fstop123/E+ via Getty Images

The Fed raised short-term interest rates by 75 basis points last week and reiterated its intent to stay vigilant in the fight to rein in inflation. It appeared that Chairman Powell regained credibility with investors after his press conference when the major market averages soared into the close on Wednesday.

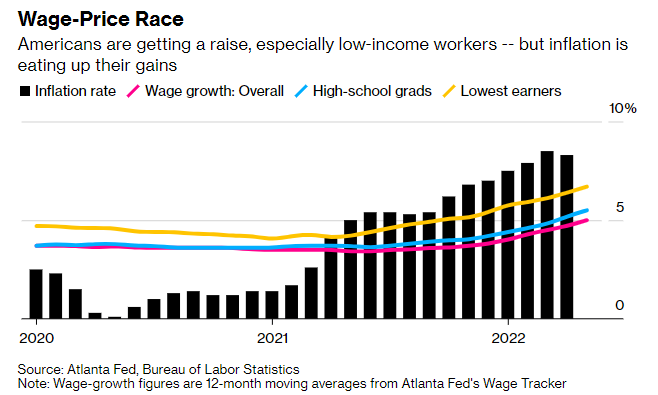

Yet, Powell’s assertion that the Fed would temporarily ignore its mandate to maintain full employment while addressing inflation raised concerns with investors. Inflation fears turned into a growth scare, which now seems to be a recession obsession. I have never seen such a rapidly built and broad-based consensus that one is imminent, and the stock market did its best to price one in by the end of last week, with the S&P 500 closing in the bear market territory.

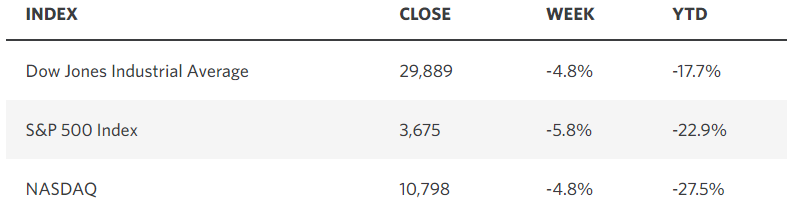

Edward Jones

Granted, we just had our first quarter of negative GDP (-1.5%) since the pandemic-induced recession in 2020, but the details behind the decline were a lot less daunting than the headline number. Consumer spending grew a solid 3%, but a huge deficit in trade combined with efforts to work off bloated inventories from the prior two quarters subtracted more than 4% from overall growth. That is unlikely to repeat. Regardless, the consensus now fears that consumers are stretched, due to $5 gas and a June reading from the University of Michigan Consumer Sentiment Index that was the lowest on record. No wonder consumers are pessimistic. All they hear and read about is recession with a daily reminder of inflation every time they drive by a gas station. Now the stock market is in the dumps, which makes them feel even worse, but it’s simply not that bad.

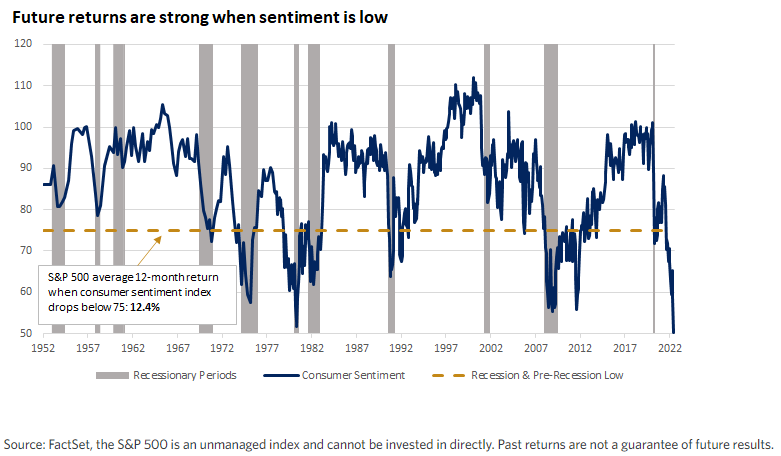

FactSet

If it were not for rising incomes, where the growth rate is highest for the lowest wage earners, I would be in the recession camp myself. I listened to market pundits assert last week that credit card debt is soaring because strapped consumers can’t fund their purchases of basic necessities due to rising costs. Statistics from the Federal Reserve Bank of New York tell a different story. Total credit card debt stood at $841 billion at the end of the first quarter, which is actually lower than it was before the pandemic. Credit card debt as a percentage of total debt is at a 20-year low of just 5.3%. Additionally, consumers still have approximately $2.6 trillion in savings strengthening their balance sheets, and it is not held predominantly by the upper class.

