Ultima_Gaina

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 26th.

Real Estate Weekly Outlook

U.S. equity markets advanced to two-month highs on the Thanksgiving-shortened week as interest rates retreated following further evidence of global economic softness and Fed minutes hinting at a potential pivot. Alongside minutes from the Federal Reserve’s November meeting revealing some willingness to slow the committee’s unprecedented pace of monetary tightening, the revived bid for long-duration bonds and beaten-down rate-sensitive assets was further fueled by a particularly weak slate of global PMI data, a reacceleration in COVID cases in China, and an unexpected jump in unemployment filings ahead of a critical week of employment data.

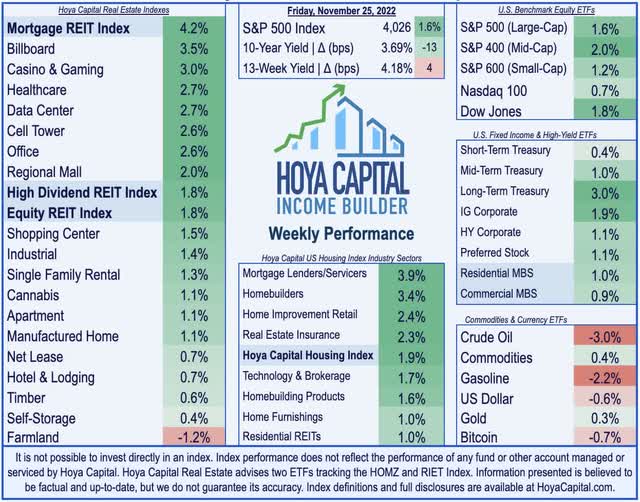

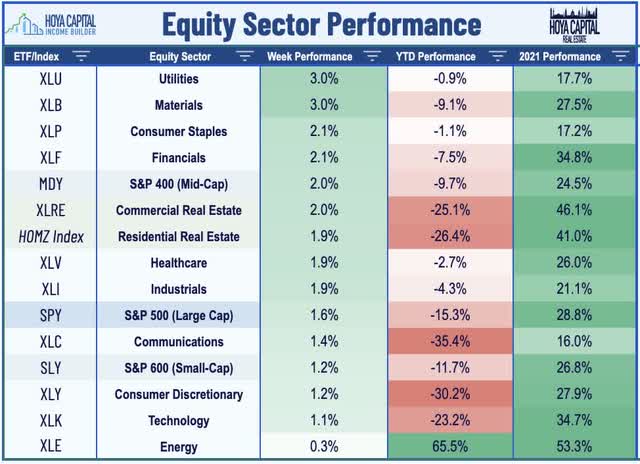

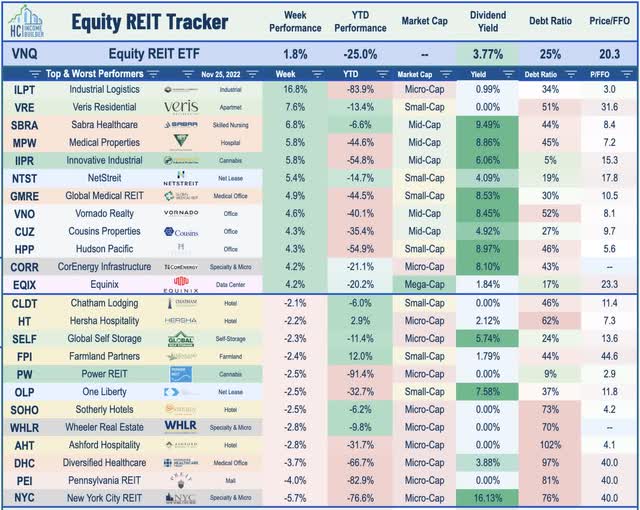

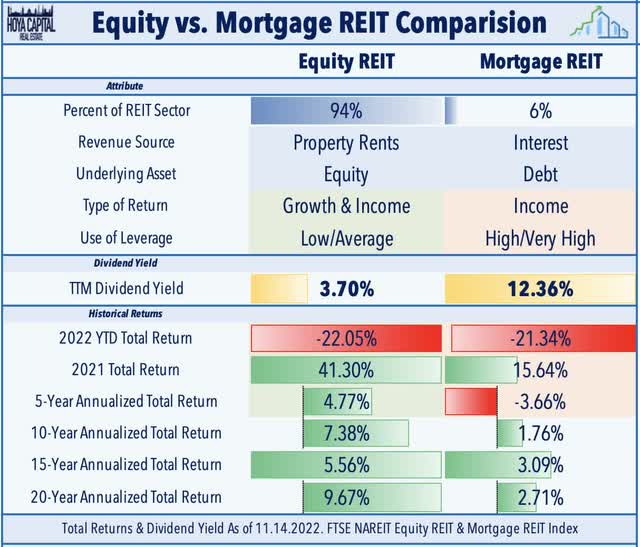

Posting its fourth weekly gain in the past six weeks, the S&P 500 gained 1.6% on the week – extending its rally from its “post-CPI” rally from the October lows to nearly 13% while trimming the benchmark’s year-to-date declines to under 15%. The Mid-Cap 400 rallied 2.0% on the week while the tech-heavy Nasdaq 100 posted more modest gains of 0.7%. Lifted by the retreat in long-term interest rates, real estate equities were among the leaders this week with the Equity REIT Index finishing higher by 1.8% while the Mortgage REIT Index rallied another 4.2%. Homebuilders, meanwhile, advanced more than 3% as mortgage rates fell sharply for a second-straight week, providing some relief to a housing market paralyzed by higher rates.

