Bill Oxford

Consolidated Water Co. Ltd. (NASDAQ:CWCO), which operates in the water industry, could receive significant business opportunities by offering its SWRO (seawater reverse osmosis) system. Besides, perhaps further expansion of its services to regions where water is scarce could enhance future free cash flow (“FCF”) growth. Under normal conditions, I believe that the fair price is close to $20.24. Even considering risks from adequate contract price forecasting or failed negotiations to obtain licenses, CWCO stock appears cheap.

Consolidated Water

Consolidated Water supplies potable water, water for reuse, and offers water-related products in the Cayman Islands, The Bahamas, the United States, and the British Virgin Islands.

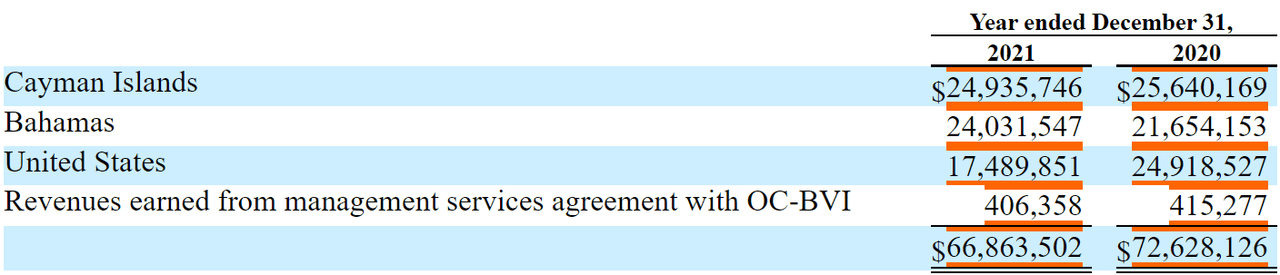

Consolidated Water’s facilities are currently located in the Cayman Islands, the Bahamas, the British Virgin Islands, and the United States. Specifically in the Cayman Islands, its services cover two thirds of the large population centers, under the approval and consensus of the island’s government. In the same way, its businesses are currently with government entities in the areas named above, always complying with long-term contracts that include objectives and compliance that work as a guarantee of quality of service. The following is a table with the origin of the revenue in each area. I believe that there is some level of geographic diversification, which some investors may appreciate:

Source: 10-k

Through a process called reverse osmosis technology, Consolidated Water supplies water to customers like public utilities, residential properties, and government facilities. Besides, clients also receive design, engineering, operating, and other services necessary for industrial water production, supply, and treatment.

In my view, the water industry has gone through a fundamental revolution since the social transformations experienced and registered during and after the 2020 pandemic. One of the marks of change in the movement and regulation of the market is the leap of water as a stock asset, which radically changed the business model. With this in mind, I would be expecting growth in the United States and other regions where Consolidated Water operates.

I believe that Consolidated Water Inc. is well-positioned to profit from expected growth in the water industry. The company has developed sustainable business models in recent years with water as the main resource. Consolidated Water concentrates its work in areas of the Caribbean, where access to water is scarce, placing greater emphasis on areas with a large tourist flow and regions where the local population is constantly growing.