Bloomberg

This is why consumers can weather this storm of higher prices for a period of time without seeing a meaningful pullback in consumption, but that doesn’t mean they are happy about it. It also means that once the rate of inflation falls below 6%, real wage gains could be restored for the lowest wage earners.

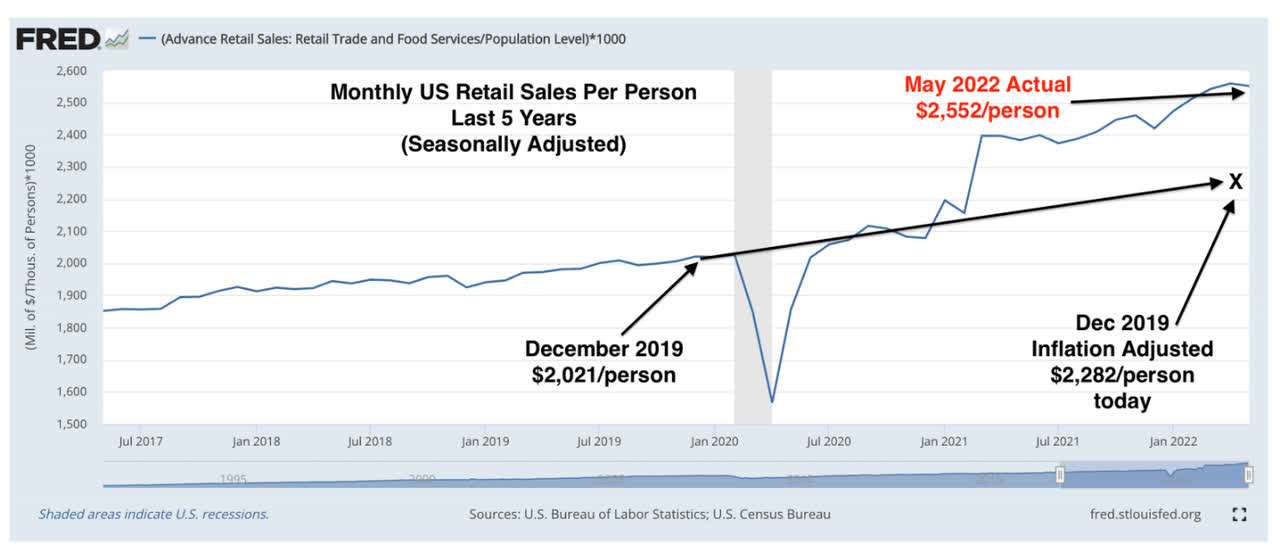

Last week’s retail sales report set off alarm bells when the increase for May was a tepid 0.5% when excluding autos, but the overall increase is still way above the uptrend line on an inflation-adjusted basis that dates back to pre-pandemic. In fact, DataTrek shows that spending adjusted for inflation to date is up $270 per capita since December 2019. This doesn’t look like a recession to me.

DataTrek

Better yet, the price of oil has started to decline with WTI crude dropping 10% last week to $108.80 per barrel. I have already seen gas prices drop more than 20 cents at my local station. This is the tip of the spear in regard to the 8.6% inflation rate. Fears of demand destruction in combination with an increase in supply from U.S. producers and OPEC+ are encouraging traders to dump oil futures contracts. It would not be unusual to see oil prices start to decline just as we hit peak levels of consternation, and it would be poetic justice for Vladimir Putin. Natural gas prices have also plunged more than 30% from their recent highs. A sustainable decline in energy prices during the second half of this year, which is my base case, could curtail the rate of inflation by 3-4%.

Finviz

Gasoline futures are already 55 cents off their highs, and the decline could not come at a better time as we are in the thick of the summer driving season. Most investors don’t realize that these energy prices are not dictated by real-world supply and demand in the short to intermediate term, but investment flows that reflect the perception of demand and supply to come. This is why we can see 20% moves in a commodity in days, whereas the supply and/or demand dynamics have not shifted that much at all. Therefore, if the consensus of investors believes that the highs are in for crude oil, natural gas, or any other commodity that has been financialized, the price can plunge as fast as it soared.

