HomoCosmicos/iStock via Getty Images

While we’ve seen margin compression across many sectors due to inflationary pressures, the gold producers have been hit the hardest, impacted by a decline in the price of their commodity coupled with higher costs (labor, fuel, cyanide, steel, power). Fortunately, for K92 Mining (OTCQX:KNTNF), the company operates a high-grade and relatively low-volume operation. In addition, the company is on track to triple production over the next four years if it can execute its Stage 3 Expansion successfully.

So, while it isn’t immune from the pressures felt sector-wide, it has considerable claw-back ability relative to peers, with the denominator on its production set to skyrocket. It also doesn’t hurt that the company’s development rates and plant performance are well above budget, providing confidence in its ability to potentially benefit from capacity well above initial expectations (1.70+ million tonnes per annum with two mills vs. 1.4 million tonnes per annum). Given the company’s industry-leading organic growth profile & ability to deliver on promises, I see it as a top-12 gold producer.

Kainantu Mine (Company Presentation)

Production & Sales

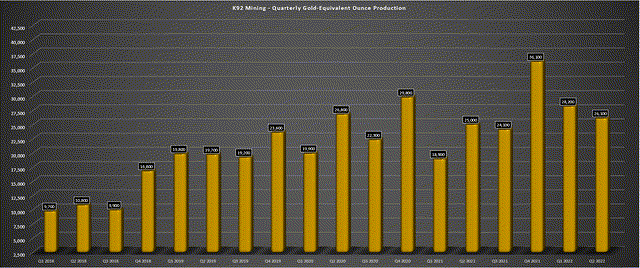

K92 Mining released its Q2 financial results last month, reporting quarterly production of ~26,100 gold-equivalent ounces [GEOs], a nearly 5% improvement from the year-ago period. However, the headline result didn’t do the Q2 performance justice. This is because both mine/mill throughput hit new records, and development meters are tracking well ahead of budgeted levels (+ 38%). Notably, the company saw new records for mill throughput reached in Q3, with multiple days above 1,600 tonnes per day (~580,000 tonnes per annum annualized), above the design capacity.

K92 Mining – Quarterly GEO Production (Company Filings, Author’s Chart)

Some investors might be a little put off by the H1 production of ~54,300 GEOs, which is tracking miles behind the FY2022 guidance mid-point of 127,500 GEOs (~42.5%) and seemingly setting K92 Mining (“K92”) up for no production growth year-over-year. However, with the benefit of mill throughput rates averaging 1,251 tonnes per day in June and potentially averaging 1,400+ tonnes per day in H2 2022 combined with higher-grade stopes, K92 Mining is on track for a strong finish to the year. Assuming the company can deliver into its guidance mid-point (127,500 GEOs), we should see K92’s quarterly production average come in at ~36,600 GEOs in H2 2022 (average), up sharply from a ~27,000 GEO quarterly average in the first half.

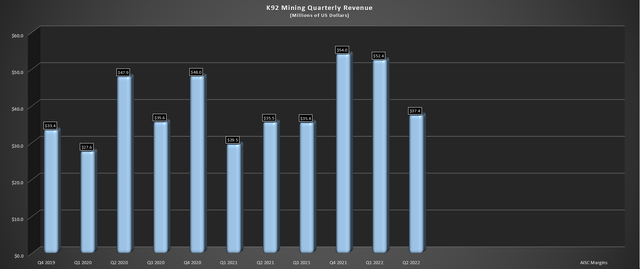

K92 Mining – Quarterly Revenue (Company Filings, Author’s Chart)

Moving over to sales, K92 didn’t get much help from the gold price, with an average realized price of ~$1,780/oz in H1 2022. However, the company saw increased by-product credits from higher copper pounds sold and a sharp increase in gold sales volume, with ~50,000 GEOs sold in H1 2022. This allowed the company to generate H1 2022 revenue of ~$89.8 million, a significant improvement from H1 2020 (fewer headwinds) and a more than 33% increase from H1 2021 levels, an easy period on a comparable basis due to multiple headwinds (travel restrictions impacting ex-pat workers, shortage of bulk emulsion explosives, an incident involving underground loader).

