Marco Di Lauro/Getty Images News

Investment Thesis

KBR Inc. (NYSE:KBR) is benefiting from the healthy demand in its end markets as well as from the Frazer Nash and VIMA acquisitions. The company ended Q3 FY22 with a healthy backlog level and a book-to-bill ratio of 1.3x. The trends such as energy security, decarbonization, high energy prices, and affordability in the sustainability side of the business should benefit the company. Additionally, the U.S. government is incentivizing sustainable areas through its Inflation Reduction Act. The company should also benefit from the increase in defense budget spending requests in the U.S. and increased defense funding in Australia.

Revenue Outlook

In Q3 FY22, the company’s revenue declined 12% Y/Y due to the completion of the Operation Allies Welcome (OAW) program in early 2022 that commenced in Q3 FY21. In 2021, the company won a project award to assist the Department of Defense in its OAW program, which provided humanitarian support to refugees from Afghanistan. In Q3 FY22, the Government Solutions (GS) segment declined 17% Y/Y due to absence of the OAW program revenues, partially offset by increased activity in the European Command and Frazer Nash and VIMA acquisitions. However, the OAW program was a large one-time benefit last year, and excluding this project, the GS segment’s revenue increased 10% Y/Y to $1.3 bn. The Sustainable Technology Solutions (STS) segment’s revenue increased 16% Y/Y to $333 mn driven by improved engineering services and technology licensing.

The trailing 12-month book-to-bill ratio in Q3 FY22 was 1.3x, with a 1.9x book-to-bill ratio in the STS segment and a 1x book-to-bill ratio in the GS segment. The backlog and options in the quarter were slightly up Y/Y to $19.7 bn with $11.3 bn backlog in the GS segment, $4 bn backlog in the STS segment and $4.9 bn in award options.

Looking forward, the company has a long-term portfolio of attractive contracts, technologies, and solutions that should drive its growth. The STS segment has several tailwinds and important long-term themes. This includes energy security, decarbonization, high energy prices, and affordability. Additionally, the U.S. has introduced the Inflation Reduction Act (IRA), which incentivizes the development of sustainable projects in areas such as hydrogen, solar, etc. Many oil & gas and chemical companies are investing a good amount of resources and financial capacity in the hydrogen economy and decarbonization, which should benefit KBR. The demand for blue ammonia in the U.S., plastic recycling in Korea, and green ammonia in Norway should create growth opportunities for the company in 2023 and beyond.

In the GS segment, national security, defense modernization, cyber, and space superiority are the growth themes for KBR. The order pipeline for the segment remains strong. The President’s FY23 budget request includes $813 bn in defense spending and $785 bn in non-defense spending, which is 4% and 5% more compared to FY22. The Australian government has also increased its defense budget for FY23. The company is expecting strong double-digit growth in the military space in FY23 and single-digit growth on the NASA side. Additionally, KBR-led JV HomeSafe Alliance won a $20 bn contract with a potential 9-year term to provide goods moving management service provider for the U.S. Armed Forces, DoD civilians, and their families. The ramp-up revenue benefit from this project should start in late FY23 and early FY24, as there will be a 9-month transition period from the contract award date. KBR’s International business is also continuing to perform well, as the bookings at Frazer-Nash continue to be strongly aligned with the budget increases in the U.K.

I believe that given the strong order pipeline and healthy backlog levels, the company should be able to grow its revenue in the coming quarters. In the long term, the trends in sustainable solutions, defense, cyber, and space should support growth.

