Dzmitry Dzemidovich/iStock via Getty Images

The Trade Desk (NASDAQ:TTD) is the leading player in demand-side programmatic advertising, an industry with massive potential for growth in the years ahead.

Management is executing at a high level, and financial performance is impeccable. In spite of the challenging macroeconomic environment, The Trade Desk has recently reaffirmed revenue and earnings guidance.

A business of this quality rarely comes for a cheap price, but The Trade Desk is now available at a more than reasonable valuation.

A High-Quality Business

The Trade Desk is a demand-side platform that works with advertisers and advertising agencies to produce more efficient and better-targeted advertising, ultimately providing data-driven decisions with more control, increasing return on investment – ROI, and delivering a better experience to consumers.

The Trade Desk is the leading independent player in this space, focused on expanding opportunities for programmatic advertising beyond the walled gardens like Facebook (META) or Google (GOOG) (GOOGL).

The Trade Desk has launched a better solution to replace third-party cookies with Universal ID 2.0. This new identifier is gaining popularity as privacy-conscious technology that also allows for better measuring and more transparent results. Among many other notable companies, Amazon Web Services has recently joined UID2.

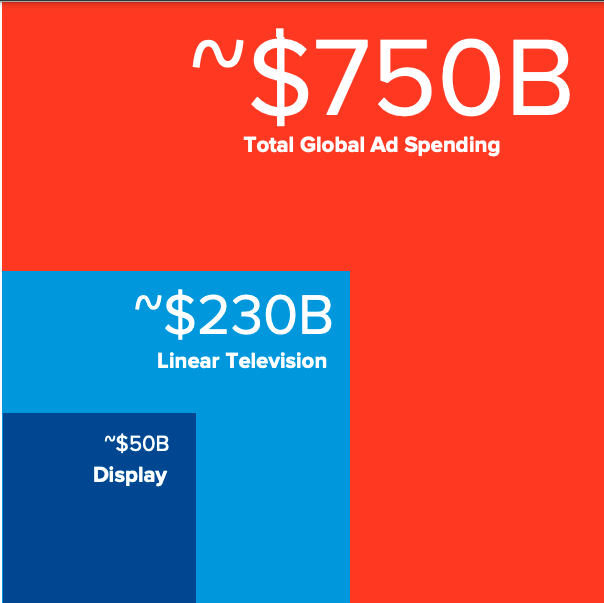

Advertising is basically demand creation, which is at the backbone of the global economic system. The overall size of the market is estimated at around $750 billion, and technological improvements are making advertising more effective, which will only increase spending in the years ahead, regardless of the natural fluctuations that always come with the business cycle.

The Trade Desk

The Trade Desk is at the forefront of innovation in advertising. The company works with advertising agencies, so it is an enabler as opposed to a disruptor for many of the incumbents.

It is not much of a stretch to say that most – if not practically all – advertising will be digital and programmatic in the future, and no company is better positioned than The Trade Desk to benefit from such a powerful trend.

Outstanding Execution

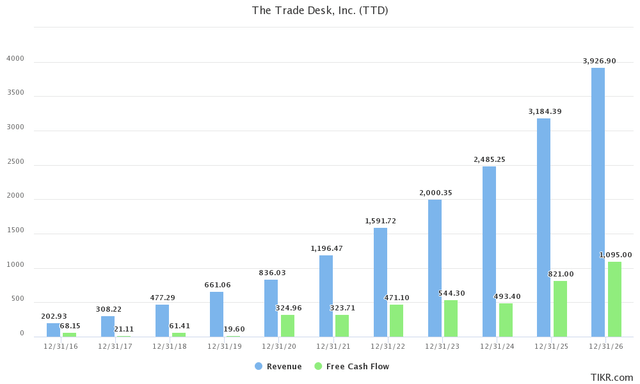

Financial performance has been impeccable over the long term. The chart below shows historical revenue and cash flows in combination with forward-looking estimates to provide a continuous perspective.

Revenue has increased from $308 million in 2018 to $1.59 billion in 2022, and it is expected to reach $3.9 billion in 2026.

Free cash flow has increased from $61 million in 2018 to $471 million expected this year and $1.1 billion projected by 2026.

TIKR

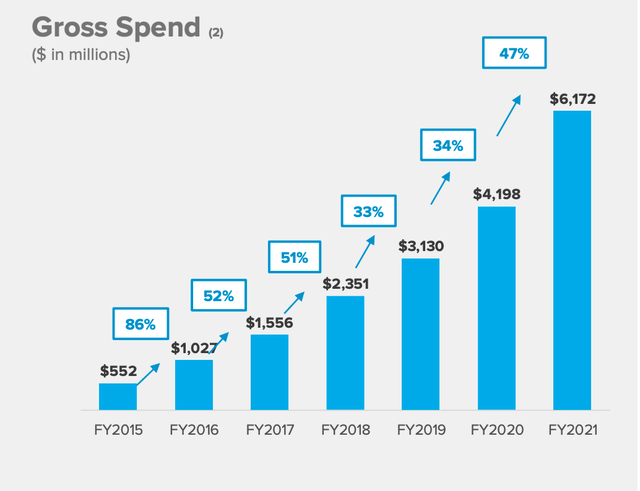

The Trade Desk delivered $315 million in revenue during the quarter ended in March of 2022. This represents a 43% increase in revenue, which is the strongest first-quarter revenue growth for the company in the last four years.

