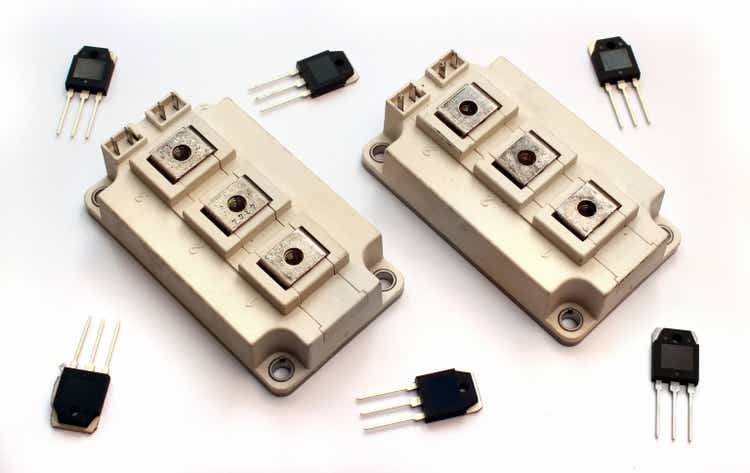

aquatarkus/iStock via Getty Images

I was quite bullish on onsemi (NASDAQ:ON) back in March due to the company’s strong margin leverage achievements and its exposure to fast-growing semiconductor opportunities like advanced power (silicon carbide (or SiC), specifically). Although the modest decline in the share price since then is a little disappointing, the nearly 30% outperformance to the SOX index does support the general notion that this is a meaningfully better-than-average semiconductor story.

Since early this year I’ve been beating the drum that the semiconductor market was going to see a slowdown, and the market has since moved to accept that as a consensus view. While onsemi does have some negative exposure to industrial end-markets (particularly with legacy products) as well as non-auto/non-industrial markets that are likely to be weaker in 2023, I believe onsemi will fare better than most. Moreover, I see ongoing revenue and margin growth opportunities that make this a standout in its space.

Valuation is still a positive, though onsemi’s better relative performance mitigates some of its appeal on a relative basis, and I do still see a risk that sentiment for the entire semiconductor space could worsen from here. All told, I think this is a stock you can buy here and be happy about it in the years to come, but there is a risk of rockier performance over the next year or two.

The Beats Go On, Driven By Strong Auto Performance

This semiconductor company continues to execute well against expectations despite a much higher bar.

Revenue grew 26% year over year and 5% quarter over quarter in onsemi’s third quarter, beating expectations by more than 3%. Growth was once again driven by the auto and industrial segments (up 41% yoy and 9% qoq, combined), with auto up 52%/up 11% (beating by 6%) and industrial up 28%/up 5% (beating by 3%). The “other” category, which includes products for consumer, compute, and communication markets, rose 3% yoy and fell 2% qoq. The company surrendered another $39M of nonstrategic, lower-margin business, bringing the company to $277M of its $750M long-term goal.

Gross margin rose almost eight points year over year (but fell 40bp qoq) to 49.3%, beating by about 25bp. Operating income rose 82% yoy and 8% qoq, beating by 9%, with margin up almost 11 pts yoy and 90bp qoq to 35.4%.

Inventory rose 19% yoy and 1% qoq, with inventory days up 8 days yoy and down 9 days qoq to 126. Channel inventories fell to an all-time low just below 7 weeks.

Auto Powers On

onsemi’s auto revenue was once again quite strong this quarter, with the company continuing to enjoy strong demand for its electric vehicle (or EV) and advanced driver assistance system (or ADAS) components, as well as chips used to grow electric systems in conventionally-powered vehicles.

I do believe that higher rates and a weaker macro backdrop aren’t great news for the auto sector looking into 2023, but Ford (F) and General Motors (GM) both reported improving supply chains and lean inventories, and the outlook isn’t all that bad at this point. What’s more, given the ongoing launch of hybrid and fully electric vehicles, as well as ICE-powered vehicles with more electric systems (like electric stability control), onsemi has significant vehicle content growth opportunities even against a backdrop of softer overall unit demand.

The longer-term outlook also remains bright. There were rumors earlier this year that the company had won inverter and/or on-board charger business from Tesla (TSLA) at STMicro’s (STM) expense given their prior sole-source status. While management hasn’t explicitly confirmed that, not long after those rumors the company did substantially raise its SiC guidance, from “doubling in 2022 and exiting 2023 at a $1B/year run-rate” to “tripling in 2022 and achieving $1B in 2023 revenue”.

While such wins are important, there’s another part to the onsemi auto story that sometimes gets overlooked – the opportunity to parlay SiC wins into additional content gains for add-on products like gate driver modules and secondary IGBTS.

Industrial Likely To Slow, As Will Other Markets

There’s little question now that semiconductor demand is softening going into 2023, as lead-times are starting to come down and there’s more talk of order cancellations. Management touched on this somewhat with guidance, noting weakening industrial/consumer demand in areas like “white goods” (appliances). Data center demand also appears to be slowing, as does demand for some 5G-related hardware.

Once again, this is a question of the short-term outlook versus the long-term opportunity. In the short term, I do think there will be a short-cycle slowdown across many industries, and I do expect a noticeable slowdown in consumer markets, as well as a slower pace of growth in data centers and communications.

Longer term, though, I am a big believer in the opportunities in automation and electrification across a wide range of industries, and that will drive meaningful addressable market growth for onsemi in the decade to come. And as is the case in autos, not only is the overall addressable market growing, but so too is the opportunity for higher-value components (like SiC chips) in markets like solar, where onsemi enjoys strong market share through its relationship with most of the leading OEMs.

The Outlook

Long term, onsemi has attractive content growth and volume growth leverage to the electrification of autos (as well as the adoption of more sophisticated ADAS), as well as the electrification of many industrial end-markets. In the short term, though, demand is going to weaken and pressure onsemi’s revenue growth rate.

I also expect the company to see some ongoing margin pressures. The company has made fantastic progress with its margin improvement initiatives – the sell-side average gross margin estimate for this year has improved 12 points over the last two years, while the operating margin estimate has more than doubled – but there are near-term headwinds now.

First, ramping up additional SiC capacity has a negative margin impact, and the company needs that capacity to deliver on its $4B-plus in long-term commitments. Second, the company has been reducing wafer starts (currently around 75% of capacity) and will likely reduce them further to manage inventories going into a period of weaker demand; semiconductor gross margins tend to be quite sensitive to capacity utilization, so this will have an impact. All of this is understandable and doesn’t alter the long-term potential of the company, but the reality is that Wall Street can be fickle, emotional, and reactive, and “oh no, gross margins are falling!” can pressure sentiment and multiples in the short run.

Long term, I’m still looking for annualized revenue growth of close to 9%, and I’m likewise expecting further margin leverage to drive adjusted FCF margins into the low-to-mid 20%’s over time, fueling low double-digit FCF growth.

The Bottom Line

Discounted cash flow suggests a long-term double-digit annualized total return from today’s price, and I consider that an attractive entry point for a company leveraged to long-term secular growth opportunities. I also value semiconductor stocks on the basis of margin-driven EV/revenue and EV/EBITDA; in a normal market fair value for onsemi would still be in the low-$80’s based on my expected operating margin in 2023, and even a cycle-low multiple would support a fair value in the low-$70’s.

I don’t want to underplay the risk as the semiconductor sector heads into a cyclical correction. It is possible that onsemi will see a bigger hit to revenue and/or margins than I expect, and that the market will react more poorly than I expect. Still, for investors who can tolerate those near-term risks, the long-term rewards look attractive.

Be the first to comment