Finally, I’d be remiss not to expand on mine throughput, which hit a record of 114,500 tonnes in Q2, well above plant throughput of 108,900 tonnes. These figures are expected to improve with additional mine equipment to be added to the fleet and a new jumbo and loader that recently landed in Papua New Guinea. From a development standpoint, its inclines #2 and #3 have advanced by 1,276 meters and 1,317 meters, respectively, setting the company up for a significant increase in mining rates to support its massive mill expansion with the addition of a stand-alone mill in line with its Stage 3 Expansion plans.

To summarize, while production may not have hit a record in Q2, a look at progress to date suggests this asset could produce up to 40,000 GEOs in a strong quarter once the Stage 2A expansion is complete.

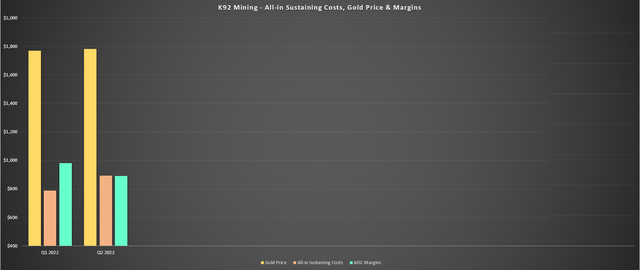

Costs & Margins

Moving over to costs, K92 Mining reported all-in-sustaining costs of $893/oz in Q2 2022, a significant improvement from $1,057/oz in the year-ago period. This was partially due to being up against easy year-over-year comps. Still, these are phenomenal results given that inflationary pressures certainly haven’t eased over the past year, even if productivity has improved as travel restrictions have been relaxed. From a margin standpoint, the lower costs combined with a slightly higher average realized gold price helped K92 Mining to enjoy a 27% increase in margins year-over-year, allowing the company to buck the industry-wide trend of margin compression.

K92 Mining – Costs, Gold Price & Margins (Company Filings, Author’s Chart)

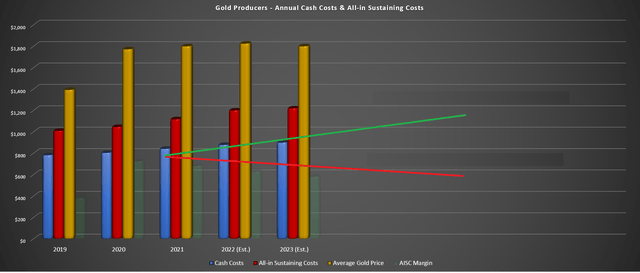

While these margins are well above the industry average AISC margins of ~$600/oz in Q2, there’s further upside to these margins, as I discussed in my previous update. This is because K92 Mining should see its all-in-sustaining costs steadily decline as it ramps up production at its Kainantu Mine, while industry-wide margins could decline again in FY2023 if we don’t see a rebound in the gold price. The reason is that while it looks like we have seen peak costs for some items (cement, diesel, steel), the benefit to all-in-sustaining costs could be offset by the lower gold price year-over-year, and I wouldn’t expect much improvement in labor, the highest input cost for producers.

K92 Mining AISC Margins vs. Database of Producers (Company Filings, Author’s Chart & Estimates)

Fortunately, K92 Mining will continue to buck this trend, with AISC that could dip to sub $650/oz in FY2026 if its Phase 3 Expansion plans meet projections, even after accounting for some inflationary pressures. So, while I would expect K92 Mining’s AISC margins to improve significantly from FY2021 levels even at a lower gold price assumption of $1,750/oz due to its improving cost profile, I would expect industry-wide AISC to increase from $1,120/oz (FY2021) to $1,290/oz (FY2026), pointing to minimal margin expansion for the group as a whole unless the gold price heads above $1,900/oz. Given this differentiator, K92 Mining is less sensitive to cost pressures than its peers.

