Kerrick

In analyzing the timber REITs, I continue to believe Weyerhaeuser (WY) is both the best company and best value of the group, so the analysis will be focused a bit more on WY than the others, but in this article I do intend to cover the entire group.

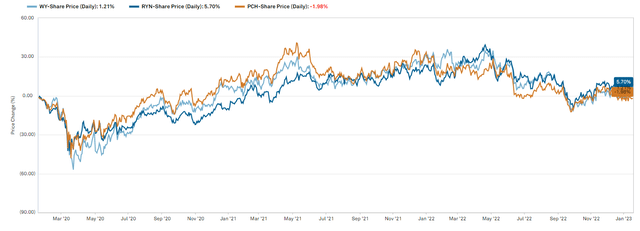

As you know, I am a fundamental analyst, so I do not rely on technicals or chart patterns, but occasionally a chart does imply significant mispricing. Here are the timber REITs over the past 3 years.

S&P Global Market Intelligence

2 aspects of this chart indicate mispricing to me.

- The 3 lines are far too correlated for companies with significantly different business models.

- The price movement largely mirrors the pricing of lumber shown below.

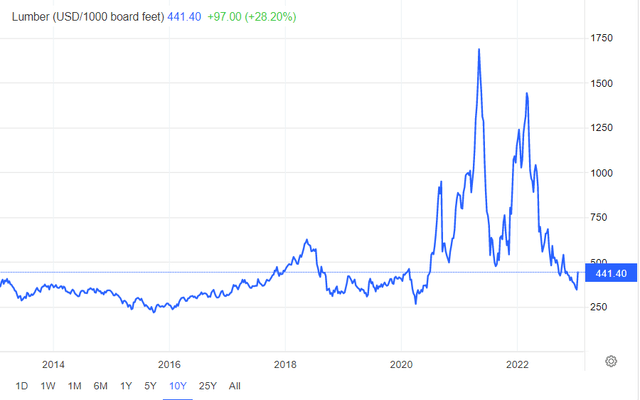

tradingeconomics

Indeed, the price of lumber is hugely impactful to near term earnings for Weyerhaeuser and Potlatch (PCH), but Rayonier (RYN) only does timber and should not be materially impacted.

I believe it also demonstrates that the market is looking far too much at current earnings and not enough at the long run.

Perhaps the myopia is a result of it being really easy to see that WY’s earnings jumped up by billions when lumber prices spiked while valuing the long run of timberland is a far more challenging endeavor. Yet, given that land lasts into perpetuity I remain confident that the long term value, even when discounted to the present, should be the primary driver of valuation.

With that in mind, I aim to construct a sort of sum-of-the-parts NAV to get a better sense for the true value of the timber REITs.

Assets and Enterprise Value

To value these companies we have to assign a value to quite a few different asset types.

- Land

- Standing timber inventory

- Mills/manufacturing facilities

- Cash

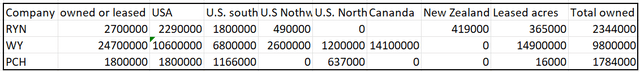

Here are the number of acres for each company in their various regional locations.

2MC

Controlled acres are significantly inflated relative to actual owned acres due to leased land. This is particularly true for WY which has 14.1 million acres of leased land in Canada and RYN which leases most of its New Zealand acreage.

Canadian timber works differently from the U.S. in that the land is owned by the government and leased to timberland companies via long term rights to harvest a pre-specified volume. When the timber company harvests that volume they pay the Canadian government a stumpage price and then get to sell the timber or manufacture it into wood products.

I will be valuing this leased land at $0 because it is not owned. The long term contract does, however, add value to the mills of these companies because it keeps them stocked with high quality timber.

Implied value of land per acre

One could look at transaction prices of timberland in similar regions and get a rough estimate. In the U.S south high quality timberland often sells for around $2000 per acre while in the Pacific Northwest it is closer to $3K-5K per acre.

However, when viewing a transaction from the outside it is hard to compare due to different stocking levels.

Was the $2000 per acre transaction raw land or does it already have trees ready to harvest? The difference is the standing inventory. Thus, I think we can get a better read if we value the land and the standing trees separately.

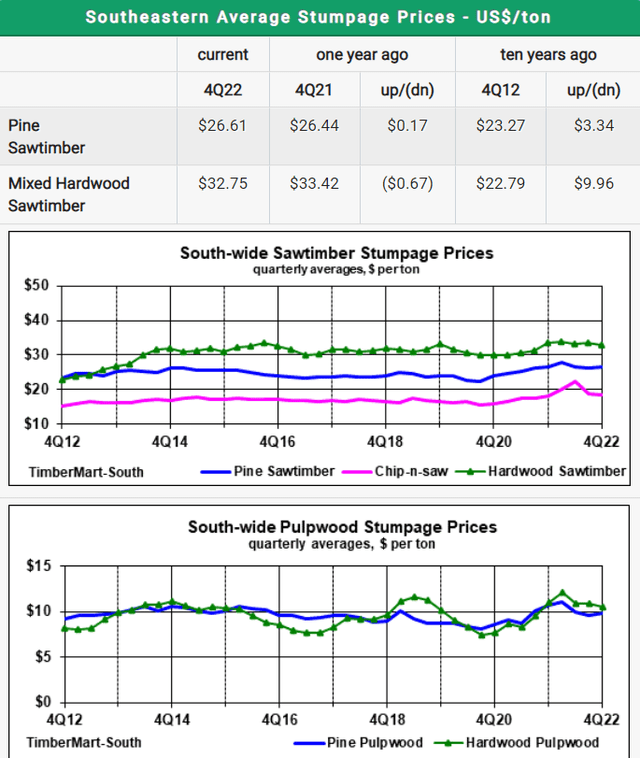

Timber has varying values depending on the type of tree, location, and quality of wood. The low quality wood that gets pulped is worth about $10 per ton while Sawtimber, that which is good enough to be made into professional grade lumber, is worth just north of $26/ton for pine and about $33/ton for hardwoods.

Here is the pricing in the southeast.

Timbermart-south

Note that these prices are quoted in stumpage value. The actual price for delivered logs is significantly higher while the stumpage price is what you can get if you have someone else come and harvest for you. In other words, it is net of transportation and harvest costs making it roughly the profit margin if one were to sell their wood.

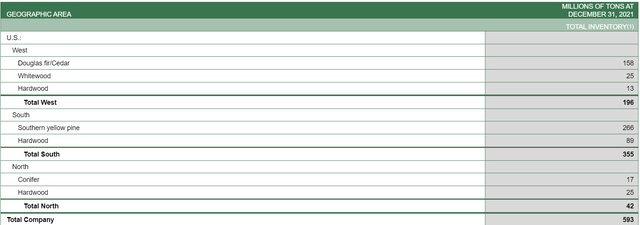

Weyerhaeuser has 593 million tons of standing inventory and this number does not include the inventory on their leased Canadian land.

WY

Rayonier and Potlatch have 91 million and 88 million tons, respectively.

While timber in the north is worth a bit more than in the south, the majority of the tonnage is located in the south so I will use southern prices to determine the value of the standing inventory.

Mix of sawtimber versus pulpwood

Even with perfect silvicultural practices, pulpwood is unavoidable. Even on a perfect tree with no knots and a straight trunk some of it will end up being pulpwood because the milling process requires contiguous chunks. Each company has well developed software to maximize the amount of lumber one gets from a log, but it is never 100%.

Thus, between this waste and other problems that occur naturally such as weather breakage, disease, pine beetles, and variance in tree age at harvest, the typical mix between sawtimber and pulpwood is about 50/50. Using the prices from Timbermart-South and assuming primarily pine this works out to a value per ton of about $17.50.

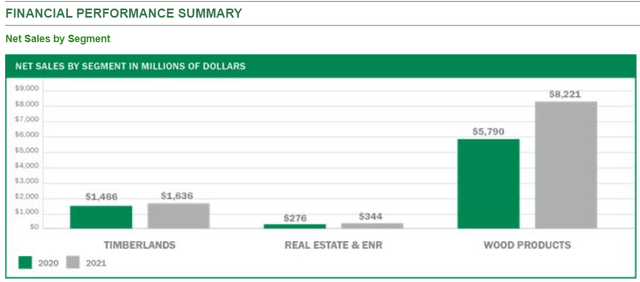

Less than $20 per ton might not seem like much but due to the immense inventory size of these companies that works out to the following values of standing timber.

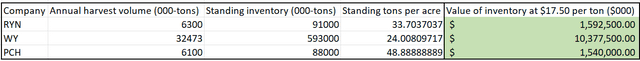

2MC

For each company that is more than 1/3 of their market caps.

Given that value of the standing inventory, we can now ponder what the raw land itself is worth. I suspect it is quite a range with huge variance by location so let me first find out what value per acre is implied by the market prices of these REITs. In other words, we are looking to calculate the enterprise value per acre once making deductions to enterprise value for each of the other items.

Next up to be valued is the milling operations.

Mills and manufacturing facilities

Sawmills are incredibly expensive. Individual pieces of machinery can cost north of $1 million and commercial grade mills require a wide variety of machines in order to efficiently process different types of wood into different cuts of lumber or other wood products.

West Fraser (WFG) recently acquired a Texas sawmill for $300 million. To my judgement that looks like a high quality and large sawmill so this is close to the high end. On the lower end, Resolute (RFP) recently bought 3 sawmills from Conifex for $163 million ($55 million each). These sawmills are in need of further capex so I suspect these are lower in value than the mills of the REITs.

This forms a wide ballpark range of valuation from $1.9B to $10.5B for WY’s 35 mills. REITs tend to own property in the top quartile of quality so both WY and PCH are probably toward the higher end of this range.

2MC

PCH became a serious mill player as well when they bought Deltic while RYN is more of a pure-play timber company. We can narrow this down a bit further by looking at the cashflows of their mill businesses.

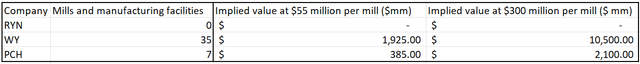

The mills are responsible for the sale of engineered wood products (EWP) and lumber which are categorized into the wood products segment. In 2021 this segment generated $8.2B in sales which is arguably an above normal figure due to where lumber prices were. The forward runrate for WY is probably somewhere between this figure and the somewhat low $5.8B of 2020.

supplemental

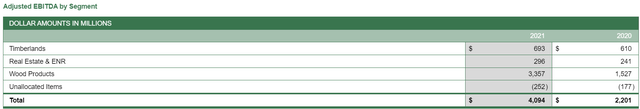

One of WY’s advantages is its meticulous cost management which results in among the best margins in the industry. The 2020 and 2021 sales resulted in EBITDA of $1.5B and $3.35B, respectively.

10-K

Applying a 5X multiple on run rate EBITDA of about $2B implies WY’s mills are worth about $10B.

Potlatch has an EBITDA run rate from wood products of about $250 million. Using the same 5X multiple that places its mills at a value of $1.25B.

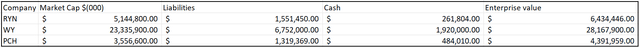

Cash and enterprise value

While the surge in lumber prices was short lived it allowed the lumber based REITs to generate some rather absurd levels of cashflow, some of which remains on the balance sheet.

I am of the belief that $1 is worth $1 so I will follow the standard practice of deducting cash from market cap and debt to attain enterprise value.

2MC

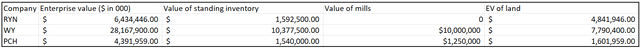

So we can finally get to the value of the land implied by the price at which the market is trading these REITs.

Subtracting the value of the mills and standing inventory from the overall EV we can get to the implied EV of the raw land for each company.

2MC

Dividing this by the owned acres results in the implied value per acre using current market pricing.

2MC

Weyerhaeuser appears to be the best value of the timber REITs at $795 per acre. On an absolute basis it also seems cheap to me. I am happy to buy income producing land at that price.

The Value of Land

In this income focused world I think people often overlook the value of land.

I view land as more akin to gold except that it also produces current income. It requires no maintenance capex and historically appreciates at a pace that exceeds inflation. Land ownership rewards patience and opportunism. It is difficult to predict exactly which form the payoff will be down the road, but eventually opportunity does present itself to extract tons of value out of the land.

Here are some of the ways WY creates value with its land

- Conservation (getting paid to let land sit there)

- Carbon capture – Occidental Petroleum (OXY) is paying WY an ample sum of money to permanently store carbon deep under WY’s land. This particular contract is just the tip of the iceberg

- Mineral rights

- HBU – as cities grow outward and become adjacent to WY’s land the land can be sold for development at many thousands per acre

- Camping/recreation: WY leases its land to recreation

These sources of revenue are additional to the timber revenue because with exception to land sold for HBU, they do not interfere with tree growth.

The opportunity

In its extreme focus on near term earnings the market has sold off the timber REITs as lumber prices fell. However, near term lumber prices are not all that impactful to the long run fundamental value of these land companies. As a result, the timber REITs have gotten far too cheap – trading at substantial discounts to NAV. WY is the best deal of the group and the highest quality.

I am happy to scoop up land at less than $800 per acre and get paid a sizable dividend while I wait for that land to appreciate in value.

Be the first to comment