photoschmidt

Investment Thesis

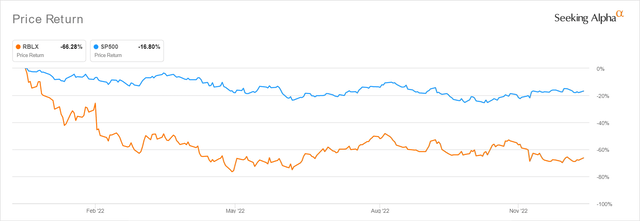

RBLX YTD Stock Price

Roblox Corporation (NYSE:RBLX) has naturally suffered a -66.28% plunge YTD, once it is clear that the macroeconomics are heading into massive uncertainties with the Russian-Ukraine war, China’s previous Zero Covid Policy, global rising inflation, and the Fed’s continuous interest rate hikes through 2023.

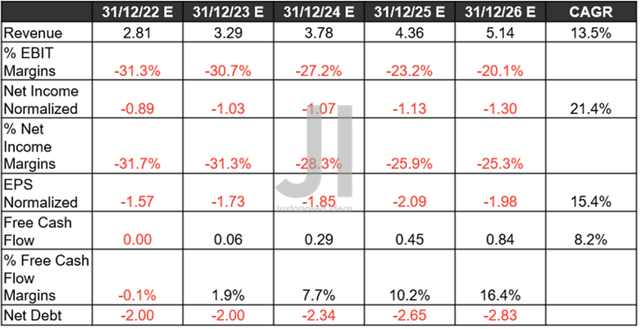

RBLX Projected Revenue, Net Income (in billion $) %, EBIT %, EPS, FCF %, and Debt

Despite the projected top-line growth at a CAGR of 13.5%, RBLX remains a wild speculation play, due to the “dying” Metaverse hype as Meta (META) aggressively restructures and the prolonged crypto winter from the FTX bankruptcy. While the company may report some Free Cash Flow [FCF] generation from FY2024 onwards, cash burn remains an issue, given the elevated cost of revenues, operating expenses, and Stock-Based Compensation [SBC].

Regardless of Powell’s dovish statement, the stock market remains highly volatile as well, since many market analysts are now projecting prolonged inflationary pain through 2024, due to China’s unexpected reopening cadence. Though it remains to be seen when the country will fully reopen, we expect to see a massive global impact in the short term, further delaying the recovery of the stock market and, consequently, the normalization of macroeconomics. Combined with the raised terminal rates to over 6%, the RBLX stock will likely underperform over the next few quarters.

RBLX’s Cash Burn Story Continues – All In The Hopes Of Aging Up Its Demographics

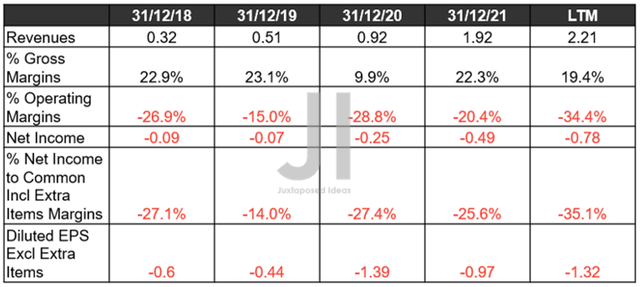

RBLX Revenue, Gross %, EBIT %, Net Income ( in billion $ ) %, , and EPS

RBLX has somehow widened its losses for the past few quarters, despite the excellent improvement in its bookings by 15% YoY, average DAU by 24%, and hours engaged by 20% in FQ3’22. The company reported worsening operating margins of -34.4% and net income margins of -35.1% by the last twelve months [LTM], with its total operating expenses expanding by an eye-watering 46.91% despite the slowing 15.7% growth in revenues at the same time.

Notably, 67.04% of the expenses is attributed to its R&D efforts, which seems to be paying off, since the company has also been reporting widening demographics. Nonetheless, these elevated costs have also naturally triggered the worsening of its EPS to -$0.5 by FQ3’22, against consensus estimates of -$0.38. Due to its underperformance thus far, it is not hard to see why market analysts have also reduced their expectations for FQ4’22, with revenues of $866.3M and EPS of -$0.48, indicating minimal improvements QoQ and YoY.

