8vFanI/iStock via Getty Images

Have you checked out the Business Development Company industry recently? Known as BDCs, these firms lend money to privately held companies, which also have co-sponsors, such as VCs and hedge funds.

We’ve covered several BDCs in our weekend articles recently, and this week we’re covering PennantPark Floating Rate Capital (NYSE:PFLT), a BDC under the Pennant Park Investment Advisors Group platform.

Profile:

PFLT seeks to make secondary direct, debt, equity, and loan investments. It focuses on companies that are owned by established middle-market private equity sponsors with a track record of supporting their portfolio companies.

The fund seeks to invest through floating rate loans in private or thinly traded or small market-cap, public middle-market companies. It primarily invests in the United States and to a limited extent non-U.S. companies. The fund typically invests between $2 million and $20 million. It also has PSSL, a Senior Secured Loan Fund.

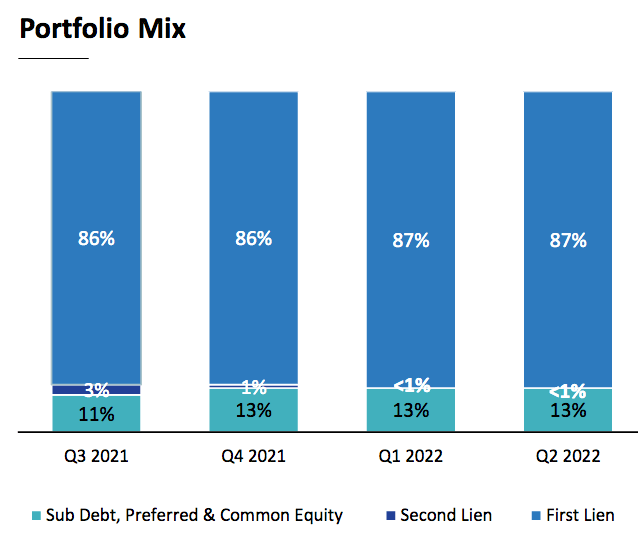

PFLT’s $1.19B portfolio consisted of $1.03B of 1st lien secured debt, 87%, (including $170.3M in PSSL), $1.0M of 2nd lien secured debt, and $159.6M of preferred and common equity (including $55.4 million in PSSL), as of March 31, 2022. It also had 13% in Subordinated Debt, and Preferred & Common Equity.

As of 3/31/22, PSSL’s portfolio totaled $705M, and consisted of 87 companies with an average investment size of $8.1M, and had a weighted average yield on debt investments of 7.4%.

PFLT’s debt portfolio consists of 100% variable-rate investments

PFLT site

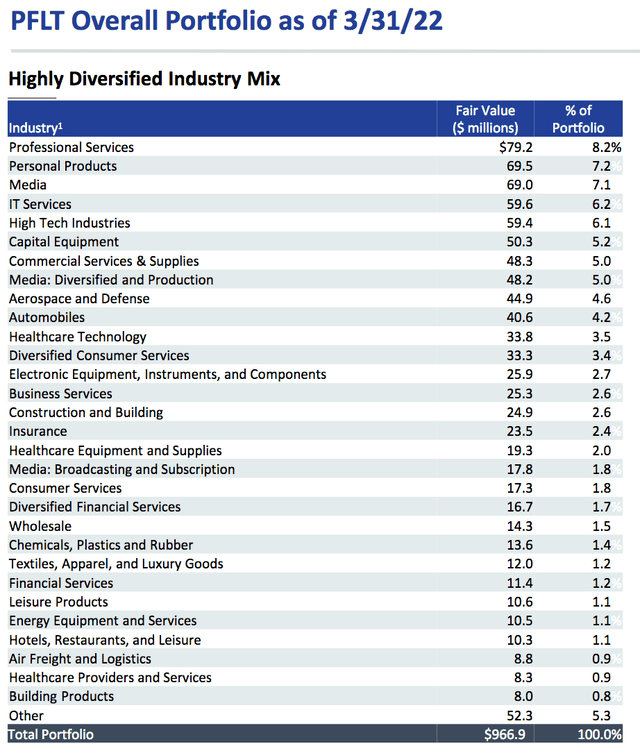

The overall portfolio consisted of 119 companies with an average investment size of $10.0M and had a weighted average yield on debt investments of 7.5%.

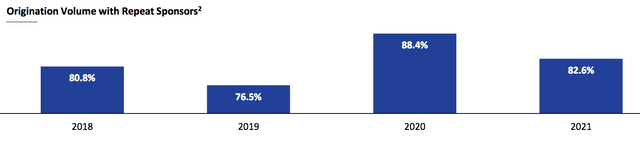

The firm has typically done new originations with over 80% repeat sponsors – this dipped to 76.5% in 2019, jumped to 88% in 2020, and was 0ver 82% in 2021:

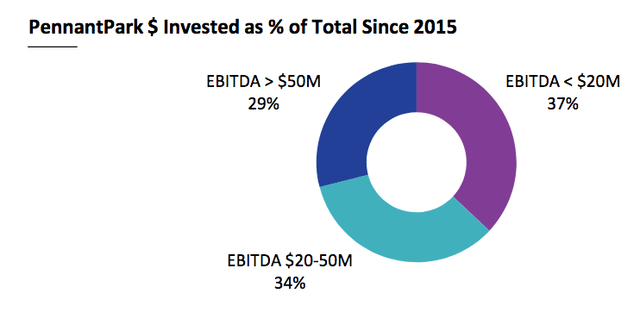

Since 2015, PFLT has invested 37% in companies with less than $20M in EBITDA; 34% in the $20 – $50M EBITDA ranges; and 29% in the above $50M range:

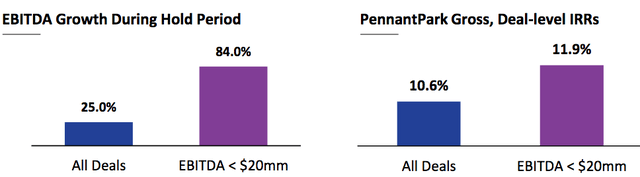

Growth has been the highest in the sub-$20M group, averaging 84%, vs. 25% for all-size companies. PFLT’s rate of return on this group is also higher, at 11.9%, vs. 10.6% for all deals:

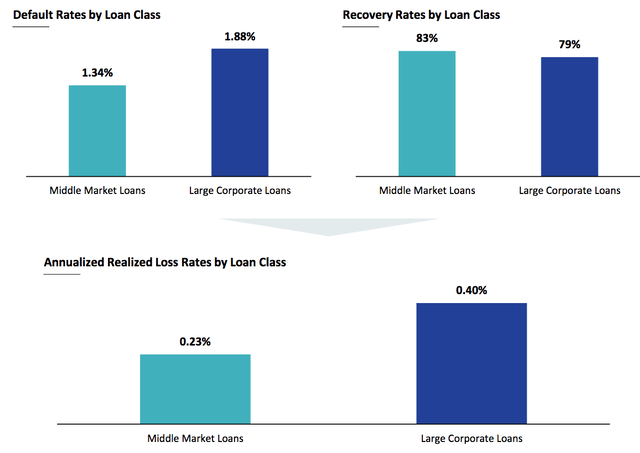

There’s an interesting, non-intuitive point about losses for small companies vs. large companies. Wouldn’t you think that smaller companies are more likely to create losses? However, that’s not the case – large corporate loans have a higher default rate, and a lower recovery rate than middle-market companies historically.

PFLT had 2 portfolio companies on non-accrual as of 3/31/22, representing 2.5% and 2.3% of its overall portfolio on a cost and fair value basis, respectively.

Earnings:

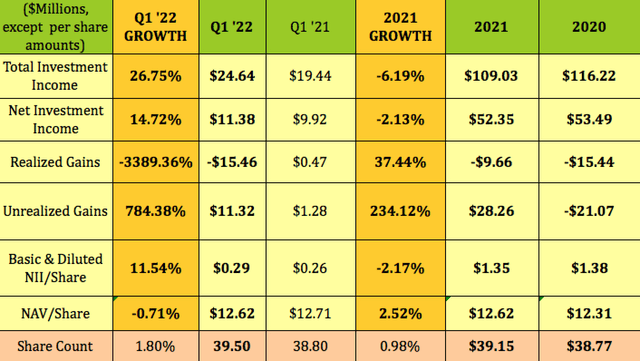

PFLT’s total investment income was by ~-6% in calendar year 2021, with NII and NII/Share down slightly, -2%. Realized and Unrealized Gains both rose significantly, while NAV/Share rose 2.5%.

Q1 ’22 had good growth, even in a tough market, with total investment income jumping by ~27%, and NII up by 14.7%. Realized Gains, which, like Unrealized Gains, are lumpy, due to timing issues, were -$15M, while Unrealized Gains were $11.3M. NII/Share rose 11.5%, while NAV/Share was down -0.71%.

NOTE: PFLT’s fiscal year ends on September 30th.

New Business:

In Q1 2022, PFLT invested $113.2M in 7 new and 29 existing portfolio companies, with a weighted average yield on debt investments of 7.2%. Sales and repayments of investments for Q1 2022 totaled $103.9M.

Dividends:

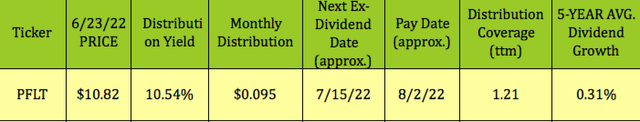

At $10.82, PFLT yields 10.54%. It’s not a dividend growth stock – it has paid $.095/month since Q1 2015. Trailing NII/Distribution coverage is solid, at 1.21X. It should go ex-dividend next in mid-July, with an early August pay date.

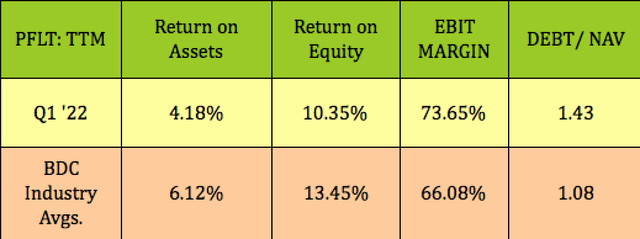

Profitability & Leverage:

PFLT’s ROA and ROE trail BDC averages, while its EBIT Margin is higher. Its Debt/NAV leverage of 1.43X is also higher than BDC average of 1.08X.

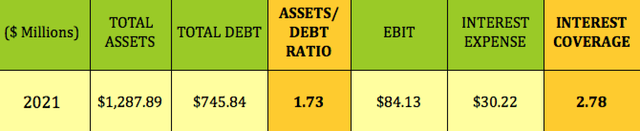

Debt & Liquidity:

As of March 31, 2022, PFLT had cash equivalents of $50.1M available for investing and general corporate purposes. It had $50.3M of unused borrowing capacity under its Credit Facility, as of March 31, 2022.

Its Assets/Debt ratio was 1.73X, and its Interest coverage ratio was 2.78X, a bit lower than the ~3.2X coverage for other BDCs we’ve covered recently.

On 5/2/22, the PSSL Credit Facility was amended to allow PSSL Subsidiary II to borrow up to $325M, up from $225M at any one time outstanding, subject to leverage and borrowing base restrictions.

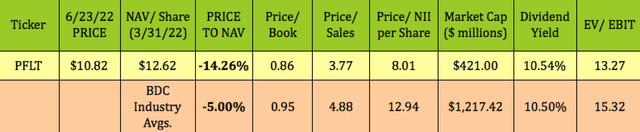

Valuation:

At its 6/23/22 price of $10.82, PFLT is selling at a -14.26% discount to its 3/31/22 $12.62/share. That’s a much deeper discount than the BDC industry average of -5%.

PFLT also looks cheaper than industry averages for earnings, with a Price/NII of 8X, vs. the 12.94X BDC industry average. It’s also cheaper on a P/Sales and EV/EBIT basis, with a very similar dividend yield.

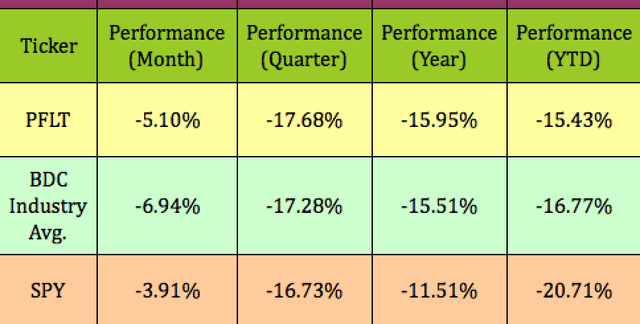

Performance:

PFLT has performed a bit better than the BDC industry so far in 2022 and has outperformed the S&P 500 by a wider margin. It has lagged the market over the past year, quarter and month, while holding up better than the BDC industry over the past month.

Parting Thoughts:

The market is bouncing between inflation worries and recession fears. PFLT will benefit from higher interest rates, due to its 100% floating rate business model. The other part of the equation is how well PFLT’s companies will fare in a recession, if that were to happen. We may nibble at some shares and take advantage of this deeper discount.

If you’re interested in other high-yield vehicles, we cover them every weekend in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment