SDI Productions/E+ via Getty Images

Introduction

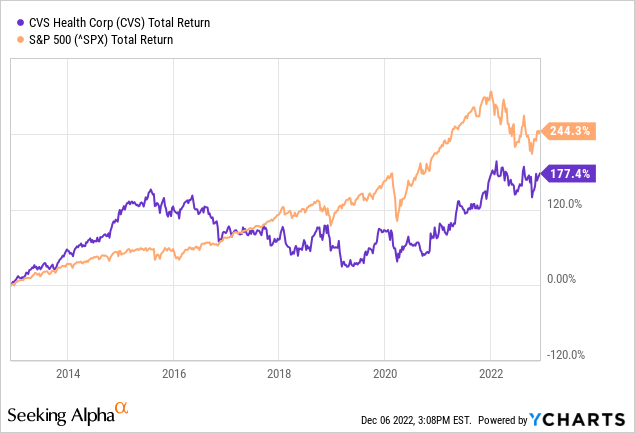

CVS Health (NYSE:CVS) is a health care company in the United States. In addition to the well-known CVS Pharmacy, it owns CVS Caremark and through its acquisition of Aetna, CVS Health now offers health insurance too. The stock price was in a bear market from 2016 to 2020 and has rebounded sharply since then. Annual returns of 10.8% have been achieved over the past 10 years. The stock’s valuation is quoting very attractively, and the acquisition of Signify Health will provide further growth in healthcare and help patients even better.

Third Quarter Earnings Were Strong

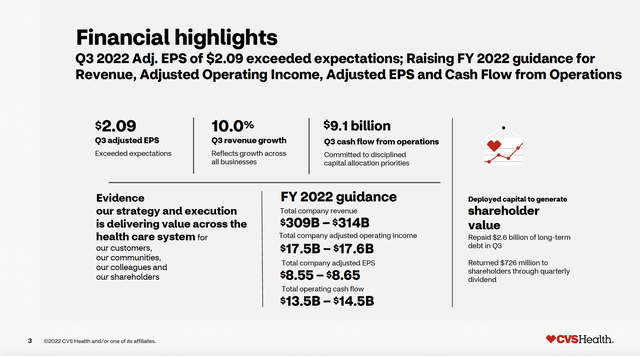

Financial Highlights (CVS Health 3Q22 Investor Presentation)

Third quarter 2022 results were strong. During the quarter, revenues increased 10%, free cash flow increased 73% and earnings per share increased 9%.

The Health Care Benefits segment experienced strong growth with a 9.9% increase in revenues and a 39.6% increase in adjusted operating income. Total medical membership increased 2.5%, with strong growth of 4.8% for government memberships. The medical benefits ratio fell favorably with 230 basis points. CVS’s Health Care Benefits segment saw its MBR ratio improve as COVID-related costs were less this year.

The Pharmacy segment also grew significantly and saw revenues increase 10.7% year-over-year last quarter. Adjusted operating income increased 5.9% and total pharmacy claims processed increased only 3.6%.

Retail/LTC segment sales increased 6.9%, but adjusted operating income declined 18.9% year-on-year due to lower Covid diagnostic tests and vaccinations. Sales in the Retail Pharmacy segment increased strongly by 9.9%, helped by a 3.8% increase in prescription pharmacies.

During the quarter, $9.1B of cash from operations was generated, and $2.6B of long-term debt was repaid, bringing net debt to $35B. EBITDA for fiscal year 2021 was $17.4B, bringing the ratio of net debt to EBITDA to 2.0.

The outlook for the full fiscal year 2022 was raised: revenues are expected to increase 6% to 7% and adjusted earnings per share are expected to increase 2% to 3% to $13.50 to $14.50 per share.

Acquisition Signify Health Is A Good Move

On Sept. 5, CVS Health announced the acquisition of Signify Health for $8 billion, or $30.50 per share. Signify Health is a leader in Health Risk Assessments, value-based care, and provider enablement. Signify offers great value for CVS through its network of more than 10,000 physicians, combined with its proprietary analytics and technology platform. It provides a better connection to CVS’ patients and thus will serve patients even better.

Signify is also a strong financial asset for CVS. Its gross margin, at 42%, is much higher than CVS’s. Signify’s free cash flow margin is high at 13%. The company is growing strongly with sales growth of 27% over 2021. Its annual revenue of $773M does not add much to CVS’ annual revenue, but qualitatively the company adds a lot to helping patients better.

Signify also outperforms CVS in financial terms. Gross margin is much higher than CVS at 42%, and Signify’s free cash flow margin is at 13%. The company is growing strongly with sales growth of 27% over 2021. Its annual revenue of $773M does not yet add one percent to that of CVS, but qualitatively the company adds much to helping patients better.

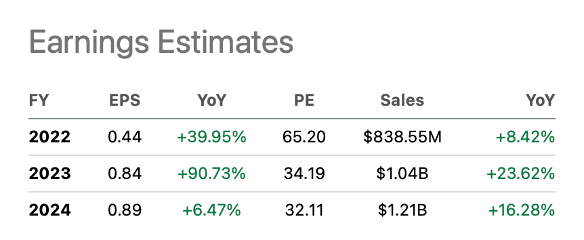

The acquisition price of $8B is a reasonable price for a company with annual sales of $773M, the price-to-sales ratio is 10. Sales are expected to increase sharply by 18% by 2023. Analysts on the Seeking Alpha Signify Health ticker page expect earnings to rise sharply along with it. The PE ratio for fiscal 2024 is 32, so the valuation is reasonable. I think the acquisition price is reasonable and Signify Health will add much value to CVS Health.

