TBE/iStock Editorial via Getty Images

thyssenkrupp (OTCPK:TKAMY) (OTCPK:TYEKF) is a German industrial icon. Its fortunes are substantially derived from the production of steel, although it has other, less cyclical businesses too. Its FY report shows great EBIT growth, but only because average steel prices for this year closed higher than last year’s, despite a substantial downward trend. China reopening could drop a sluice in front of the declines in the steel prices, but operating leverage means that there is little margin for error. Finally, we think value realisation on Nucera is going to be very limited as the capital markets environment has changed so much. Overall, the 3.46x PE makes sense given the risks.

FY Breakdown

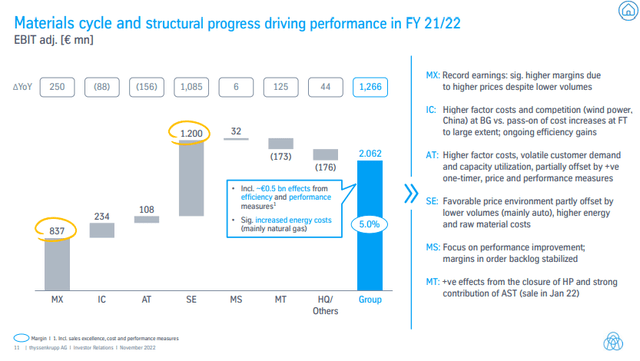

The results show that the SE segment, which is the steel segment, contributed the most to the YoY growth.

This is because most of the 2021 fiscal year saw steel prices at pretty low levels. The real growth in the pricing for steel came once spot prices settled at consistently high levels in 2022.

Steel Prices (tradingeconomics.com)

However, much of the strong steel price environment has dissipated, and as contracts to supply steel from thyssenkrupp roll over into lower prices, profitability is incrementing down trailing the falling spot prices.

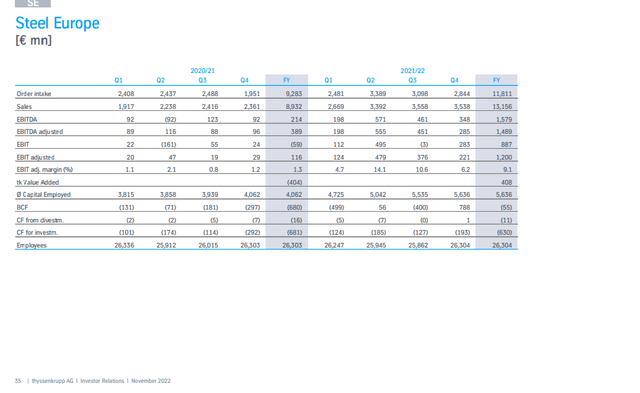

Steel Segment Quarterly (FY 2022 Pres)

Steel is almost 50% of EBIT, so the downward trend is a problem, and hasn’t been helped by the situation in China, which determines global steel prices to a large degree. Reopening there should do something to stop the hemorrhaging, especially as China addresses the problems in the real estate market and with real estate learning.

With steel prices at thyssenkrupp trailing the spot prices, for the next few quarters we expect continued pain from the steel segment, and operating leverage is going to drag heavily on those profits. Currently, there are quite a few long-term contracts that have insulated thyssenkrupp, but in January a bulk of those have to be renegotiated. If the Chinese reopening doesn’t take hold, there will be little leverage to stop price declines.

So, that I mean, I think what we see now is that our sales for the moment is comparatively quiet, okay, because we have this long-term contract. And the next relevant date will be the first of January, where we do negotiate a substantial portion for the next coming longer terms. We’re ready to say something, but of course, it is very crucial to even in this price environment, we are in here to reflect on the factor costs and energy costs we see here.

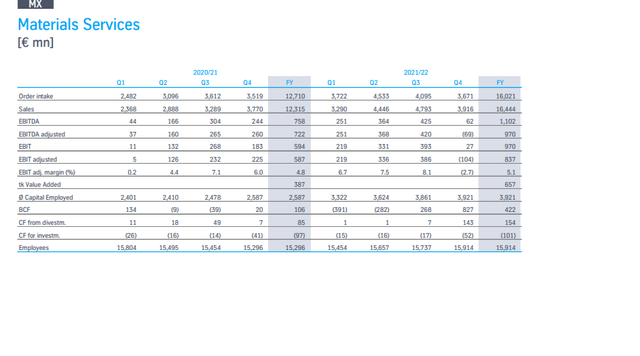

Another big effect on this quarter was a 100 million EUR write-down in inventories related to the materials business. The reason this occurred is because of a sudden drop in demand for inventory that they were dealing with. This should be a one-off, but it does signal volatility in the European demand environment, and that thyssenkrupp’s materials segment can be pretty exposed.

The other segments were performing well, including heavier industrial technology segments.

Bottom Line

thyssenkrupp is not out of the woods. While it’s selling at decent albeit falling price thanks to predetermined deals, they have billions in steel working capital, and this is at risk of being written down, for example, if Europe stays weak and China cannot muster an interventionist recovery. Analysts pointed to the fact that some competitors were shutting down furnaces and writing down steel inventory – thyssenkrupp management admitted that while a more limited risk for them, it is possible. The working capital balances are beginning to match up to the company’s whole market cap. It’s a concern.

Valuation definitely accounts for some of the pressures, with the PE at 3.46x and the market is correct to imply earnings declines. We think they’ll really hit next quarter for the steel segment, and materials have proven to be volatile too.

Materials Segment (FY 2022 Pres)

The last thing to comment on is Nucera, which is their business that is selling electrolysis technology aimed at the hydrogen energy opportunity. They are planning an IPO. We think that capital markets won’t be receptive to pie-in-the-sky opportunities around renewables for a while longer, and that the current crash in venture stocks in particular will have quite long ripples. Even if they do go through with the IPO soon, the payoff won’t be great, and they’re likely to keep a lot of ownership and raise little money. At least the thyssenkrupp balance sheet is in good shape.

Be the first to comment