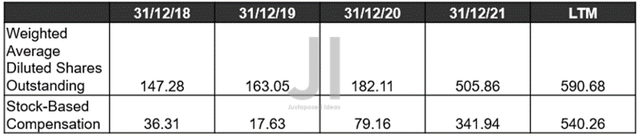

RBLX SBC Expenses (in million $) and Share Dilution (in million)

Much of its lack of profitability is attributed to RBLX’s elevated SBC expenses of $540.26M by the LTM, representing a massive increase of 227.07% sequentially. Thereby, triggering a continuous share dilution to 590.68M as well. This will, unfortunately, be a common occurrence over the next few years, since the company will not be reporting any GAAP profitability yet.

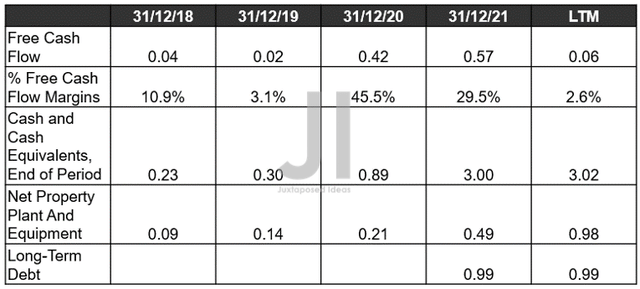

RBLX FCF (in billion $) % and Balance Sheet

RBLX’s FCF generation has also been negative over the past two quarters, due to its elevated capital expenditure of $217.17M against cash from operations of $93.64M at the same time. We expect to see its FCF impacted over the next few quarters since its Capex has also been expanding tremendously by 313.21% sequentially to $313.9M by the LTM. In the meantime, its cash and equivalents of $3.02B and total receivable of $185.83M in FQ3’22 may prove sufficient over the next few quarters, depending on the management’s prudence and its platform’s success. We’ll see.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Roblox: Has The Metaverse Hype Train Crashed?

- Meta Vs. Roblox: The Battle Of Metaverse Commission Rates – 47.5% Vs. 72%

So, Is RBLX Stock A Buy, Sell, Or Hold?

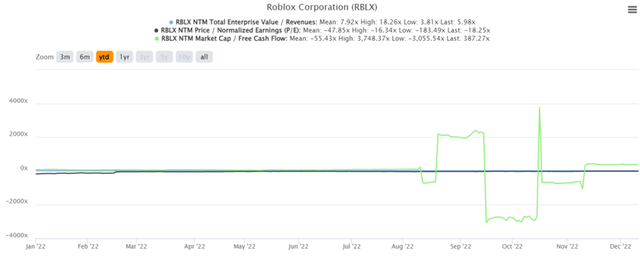

RBLX YTD EV/Revenue, P/E, and NTM Market Cap/FCF Valuations

RBLX is currently trading at an EV/NTM Revenue of 5.98x, NTM P/E of -18.25x, and NTM Market Cap/FCF of 387.27x, lower than its 2Y mean of 12.21x, -29.05x, though highly inflated against 17.12x, respectively. Otherwise, lower than its YTD mean of 7.92x, -47.85x, though again inflated against -55.43x, respectively. Due to its lack of meaningful profitability over the next few years, it is naturally hard to place a supposed price target on the stock. However, based on market analysts’ projection of FY2026 EPS at -$1.98 and its current P/E valuation, we are looking at an ambitious price target of $36.15, similar to the consensus of $35.83.

In the long shot, RBLX may potentially succeed, due to the impressive growth of its over-13-segment to 54% of DAUs and the 17-through-24-cohort by 41% YoY. This is proof that the company has been remarkably successful in aging up its previously young demographics, since our very first coverage in February 2022. Thereby, somewhat justifying the management’s choice in growth at all costs, with profitability ranking second, since the company has also been making large strides in its game engine/ cloud performance through Capex and SBC expenses through talent hiring. Monetization is decent as well at Average Bookings per DAU (ABPDAU) of $11.94 in FQ3’22, though declining by -2.53% QoQ and -11% YoY.

However, we prefer to remain neutral for now, due to the minimal margin of safety. The Metaverse’s outlook is uncertain in this macroeconomic environment and, therefore, leads to its little catalyst for intermediate-term recovery. Patience would work well now.

Be the first to comment