Stefonlinton/iStock Editorial via Getty Images

Introduction

All financial data are reported in CAD unless otherwise noted.

Here we are with our last article of the follow-up coverage we are doing on North-American Class 1 railroads. This time it is the turn of Canadian Pacific Railway (NYSE:CP). We are going to look at its Q3 earnings report.

Many investors were looking with particular interest at railroads reports to get a feeling of how the economy is doing. In particular, key aspects that were expected to drive the railroad’s revenues were the Canadian grain harvest as well as the easing supply chain for automakers that have been able to substantially increase their deliveries. Inflation was also a key concern and during these reports railroad operating companies have been screened to see how well they were managed.

We will take a look at how Canadian Pacific performed, but, before we start, I would like to remind that this series on railroads was introduced by this article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study.”

Many who have followed the series have read it, but in case you haven’t, I recommend going over it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire Hathaway (BRK.A, BRK.B) owns. The approach I am taking to assess the company comes directly from what I am learning from Buffett and can, therefore, be a little bit different from other ways to value a company.

Summary of previous coverage

The key aspects we are going to look at are earning power, efficiency, use of capital, and shareholder return.

In fact, once Mr. Buffett realized how important these metrics were, he decided that capital-intensive businesses were not to be shunned, but actually to be a reasonable return rate on the capital employed by the business.

Mr. Buffett has also kept true to his investing philosophy that looks for investments that have some sort of a moat and that can benefit from macrotrends at play. In particular, class 1 railroads have a moat provided by their own railway infrastructure, which is costly and difficult to replicate. As far as macrotrends go, Mr. Buffett has highlighted more than once that he sees railroads enjoying three main tailwinds against trucks:

- cost and environmental advantages over trucking

- fuel efficiency that leads to better operating costs

- increasing need for freight trains.

In our previous episode on the company we saw that, thanks to the Kansas City Southern acquisition, the company will operate 20,100 route miles of a three coastal network that will be the only one to directly connect all three North-American countries. In terms of business mix, we saw that the company is particularly exposed to grain and chemicals, which make up 20% each of total revenues. Intermodal is important, too, in particular on the West Coast.

Past key metrics

Let’s recap quickly where Canadian Pacific was standing at from our point of view.

Its earning power ratio was 6.2. Its efficiency in Q2 reached an operating ratio of 59.5% and its fuel efficiency was 0.96 of US gallons of locomotive fuel per 1,000 GTMs.

When we look at the use of capital, Canadian Pacific had a very good 16.7% ROIC until the Kansas City Southern Acquisition. Now, this number is at 8.2% because the acquisition was also funded through debt, which increases the denominator and thus lowers the ratio. However, the company has a very well-managed track record of keeping its capex under control, usually below 20% of total revenues.

In addition, we saw that the company is quite conservative when speaking of returning cash to its shareholders and that is also paused its share repurchase program until its net debt/EBITDA ratio will be once again below 2.5. Nonetheless, when we look at dividends, we see that, although the starting yield is quite low (0.68%) and the payout ratio is below 20% the trailing 5 yrs growth rate is strong, scoring a 12.6%.

Q3 Results

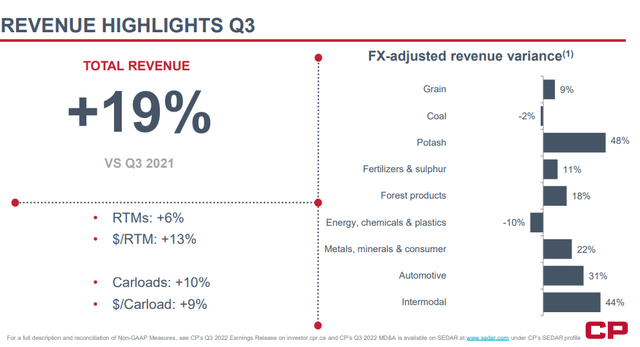

Now, let’s take a look at the main Q3 highlights Canadian Pacific wanted investors to be aware of. Total revenue was up 19% YoY with big increases in potash and intermodal and only minor reductions in coal and chemicals.

Canadian Pacific Q3 Results Presentation

So far, so good. Every other railroad reported increasing revenues. However, what has been harder to achieve is an improving operating ratio, too. Canadian Pacific, from this point of view, overperformed its peers since it was able to improve its reported operating ratio by 70 basis points to 59.5% from 60.2% last year, while its adjusted operating ratio improved to 58.7% from 59.4% last year. This means that the company was able to completely offset any inflationary pressure due to fuel and labor costs.

Finally, Canadian Pacific never misses the chance to point out its best-in-class results in terms of injury frequency and train accidents. This quarter, the Federal Railroad Administration (“FRA”) – reportable train accident frequency decreased 76 percent to a record-low 0.37 from 1.54 last year. In addition, FRA-reportable personal injury frequency declined 12% to 0.86 from 0.98 last year.

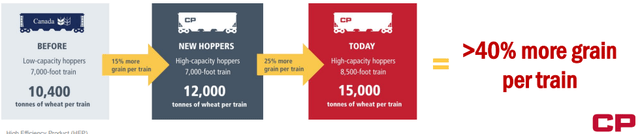

Now, an important aspect for Canadian Pacific is that the harvest this year is among the top five harvests ever. The company could risk to be overwhelmed by this fact, but, luckily, it started back in 2018 a program to renew its grain cars so that it is now prepared to move an extra 40% more grain per train.

As John Brooks, Canadian Pacific’s CMO, said during the last earnings call:

The most recent expectation for the Canadian grain crop size is around 75 million metric tons. This would make it a top five all-time crop and about 7% better than the five-year average. This comes at a great time, certainly following a lot of investment into the supply chain by not only Canadian Pacific, but many of our grain partners. This will be the first year we have a critical mass of our new high-capacity grain cars. As you recall, back in 2018, we announced a multi-year plan to purchase 5,900 new high-capacity grain cars, and we’re going to receive the last little bunch of those later this year.

In a few years, the company has replaced 10,400 tonnes hoppers with 15,000 tonnes ones that will be of great help during the harvest and the following quarters.

Canadian Pacific Q3 Results Presentation

The company also received a US$200 million dividend from KCS in the third quarter. This brings the total of received dividends to US$465 million. This is important because Canadian Pacific is using its free cash to pay down debt. Year-to-date, it has already repaid nearly $1.2 billion in debt, which is 100% at a fixed rate, and this sets the company on a strong path to return to its target leverage or a net debt-to-EBITDA ratio of 2.5

Key metrics

Earning power

What exactly is earning power? It is a measure to understand how well a company can meet on its own interest requirements in any economic condition. In the TTM, the ratio went down to 5.6 which makes Canadian Pacific the worst performer in the industry, less than half of the stunning 13 that Canadian National has achieved.

Efficiency

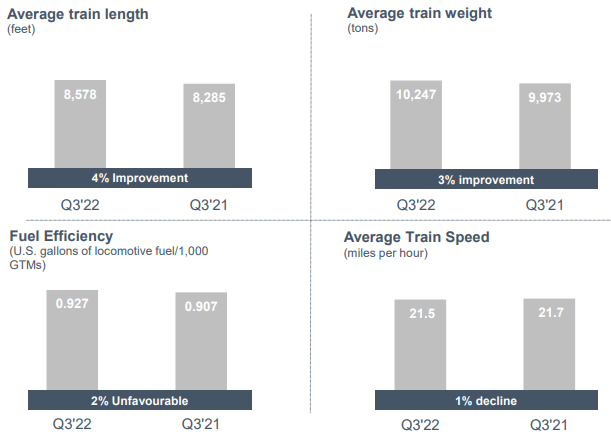

We have already seen that Canadian Pacific performed really well when we look at the operating ratio. Now, if we look at fuel efficiency, the company, although YoY, it saw a 2% unfavorable decrease, QoQ has improved, moving from 0.96 to 0.93. Considering that, YoY, the average train length increased by 4% and the average train weight improved by 3%. So, even if fuel efficiency was a bit worse YoY, the other efficiency parameters were up for more than 2%, showing once again that Canadian Pacific is performing, and it is managed well.

Canadian Pacific Q3 Presentation

Use of capital

ROIC is a key metric to look at, especially in capital intensive businesses such as railroads. We know that before the KCS acquisition, Canadian was the best in the industry, scoring well above 16%. Now the most recent ROIC calculation is at 8.9% because of the debt the company has taken to fund the acquisition. Per se, it is not a problem as it is clearly understandable why ROIC is moving down. If the investment goes through, we will see it quickly recover.

We also know that the share repurchases have been paused in order for the company to get as quickly as possible back to its usual balance sheet metrics. I think this is a smart move because it shows that the company wants to be financially strong and not operate through excessive leverage.

Conclusion

I still stick to the discounted cash flow model I shared in my previous article where I explained that, though the company seems overvalued, there is a premium I am willing to grant it because of its new network it is creating. However, given the recent rally, I still think that the stock is a buy below $70 and this is why I confirm my hold rating.

For those interested in reading the previous episodes, here are the links:

- Looking At Railroads As Mr. Buffett Does: Canadian National Railway

- Looking At Railroads As Mr. Buffett Does: Canadian Pacific

- Looking At Railroads As Mr. Buffett Does: Norfolk Southern

- Looking At Railroads As Mr. Buffett Does: CSX Corporation

- Looking At Railroads As Mr. Buffett Does: Union Pacific

- Why I Want To Buy Canadian National Railways Company

- CSX: When Traditional Metrics and Buffett Metrics Diverge

- Norfolk Southern: Share Repurchases Seem To Be Funded By Debt

Be the first to comment