Wirestock/iStock Editorial via Getty Images

In a previous report, I discussed the potential order from United Airlines (NASDAQ:UAL) for a significant number of Boeing 787 jets. Boeing (NYSE:BA) and United Airlines have now both confirmed the order. As I explain in this report, the order meets and even exceeds expectations. I will address the order composition and the importance of the deal to Boeing as well as United Airlines.

Boeing Wins Order For Up To 300 Jets

Boeing

In my preview of the order, I saw opportunity for Boeing to win at least 45 Boeing Dreamliner orders. In this scenario there would still be an unlikely role for the Airbus A350 of which United Airlines has 45 aircraft on order. On a one-to-one replacement basis, there would be an order potential for approximately 125 aircraft and adjusted for capacity this would be a potential for around 95 aircraft. United Airlines ended up ordering 100 Boeing 787 jets replacing the Boeing 767 and Boeing 777-200(ER) in its fleet. So, we see that the order quantity did lean towards the adjusted capacity method I used to determine the order potential. On top of that United Airlines has options for another Boeing 787s bringing the number of Dreamliners to be ordered to up to 200 units.

A bit of a surprise in the deal was the order for the Boeing 737 MAX for which United Airlines ordered another 100 Boeing 737 MAX aircraft exercising 44 options and ordering an additional 56 aircraft. Yesterday there already was a sign that the Boeing 737 MAX could be part of the order mix as United Airlines flew a MAX into Charleston where United Airlines and Boeing are hosting a media event to comment on the order.

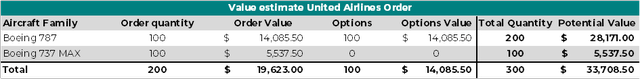

It’s somewhat unfortunate that United Airlines and Boeing are announcing the biggest order of the year so far, but have failed to provide details of the order split. This also makes it somewhat difficult to assess the value of the deal.

At list prices the deal is valued between $37 billion and $47.5 billion, and this list price value could rise to a range of $62 billion to $82 billion when options are fully exercised.

However, airlines never pay list prices and looking at actual base values are more reflective of what the order value could be. This would give us a base value of $11.5 billion to $21.6 billion or $22.4 billion to $37.3 billion when options are fully exercised.

The Aerospace Forum

Using our assumed mix that is based on the split provided in my report previewing the order we get to an order value of $19.6 billion plus $14.1 billion in options which could ultimately result in $33.8 billion when the options are exercised. Obviously, changes to the order composition could significantly impact the value. To give you a feel of it a Boeing 787-10 costs over 40% more than a Boeing 787-8.

Boeing Receives Further Support For Production Rate Increases

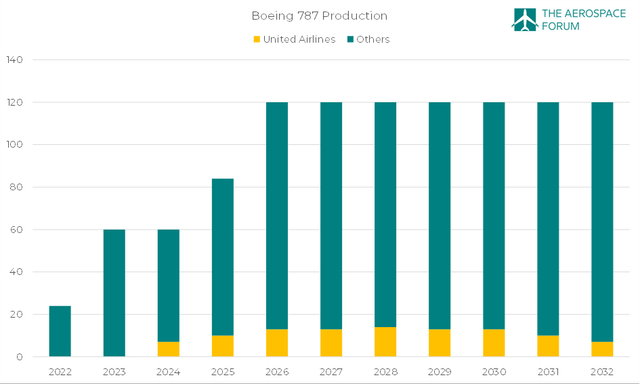

Boeing 787 Production plan (The Aerospace Forum)

The deliveries of the Boeing 787 aircraft are scheduled between 2024 and 2032 and provides significant support for Boeing’s plan to increase production from the current two aircraft per month to 10 aircraft per month and that’s also what United Airlines needs. The Boeing 767-300ER fleet has an average age of 23.8 years with 20 out of 37 Boeing 767-300ERs already older than 25 years, while the Boeing 767-400ER fleet averages 21 years. The Boeing 777-200ER fleet also is aging with an average age of 23.5 years and United Airlines had quite some problems with that subfleet due to problems with the Pratt & Whitney turbofan blades that led to two uncontained engine failures and ultimately led to a prolonged grounding of the fleet. United Airlines also ran into service re-entry issues for those jets and even absent of the issues, to maintain a competitive fleet a new technology replacement is required.

