Prostock-Studio/iStock via Getty Images

Ellington Financial is a hybrid mortgage REIT that has garnered interest among readers with its fairly high, monthly yield and its general resiliency over the years to different economic environments. With shares 20% off of their 52-week highs, I thought it warranted a look to see if it was worth picking up as part of an income portfolio.

Recent EFC Performance (Finviz)

Colorado Wealth Management Fund covered (NYSE:EFC) back in October 2020, where he concluded that the stock was “okay”. I couldn’t agree more. Below we’ll cover the good, bad and “meh” about Ellington Financial.

Assets

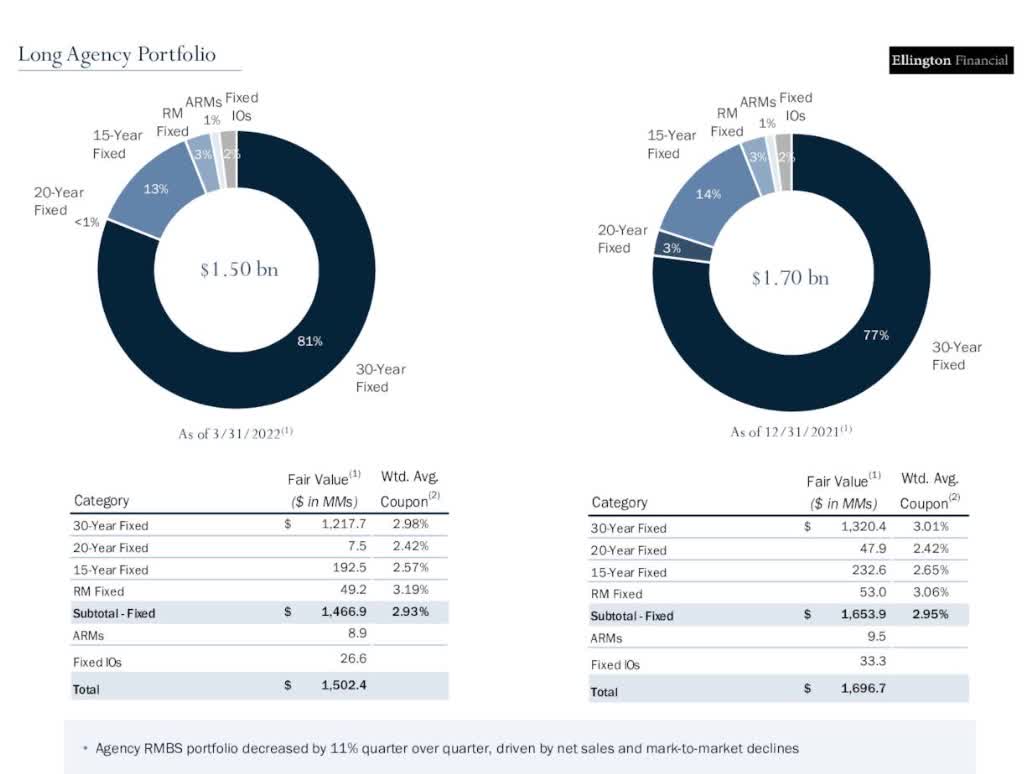

EFC Agency RMBS Portfolio (Q1 22 Investor Presentation)

To briefly recap their operations, EFC has two main branches of assets, credit and loans, which are primarily 30 year fixed agency RMBS. They have exposure to other assets through their credit portfolio, such as CLOs, CMBS, consumer loans and some small equity investments. I prefer hybrid REITs for this diversified approach that can help mitigate one specific asset encountering problems, instead of pure play mREITs facing big declines in their RMBS portfolios lately.

