narvikk/E+ via Getty Images

In the modern era, both the construction and agricultural industries require a significant amount of equipment in order to flourish. Equipment can make a huge difference when it comes to remaining competitive in a global market. And one company dedicated to making sure that these players can succeed is a firm called Titan Machinery (TITN). In recent years, Titan Machinery has succeeded in growing its top line and expanding from a cash flow perspective. And to top that all off, shares are trading at levels that look reasonable on an absolute basis, even as they might look pricey relative to some of the competition.

A focus on equipment

Today, Titan Machinery describes itself as an owner and operator of a network of full-service agricultural and construction equipment stores spread across the US and Europe. Its current business model includes selling new and used equipment, selling parts for that equipment, offering equipment repair and maintenance services, and providing equipment rental and other related activities. Equipment includes machinery and attachments that are used for large-scale farming, as well as for other activities like home and garden purposes. In addition, it offers construction equipment that includes heavy construction machinery, light industrial machinery that is used for commercial and residential construction, and road and highway construction products. According to management, the sale of new and used equipment comprised 72% of the company’s overall revenue during its 2021 fiscal year. Parts sales made up a further 17.3% of revenue, while equipment repair and maintenance services made up 7.6%. The last 3.1% of revenue was attributable to equipment rental and other related business activities.

It does all of this through three key operating segments that had a combined 109 stores (75 in the US and 34 in Europe). The largest of these segments, at the end of its latest completed fiscal year, was called Agriculture. This made up 62.8% of the company’s overall revenue in that fiscal year. And it accounted for substantially all of the pretax profits the company generated. The next largest segment is called Construction. According to management, this segment made up 21.7% of overall sales in 2021. And finally, we have all of its miscellaneous activities that it sells to customers globally through the International segment. This made up 15.5% of sales in 2021.

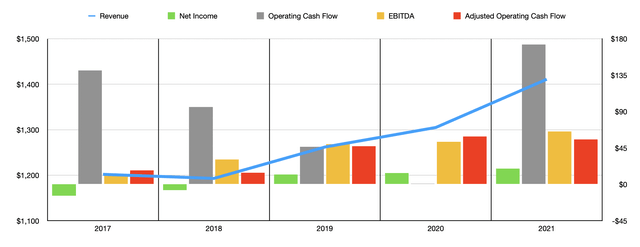

Author – SEC EDGAR Data

Over the past few years, management has succeeded in continuing to grow the company. Revenue increased from $1.20 billion in 2017 to $1.41 billion in 2021. As a result of this expansion and revenue, the company went from generating a net loss of $14.2 million to generating a profit of $19.4 million. But net income is not the only metric we should pay attention to. Operating cash flow is also important. As the chart above illustrates, this metric has been all over the map in recent years. But if we adjust for changes in working capital, the trend has been much more consistent, with it rising from $17.3 million in 2017 to $55.6 million in 2021. Also during this timeframe, EBITDA expanded, rising from $11.7 million to $65.4 million.

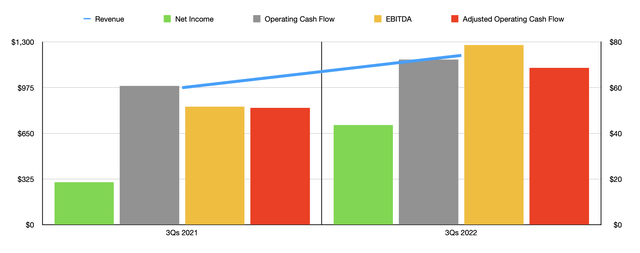

Growth for the company has been really impressive for its current fiscal year. In the first nine months of its 2022 fiscal year, for instance, the company generated revenue of $1.20 billion. That represents an increase of 23.6% over the $974.5 million generated one year earlier. Net profits jumped from $18.6 million to $43.6 million. Operating cash flow expanded from $60.8 million to $72.3 million, while the adjusted equivalent grew from $51.1 million to $68.6 million. And finally, EBITDA expanded, rising from $51.7 million to $78.6 million.

Author – SEC EDGAR Data

For the 2022 fiscal year, management has provided some guidance for investors. For instance, revenue for the Agriculture segment should rise by between 23% and 28%. Construction revenue should grow from between 2% and 7%. And International revenue should grow by between 35% and 40%. Investors should keep in mind that at least some the company’s growth should be achieved over time and will be due to acquisitions the company makes. The latest of these, announced in October of last year, was of a company called Jaycox Implement. According to management, this particular purchase will bring in annualized revenue for the company of about $91 million. Due to the strong performance, the company is anticipating earnings per share of between $2.40 and $2.60. At the midpoint, this would imply net profits of $56.5 million. If we annualize other profitability metrics, then operating cash flow should be around $74.6 million, while EBITDA should be around $99.4 million.

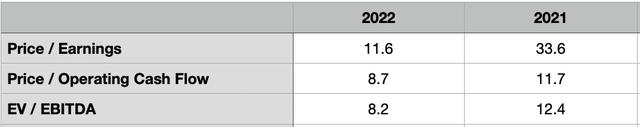

Author – SEC EDGAR Data

Taking these figures, we find that shares are trading at pretty cheap levels. The company is trading at a forward price to earnings multiple of 11.6. This compares to the 33.6 reading we get if we rely on the 2021 figures. Other year-over-year comparisons are much closer, with the price to operating cash flow multiple falling from 11.7 if we rely on the 2021 data to 8.7 if we rely on the 2022 estimates. Over the same window of time, the EV to EBITDA multiple of the company should drop from 12.4 to 8.2.

To put this all in perspective, I decided to compare the company to the five highest-rated of its peers as defined by Seeking Alpha’s Quant platform. On a price-to-earnings basis, these companies ranged from a low of 2.8 to a high of 12.5. Four of the five companies were cheaper than our prospect. On a price to operating cash flow basis, the range was 4.3 to 13.1. And using the EV to EBITDA approach, the range was 2.8 to 13.5. On both of these latter cases, three of the five companies were cheaper than Titan Machinery.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Titan Machinery | 11.6 | 8.7 | 8.2 |

| BlueLinx Holdings (BXC) | 2.8 | 6.4 | 3.2 |

| Veritiv Corporation (VRTV) | 12.5 | 13.1 | 9.9 |

| Marubeni Corporation (OTCPK:MARUY) | 6.1 | 4.3 | 13.5 |

| Boise Cascade Company (BCC) | 4.9 | 5.3 | 2.8 |

| Hudson Technologies (HDSN) | 7.3 | N/A | 6.3 |

Takeaway

Based on the data provided, I must say that I am quite impressed with the performance Titan Machinery has achieved recently. Although the company does have some volatility, the general trend has been bullish. Add on to this the fact that shares are trading at reasonable levels on an absolute basis, even if we revert back to performance seen in 2021, and I believe it’s not a bad prospect to consider even though I wouldn’t necessarily classify it as a ‘buy’ opportunity just yet.

Be the first to comment