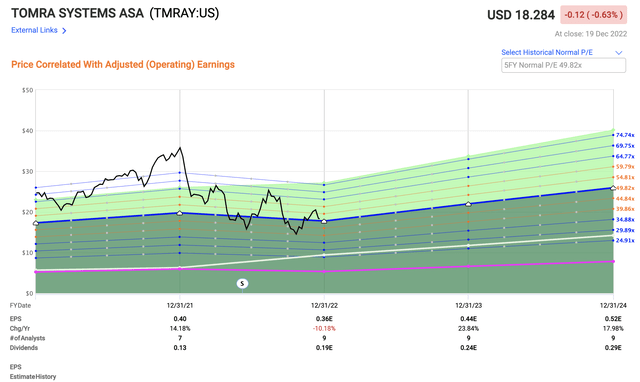

F.A.S.T Graphs Tomra Upside (F.A.S.T Graphs)

As mentioned, the ADR trades at closer to 50x P/E premium on a historical basis, and despite recent normalization, there is no real discount to the business at its current valuation.

What’s more, the ramp-up in EPS isn’t as clear as these forecasts would like to illustrate, given the significant margin pressure we’re currently looking at. Yes, the company is really pushing new segments, so EPS might rise on the basis of sales/mix rather than margins – more with fewer margins, so to speak. But there is some uncertainty baked into things here.

No company is worth 50x. I don’t care what the company is unless it has reliable, visible growth in the several hundred percent ranges – and that’s not where we are.

Some native data. TOM also trades at a P/E of over 40, but not close to 50 – closer to 42x here. That’s still too high. For a company like Tomra, I want to look at the 10-15 year basis, and the mean here is closer to 32x.

30x P/E is something I would definitely pay for Tomra, but I doubt we’ll see that, as that would imply a current share price of around 130 NOK per share. We haven’t seen that in almost 4 years at this point.

We don’t find much guidance help in peers. There are no competitors in the reverse vending machine market that are even close to the same fundamentals or upside. The company isn’t your standard waste management company, so we can’t use those as peers – and even if we did, those valuations are wild with ranges of 15-35x across the world depending on the company.

Analysts have a tough time with this one. they went way too high as the company bounced and targeted 230 NOK/share. A year ago, the mean target was 230 NOK, but the company was trading above 310 NOK. The 6 S&P Global analysts that follow the company do not have a solid history and have mostly considered the business overvalued for almost 2 years at this point.

I agree with this assessment, and I believe the market is in an extended “bubble” for this company. Even considering generous 4-8% EBITDA growth ranges for the DCF, and with the company’s conservative WACC, we get no realistic price target over 160 NOK/share – not that you can make a profit on.

That’s an overvaluation of over 10% at this time as the company’s current share price is 181.

The 6 analysts give the company a target of 163 NOK average, with a high of 203 and a low of 138 NOK. No analyst considers it a “BUY” here – 2 “SELL” and 4 “HOLD” is what we have.

I agree with this assessment.

Here is my current thesis for Tomra

Thesis

- Tomra is a market-leading, world-leading reverse vending machine and recycling business. At the right price, it becomes a “MUST-BUY”, with a holding target that goes beyond the usual, for a superb business model with proven reach and scalability.

- However, anything above 40x P/E is a no-go for this business, and I want it cheaper. I don’t believe 30x P/E is in the possibilities, but 35x is the most I will pay.

- This comes to a PT of around 150-160 NOK/share normalized, depending on how you average out earnings and expectations. I go for a 155 NOK PT here, which makes the company overvalued.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.’

The problem is that Tomra doesn’t fulfill my valuation-specific requirements. That makes this investment a no-go here.

Be the first to comment