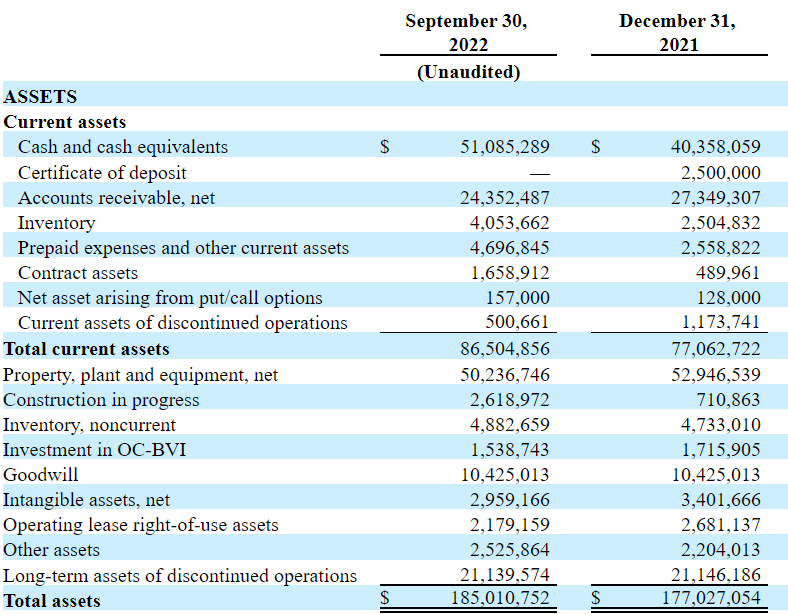

Balance Sheet

As of September 30, 2022, Consolidated Water Inc. reported cash worth $51 million in addition to accounts receivable of $24 million. Total current assets stand at $86 million, which is significantly larger than the total current liabilities. Thus, I wouldn’t be worried about the company’s liquidity.

Non-current assets include property worth $50 million, goodwill of approximately $10 million, and long term assets of $21 million. Finally, the total assets would be close to $185 million. The asset/liability ratio stands at 10x, which would suggest that the company’s solvency is in good shape.

Source: Quarterly Report

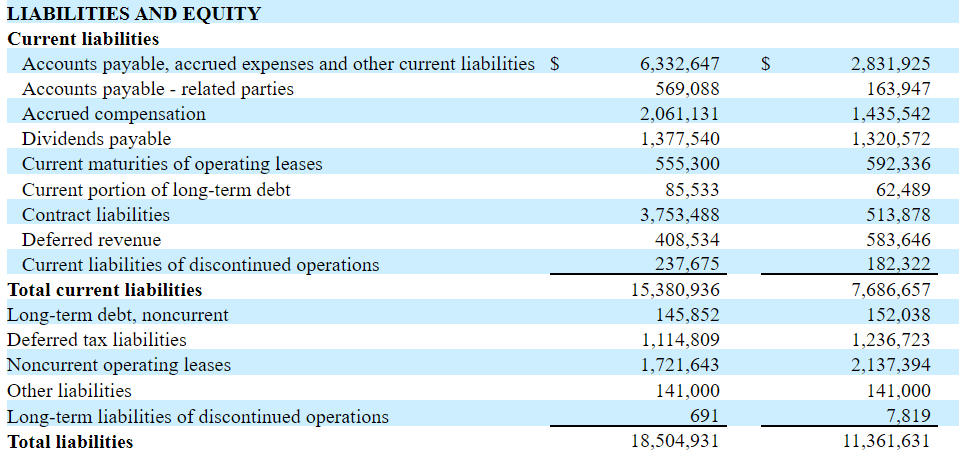

The list of liabilities include accounts payable worth $6.3 million, accrued compensation worth $2 million, and contract liability of $3.7 million. Total current liabilities are close to $15 million, and the total liabilities are equal to $18 million.

Source: Quarterly Report

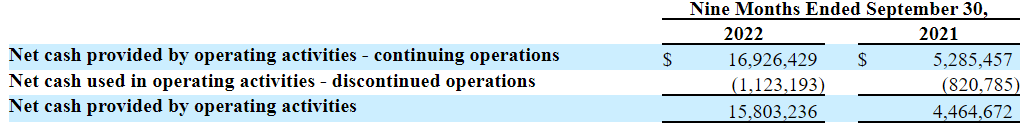

Cash Flow From Operations Increased In The Nine Months Ended September 30, 2022, And Estimates From Other Market Analysts Include 2023 EBITDA Margin Of 17%

I recently became a bit more optimistic about the company’s figures. In the nine months ended September 30, 2022, CFO increased to $15.8 million. In the same period in 2021, Consolidated Water reported CFO close to $4 million.

Source: Quarterly Report

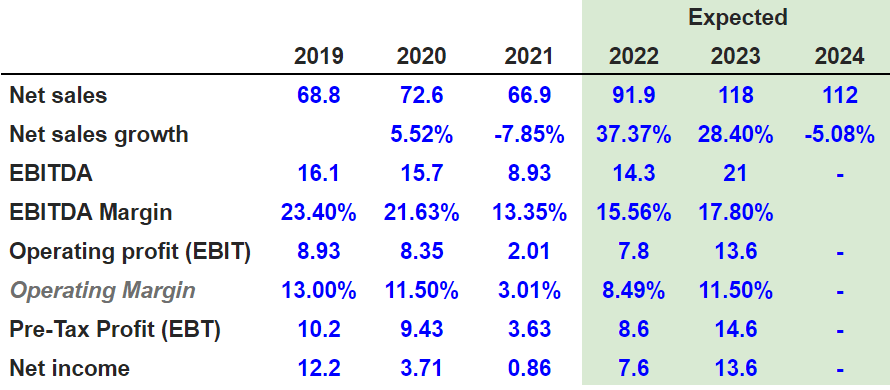

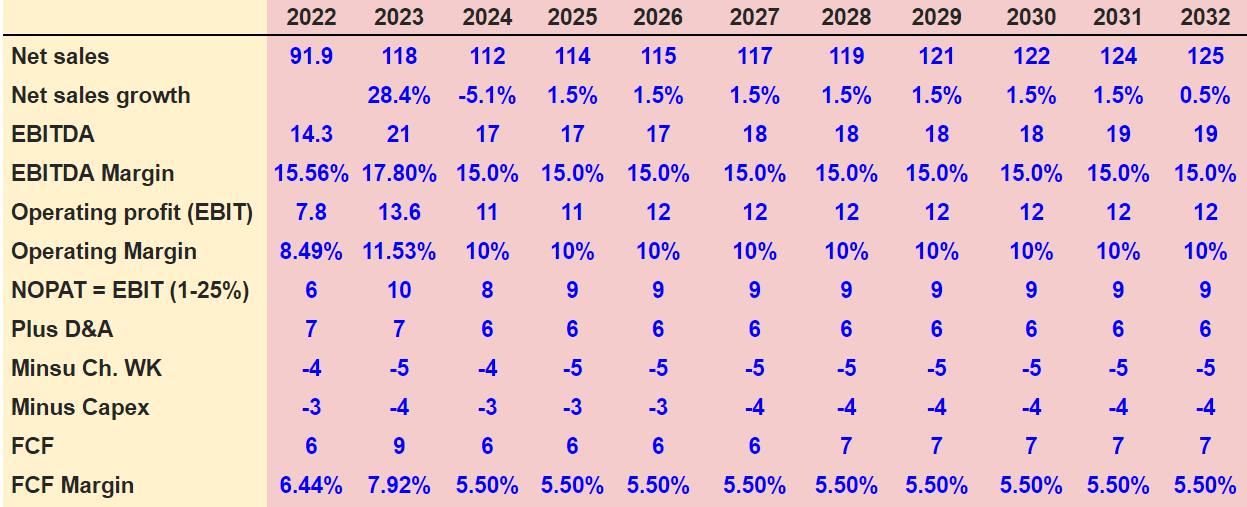

I also believe that the expectations of analysts are beneficial. Market estimates include 2024 net sales of $112 million by 2024. 2023 EBITDA is expected to be around $21 million with an EBITDA margin of 17.80%. Besides, 2023 operating profit would stand at $13.6 million with an operating margin of approximately 11.50%. Finally, pre-tax profit would stand at $14.6 million, and 2023 net income would be $13.6 million.

Source: Marketscreener.com

Under Normal Conditions And Successful Implementation Of The SWRO system, My Fair Price Would Stand At $20.24 Per Share

Consolidated Water designs the extraction, purification, and supply systems. It also offers the management and administration of facilities for the maintenance of the system via its technical knowledge and economic development of these establishments via its financial knowledge. I believe that the know-how accumulated will help Consolidated Water maintain a leading position in the water industry. New clients may arrive by learning the company’s history.

Under normal conditions, I am optimistic about the company’s SWRO system, which offers the enormous novelty of obtaining drinking water through seawater, filtering the residual salt in the water through its reverse osmosis system, thus allowing its use for drinking, eating, bathing, and meeting the basic needs of every human being. If more international clients are interested in Consolidated Water’s services, revenue growth will likely trend north.

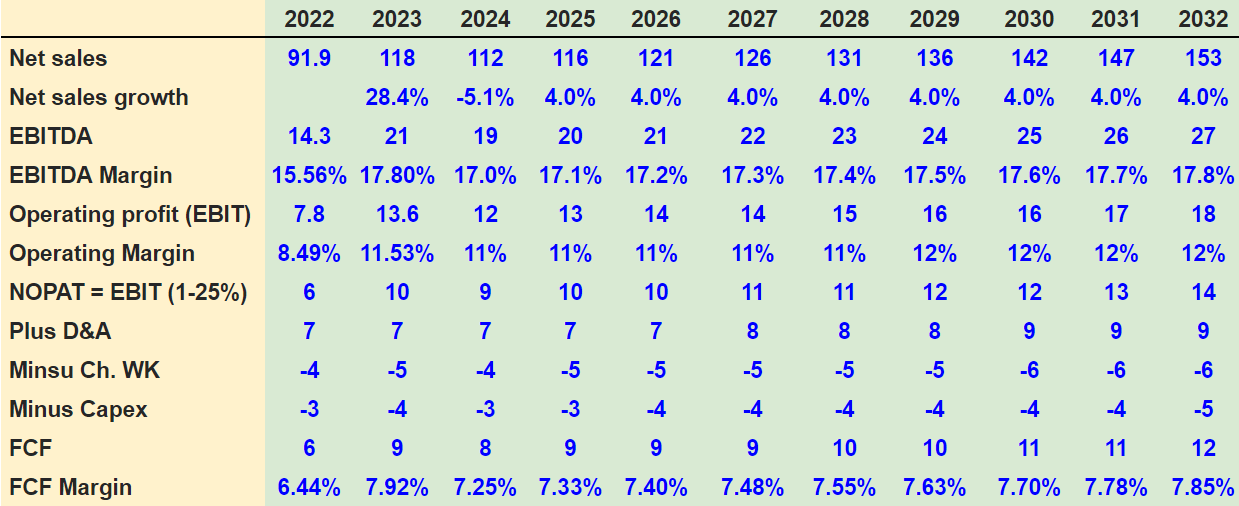

Under normal conditions, I would expect 2032 net sales of $153 million and net sales growth of 4%. In addition, I included 2032 EBITDA of $27 million, an EBITDA margin of 17.8%, operating profit of $18 million, and an operating margin of 12%.

If we assume a conservative effective tax of 25%, NOPAT would stand at $14 million. With 2032 D&A of $9 million, 2032 changes in working capital of $6 million, and 2032 capex of -$5 million, 2032 FCF would be $12 million.

Source: Author’s Work

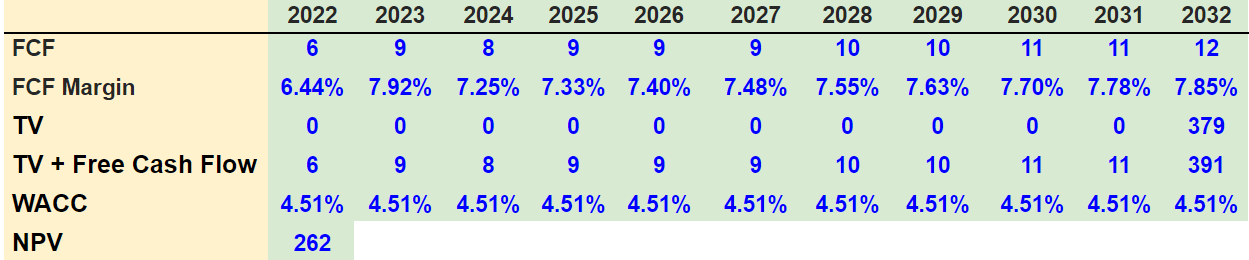

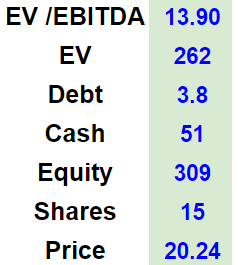

My financial model included an EV/EBITDA of 13.9x and a WACC of 4.51%, which implied a sum of free cash flow of $262 million.

Source: Author’s Work

If we take into account debt of $3.8 million along with a cash of $51 million, the equity would stand at $309 million, and the fair price would be $20.24 per share.

Source: Author’s Work

Under Certain Risks And Detrimental Outcomes, The Implied Fair Price Could Trend Down To $12.35 Per Share

Consolidated Waters’ business expansion depends on political provisions as many clients are governmental organizations. The company appears to have expertise and good relations with governments in Cayman or the United States. With that, license negotiations could change, and Consolidated Water could experience revenue growth decline. In line with my previous words, let’s note that Consolidated Water continues to negotiate licenses with authorities in Cayman.

Supplemental legislation was passed by the Government of the Cayman Islands in April 2017, which transferred responsibility for the economic regulation of the water utility sector and the negotiations with us for a new retail license from the Water Authority-Cayman to OfReg in May 2017. We began license negotiations with OfReg in July 2017 and such negotiations are ongoing. Source: Quarterly Report

Management has to make forecasts about manufacturing cost, operating costs, cost of services, and contract prices. Considering the current level of inflation, forecasting is not at all easy these days. In my view, under a complicated case scenario, engineers may not charge enough to clients, which may lower future EBITDA margin and free cash flow growth.

Because we base our contract prices in part on our estimation of future construction, manufacturing and operating costs, the profitability of our plants and our manufacturing and management contracts is dependent on our ability to estimate these costs accurately. The cost of materials and services and the cost of the delivery of such services may increase significantly after we submit our bid for contract, which could cause the gross profit for a contract to be less than we anticipated when the bid was made. Source: Quarterly Report

Other external risk factors such as the success of the tourist facilities under development or the climatic and environmental conditions of the regions where their plants are located could affect future revenue growth. Lower sales growth would bring the company’s valuation down. The company discussed these risks in the last annual report.

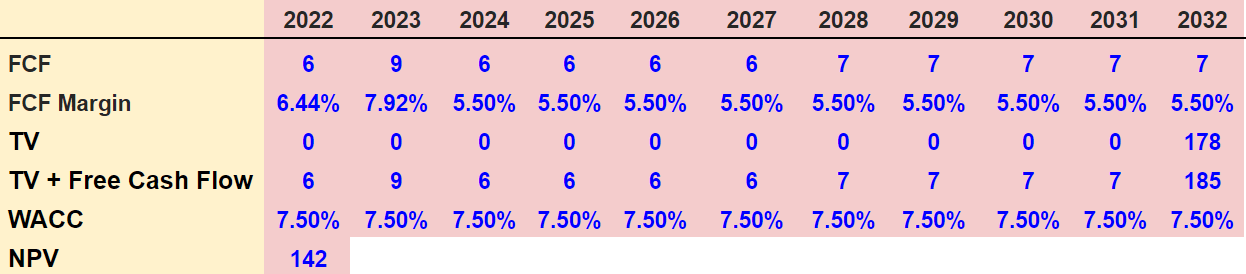

Estimates for 2032 include net sales of $125 million and net sales growth of 0.5%. EBITDA would stand at $19 million with an EBITDA margin of 15%. Besides, I included an operating profit of approximately $12 million with a 2032 operating margin of 10%.

My results also included 2032 NOPAT of $9 million. If we add D&A worth $6 million and subtract changes in working capital of $5 million and capex of $4 million, the FCF would be around $7 million. We would be talking about a free cash flow margin close to 5.50% in 2032.

Source: Author’s Work

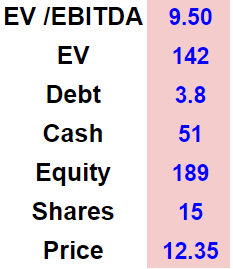

With an EV/EBITDA multiple of 9.5x and a discount of 7.5%, the discounted sum of future free cash flow would stand at $142 million.

Source: Author’s Work

The implied enterprise value may be close to $142.5 million. I also included debt of $3.8 million and cash of $51 million, which implied an equity valuation of close to $189.5. Finally, the fair price would be around $12.35 per share.

Source: Author’s Work

Conclusion

Consolidated Water’s SWRO system, the expertise accumulated by management, and its geographic diversification will likely enhance future revenue growth. I also believe that more services in islands and regions where water is scarce could bring significant free cash flow growth. Under my own DCF model, I believe that future free cash flow discounted with a WACC of 4.51% would imply a valuation of $20.24. By assuming several risks, my financial model resulted in a valuation of $12.35 per share. In my view, there is more upside potential in the stock price than downside risk.

Be the first to comment