Earnings Recap

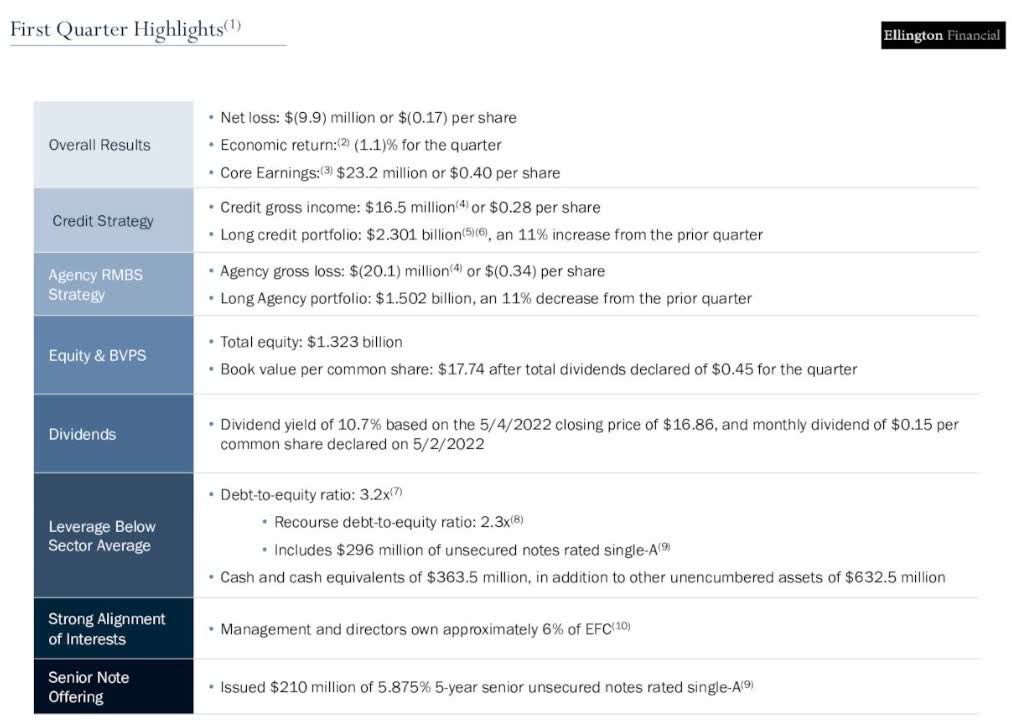

Q1 22 Earnings (Q1 22 Investor Presentation)

First quarter earnings results were pretty underwhelming due to the effect of rising rates on the bottom line. EFC posted a $0.40 core earnings per share which was a decline from $0.44 last quarter and $0.43 year over year. Their credit portfolio performed well and did the heavy lifting towards earnings.

Hedging

The bad news for EFC is that this is exactly the wrong time to have a big portfolio of fixed rate assets at a low coupon. Their 30 year fixed assets have a tiny 2.98% weighted average coupon, and the increase in mortgage rates by 156 bps during the quarter from 3.01% to 4.67% caused an unrealized loss across the RMBS portfolio of 11%, or roughly $70 million. The 15 year MBS didn’t fair much better, just that there was less of it on the balance sheet. The other assets didn’t have much movement or effect overall.

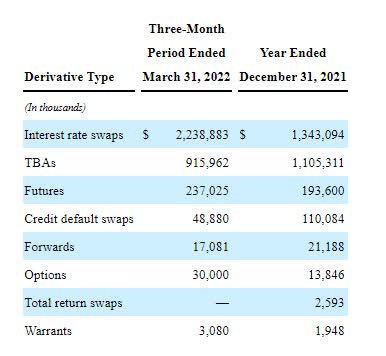

It’s fairly excusable to be caught a little flat-footed here with such a large and sudden increase in rates. To their credit, they do have a rather robust hedging system in place, and they beefed it up during the quarter as can be seen below:

EFC Hedging as of 3/31 (Q1 22 Investor Presentation)

Since at least 75% of their assets are fixed rate, it becomes imperative to institute some form of hedging. I think companies such as New Residential (NRZ) have the better business model of hedging earnings through diverse operations and holdings with various rate sensitivity. Instead of doing that, EFC is much more simple and aims to hedge book value through many different instruments. The natural question would be just how much effect their hedges are, and if they are net long or short overall.

