SimonSkafar

Looking for some winners? Plug into the hot Utilities sector. Amid a year of volatility and rising interest rates, investors have sought safety in the low-beta niche of electric utility companies. This part of the market, less than 5% of the S&P 500, returns cash to shareholders through a high dividend yield. Low-duration assets have generally been good to own in 2022, and Utilities, while they are often seen as a bond substitute, are actually not very rate sensitive since they return capital to shareholders through strong and usually stable dividends. One regional utility is the sector’s second-best YTD performer and closed last week at a fresh all-time high.

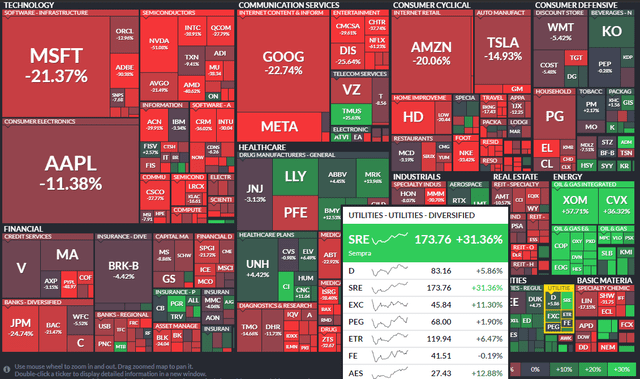

2022 S&P 500 Performance Heat Map: SRE A Winner

Finviz

According to Bank of America Global Research, Sempra (NYSE:SRE) is a natural gas and electric transmission and distribution company headquartered in San Diego, CA. Operations are divided into three segments: the California Utilities, Texas Utilities, and Sempra Infrastructure Partners (Gas, Power, and Renewables). The California Utilities (South California Gas Company and San Diego Gas and Electric) distribute gas and electricity to approximately 25 million customers in Southern California.

The California-based $55 billion market cap Multi-Utilities industry company within the Utilities sector trades at a high 48.8 trailing 12-month GAAP price-to-earnings ratio and pays a 2.6% dividend yield, according to The Wall Street Journal.

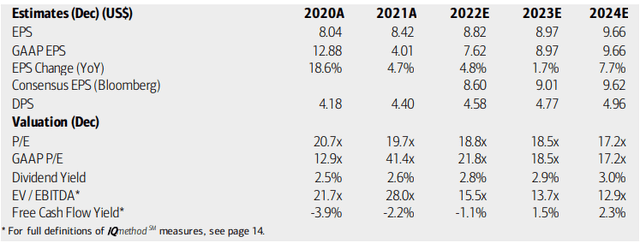

On valuation, BofA sees strong 6-8% EPS growth by way of its presence in the California and Texas regulated utility markets. Big upside potential is seen through its developing LNG export facilities in North America – that could be a tremendous bull market over the coming years as Europe and Asia demand energy via LNG.

While SRE’s GAAP P/E is high, it trades at a more reasonable 18.8 times 2022 forecast operating earnings, and dividends are seen as increasing through 2024. Sempra’s EV/EBITDA multiple is high for a utility and its free cash flow yield is around 0%, which is also not great. So, the valuation picture is not ideal, but there are growth opportunities that warrant a premium.

Sempra: Earnings, Valuation, Dividend Forecasts

BofA Global Research

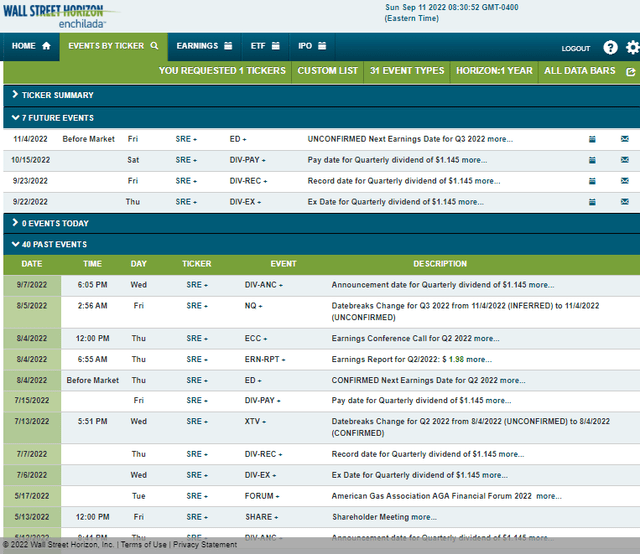

Looking ahead, corporate data provider Wall Street Horizon has a Sept. 22 dividend ex-date ahead of its Q3 2022 unconfirmed earnings date of Friday, Nov. 4 BMO.

Corporate Event Calendar

Wall Street Horizon

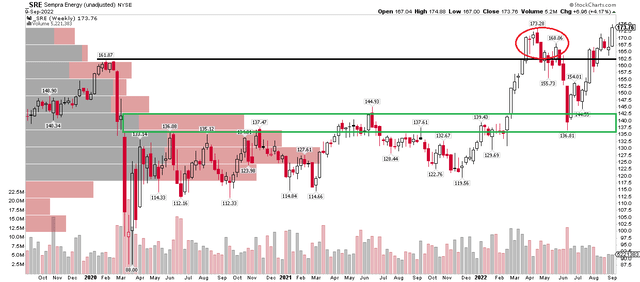

The Technical Take

Technicians have to like what they see when glancing at the chart of SRE. After a bearish false breakout during the second quarter, the stock pulled back big from $173 to $137 at the June low. The bulls dusted themselves off and brought shares to fresh all-time highs to close out last week. A strong earnings report back on Aug. 4 helped. Notice how there was ample volume by price in the mid-$130s, which helped to provide support during the summer.

Based on a cup and handle pattern breakout, I have a price objective to the $200 to $205 range. The strong relative performance and solid absolute price chart help support a bullish technical thesis. A stop below the August low makes sense, perhaps $162.

SRE Stock: Bullish Cup & Handle Breakout To All-Time Highs, Eyes $200

Stockcharts.com

The Bottom Line

Sempra shares look good here. While not incredibly cheap for a Utilities sector company, there are unique growth opportunities with its LNG exposure and the technical chart is good, along with very impressive relative price strength this year. I see the stock going to $200 before long.

Be the first to comment