Hersson Paul Miguel Estrada/iStock via Getty Images

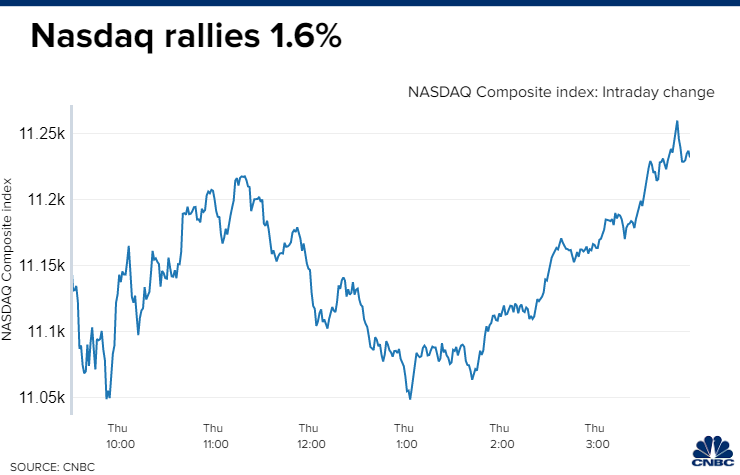

Stocks were volatile yesterday as Chairman Powell testified for a second day before members of Congress. He has become increasingly less confident in the Fed’s ability to tame inflation without bringing an end to the current expansion. In other words, he is admitting that a recession is a distinct possibility. It’s a good thing he has a terrible track record as a forecaster. Do you remember when he said last year that inflation would be transitory? His somber tone and growing recession fears among investors have resulted in sharp declines in interest rates over the past two weeks with the 2-year Treasury yield falling from 3.45% to 3.01% and 10-year falling from 3.49% to 3.09%. Yesterday’s decline in yields gave growth stocks a bid with large-cap technology names leading the market higher, but it was the defensive sectors that hold up best in a recessionary environment that were at the top of the leaderboard.

Finviz

Meanwhile, the cyclical sectors that were outperforming the market up until just recently have been taken to the cleaners. The energy and material sectors have followed the broad decline in the commodity complex with the Energy Select Sector SPDR Fund (XLE) down 25% from its 52-week-high in just 10 trading days. If we do have a recession this year, it will be the most anticipated economic contraction on record. Fears of monetary policy tightening, inflation, and now recession have blasted one segment of the stock market after another. We seem to be in the final stage when the value-oriented cyclical names are taking their turn as the punching bag.

CNBC

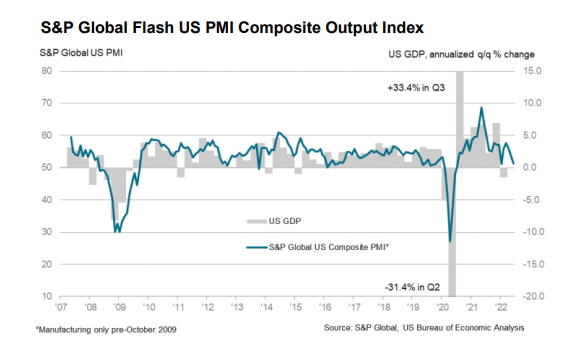

Yesterday’s purchasing managers survey for the manufacturing and service sectors from S&P Global showed a rapidly decelerating rate of economic growth in June, but that is exactly what we want to cool the rate of inflation, and inflationary pressures did subside. It did not indicate the economy was in recession. With 50 being the line of demarcation between expansion and contraction, the composite index fell to 51.2 in June from 53.6 in May.

The U.S. services Business Activity index slowed from 53.4 to 51.6, which was the weakest rate of expansion since January. Both the rate of domestic and export new order growth decreased, and backlogs of work fell for the first time in two years. This resulted in the slowest rate of job creation in four months. Input price inflation remained elevated, but it was the softest increase in five months, which is the silver lining in slower growth. Output price inflation was the softest since March 2021, which is even better.

The U.S. Manufacturing Purchasing Managers Index slowed from 57.0 in May to 52.4 in June, which was the weakest reading in almost two years, due to contractions in new orders and output. Material shortages and delivery delays are still weighing on production and new sales, but the rise in input prices was the slowest since April 2021. Due to the declining backlogs of work, job creation was also the weakest since February.

S&P Global

The tightening of financial conditions and inflation have combined to slow the rate of economic growth to what Chris Williamson, Chief Economist at S&P Global, believes to be less than 1% in June. This is a mission accomplished for Chairman Powell. In order to thread the needle, we now need a catalyst to resurrect the rate of growth in the second half of the year.

I think that catalyst will be a more rapid decline in the rate of inflation than the market or the Fed are now expecting. The plunge in commodity prices over the past two weeks is a critical step in that direction. Unlike prior late-stage periods in the economic cycle, we do not have a demand problem that leads to bloated inventories. We have had a supply problem, but that is being rapidly resolved as supply-chain issues moderate. The recent rise in inventories is deflationary, but it is not associated with a plunge in demand. We are seeing a softening in demand, but not to the extent that it has to result in a contraction in overall growth. Again, unlike prior late stages in the economic cycle, consumers have a record level of savings, solid wage gains, and full employment. That should allow them to endure the current spike in inflation.

If investors take their lead right now from the emotional and dizzying swings in the stock, bond, and commodity markets, I think they will be thrown for a loop. If they focus on the fundamentals, which are far less volatile and tell a different story than markets, I think they will be rewarded later this year. I still see us threading the needle and continuing this economic expansion.

Be the first to comment