The Trade Desk

Management highlighted the fact that The Trade Desk is delivering strong numbers in a tough environment, which is particularly notable. Even a mediocre company can do well when the wind is at its back, but it takes a special business to outperform under challenging conditions.

From the conference call:

Our performance is especially encouraging because annual advertising budgets are often being reset and reconsidered in Q1, making them historically harder to predict. And this year, the macro environment was challenging with the ongoing global pandemic, war in Ukraine and the higher rates of inflation around the world. Despite those challenges, we again exceeded our own expectations.

I believe we are now firmly established as the default DSP – demand side platform – for the open Internet and that we are very well-positioned to grow and grab share regardless of the macro environment.

We now have over 1,000 customers, representing tens of thousands of advertisers spending on our platform across the open Internet. We continue to see a steady stream of new agencies and brands starting to work with us for the first time as well as existing customers increasing their spend with us. We are seeing strong momentum around key initiatives, such as connected TV, shopper data, UID2, OpenPath and our game-changing new data marketplace.

From a competitive point of view, the business is stronger than ever. The Trade Desk is expected to grow at above 33% this year, while the rest of the industry is growing 8%-14% depending on the estimates.

There are some very real concerns about how the economic environment can affect companies in the space. High inflation, a potential recession, and supply chain disruptions are obviously problematic for the advertising industry.

That said, The Trade Desk reaffirmed its guidance on May 26, which happened a few days after Snap (SNAP) delivered disappointing numbers and generated wide concerns regarding the overall health of the advertising industry.

Moving forward, The Trade Desk has abundant opportunities for growth.

A potential partnership with Netflix (NFLX) now that Netflix is entering advertising is obviously of much interest, and Netflix was mentioned 35 times during the latest conference call.

I’ve been saying for more than half a decade that I believe that Netflix will eventually have to show ads. And that’s really based on the fact that I believe that consumers want choice. And that while Netflix has done a phenomenal job of preserving an amazing experience for consumers that, at some point, that becomes cost-prohibitive because you have to just keep raising prices. That is exactly what’s happened over the years. And they’re now at a place where I believe they will benefit from offering that choice.

You may know David Wells, who was the previous CFO of Netflix, joined our Board almost 5 years ago. So we’ve had a great relationship with Netflix because of him, and I’m extremely optimistic in the potential for us to partner with Netflix

International markets offer enormous room for expansion in the years ahead. The Trade Desk is currently making only 12% of revenue from international markets. On the other hand, international represents 2/3 of the global advertising industry.

Leaving aside the current macroeconomic headwinds and the impact of the war in Europe in the short term, the Trade Desk has the fundamental strength to thrive on a global basis over multiple years.

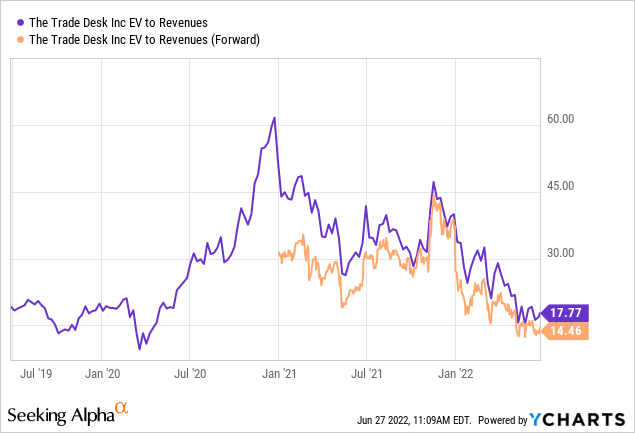

Reasonable Valuation

Valuation has always been tricky for The Trade Desk. The stock has traditionally traded at a considerable premium versus other growth stocks, which is arguably well deserved because of its superior quality. In the current market environment, however, valuation is reaching reasonable levels for The Trade Desk.

The EV to Revenue ratio is close to the lows of the pandemic in 2020, but still rather expensive in comparison to other growth stocks.

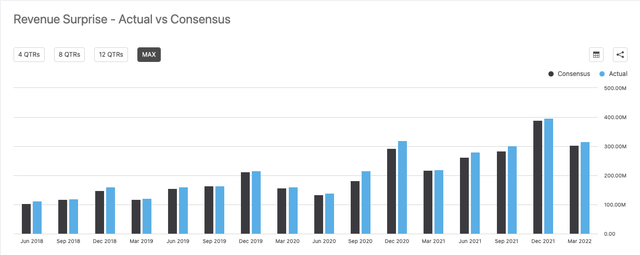

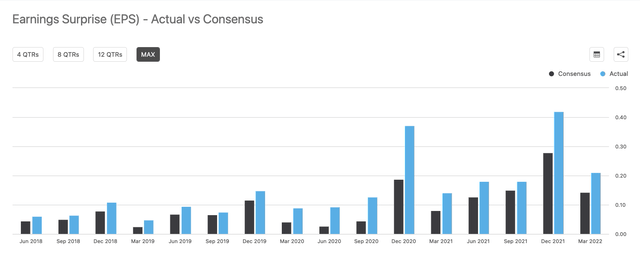

A key aspect to consider is the company’s impeccable track record of consistently outperforming both revenue and sales estimates in each and every quarter. This degree of consistency is hard to find.