So, United Airlines needs a replacement and they need it fast. The fact that they have not made a sizable widebody earlier is likely related to the airline’s interest in Boeing’s new mid-size jet which Boeing shelved plans for a new mid-size jet for now and United Airlines had to re-evaluate its replacement plans.

United Airlines and Boeing have not detailed an exact delivery plan but with 100 deliveries scheduled between 2024 and 2032, we see that the recent order from United Airlines provides significant support for Boeing to return to a range of 10 aircraft per month on the Dreamliner program by 2026 as was communicated during the Investor Day. Obviously, with the United Airlines order you don’t get there, but one can assume that Boeing has outlined plans to return to a rate of approximately 10 aircraft per month based on insights in its sales pipeline.

United Airlines

The support for production rates on the Boeing 737 MAX production is somewhat smaller since the order quantity is somewhat smaller compared to the production. Boeing aims to increase production to 50 aircraft per month by 2025-2026. The 44 jets exercised are slated for delivery between 2024 and 2026 and the 56 aircraft that are firmed will be delivered in 2027 and 2028. At a rate of 50 aircraft per month the order for the MAX provides two months of production, but in this order we do see overall support for hiking and maintaining the rate granted that supply chain issues dissolve fully by the end of 2023.

Fleet Expansion and Renewal As Part Of NEXT Plan

Today’s order fits in United Airlines’ Next capacity plan which aims to grow the fleet, improve operational excellence, improve customer service and manage unit costs. Today’s order provides a lot of support to the fleet growth as well as unit cost control.

The past year has been quite brutal on airlines with fuel prices being up significantly and fuel hedging is one way to counter that, but having fuel efficient long-term assets is probably a preferred way to go.

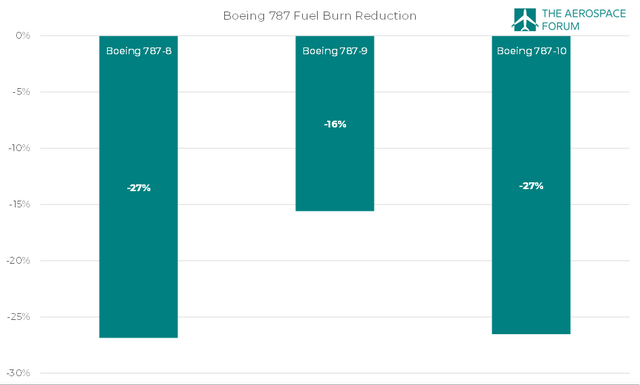

United Airlines said that the fuel burn associated to the wide body aircraft they are replacing is set to be significantly lower:

Approximately 100 planes of the new widebody order are expected to replace older Boeing 767 and Boeing 777 aircraft, with all 767 aircraft removed from the United fleet by 2030, resulting in up to an expected 25% decrease in carbon emissions per seat for the new planes compared to the older planes they are expected to replace.

Preliminary estimate Boeing 787 Fuel burn reduction

We look at some fuel burn reductions and what we are seeing is that fuel burn reductions are in the 15% to 30% range. Obviously, the routes that these aircraft will be deployed on and the cabin configurations determine the exact fuel burn reductions but a first look at the possible fuel burn reduction range does support the 25% reduction that United Airlines expects in fuel costs for this order.

Is Boeing Stock A Buy?