Earnings Estimates (Signify Health Seeking Alpha Ticker Page)

Dividend Increase, And $10B Buyback Program

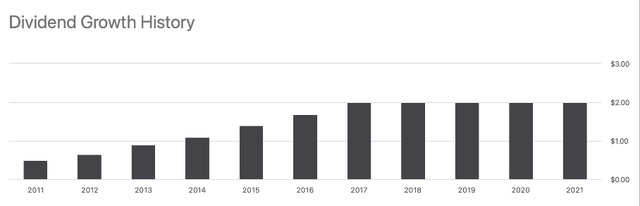

While dividend per share growth was stagnant for years, this year the dividend per share is growing 10%. The dividend is currently listed at $2.10, representing a dividend rate of 2.2%.

For the next few years, analysts on the Seeking Alpha CVS ticker page expect the dividend to grow 5% for fiscal 2023, and fiscal 2024. This is the beginning of a dividend growth rally.

Dividend Growth History (CVS Health Ticker Page On Seeking Alpha)

The increase in dividends per share is made possible in part because of share repurchases. CVS has announced a massive $10B share repurchase program. The massive share repurchase package represents an 8% share buyback yield.

Share repurchases lead to a reduction in outstanding shares, a reduced supply of shares. At the same time, demand increases when shares are repurchased on the open market. Less supply and more demand for stocks can drive up the stock price. It is a tax-efficient way to increase the dividend per share and a possible increase in the share price.

Valuation Is Cheap

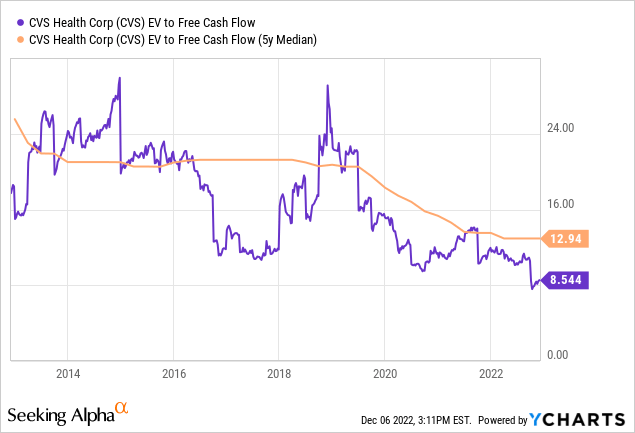

When valuing stocks, I look first at the EV/FCF ratio. After all, with an interest coverage ratio of 6.7, it is important to include cash and debt in the valuation as well.

CVS Health is currently cheaply valued given its EV/FCF ratio. With the EV/FCF ratio of 8.5, CVS is historically cheaply valued, below the 5-year average of 13 (providing a discount of as much as 35%).

After the acquisition of Signify Health, however, the EV/FCF will quote higher. After the acquisition, the enterprise value of CVS is $169B, and the free cash flow is then $15.8B. This makes the EV to Free Cash flow ratio 10.7 after acquisition, CVS is then still very attractively valued, a 17% discount plus Signify as an additional growth catalyst.

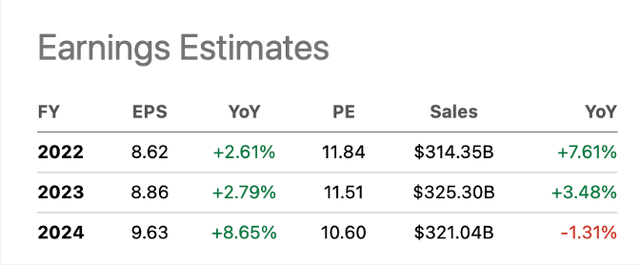

Another method of determining CVS’ valuation is to take the average PE ratio and multiply it by the expected EPS in the near future. The 5-year average PE ratio is 15, and fiscal 2024 EPS has been revised upward by 21 analysts and is expected at $9.63. This makes CVS Health’s average share price at the end of fiscal 2024 $144. The current share price is at $100, so CVS Health is also very attractively valued based on the PE ratio.

CVS Health Earnings Estimates (CVS Health Ticker Page On Seeking Alpha)

Key Takeaway

- CVS Health is a health care company known for its CVS Pharmacy. In addition to CVS Pharmacy, CVS Health owns CVS Caremark and Aetna, among others.

- The stock price was in a bear market from 2016 to 2020 and has rebounded sharply since then.

- Third quarter 2022 results were strong. During the quarter, revenues increased 10%, free cash flow increased 73% and earnings per share increased 9%.

- The outlook for the full fiscal year 2022 was raised: revenues are expected to increase 6% to 7% and adjusted earnings per share are expected to increase 2% to 3% to $13.50 to $14.50 per share.

- The acquisition price is reasonable, and Signify Health will add much value to CVS Health.

- While dividend per share growth was stagnant for years, this year the dividend per share is growing 10%.

- Analysts on the Seeking Alpha CVS ticker page expect the dividend to grow 5% for fiscal 2023, and fiscal 2024.

- The stock’s valuation is cheap given its EV to FCF ratio and PE ratio.

Be the first to comment