Justin Sullivan

As eBay Inc’s (NASDAQ:EBAY) revenue had declined by 5.9% YoY in Q1 2022, we determined the outlook of the internet retail industry based on retail sales and e-commerce as a share of total retail sales. Moreover, we compared eBay with the top 10 largest e-commerce companies in terms of its market share, sales growth, analyst revenue consensus beat and stock price change.

Retail Industry Outlook Slowdown in 2022

US Census Bureau, Khaveen Investments

According to FRED, US Retail sales grew by 10.8% YoY in Q1 2022, lower than the previous quarter at 14.9%. The National Retail Federation (‘NRF’) expected retail sales to grow between 6% and 8% to more than $4.86 tln in 2022. However, its forecast is significantly slower than the 14% annual growth rate in 2021, which was the highest in more than 20 years. Though, the NRF’s 2022 outlook is still above the 10-year and pre-pandemic growth rate of 3.7%. Additionally, the NRF explained that it expects inflation to persist until 2023 but the retail industry to benefit from declining unemployment and strong wage growth.

However, the NRF’s forecast was released in March 2022, thus we also referred to Amazon (AMZN) and Walmart’s (WMT) revenue guidance which was released in April and May for each company respectively. According to Amazon’s guidance, it expects its revenue to grow by 5% at the midpoint in Q2 2022. Additionally, Walmart guided its 2022 full-year sales growth to between 4.5% to 5% (excluding divestitures).

In our view, we believe inflation which had increased to its highest level for the year of 8.6% could translate to higher selling prices and benefit retail industry sales. On the other hand, consumer confidence had declined based on the Consumer Conference Board’s Consumer Confidence Index which had dropped to its lowest level in 2022 at 98.7 from 111.1. The Conference Board defines the index as a “monthly report of consumer attitudes and buying intentions” based on several factors such as age, income and region. Thus, while we expect the retail industry to benefit from higher prices, we believe the declining consumer confidence indicates lower demand which is negative for retail sales. Based on the chart above, retail sales growth had decelerated from 2021 at a peak in Q1 2021 as inflation had risen throughout 2021. Moreover, the US Federal Reserve raised its Fed Funds Rate in June by 75 basis points and we expect this to pose a risk to consumer spending with higher borrowing costs impacting borrowers which could lead to reduced consumer purchasing power.

Furthermore, while unemployment had declined and wage growth had been strong at the start of the year, the monthly unemployment rate had stayed at 3.6% since March 2022 and wage growth moderated to 11.67% YoY from its highest of 11.85% in February. Thus, we believe this indicates the normalizing growth in the labor market and wage growth which is in line with the retail sales growth which is normalizing since its peak in 2020 and we expect it to continue normalizing towards its pre-pandemic level which had stable flattish growth.

Moderating Share of E-commerce Sales

US Census Bureau, ITU, Statistics Times, Khaveen Investments

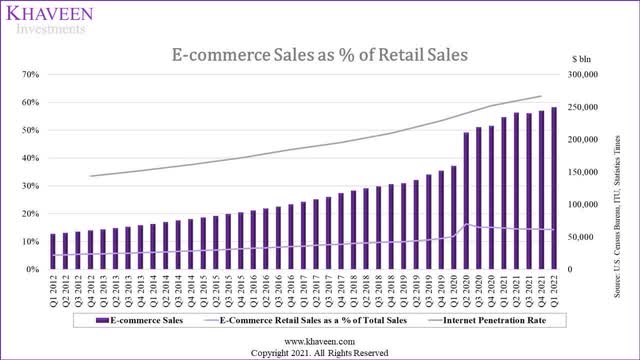

According to data from the US Census Bureau, e-commerce sales grew by 6.6% in Q1 2022, lower than its previous growth rate of 10.2% YoY in Q4 2021 which continues to indicate a slowdown in growth. Also, e-commerce sales as % of retail sales were at 14.3% in Q1 2022, which is also lower than in Q4 2021 at 14.5%. Notwithstanding, the share of e-commerce sales of total retail sales remains higher than its pre-pandemic level in Q4 2019 of 11.1% but also lower than its peak of 16.4% in Q1 2020. In our previous analysis of Amazon, we expected the company to benefit from the secular tailwind of rising e-commerce adoption due to the following factors:

- Rising global internet penetration rate

- Rising smartphone ownership and usage

- Growth in consumer retail spending

- Shifting consumer behavior towards e-commerce

|

Global Share of E-Commerce Sales over Retail Sales |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Share of E-Commerce Sales |

10.40% |

12.20% |

13.80% |

17.90% |

19.0% |

20.3% |

21.5% |

22.5% |

23.6% |

|

E-commerce Sales ($ bln) |

2,382 |

2,982 |

3,354 |

4,280 |

4,843 |

5,516 |

6,105 |

6,676 |

7,318 |

|

Growth % |

29.11% |

25.19% |

12.47% |

27.61% |

13.16% |

13.89% |

10.68% |

9.36% |

9.61% |

Source: eMarketer, Khaveen Investments

For the rest of 2022, we believe the share of e-commerce sales could resume its long-term trend upwards as physical retail continues to normalize with traffic recovering towards pre-pandemic levels globally as Covid-19 restrictions ease referring to data from Our World in Data. Based on eMarketer, the forecasted share of global e-commerce sales is expected to increase from 19% to 23.6% by 2025 from eMarketer.

Increasing Competition From Higher Growth Competitors

US Census Bureau, Company Data, Khaveen Investments

|

Company |

Revenue Market Share (Q1 2022) |

Revenue YoY Growth % (Q1 2022) |

Revenue Growth QoQ % (Q1 2022) |

Analyst Consensus Difference (Q1 2022) |

Stock Price Change (Q2 2022) |

|

Amazon |

30.6% |

-0.2% |

-20.7% |

0.0% |

-30.8% |

|

Wayfair (W) |

1.2% |

-13.9% |

-8.0% |

0.3% |

-49.9% |

|

Qurate (QRTEA) |

1.2% |

-13.6% |

-29.0% |

-4.0% |

-34.0% |

|

eBay |

1.0% |

-5.9% |

-5.0% |

0.8% |

-24.8% |

|

Chewy (CHWY) |

1.0% |

13.7% |

1.7% |

0.8% |

-6.8% |

|

Etsy (ETSY) |

0.2% |

5.2% |

-19.2% |

0.8% |

-36.5% |

|

Overstock (OSTK) |

0.2% |

-18.8% |

-12.5% |

-6.5% |

-30.0% |

|

Stitch Fix (SFIX) |

0.2% |

-8.1% |

-4.8% |

-0.2% |

-43.1% |

|

1-800-Flowers (FLWS) |

0.2% |

-1.0% |

-50.2% |

-1.8% |

-18.6% |

|

Revolve (RVLV) |

0.1% |

58.5% |

18.2% |

-8.6% |

-46.6% |

|

Others |

64.2% |

N/A |

N/A |

N/A |

N/A |

|

Average |

N/A |

1.6% |

-12.9% |

-1.8% |

-32.1% |

Source: US Census Bureau, Company Data, Seeking Alpha, Khaveen Investments

Based on the table above, the average revenue growth YoY among the top 10 US e-commerce companies was 1.6% while the average revenue growth QoQ was -12.9% from Q4 2021. In comparison, the average decline of the top 10 e-commerce companies’ stock prices since April 2022 was 32.1%. We believe the average stock price decline is not justified when compared with the average revenue growth of only -12.9% QoQ.

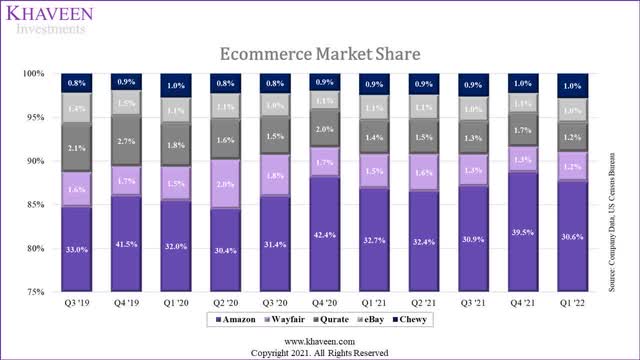

Moreover, eBay’s revenue declined by 5.9% YoY and 5% QoQ as the company’s transaction volume declined by 17% but its take rate increased by 30 basis points to 12.1% as it migrated towards its Managed payments platform. In comparison, eBay performed better than the top 10 e-commerce companies which had an average growth of -12.9% QoQ. Though, it performed worse than its competitors based on its YoY growth which was below the average of 1.6%. In terms of market share, eBay is tied with Chewy at the fourth position with a market share of 1% in Q1 2022 behind Amazon, Wayfair and Qurate Retail but saw its market share decline from 1.1% in the previous quarter. Whereas Amazon continued to retain its solid market leadership with a market share of 30.6%.

Furthermore, we calculated the difference between the top 10 e-commerce companies’ revenue and the average analyst revenue consensus in Q1 2022. Based on the table, 4 companies within the top 10 beat analyst consensus including Wayfair, eBay, Chewy and Etsy while Amazon was in line with analyst consensus. The average difference between the actual revenue and analyst consensus was -1.8%.

Overall, while eBay had a negative growth quarter in Q1 2022, it was not as bad as expected based on analyst consensus and still maintained its market share position as the fourth largest e-commerce company. However, we expect it to face increasing competition from higher growth competitors such as Revolve, Chewy and Etsy, 1800 Flowers and Amazon with higher revenue growth YoY than the company. For the full year 2022 outlook, based on its latest earnings briefing, eBay’s management cited the economic growth and consumer confidence impact in Europe and the rest of the world despite Russia and Ukraine accounting for less than 1% of its transaction volume. Additionally, the company also highlighted challenges including inflationary pressures, supply chain challenges, rising interest rates affecting economic growth in the near term and consumer spending pressures from high fuel costs. The company lowered its guidance for its transaction volume by 5% to grow between -12% to -10% but guided its revenue growth to be between -6% to -3%. This is lower compared to our revenue projection in our previous analysis of eBay where we forecasted its revenue have positive growth of 2% in 2022 as we expected its GMV growth of 4%. In terms of earnings, the company expects its EPS to grow by -3% to 2% in 2022 and its operating margin to be between 29% to 30%.

Risk: Market Share Loss

While eBay had beat analyst consensus in Q1 2022 by 0.8%, we believe it could face a risk of losing market share as its revenue growth had been below the average of 1.6% among the top 10 e-commerce companies in Q1 2022. In comparison, its 5-year revenue growth had been 4.2% and its 10-year average was -6.1% which is lower compared to the industry average of 20.6% and 17.3% respectively based on data from the US Census Bureau.

Verdict

All in all, we expect the total retail sales growth to face a slowdown risk in 2022 with the declining consumer confidence, normalizing labor market and wage growth despite rising prices of goods which could translate to higher selling prices for the industry. However, despite the moderating share of e-commerce sales growth, we expect the secular tailwinds of rising e-commerce adoption could spur the internet retail industry growth in 2022 which could benefit companies including eBay. That said, despite outperforming its competitors in Q1 2022, we expect it to face greater competition from higher growth competitors and could continue to lose market share. Notwithstanding, the company’s stock had declined by 35% YTD and has an analyst consensus price target of $55.65 which is an upside of 29%. Based on our previous analysis, we valued the company with a DCF analysis with a price target of $75.06 which is an upside of 74%.

Be the first to comment