Obviously, with negative real rates and sentiment for gold in the dumps, one could argue that a gold price of $1,900/oz is a very conservative assumption, and I would agree. In this scenario, or a higher gold price scenario, the inflationary pressures sector-wide are completely offset, and the margin compression we’re seeing across a universe of 70+ producers I track reverses to margin expansion. That said, given that we cannot rely on the gold price, K92 Mining is a defensive way to get exposure to the metal, with the company not needing higher gold prices to increase earnings and cash flow per share significantly. Let’s look at the valuation:

Valuation & Technical Picture

Based on ~237 million fully diluted shares at year-end and a share price of US$5.90, K92 Mining trades at a market cap of ~$1.40 billion and an enterprise value of ~$1.29 billion. At first glance, this may appear to be a very steep valuation for a junior producer, especially when other junior producers like Karora (OTCQX:KRRGF) and Victoria (OTCPK:VITFF) are trading at sub $500 million market caps. That said, while Victoria and Karora both offer growth, K92’s organic growth profile is nearly unparalleled, with the potential to triple production to 350,000 GEOs in 2026 and north of 375,000 GEOs in FY2027 (assuming two mills at full capacity – ~1.75 million tonnes per annum).

Given this incredible growth profile that can be fully funded without dilution following the recent financing (new cash balance: ~$120 million), K92 Mining can easily justify trading at a premium to its peer group. So, with an estimated asset net asset value of $1.96 billion and a P/NAV multiple of 1.0, K92 Mining continues to trade at a discount to fair value (~$1.96 billion), with fair value sitting closer to US$8.30 on a fully-diluted basis. Based on K92’s ability to over-deliver on promises to date and meaningful upside to fair value, this sets the stock up to re-test its all-time highs before year-end 2023 if the gold price can cooperate, translating to a 40% upside from current levels.

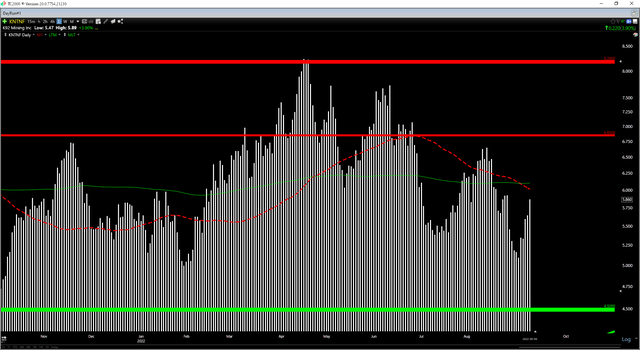

KNTNF Daily Chart (TC2000.com)

From a technical standpoint, K92 Mining has seen multiple key support tests at US$5.35. However, while the recent undercut of this support led to a new low, the bulls immediately recovered their fumble and drove the share price back above this pivotal level. The fact that K92 Mining has been unable to break down despite a violent bear market in the Gold Juniors Index (GDXJ), softening gold price, and a weak general market suggests that the US$4.50-US$5.00 level may end up being the floor for the stock. So, if I were looking to start a new position in the stock, this support zone looks to be the most favorable area to start new positions.

Summary

K92 Mining continues to execute flawlessly, and while H1 production is well below the guidance mid-point, the company should have no issue reporting production of 120,000+ GEOs this year, delivering into guidance. The bigger news is that the company appears to be fully funded for its Stage 3 Expansion and may be able to secure its renewed mining lease ahead of time (October 2024) to take any uncertainty off the table. If we see meaningful progress on these developments (license renewal, progress on construction of Stage 3), I expect to see a test of the prior all-time highs in the stock (US$8.30).

That said, while K92 Mining has a 40% upside to fair value and is arguably a top-12 gold producer, I see more relative value in other names, with names like Karora offering significantly more margin of safety due to share-price underperformance. This doesn’t mean that K92 Mining can’t perform well, but I prefer to invest where I see the best reward/risk, and Karora remains more attractive at current levels (at least in my view). Still, if I was looking for growth in this sector and didn’t mind owning a single-asset producer, K92 Mining remains a top idea on any pullbacks below US$5.00.

Be the first to comment