Michael Vi/iStock Editorial via Getty Images

National security has always been an important topic. But after the 9/11 terrorist attacks, the need for data and the ability to process that data became clearer than it ever was before. One company that developed around that time with the focus of providing software for the intelligence community was Palantir Technologies (NYSE:PLTR). Fast forward to today, and the enterprise is a behemoth in the market, boasting a market capitalization of $25.21 billion. Although the company has been subjected to significant volatility from a share price perspective as of late, management continues to expand the firm on both its top and bottom lines. At present, shares of the business are incredibly pricey. And because of that, investors should tread cautiously. But if management can achieve the targets they set, then it could still make for a reasonable investment for growth investors who are willing to hold on for the long haul. But value investors should tread cautiously given how shares are currently priced.

Palantir – A play on national security

In the eyes of many Americans, you cannot get more patriotic than supporting a firm that is dedicated to preserving the nation’s national security. At the same time, companies like Palantir Technologies have become controversial because of the large portion of America’s population that wishes to reduce human rights issues surrounding US immigration enforcement and privacy rights involving local police departments. Which side is right in this argument, or whether both sides have valid points, is less of a concern for investors than the fact that the firm has done well to establish itself as a valuable player in this market over the years. Although the company is largely focused and has historically been focused on government clients, it does have a large degree of exposure to the commercial market. In 2021, for instance, 58% of the company’s revenue came from its government operations. The remaining 42% was attributable to commercial clients.

Today, Palantir Technologies operates largely through three different software platforms that it developed over time. The first of these is called Palantir Gotham. Its emphasis is on enabling users to identify patterns that might be hidden within datasets that otherwise wouldn’t be easily discernible to the naked eye. It also facilitates in the handing off of this information between analysts and operational users, helping, in effect, operators to plan and execute real-world responses to threats that the platform has identified. Though this platform does focus largely on serving the government, it is also available for commercial customers like those in the financial services industry when it comes to searching for potential fraud.

The next platform that Palantir Technologies developed is called Palantir Foundry. In essence, IT services organizations by taking their data and centralizing it in one place, with the end goal of allowing them to integrate and analyze that data all together. And finally, we arrive at Palantir Apollo. This particular feature involves the delivery, in a timely manner, of the company’s software and updates across its other platforms. Initially, this platform was only available to government clients. But starting last year, the company made it available to commercial customers in order to empower them to securely deploy their own software as needed.

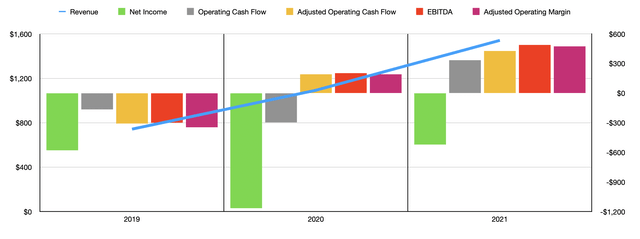

Author – SEC EDGAR Data

Over the past three years, management has done exceptionally well to grow the company’s operations. Back in 2019, for instance, the business generated revenue of just $742.6 million. This expanded to $1.09 billion in 2020 before surging to $1.54 billion last year. What’s really impressive is that, despite its size, management expects the firm to continue expanding at a rapid pace for the foreseeable future. In fact, they currently forecast that revenue will continue to grow at an annualized rate of 30% or higher through at least the year 2025. Taking this at face value, this would imply revenue this year of about $2 billion, with revenue in 2025 totaling $4.40 billion.

How you determine the company’s success on its bottom line would really depend on what you define as profitability. Taking the term ‘profitability’ literally, we would pay attention to net income. By this measure, Palantir Technologies has been a rather volatile company in recent years, as well as a business that simply fails to deliver. In each of the past three years, for instance, the business has generated a net loss. The loss in 2019 was $579.6 million. This ballooned to a loss of $1.17 billion in 2020 before narrowing to a loss of $520.4 million last year.

There are, of course, other ways to measure profitability. And when you consider that a rapidly growing enterprise like this is paying a significant amount to employees in the form of stock-based compensation, it’s reasonable to look at these other metrics instead. Operating cash flow has been a bit better. In 2019, this was negative to the tune of $165.2 million. Although it worsened to $296.6 million in 2020, it eventually turned positive to the tune of $333.9 million last year. If we adjust for changes in working capital and certain one-time adjustments, it turned from a negative $306.4 million in 2019 to a positive $425.9 million last year. Another metric that warrants our attention is EBITDA. This also has followed a favorable trend, going from a negative $298.8 million in 2019 to a positive $488.3 million last year.

