FotografieLink

We recently published our Q3 impression of Bridgestone’s (OTCPK:BRDCY) financial performance, commenting also on its “2030 Long-term Strategic Aspiration” business plan. Within our tire coverage, the Japanese company as well as Continental Aktiengesellschaft (OTCPK:CTTAF) were rated as neutral, whereas our top pick preference was for Michelin (OTCPK:MGDDD). Last time, we provided our comments after the Q2 results, presenting three upsides and three downsides.

Today, we would like to follow up on Mare Evidence Lab’s negative points.

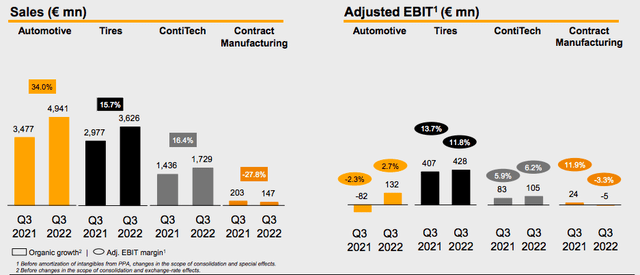

- As previously mentioned, many investors were concerned about Continental’s automotive segment’s profitability level, lagging also its closest competitors. In Q2, the CEO was proud to not increase its segment losses; in Q3, the company managed to return back in profit from minus €82 million to a plus €132 million on a yearly comparison. This was positively welcome by the investor community as well as surprised our forecast assumptions. Looking at the segment performance, we should note that Continental was positively influenced by favorable currency development. Numbers in hand, the company recorded an adjusted operating profit of 2.7% in the quarter;

- Last time, we said that Continental was minimizing the energy problem and we emphasized how the company “will have to prefer original equipment sales over replacement tires, which are going to be negative for the company’s profitability. Most of the Conti factories are located in Germany and given this apocalyptic scenario, this is also not supportive. Our internal team does not believe that pricing power will be sufficient to cover cost increases“. This is exactly what happened. In detail, the division was impacted by raw material inflationary pressure and higher logistic costs, adding a few notes, energy prices doubled compared to the same quarter last year. Turnover increased by almost 20%; however, the adjusted operating profit recorded a margin of 11.8% versus the 13.7% achieved last year;

- Related to point 2), in Q2, Continental’s tire division benefited from warehouse revaluation adjustment. This was not anymore the case and we forecasted a lower margin in the second part of 2022. Again this was a point taken by Mare Evidence Lab’s previous analysis.

Continental financials in a snap

Source: Continental Aktiengesellschaft Q3 results presentation

Our positive key takeaway continues to be valid. Indeed, the company continued to increase its order intake. In Q3, this was equal to €6 billion with a plus of 28.4% versus Q3 2021, and looking at the nine-month aggregate, the order output increased by almost 38% compared to last year. Regarding the tire volume side, Michelin recorded a better performance. Continental declined by 4.7% across its regional area, whereas the French tire manufacturer was down by only 2.6%.

Conclusion and Valuation

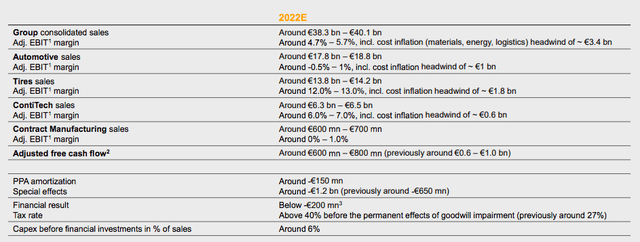

It was a good quarter for Continental but our downsides are still there. The company left its guidance unchanged and we are more positive for the last quarter. However, as already mentioned, consumer slowdown might translate “into product switching to lower-priced tires” and negatively impact the company’s profitability. We are still forecasting the company’s low range of its turnover outlook as well as we are not optimistic about the EBIT guidance. Despite that, we continue to value Continental with a Price/Earnings ratio of 7x in our forecasted number in 2023 with earnings per share of €8. This translate into a €56 target price, very much in line with the current share price; therefore, our neutral rating target is maintained. We still prefer Michelin up by more than 17% since its Q3 release.

Source: Continental Aktiengesellschaft Q3 results presentation

Be the first to comment