Pgiam/iStock via Getty Images

Cornerstone Strategic Value Fund, Inc. (NYSE:CLM) is a small sized closed-ended equity mutual fund with an asset under management (AUM) of $896 million. The fund has been paying steady monthly dividends for the past 20 years, with an exceptionally high average yield of 20 percent. This is great news for income seeking investors, but is this yield sustainable?

Cornerstone Strategic Value Fund

Cornerstone Strategic Value Fund is launched and managed by Cornerstone Advisors, Inc. The fund primarily invests in the public equity market of the United States. The Fund benchmarks itself against the S&P 500 TR index. At present, CLM has a market capitalization of a little less than $1 billion. It has a relatively high expense ratio of 1.12 percent. Altogether, CLM’s portfolio has 119 stocks, more than 92 percent of which are large-cap stocks.

Almost half of the fund is invested in blue-chip stocks from information technology & communication (ITC) and the financial sector. Blue chips are typically large, well-established, financially sound companies that have market capitalization in excess of $5 billions. These companies are household names, have dependable earnings and are in operation for many years. Another 15 percent is invested in the equities of healthcare companies such as UnitedHealth Group Incorporated (UNH), Abbott Laboratories (ABT), AbbVie Inc. (ABBV), Eli Lilly and Company (LLY), Johnson & Johnson (JNJ), etc.

CLM Portfolio (CLM website)

Performance Of CLM’s Portfolio

The price of CLM, which consistently moved around $14 between November 2021 and March 2022, suddenly started falling from the week starting April 11th. During the past 10 weeks, prices fell by almost 44 percent. This price drop resulted from the negative price growth of CLM’s top 11 stocks that accounts for 40 percent of its portfolio. These stocks witnessed a price drop between 10 percent to 35 percent over the past 10 months.

These same set of stocks recorded a growth in the range of 48 percent to 748 percent over the past 5 years. The big players from the ITC sector recorded huge growth: Nvidia Corporation (NVDA) +313 percent, Apple Inc. (AAPL) +260 percent, Microsoft Corporation (MSFT) +248 percent, Alphabet Inc. (GOOG) (GOOGL) +123 percent, and Amazon.com, Inc. (AMZN) +112 percent.

Stocks of financial giants Mastercard Incorporated (MA) +151 percent, Visa Inc. (V) +99 percent, and Berkshire Hathaway Inc. (BRK.A) (BRK.B) +60 percent, also generated good returns. Automobile behemoth Tesla, Inc. (TSLA) grew by 748 percent, healthcare giant UNH grew by 144 percent, and consumer cyclical company The Procter & Gamble Company (PG) grew by 48 percent. Out of the 14 stocks mentioned above, 10 stocks are part of CLM’s portfolio for the past 15 quarters.

High Dividend Yield: Is That Sustainable

Domiciled in the United States, Cornerstone Strategic Value Fund was formed on 1st May 1987. The fund has been paying steady monthly dividends for the past 20 years. Prior to that, CLM used to pay annual dividends. However, the monthly payout has decreased enormously from $0.368 in 2015 to $0.1808 at present. As a result, the average yield has come down from 26 percent in 2016 to 16 percent in 2022. Still, the yield is exceptionally high.

If I consider the past 10 years’ average yield, which comes to around 20 percent, I’ll happily invest in this fund. However, there is some concern over sustainability of such a high yield. The fund is generating this high payout partially from its capital. As a result of which, the dividend payout has come down and will drop further down. This surely is not a good business practice.

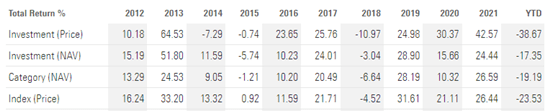

However, Cornerstone Strategic Value Fund has a robust portfolio which generated huge returns over the medium and long term. On an average, the fund’s net asset value (NAV) recorded double-digit annual growth. Its NAV recorded an average growth of 10 percent, 11 percent, and 13 percent over the past 3 years, 5 years, and 10 years, respectively. Despite the Covid-pandemic related stock market crash during mid-March 2020, CLM was able to generate 16 percent NAV growth in that year.

Because the portfolio consists of large-cap stocks, mostly from ITC and financial sectors, the portfolio by default will be very volatile. In the years of positive growth, CLM recorded huge price growth, and in the years of negative price growth, it fell drastically, too. However, the good thing is, NAV did not fall that much during the years of negative price growth. Barring 2015, and 2018, its NAV recorded positive growth. In those two years, the US stock market performed poorly. 2022 is going to be one such year.

CLM NAV growth (CLM website)

Valuation

In addition to the above-mentioned stocks, some more shares which have been part of CLM’s portfolio for more than 15 quarters such as Costco Wholesale Corporation (COST), Union Pacific Corporation (UNP), and ABT – these recorded significant positive growth in excess of 90 percent, over the past five years. Thus, over the medium and long run, this portfolio has been quite effective. Hopefully, the major holdings of this fund will continue to generate high growth in their value. This year, however, will be difficult for this fund.

The weighted average Price/Cash flow (P/CF) ratio of the component stocks of Cornerstone Strategic Value Fund comes to around 13.86, compared to the index’s P/CF ratio of 10.17. CLM’s Price/Equity (P/E) ratio (21.97) is also higher than that of the index (17.66). These price multiples indicate a possible overvaluation. However, the price/sales (P/S) of 2.58 which is marginally higher than that of the index (2.19) and Price to Book (P/B) ratio of 4.03 which is again slightly higher than the index’s P/B ratio of 3.2 suggests that this overvaluation is almost marginal.

Cornerstone Total Return Fund (CRF), another fund managed by Cornerstone Advisors, Inc. also has been consistently paying a monthly dividend with an extremely high yield, almost similar to that of CLM. There may be several reasons behind their payment of high yield, but Cornerstone management has also been effective. Similar to Cornerstone Strategic Value Fund, CRF also had made huge growth in its NAV over the years.

Investment Thesis

Cornerstone Strategic Value Fund has a robust portfolio which generated huge returns over the medium and long term. Funds managed by Cornerstone Advisors, Inc. have been consistently paying a steady monthly dividend with an extremely high yield. Barring a few bad patches like we see in 2022, the major holdings of this fund will continue to generate strong returns over the medium and long term, on the basis of which CLM will be able to generate at least a double-digit yield. Even if it fails to sustain the historical average yield of almost 20 percent, I believe that its yield still will be high enough to attract income seeking investors.

Be the first to comment