Softer-than-expected economic data and ever-so-slightly less-hawkish Fed commentary kept downward pressure on the US Dollar Index and pushed the 10-Year Treasury Yield back below 3.70% for the first time since early October, sending the 10-2 Yield Curve back to its deepest inversion since 1982. The CBOE Volatility Index (VIX), meanwhile, fell to its lowest level in more than three months. Renewed COVID concerns in China weighed on global energy prices this week with Crude Oil dipping another 3% – effectively erasing its year-to-date gains which were as high as 60% in late May. Ahead of the peak holiday shopping season, a handful of retailers including Best Buy (BBY) and Abercrombie (ANF) were notable leaders on the week following surprisingly solid earnings results while technology stocks lagged as Google (GOOG) (GOOGL) joined the growing list of tech companies planning major layoffs.

Real Estate Economic Data

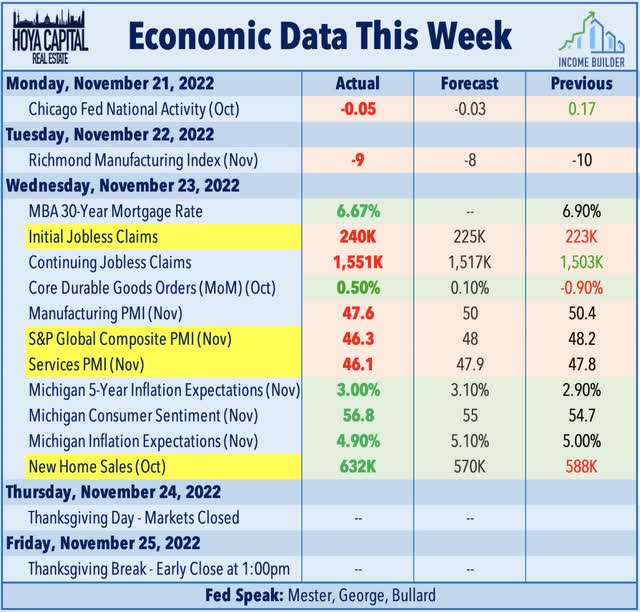

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

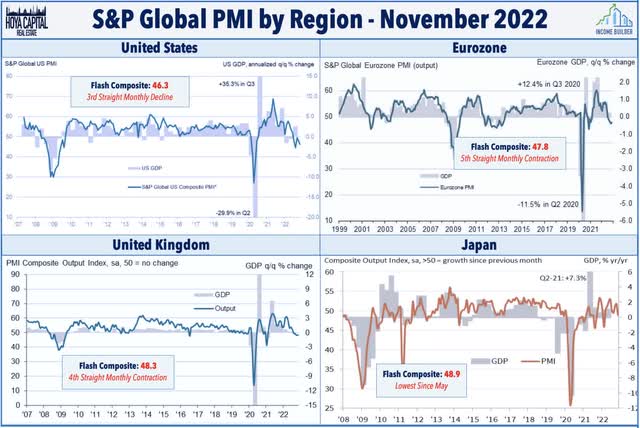

S&P Global released its slate of Flash PMI data this past week for the U.S., Eurozone, and Japan – and it sure wasn’t pretty. The headline Flash US PMI Composite Output Index registered 46.3 in November – the second-lowest reading since May 2020 – as new orders across the private sector fell at the fastest pace since the initial pandemic wave in May 2020. Similar trends of weakening demand were seen across the Eurozone and Japan with essentially every major economy besides Australia now in contraction-territory per Bloomberg’s Global PMI Tracker, a sharp reversal from the synchronized global recovery trends observed earlier this year. On a more positive note, however, inflationary pressures eased further in November. Private sector input cost inflation in the U.S. softened for the sixth-straight month while firms raised their selling prices at the slowest rate in over two years.