Margin Outlook

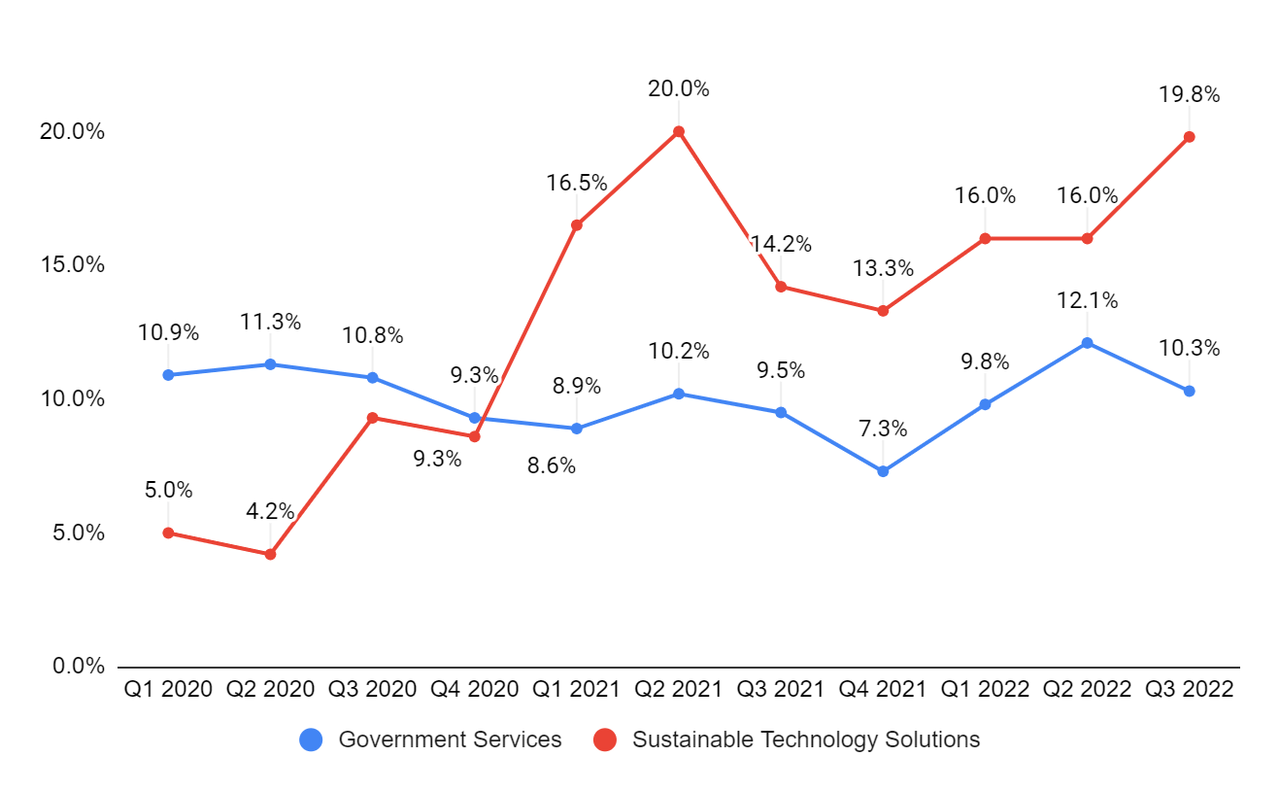

The adjusted EBITDA margin in Q3 FY22 improved by 170 bps Y/Y to 10.5%, driven by strong execution across its business. The adjusted EBITDA margin in the GS segment improved by 80 bps Y/Y to 10.3%, driven by a favorable mix and strong project execution. The adjusted EBITDA margin of the STS segment improved 560 bps Y/Y to 19.8%, driven by a favorable revenue mix, the achievement of certain licensing milestones, and contributions from an LNG project.

KBR’s segmentwise adjusted EBITDA margins (Company data, GS Analytics Research)

Looking forward, I believe STS adjusted EBITDA margin should be in the mid-to high teens in FY23 and beyond given the robust market conditions for the segment. In the medium to long run, the margins should benefit from a mix shift towards the STS segment which is growing at a faster rate compared to the GS segment and has higher margins. In addition, a ramp up in revenues from higher-margin projects (for example, the recent win as the goods moving management service provider for the U.S. Armed Forces, DoD civilians, and their families) should also benefit margins.

Valuation & Conclusion

The stock is currently trading at 17.66x FY23 consensus EPS estimate of $2.92. The company’s long-term growth prospects are encouraging, and the sell-side is modeling strong EPS growth over the next few years. The company has good medium to long-term growth prospects given the trends in defense, NASA, cyber, sustainability, and technology. I believe these strong end markets should help the company grow its backlog levels and sales pipeline in FY23 and beyond. Hence, I have a buy rating on the stock.

Be the first to comment