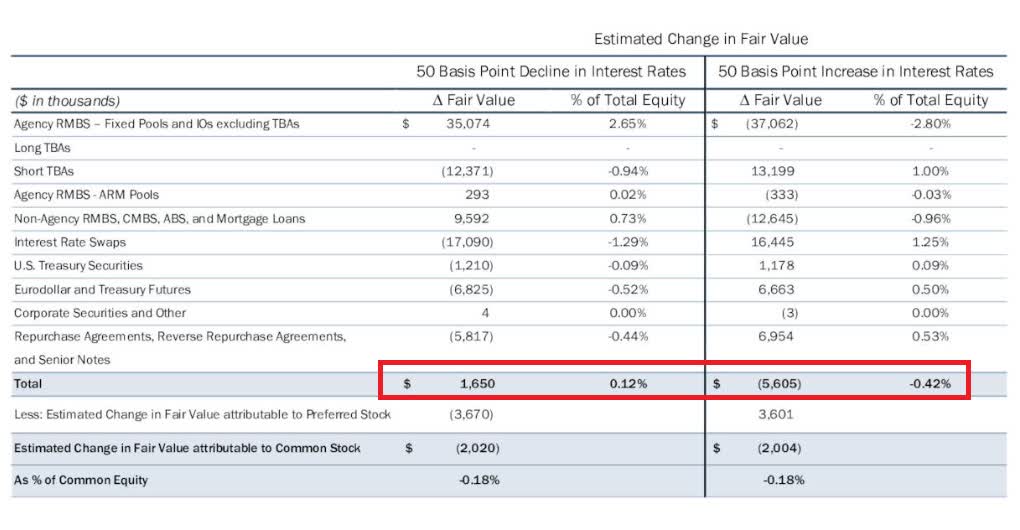

EFC Interest Rate Sensitivity for BV (Q1 22 Investor Presentation)

The vast majority of their book value is now hedged from March 31st forward, and it is now essentially interest rate agnostic. Since this wasn’t fully in effect at the beginning of last quarter when the big moves started, we saw book value drop pretty significantly from a recent high of $18.39 in January to $17.74 at March 31st, to the most recently released estimate of $17.10 in May. Subsequent to quarter end, EFC issued 383,700 shares through their ATM, but that would not have that large of an impact to justify the further drop. Since we don’t have any more filings since then, we don’t know exactly what the further decline was due to. If the hedging system is as good as advertised, then perhaps it was a write-down in some of their other assets, such as writing off some loans in their credit operations for example. We will have to wait and see.

Discount to Book Value

One of the often touted strengths of the bull argument is the company’s discount to book value. However, discounts and premiums to book value only matter in a few situations. Buying at a discount or avoiding paying a premium only makes you look smart if those valuations normalize towards book value. Main Street Capital (MAIN) and Realty Income (O) have enjoyed large premiums to estimated book value / NAV that have always been above 1.5x and could be often found closer to 2x book. EFC has almost always traded below book value except for the week before COVID and May to July 2021. Before that, it was briefly in 2014 when it touched 1.02x for a week.

EFC Price to Book Value (Seeking Alpha)

Of course it’s better to buy assets at a discount. However, I just wanted to point out nearly every Seeking Alpha news update with the new book value estimate has comments saying that it’s a great deal because shares are selling below book. Instead of focusing on if the discount is 10 or 15%, I urge investors to care more about if book value is going to drop by 7% in the last 4 months. I can’t recall what the recent price to book of NRZ is, but I know that BV is going to be even higher next earnings report because they are quite positively sensitive to rising rates.

One of the other situations that matter when dealing with price to book valuation is with share issuance and buyback. Issuing shares at below book value is destructive to shareholder value assuming that your investments are of average quality. Issuing shares at a premium is conversely very accretive, which is why richly valued and low yield equity REITs have consistently outperformed.

EFC issued 5.75 million shares in the fourth quarter of 2021, and hopefully they did it early, because after November 1st their price to book steadily dropped to a low of 0.86x towards the end of the quarter. I’m not accusing them of being bad stewards of capital, but you have an externally managed REIT that gets paid a 1.5% compensation fee based off of total equity that also habitually trades at a discount to BV. I’m not saying it’s not common, but it sours my view on discounts unless there is reason to believe that they will be disappearing over time or that dilution won’t occur.

Dividend

The majority of the people who own this stock don’t care about small movements in book value or share price, they care about the income produced by the dividend payouts. As someone who heavily invests in CLO equity I can appreciate that method of thinking. While EFC did not cover their $0.15 monthly dividend for the past two quarters (earnings of $0.44 and 0.40), they have in the past and they were still in the ballpark. In addition, EFC is floating a lot of cash right now mainly due to selling some investments and issuing the $210 million of 5.875% 2027 notes. They had $363 million in cash, or about $6.30 per share. Compare that with the fact that dividends paid per quarter are only $11.6 million. They can afford to IOU $1.2 million this quarter from the balance sheet to cover the shortfall.

Since the majority of that cash can be invested into assets that are way better priced and yielding compared to their current investments, I view most of the earnings problems as temporary issues. Just understand that EFC should not be quite as deserving of SWAN status as some investors would like to think.

Summary

Ellington Financial is a relatively simple hybrid mREIT with a strong hedging and a conservative focus. There will be quarters that will impress you and recent quarters that will not. I would rather own New Residential for their strong complementary and flywheel operations business units, or CLO equity funds like Oxford Lane Capital (OXLC) or Eagle Point Credit (ECC) for their strong cash flow and dividend. A usually-covered 11.5% yield just doesn’t adequately compensate you for the risks or the lack of growth. There are better choices out there.

Be the first to comment