There was a bit of good news on the economic data front from an unlikely source – the beaten-down single-family housing sector. The Census Bureau reported this week that New Home Sales rose 7.5% from the prior month to a seasonally-adjusted annual rate of 632,000 – well ahead of estimates of roughly 570k. New Home Sales remain lower by more than 14% on a year-to-date basis, however, on pace for the steepest annual decline since 2011. There may be relief on the horizon for potential homebuyers that have been priced out of the market by the historic surge in financing costs as the 30-Year Mortgage Rate has receded by 50 basis points since peaking earlier this month above 7%, declining to 6.58% per the Freddie Mac Index this week.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

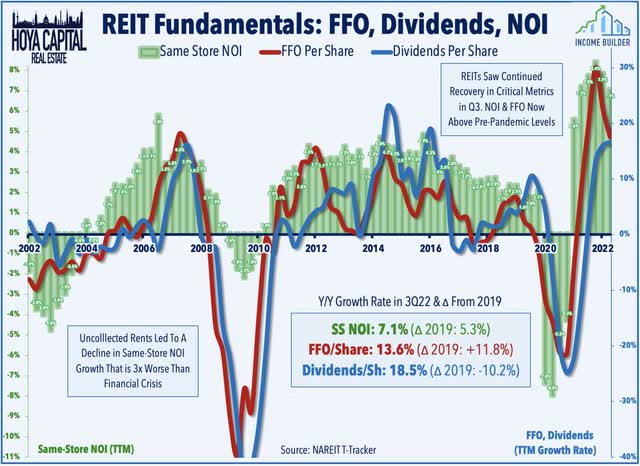

This week, we published our State of the REIT Nation Report, which analyzed high-level commercial real estate fundamentals. Of note, private real estate markets are finally “catching up” to the reality of sharply higher interest rates which have been reflected in public real estate markets for several quarters. Green Street Advisors’ data shows that private-market values of commercial real estate properties have dipped nearly 13% over the past six months after a historically sharp 8% decline in October alone. Due to conservative balance sheet management over the past decade, REITs have been able to “hunker down” during this period of rising rates – avoiding the type of dilutive and high-cost capital raises that were necessary during the Financial Crisis. Obscured by the macro narrative, REIT property-level fundamentals have remained quite strong in recent quarters and have rewarded investors with a historic wave of dividend hikes this year.

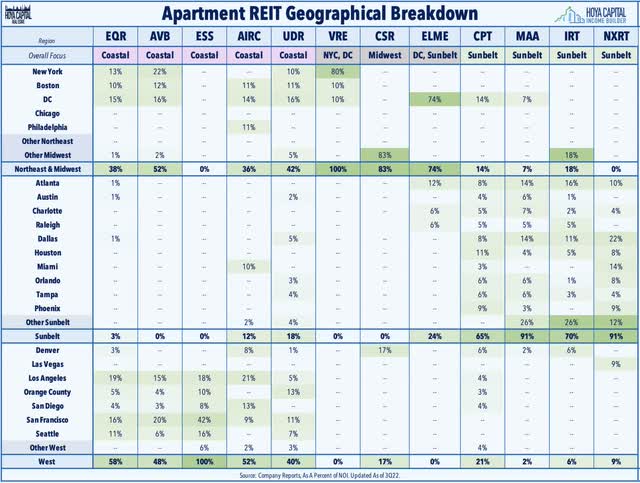

Apartment: M&A news highlighted an otherwise quiet week of REIT-related newsflow. Veris Residential (VRE) rallied nearly 8% on the week following reports that private equity firm Fortress Investment Group agreed to help fund Kushner Company’s unsolicited $4.3B bid to acquire the apartment REIT. Citing a November 17th letter from Fortress to Veris’s board, the WSJ reported that Fortress was prepared to back the debt and equity needed to complete Kushner’s offer to buy Veris for $16 a share offer – an offer that was again rejected this week by the Veris Board, noting that the offer “grossly undervalues the company in its current form.” Separately, Apartment Income REIT (AIRC) traded slightly lower on the week after announcing that it sold its New England portfolio of six communities with 1,314 apartment units for $500 million, representing a roughly 4.4% cap rate. Since the end of 2020, AIR has completed $2.2 billion of property sales as part of its plan to ‘recycle” capital from Coastal markets into faster-growing Sunbelt markets.