When it comes to the company’s 2022 fiscal year, management has only provided one estimate that might help us figure out what kind of cash flow the business could generate. This refers to the adjusted operating margin for the enterprise. Management defines this as the company’s operating income or loss, plus stock-based compensation, plus employer payroll taxes related to stock-based compensation, plus non-recurring direct listing charges. They anticipate this margin to be about 27% of the company’s revenue. This would translate to a figure of about $541.2 million. Using the historical adjusted operating margin for the company, I found that it closely mirrors the company’s adjusted operating cash flow and its EBITDA. Because of this, I feel like it’s appropriate to use this as a proxy for both of those metrics.

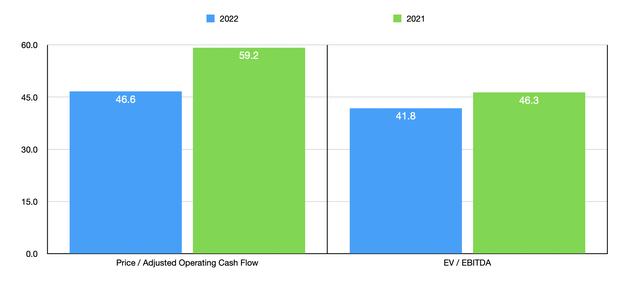

Author – SEC EDGAR Data

Using this approach, we find that shares of Palantir Technologies are incredibly pricey at this point in time. Using the company’s 2021 results, we find that it is trading at a price to operating cash flow multiple of 59.2. Meanwhile, the EV to EBITDA multiple of the company should be 46.3. If, instead, we rely on the 2022 estimates, these multiples are 46.6 and 41.8, respectively. To put the pricing of the company into perspective, I compared it to five other application software companies. Unfortunately, none of these are perfect comparables by any means. But they are probably the best we can get. On a price to operating cash flow basis, these companies ranged from a low of 30.5 to a high of 141.7. Three of the five companies were cheaper than Palantir Technologies. Using the EV to EBITDA approach, the range was from 30.2 to 12,559. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Palantir Technologies | 59.2 | 46.3 |

| ANSYS (ANSS) | 46.1 | 38.9 |

| HubSpot (HUBS) | 84.3 | 12,559 |

| Datadog (DDOG) | 141.7 | 1,638 |

| Salesforce (CRM) | 30.5 | 48.8 |

| Dassault Systems SE (OTCPK:DASTY) | 31.2 | 30.2 |

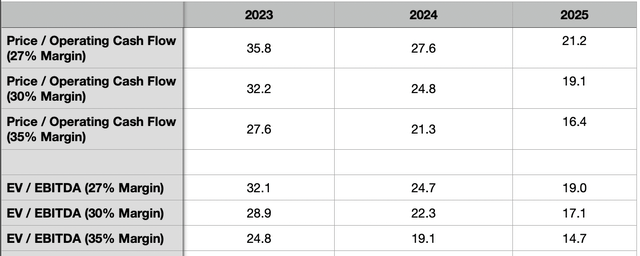

As for the future, the fact that Palantir Technologies is expensive today but is likely fairly priced compared to similar firms, may not be an issue if management can continue growing the company at a rapid pace. To see why this is, I took management’s guidance for revenue for the next few years and, using three different scenarios, priced the business from a price to operating cash flow basis and from an EV to EBITDA basis (again, using the adjusted operating margin as a proxy for both of these). In the first scenario, I assumed that the adjusted operating margin for the business would average the 27% that the company is forecasting for this year. In the second scenario, I’m using the assumption that this margin grows to 30%. And in the final scenario, I assumed that the margin would grow to 35%. It should be mentioned that this margin has been historically volatile. In 2020, for instance, it was just 17%. And in 2021, it averaged 31%.

Author

Using this approach, we find that shares do become cheaper over time. But how much cheaper and how rapidly is the magic question. Generally, using all three scenarios, shares look to be reasonably priced by the 2025 fiscal year. Though if the firm can continue rapid growth, the data for 2024 doesn’t look all that bad either. What this means is that, in order for the company to ultimately be a valid prospect, the firm must maintain strong margins and achieve the growth targets management has set for it.

Takeaway

Based on the data provided, Palantir Technologies seems to be a quality company that is growing at a rapid pace. Having said that, shares of the business are not particularly cheap. Technically, I would argue that they look rather expensive right now, even though they might be fairly priced compared to similar firms. At the end of the day, the only investors who should buy into the company are those who don’t mind volatility and who believe that management can achieve the targets set for it. Anybody who is value-oriented and does not want to rely on such strong growth would be wise to steer clear of the firm at this point in time. Although I can understand investors being bullish on the firm, I myself would not purchase it given my own, value-oriented, approach to investing.

Be the first to comment