Finviz

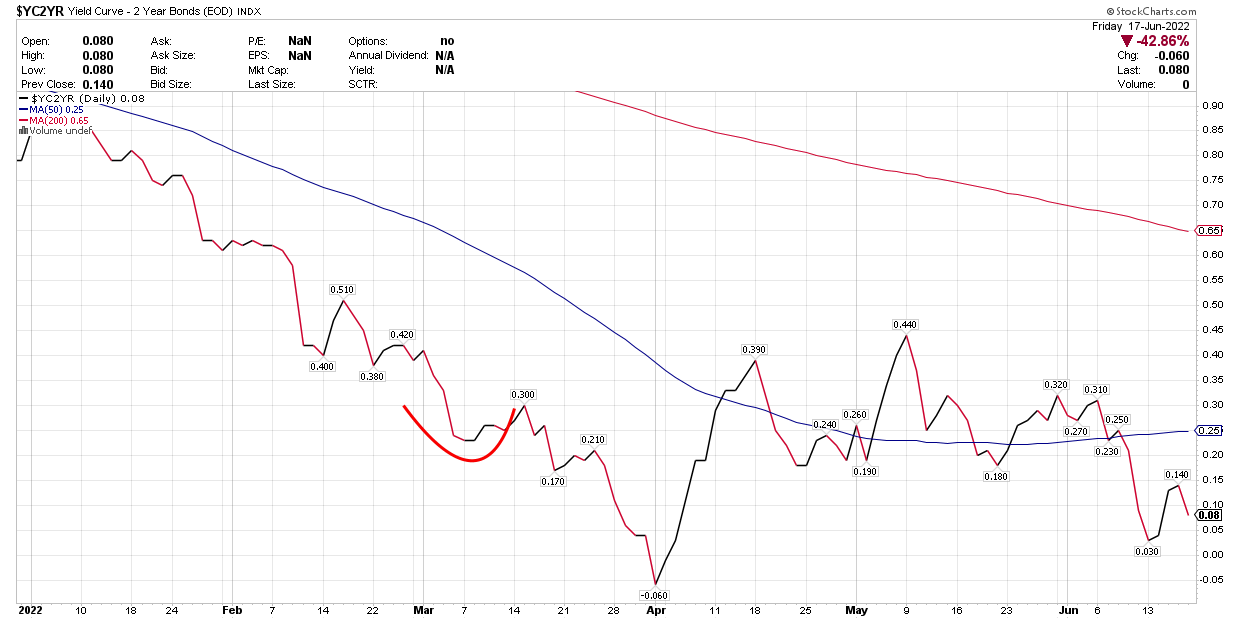

I am not ignoring the signs of a slowing economy. The doubling of mortgage rates in a short span of time is already adversely impacting housing activity. The manufacturing sector has cooled from the spike in inventories and supply chain bottlenecks that are still gradually opening. There have been some layoff announcements, but continuing unemployment claims remain near multi-decade lows. This slowing in economic activity is reflected in the flattening of the yield curve, whereby the spread in yield between 2- and 10-year Treasuries has fallen to 8 basis points, but it remains positive.

StockCharts

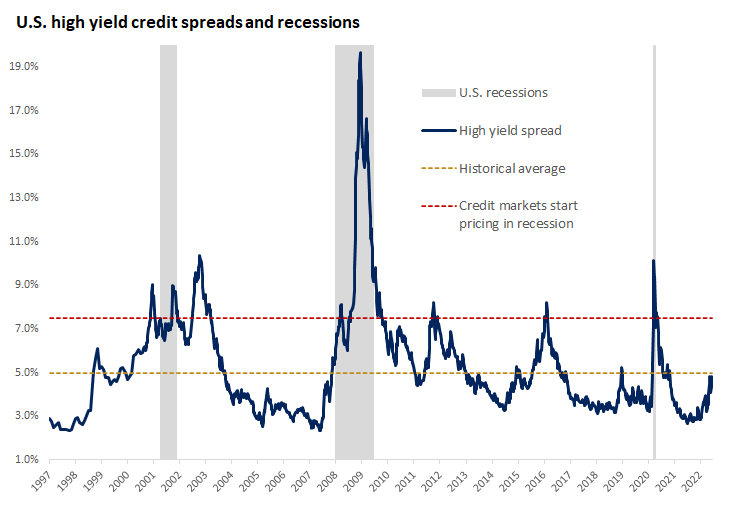

Meanwhile, as credit conditions have tightened throughout the economy, the spread that high-yield borrowers must pay above government borrowing costs has widened this year. That said, a 5% premium is the historical average and well below the 7.5% that we typically see in advance of a recession. The bond market has always led the stock market in terms of forward-thinking, and this tells me that stocks are overly pessimistic.

Edward Jones

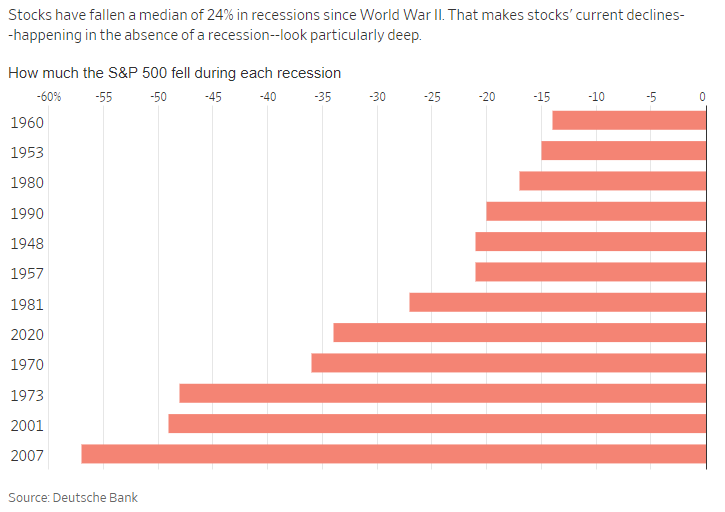

Financial markets have not only priced in a year’s worth of interest-rate increases already but a recession that has yet to happen as well. The median decline in the S&P 500 during recessions since WWII has been 24%, which is pretty close to where it stands today. Now flip the script and imagine what might happen if this recession does not materialize. Selling stocks when sentiment is near historical lows, much less all-time lows, has never been a good move in the past. This is not 2001 or 2008. Instead, it feels more like your garden-variety bear market, which is closer to complete than just getting started.

Wall Street Journal

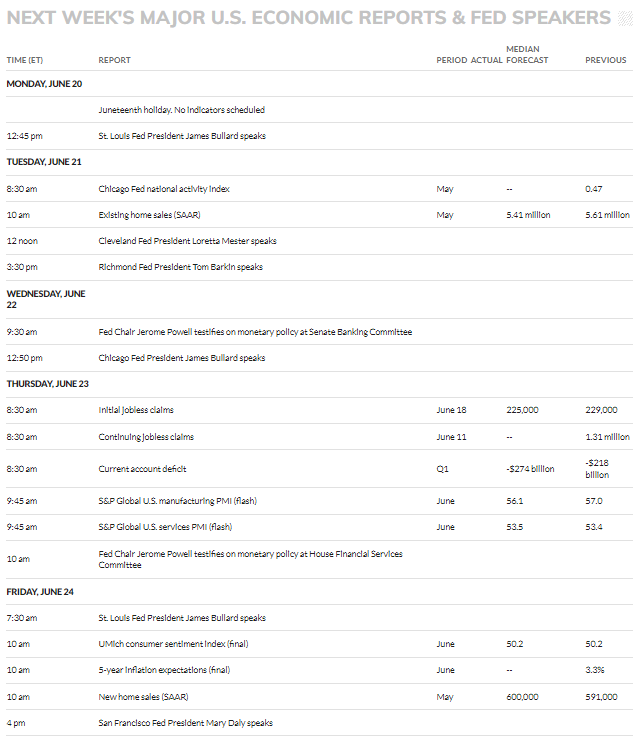

Economic Data

Existing home sales on Tuesday should show a deceleration in activity due to mortgage rates. Jobless claims will be watched closely on Thursday for any signs of economic weakness. S&P Global’s mid-month survey of the manufacturing and service sectors on Thursday should give us a real-time temperature of economic activity across the broad economy. Finally, Chairman Powell will testify before Congress on Wednesday and Thursday.

MarketWatch

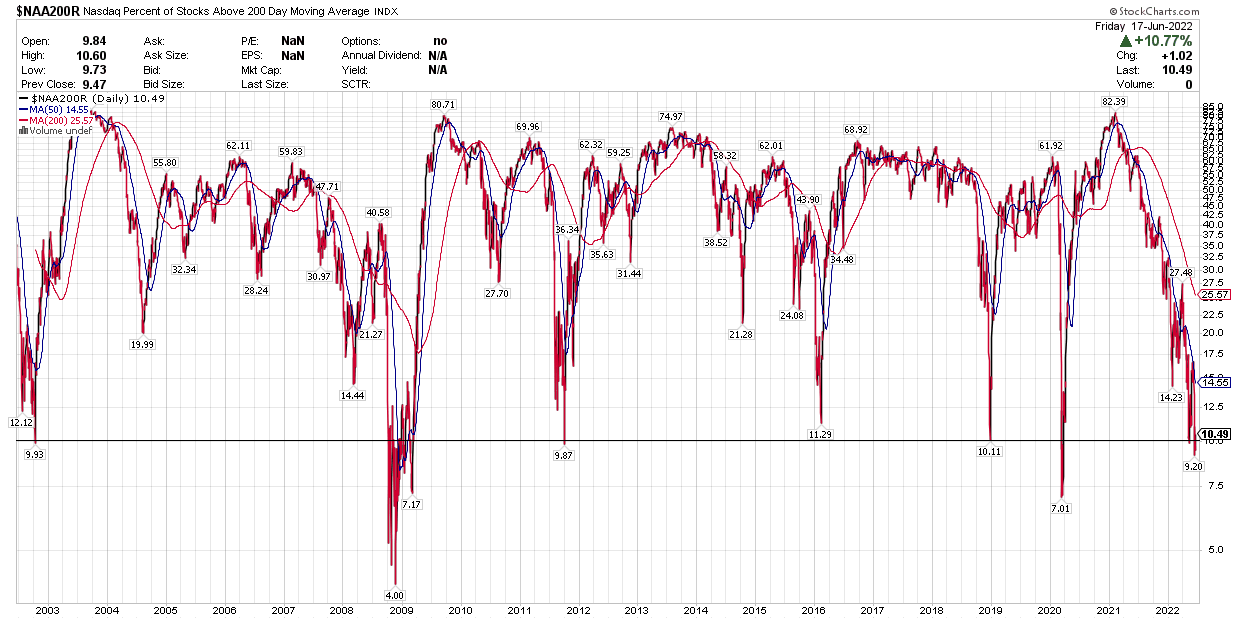

Technical Picture

Unless we are embarking on a new global financial crisis similar to 2008, I think the percentage of stocks on the Nasdaq Composite trading below their 200-day moving averages is bottoming here.

StockCharts

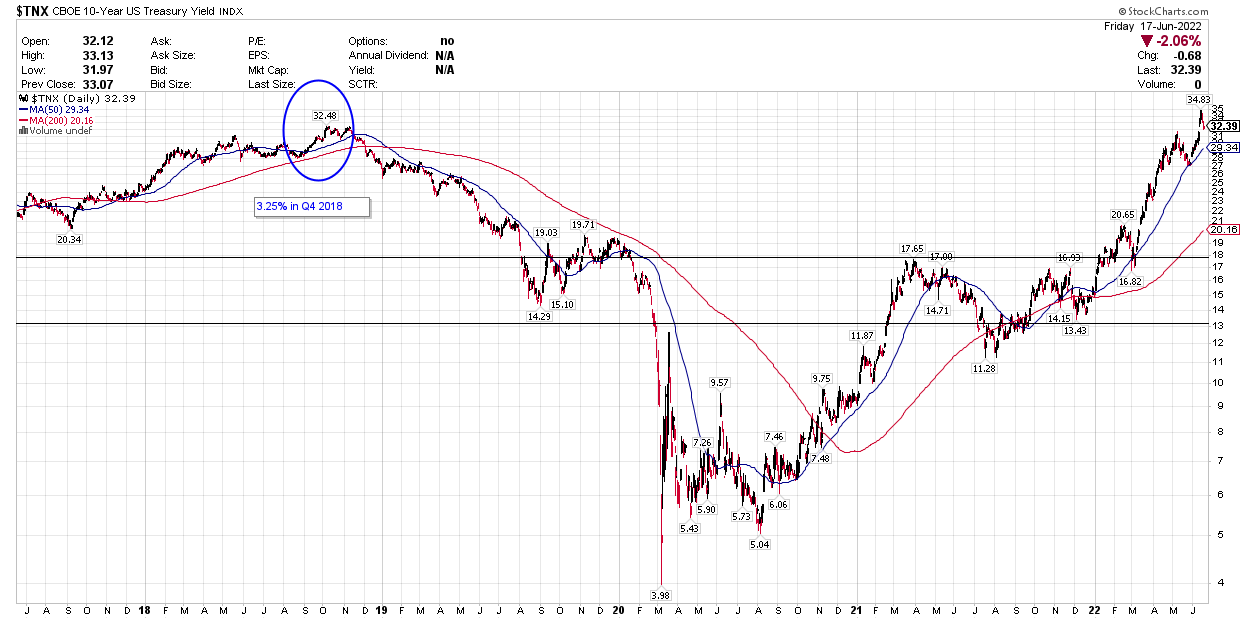

That means we may have seen the peak in 10-year yields at just under 3.5% last week, surpassing the 2018 high of 3.25%.

StockCharts

Be the first to comment