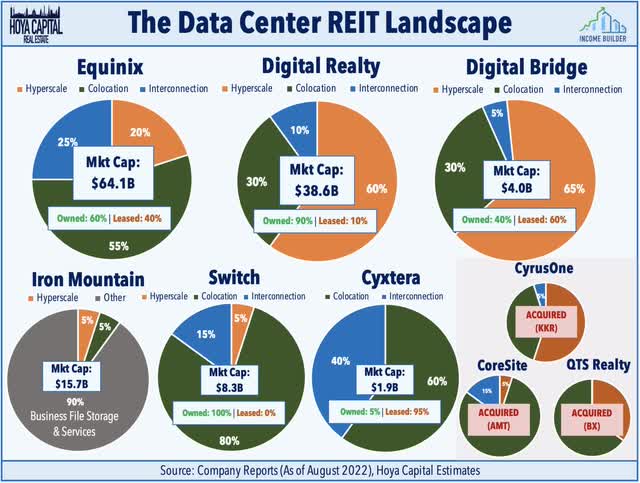

Data Center: Digital infrastructure firm DigitalBridge (DBRG) gained about 3% on the week after it announced that it acquired an ownership stake in Malaysia-based data center operator AIMS for an undisclosed sum and announced a new platform focused on the Southeast Asia region. Digital Bridge – which announced earlier this year that it will shift its focus to an “asset-lite” model focused on investment management and will no longer qualify as a REIT going forward – has been far more active on the M&A front this year than the major data center REITs – Digital Realty (DLR) and Equinix (EQIX) – with several major pending acquisitions of data center operator Switch (SWCH) and cell tower owner GD Towers.

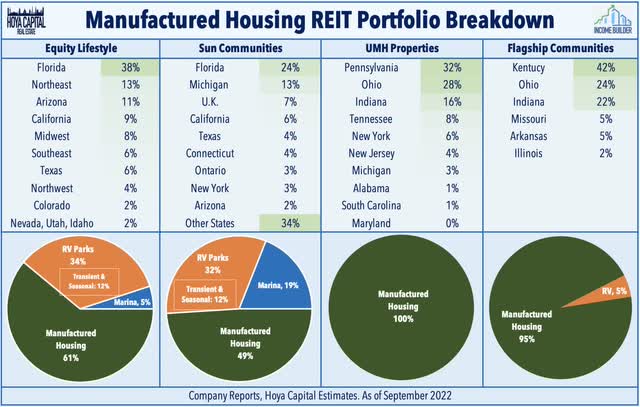

Manufactured Housing: UMH Properties (UMH) advanced about 2% on the week after it announced that it closed on an acquisition of a manufactured home community in Canton, OH for $19.1 million. The community contains 321 developed homesites, of which 77% are occupied and is situated on approximately 170 acres. The acquisition brings UMH’s full-year acquisition total to 1,226 sites for a total purchase price of $63 million. With just over a month to go in 2022, the record-breaking nine-year streak of outperformance for the Manufactured Housing REIT sector is in jeopardy with MH REITs training the broader REIT Index by about 4 percentage points.

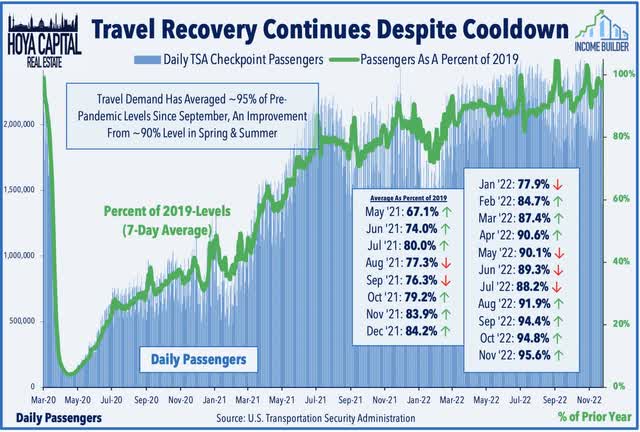

Hotel: Pebblebrook (PEB) was among the better performers this week despite providing a lukewarm operating update which noted that its Revenue Per Available Room (“RevPAR”) in October was 3% below pre-pandemic 2019-levels – representing a slowdown from September when its RevPAR was 5% above 2019-levels. The recovery continues to be driven primarily by higher room rates as a 15% increase in comparable Average Daily Rates (“ADR”) helped to offset a roughly 10% drag from lower occupancy rates. Pebblebrook noted that it “continues to monitor business transient and group bookings in light of the increased number of companies announcing layoffs and expense reductions” but has not yet seen a material uptick in cancellations. Recent TSA Checkpoint data has indicated that domestic travel throughput has remained quite strong into the critical Holiday travel season as a long-awaited recovery in business travel has offset a moderation in leisure demand in recent months.

Mortgage REIT Week In Review

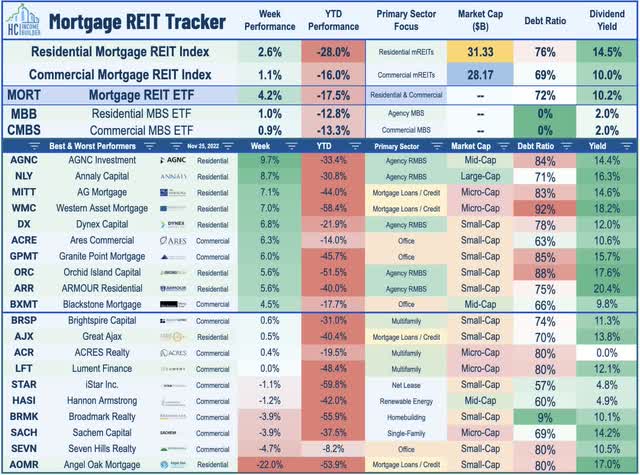

Mortgage REITs continued their recent resurgence this past week with the iShares Mortgage Real Estate Capped ETF (REM) rallying another 4% to extend its rebound from the October 10th lows to 26.8%. While it was a quiet week for mREIT-specific newsflow, Bloomberg reported this week that several major institutions are seeing value in the beaten-down mortgage-backed bond space, quoting several managers which see valuations as particularly “cheap” after the Federal Reserve stepped back from the MBS market. The two largest residential mREITs – AGNC Investment (AGNC) and Annaly Capital (NLY) – rallied more than 8% on the week. On the downside this week, Angel Oak Mortgage (AOMR) dipped over 20% following an analyst downgrade. Elsewhere, iStar (STAR) slipped 1% after providing logistics on its pending merger with its subsidiary Safehold (SAFE), noting that STAR will pay a special dividend of roughly $190M to SAFE shareholders which will be finalized before the Nov. 30 ex-dividend date. STAR will suspend the payment of quarterly cash dividends through the closing of its merger.

Last week we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs – which were left for dead amid a historically brutal year across fixed-income markets – have posted an impressive recovery in recent weeks amid a long-awaited bid for bonds and after earnings results were not as weak as feared. Mortgage REITs are now outperforming Equity REITs for the year on a total return basis, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio. Despite paying average dividend yields in the mid-teens, the majority of mREITs were able to cover their dividends as improved earnings power from wider investment spreads offset book value declines, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

2022 Performance Check-Up

With nearly eleven months of 2022 now in the books, the Equity REIT Index is lower by 25.0% on a price return basis for the year – on pace for its second-worst year of performance behind the 37% declines in 2008 – while the Mortgage REIT Index is lower by 27.7%. This compares with the 15.3% decline on the S&P 500 and the 9.7% decline on the S&P Mid-Cap 400. Within the real estate sector, just one property sector is in positive territory on the year – Casino REITs – and four property sectors are lower by more than 30%. At 3.69%, the 10-Year Treasury Yield has surged 218 basis points since the start of the year, but is well below its 2022 highs of 4.30%. Despite the rebound this past week, the US bond market is still on pace for its worst year in history with a loss of 12.7% on the Bloomberg US Aggregate Bond Index, which is 4x larger than the previous worst year back in 1994 (-2.9%).

Economic Calendar In The Week Ahead

Employment data and inflation data highlight another critical week of economic data in the week ahead headlined by JOLTS and ADP Payrolls data on Wednesday, Jobless Claims data on Thursday and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 200k in November – which would be the smallest gain since December 2020 – and for the unemployment rate to stay steady at 3.7%. ‘Good news is bad news’ will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. On Thursday, we’ll also see the PCE Price Index – the Fed’s preferred gauge of inflation – which is expected to show similar trends of moderating price pressures as seen in the CPI and PPI reports in the prior week. We’ll also see housing market data on Tuesday via the Case Shiller and the FHFA Home Price Index, each of which is expected to show a month-over-month decline in home prices for a third straight month.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment