courtneyk/E+ via Getty Images

The larger the companies grow, the more that certain functions become necessary that might otherwise have been unnecessary when they were smaller. For instance, large companies are complex ecosystems that often require human resources. But the downside to this is that these systems can often be sources of costs without any offsetting revenues. To minimize costs, some firms outsource these activities to specialty companies. This lets the company that engages in the outsourcing focus on its own core competencies while benefiting from another party that has developed a range of competencies specifically suited for the outsourced activity in question. One player in this market that investors should be aware of is Insperity (NYSE:NSP). In recent years, the general trajectory for the company has been positive. Long term, I fully expect this trend will continue. However, this does not mean that the business makes for a compelling opportunity. On an absolute basis, shares of the company are either fairly valued or slightly underpriced. But compared to similar players, the business is a rather lofty prospect. Because of that, I have decided to rate the firm a ‘hold’ at this time, indicating my belief that its returns will more or less match what the broader market does moving forward.

Insperity – A business for your business

As I mentioned already, Insperity provides human resource services to its clients. To be more specific, the company focuses on small and medium-sized businesses in the U.S. market, providing them with a variety of offerings such as payroll and employment administration services, employee benefits services, workers compensation activities, government compliance, performance management, and training and development services. The company provides these offerings through two key solutions known as Workforce Optimization and Workforce Synchronization. Management classifieds the former as the company’s primary offering and, through it, it facilitates much of the aforementioned activities. Meanwhile, the Workforce Synchronization solution is generally offered to middle-market clients and is a lower-cost offering that provides much of the same services but with a longer contractual commitment from its clients. As part of this service, clients can also select, for an additional fee from a variety of strategic human resources products and services offered under Workforce Optimization.

To be clear, these aforementioned solutions, both combined, represent what management calls its PEO HR Outsourcing solutions. This kind of arrangement involves the client firm signing a client service agreement, after which Insperity then acts as a co-employer with the client firm of the employees that are hired to perform the tasks in question. These employees then often work at the client’s work site. As part of this arrangement, Insperity takes responsibility for personnel administration and, in exchange, it charges a comprehensive service fee.

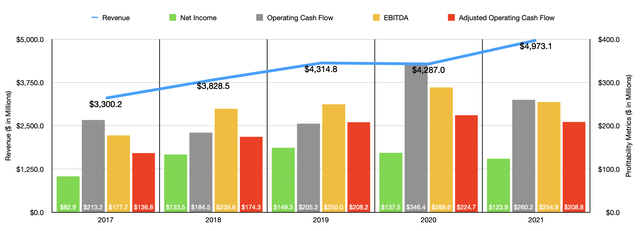

Over the past few years, the management team at Insperity has done a really good job growing the company’s top line. Revenue has risen in four of the past five years, ultimately climbing from $3.30 billion in 2017 to $4.97 billion in 2021. This works out to an annualized growth rate of 10.8%, with the rise from 2020 to 2021 coming in at an impressive 16%. Even the down year, 2020, which was the time when the industry was hit by the COVID-19 pandemic, was not particularly painful for the company. Revenue that year dropped by just 0.6%, falling from $4.29 billion to $4.31 billion.

Profitability for the company, however, has been much more mixed. After seeing net income rise from $82.9 million in 2017 to $149.3 million in 2019, it then began a consistent decline, eventually hitting 123.9 million dollars last year. Other profitability metrics have also been volatile. Operating cash flow has bounced all over the map, ranging from a low point of $184.5 million in 2018 to a high point of $346.4 million in 2020. However, if we adjust for changes in working capital, the picture is not quite as bad. This metric then would have risen in four of the past five years, climbing from $136.8 million in 2017 to $224.7 million in 2020. In 2021, it then dipped slightly to $208.8 million. As for EBITDA, its trend has followed the trend that we saw when looking at adjusted operating cash flow. This metric ultimately rose from $177.7 million in 2017 to $288.6 million in 2020 before dipping to $254.9 million last year.

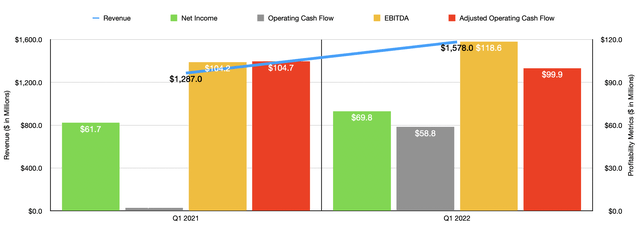

Growth for the company has continued into the 2022 fiscal year. According to management, revenue in the first quarter of the year totaled $1.58 billion. This represents an increase of 22.6% compared to the $1.29 billion generated in the first quarter of 2021. This kind of increase makes sense when you consider how tight the labor market has become. As a result of this, profitability for the company has also largely improved. Net income rose from $61.7 million in the first quarter last year to $69.8 million the same time this year. That translates to a 13.1% increase year over year. Operating cash flow skyrocketed, climbing from just $2 million to $58.8 million. But if we adjust for changes in working capital, it would have actually dipped from $104.7 million to $99.9 million. On the other hand, EBITDA for the company did improve, ticking up from $104.2 million to $118.6 million.

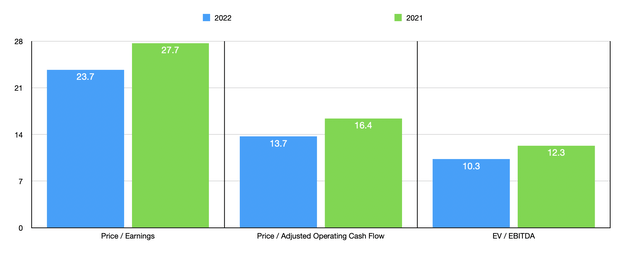

When it comes to the 2022 fiscal year, management has provided some guidance. They currently anticipate earnings per share of between $4.31 and $5.09. At the midpoint, this would imply net profits of $145 million. They also expect EBITDA of between $285 million and $327 million. The midpoint here would come in at $306 million. No guidance was given for operating cash flow. But if we assume that it, on an adjusted basis, will climb at the same rate that EBITDA should, then that metric should ultimately rise to $250.7 million this year. Using this data, we can easily value the business. Using results from 2021, the firm is trading at a price-to-earnings multiple of 27.7. This should drop to 23.2 if we use the 2022 estimate. The price to adjusted operating cash flow multiple, then, should decline from 16.4 to 13.7, while the EV to EBITDA multiple should decline from 12.3 to 10.3. To put this in perspective, I decided to compare the company with five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.4 to a high of 15.1. And using the EV to EBITDA approach, the range was from 4.6 to 10.2. In both of these cases, Insperity was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the range was from 6.6 to 32.5. In this scenario, four of the five companies were cheaper than our prospect.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Insperity | 27.7 | 16.4 | 12.3 |

| ManpowerGroup (MAN) | 10.1 | 7.3 | 5.9 |

| ASGN Incorporated (ASGN) | 9.9 | 32.5 | 9.7 |

| Korn Ferry (KFY) | 9.4 | 6.6 | 4.6 |

| TriNet Group (TNET) | 12.2 | 7.7 | 7.2 |

| Kforce (KFRC) | 15.1 | 13.7 | 10.2 |

Takeaway

Based on the data provided, it looks to me as though Insperity is doing quite well for itself. Fundamentally, I don’t see that picture changing in the long run. However, if the market does hit a weak spot, it is possible that performance could worsen. The good news for investors is that the company recently went through a downturn because of the COVID-19 pandemic. And even during that timeframe, fundamental performance remained robust. So it’s likely that any decline we see will be temporary in nature. On an absolute basis, shares look perhaps slightly on the cheap side if 2022 estimates turn out to be accurate. But relative to similar players, the company does look quite lofty. Because of this, I have decided to rate the business a ‘hold’ for now.

Be the first to comment