Seeking Alpha

Seeking Alpha

It is of utmost importance to follow how earnings and sales expectations for a company are changing over time. Past performance is no guarantee of future returns, but companies with a solid track record of outperforming expectations tend to continue outperforming those expectations more often than not.

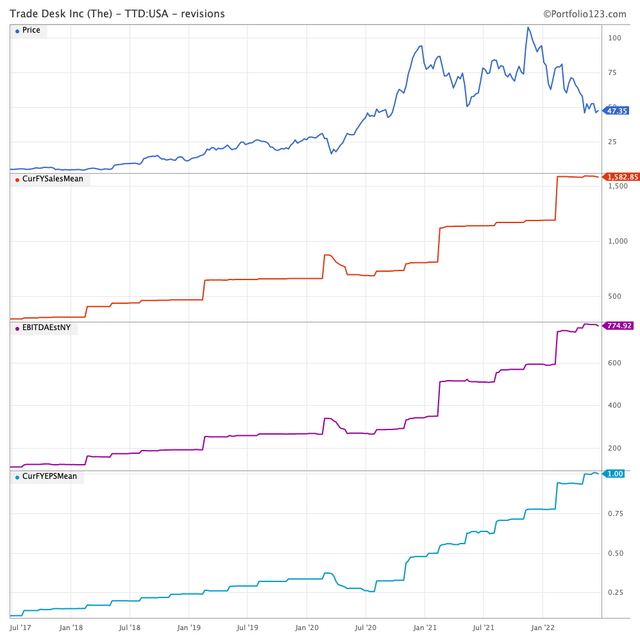

Five years ago, Wall Street calculated that The Trade Desk would make $190 million in revenue for the year 2022. Now they are expecting almost $1.6 billion for that same year.

EBITDA estimates have increased from less than $110 million to nearly $775 million and earnings per share estimates have gone from $0.07 cents to $1.00.

Portfolio123

Stock prices reflect expectations about the future of a business. If the company can widely outperform those expectations over the years, this arguably means that the stock price is underestimating the true value of the business.

Wall Street analysts are currently expecting The Trade Desk to produce $2.29 in earnings per share during 2025, which puts the company at a PE ratio of 22.5 times earnings three years from now. Importantly analysts are also expecting earnings growth to be almost 30% after 2025, so vigorous growth should support a healthy valuation premium for The Trade Desk in the future.

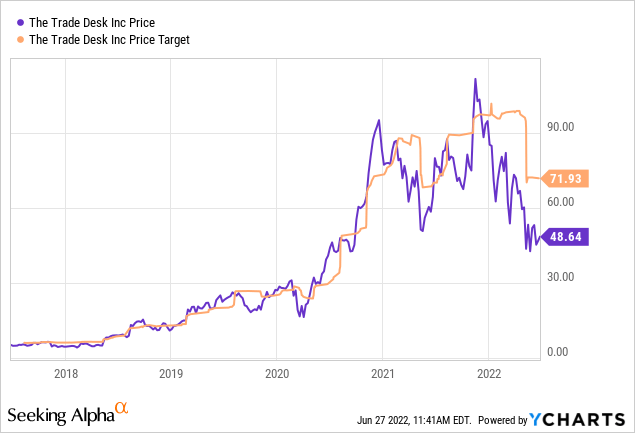

Wall Street analysts have been cutting their price targets for all growth stocks due to current market conditions in recent months, and The Trade Desk is no exception. Nevertheless, the current price target of $71.90 still implies an upside potential of nearly 48% versus the current stock price.

The Main Negatives

The main negative factor is that there is a huge stock-based compensation expense of $124.9 million last quarter, including $66 million for CEO Jeff Green due to long-term performance incentives.

The company has achieved massive financial success over the years, and compensation incentives are tied to financial success, so I can understand that performance – and compensation – have been well above expectations. But the number is still too high.

The advertising industry is highly cyclical, and The Trade Desk cannot be expected to remain immune if economic conditions continue deteriorating. Macroeconomic headwinds should be temporary by nature, but investors in The Trade Desk need to be willing to tolerate some volatility in the stock price in an unfavorable economy.

On the other hand, advertisers tend to be increasingly conscious of ROI and measurability during tough economic times. From that perspective, The Trade Desk should be able to accelerate market share gains versus the competition in a difficult economic environment. This kind of high-quality business tends to get stronger during challenging times.

The Bottom Line

Leaving aside the short-term economic risks, The Trade Desk is the top player in an industry with enormous potential, both revenue and cash flows are growing spectacularly well, and valuation is not excessive considering the quality of the business. The Trade Desk is an excellent candidate for growth investors to consider owning over multiple years.

Be the first to comment