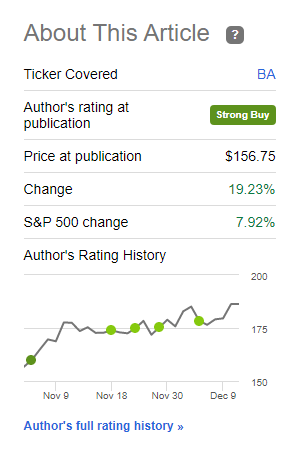

Shares of Boeing are trading modestly higher today, but we also shouldn’t really be expecting big pops at least not fundamental driven pops. We often see that when there is the notion of a big order coming up or being announced that stocks from the original equipment manufacturers pop. Boeing shares already rose earlier this month anticipating this order, so the fact that we see a modest share price change of 0.66% today is likely related to that as well as the fact that the value of the order will materialize over a timespan of a decade.

So, it does make sense to not see big pops in the stock price as it would be equivalent to valuing future performance in today’s stock price. I do maintain my buy rating as we are currently seeing significant demand driven potential for Boeing to improve its financial results.

Seeking Alpha

Since marking shares of Boeing a Strong Buy, we saw Boeing stock outperforming the market significantly showing a 19.2% return compared to 8% for the broader market and I maintain my price target of $240.

Is United Airlines Stock A Buy?

United Airlines stock is trading down nearly 7%. I have a Hold rating on the stock and I am not upgrading to Buy at this moment. Yes, indeed on constant fuel prices the fuel bill will be significantly lower for United Airlines when it starts replacing the less fuel and cost efficient aircraft. However, this is a multi-year story and going forward there are uncertainties on how strong unit pricing will be. So, I don’t feel that it would be a prudent decision to upgrade the stock to buy based on effects that we will see from 2024 onward while we don’t know what the unit revenue environment will look like going forward. I expect it to be strong at off-peak levels, but today’s order is not something that will make me view United Airlines shares as a buy.

United Airlines

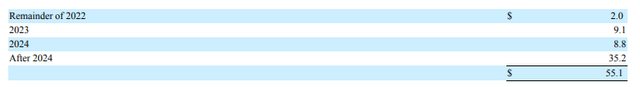

The market agrees and the market also is once again short sighted. The stock is down 7% and that’s driven by the increased capex requirements. With the new order in place, the commitments from United Airlines increased from $34.6 billion to $55.1 billion for aircraft and related spare engines, aircraft improvements and all non-aircraft capital commitment.

This is something I already had anticipated:

United Airlines is looking at CapEx of $8 billion to $9 billion to renew the fleet. Usually this is financed with debt and with interest rates higher, that could become costly for United Airlines while the competition is progressing better in keeping the fleet age down.

The comment from my previous analysis covers a Boeing 777 replacement and obviously to those $8 billion in capex we also have to add the Boeing 767 replacement as well as the order for the Boeing 737 MAX. I would be careful with concluding that the $20.5 billion is fully reflective of the order value as United Airlines maintains flexibility to adjust the order according to its needs. The $20.5 billion does also include non-aircraft costs, but overall it seems with our estimate of $19.6 billion we are quite close to the envisioned mix.

So, the stock is trading down based on this increase capex that will likely be financed with debt and possibly sale-and-lease back agreements and that’s not something that was completely unexpected, as I highlighted this before but it was enough to send United Airlines stock in the red.

Conclusion: A win-win for Boeing and United Airlines

I would mark the order from United Airlines as a win-win. United Airlines shareholders did not have a lot to cheer about today as the order announcement increases the capital expenditures by $20.5 billion. However, this should help the airline in executing its plan and significantly reduce the fuel burn for the wide body fleet. So, overall that’s a positive and gives United Airlines a cost-efficient fleet to operate its international network.

For Boeing, this is also a huge win. The company, as expected, beats Airbus to win the order and maybe more importantly today’s win shows continued market appeal for its programs that on any normal day are its cash cows. There have been times when investors thought things were completely lost for Boeing, and while they certainly have a lot to improve on, we see when they get their product up to spec airlines love their product.

Be the first to comment